INDUSTRIES

Capital Markets

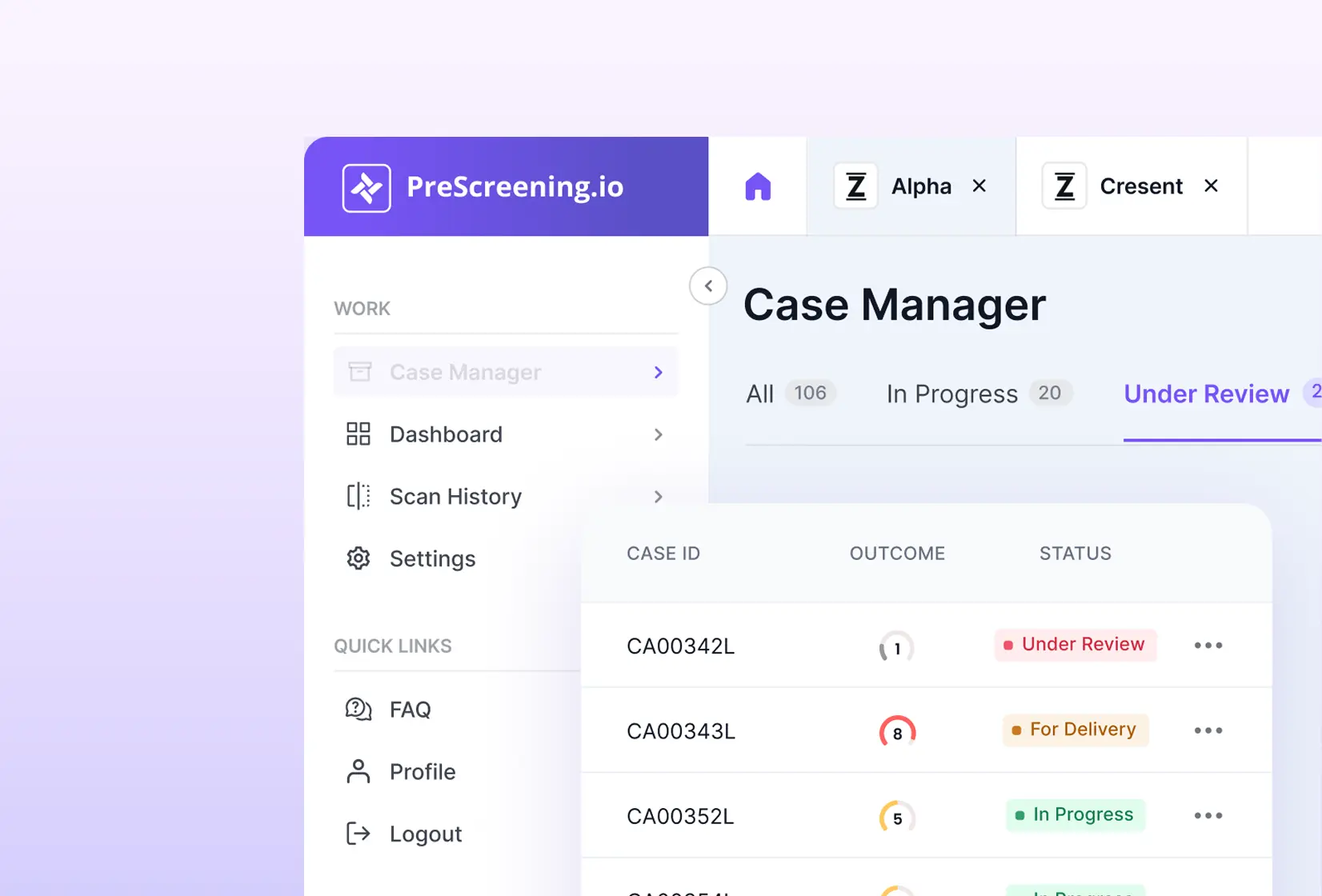

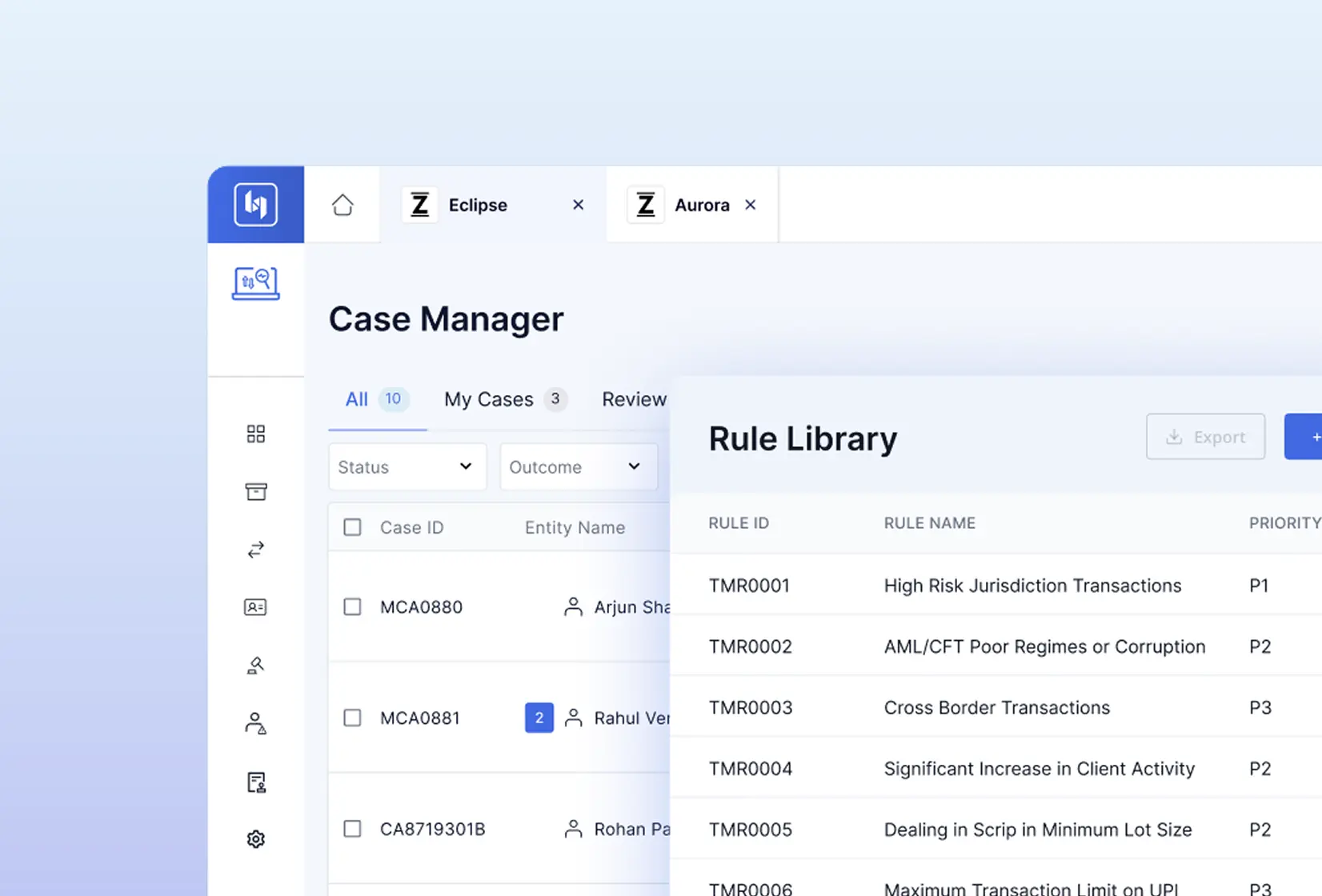

