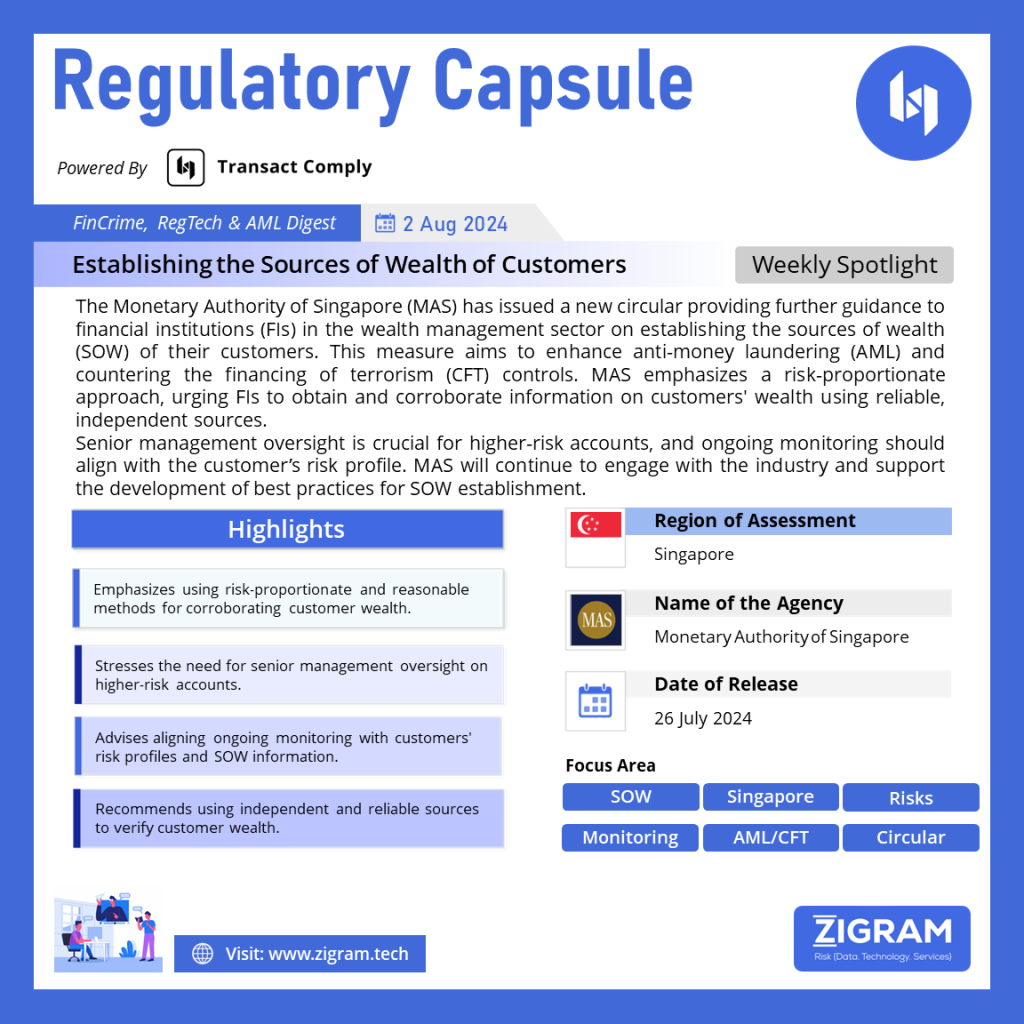

Regulation Name: Establishing Sources Of Wealth of Customers

Publishing Date: 26 July 2024

Region: Singapore

Agency: Monetary Authority of Singapore

The Monetary Authority of Singapore (MAS) has issued a comprehensive circular providing further guidance to financial institutions (FIs) in the wealth management sector on establishing the sources of wealth (SOW) of their customers. This step underscores Singapore’s commitment to maintaining its status as a premier financial hub while ensuring robust anti-money laundering (AML) and countering the financing of terrorism (CFT) measures.

Singapore’s Appeal and the Need for Vigilance

Singapore’s position as a leading financial center attracts high-net-worth individuals (HNWIs) from around the globe seeking sophisticated wealth management services. However, the inherent risks of money laundering and terrorism financing (ML/TF) in this sector necessitate stringent controls. Given the significant transaction sizes and complexity involved in managing HNWIs’ wealth, FIs play a crucial gatekeeper role in ensuring that fund flows into Singapore remain legitimate.

Historical Context and Prior Guidance

Over the years, MAS has issued several guidance papers to help the industry implement effective AML/CFT controls, particularly in private banking. These include:

– Guidance on Private Banking Controls (June 2014)

– Effective AML/CFT Controls in Private Banking (September 2020)

– Strengthening AML/CFT Practices for External Asset Managers (August 2022)

– Money Laundering and Terrorism Financing Risks in the Wealth Management Sector (March 2023)

The latest circular aims to further clarify MAS’s supervisory expectations regarding the establishment of customers’ SOW before initiating business relations.

Key Principles and Recommendations

MAS emphasizes a tailored approach, urging FIs to employ risk-proportionate and reasonable methods to establish the SOW of their customers. The circular outlines several key principles and recommendations:

1. Materiality: FIs should focus on obtaining information on a customer’s entire body of wealth to the extent practicable. While understanding the total wealth is crucial, the emphasis should be on corroborating more material or higher-risk SOW. In situations where certain SOW cannot be easily verified, FIs should assess the residual risk and determine if additional risk-mitigating measures are necessary.

2. Prudence: For significant SOW, FIs should rely on more reliable corroborative information, such as audited accounts or documents from independent third parties like tax accountants. When benchmarks or assumptions are used, they must be reasonable, relevant, and appropriate for the customer’s risk profile. FIs must document and periodically review these benchmarks and assumptions to ensure they facilitate a plausible assessment of the customer’s SOW.

3. Relevance: FIs should seek fit-for-purpose corroborative evidence and exercise reasonable judgment in determining which documents are essential. Where possible, independent and reliable documents from credible public sources should be utilized to support the assessment, minimizing reliance on customer-provided evidence.

Role of Senior Management and Ongoing Monitoring

The circular underscores the importance of senior management oversight, particularly for higher-risk accounts. If significant portions of a customer’s wealth cannot be corroborated, the case should be escalated to senior management for approval before establishing business relations. Additionally, ongoing monitoring controls should be aligned with the customer’s risk profile, taking into account information gleaned from SOW establishment.

Industry Engagement and Future Developments

MAS reaffirms its commitment to engaging with the industry and supports the ongoing efforts of the AML/CFT Industry Partnership (ACIP) in developing best practices for SOW establishment. This collaborative approach aims to enhance the effectiveness of AML/CFT measures in Singapore’s wealth management sector.

The new circular from MAS represents a significant step in strengthening the AML/CFT framework in Singapore’s wealth management sector. By providing detailed guidance on establishing the SOW of customers, MAS aims to help FIs better understand their clients and ensure the legitimacy of their assets. This proactive approach is crucial in maintaining Singapore’s reputation as a trusted and secure financial hub.

Read the guidance here.

Know more about the product: Dragnet Alpha

Click here to book a free demo.

- #MAS

- #WealthManagement

- #AML

- #CFT

- #FinancialRegulation

- #Compliance

- #SourcesOfWealth

- #RiskManagement

- #FinancialInstitutions