HYPERCHARGED SOLUTIONS FOR

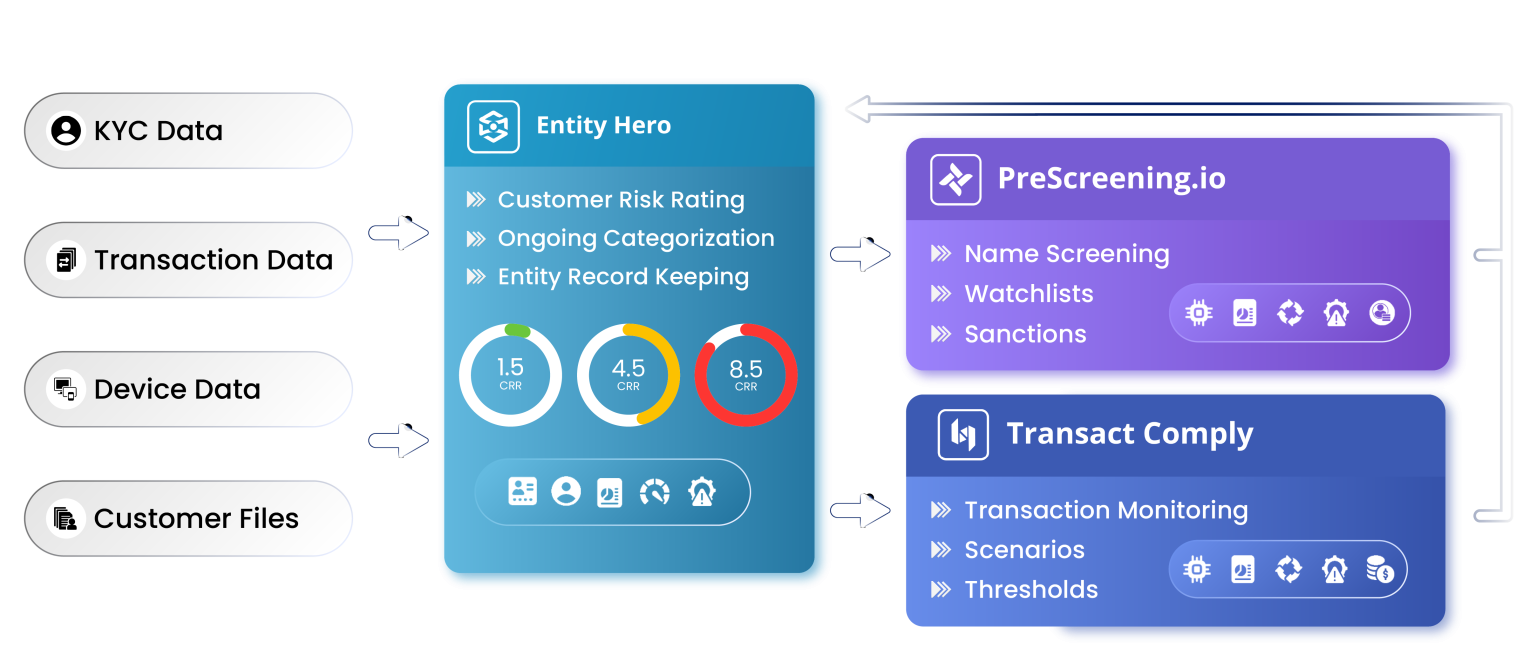

ZIGRAM’s Complete AML System powered by PreScreening.io, Transact Comply, and Entity Hero provides exactly that! It delivers comprehensive AML compliance, stronger risk management, and operational efficiency making it the ideal compliance backbone for fast-growing and regulated organisations.

Know More

We are a rapidly growing global data asset company with a fully integrated RegTech stack featuring proprietary data, cutting-edge applications, advanced intelligence, and comprehensive services.

Risk Use Cases

Professionals

Billion Risk Scans

Deployments

Global Jurisdictions

Billion News Content

Watchlists

Languages

LEARN MORE

Discover how our technology and data solutions can accelerate your compliance goals.

Copyright © 2026 ZIGRAM Data Technologies Pvt Ltd