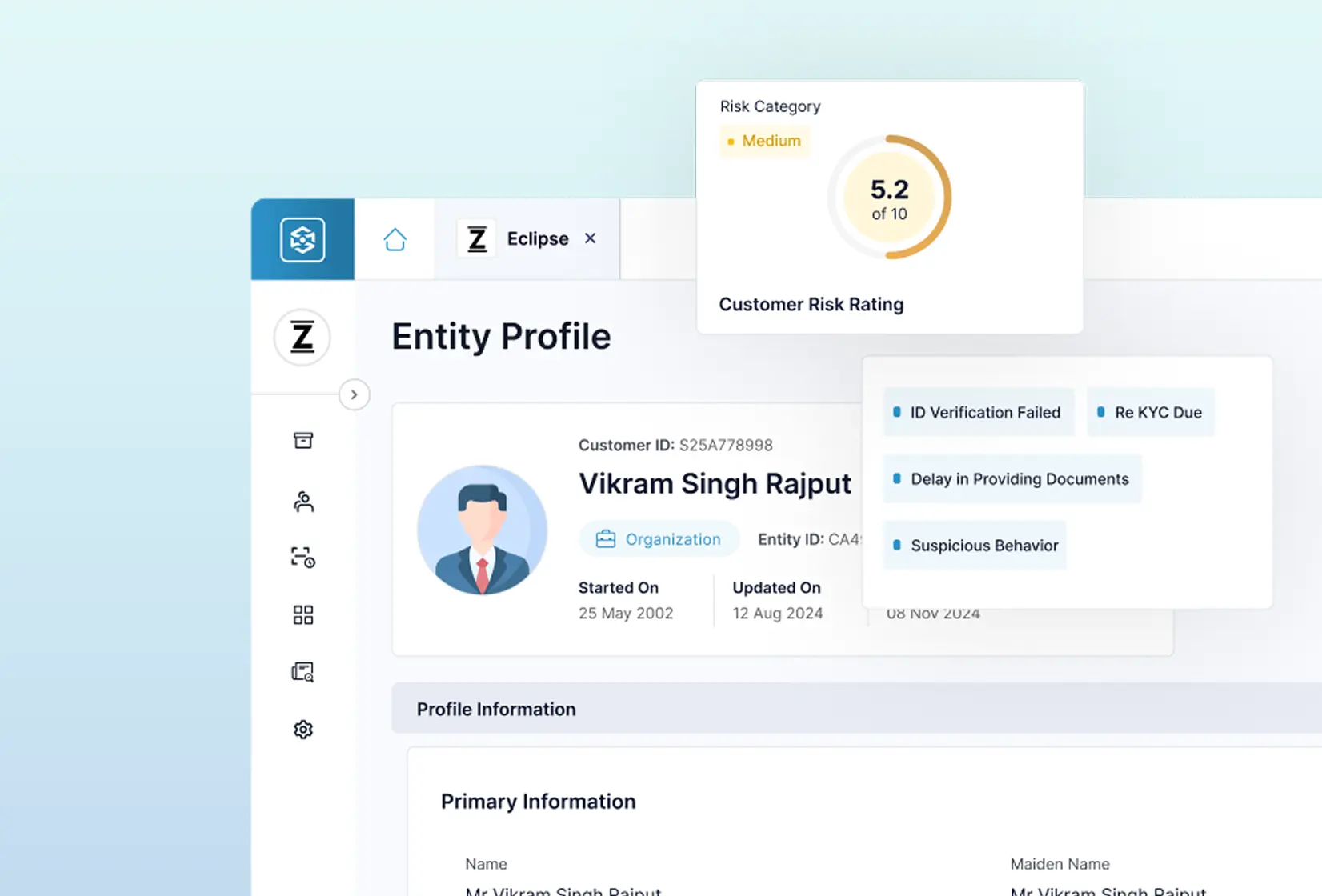

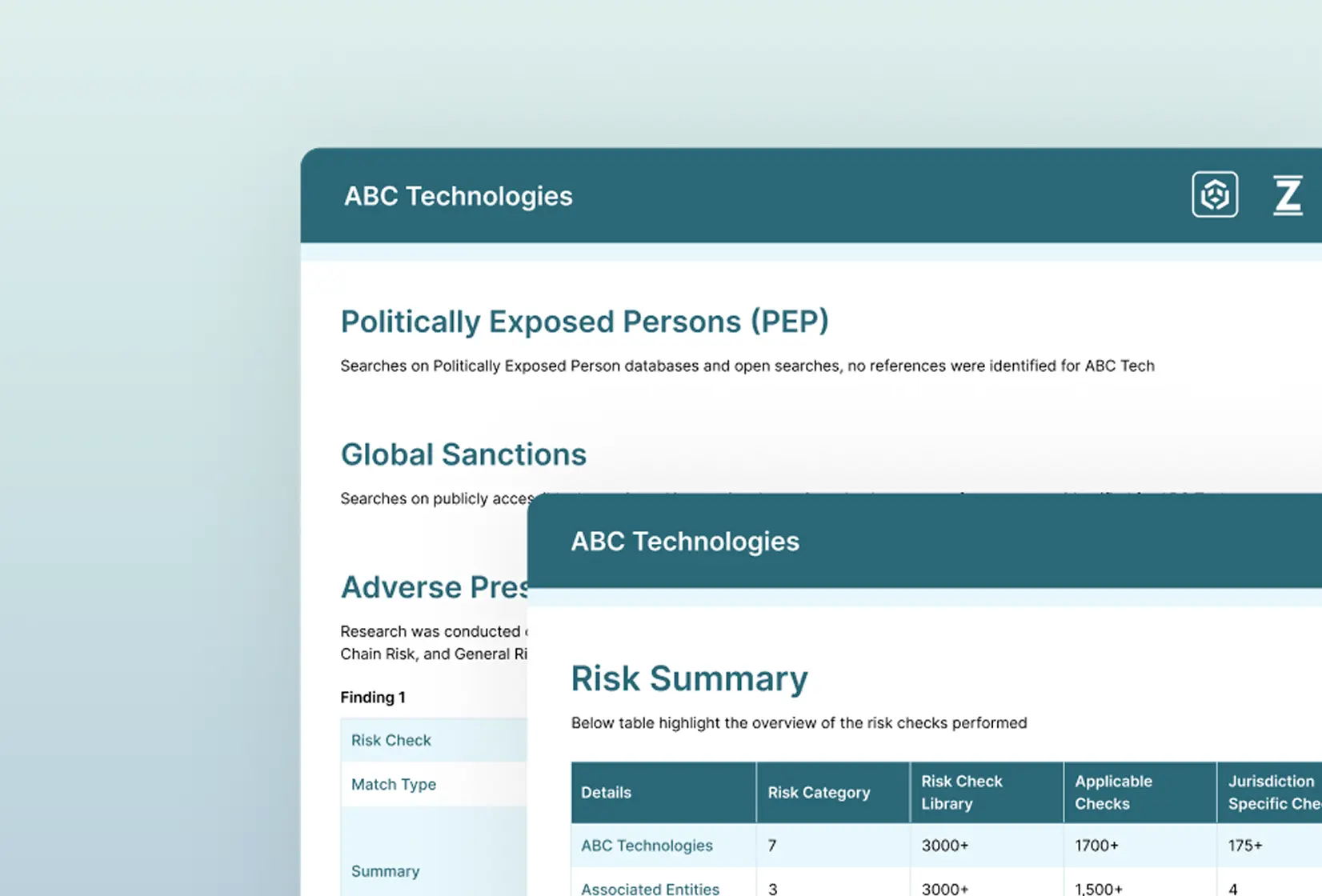

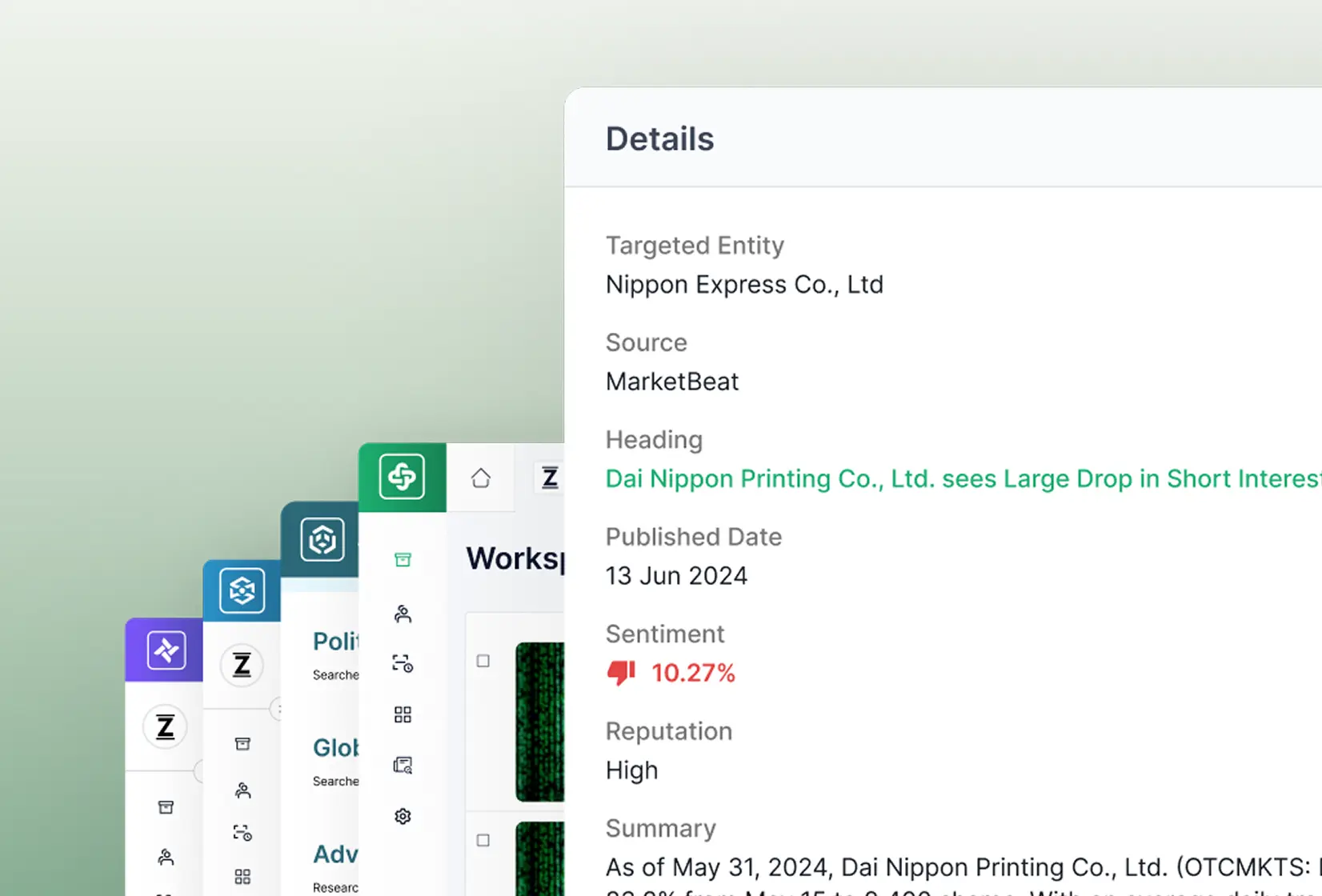

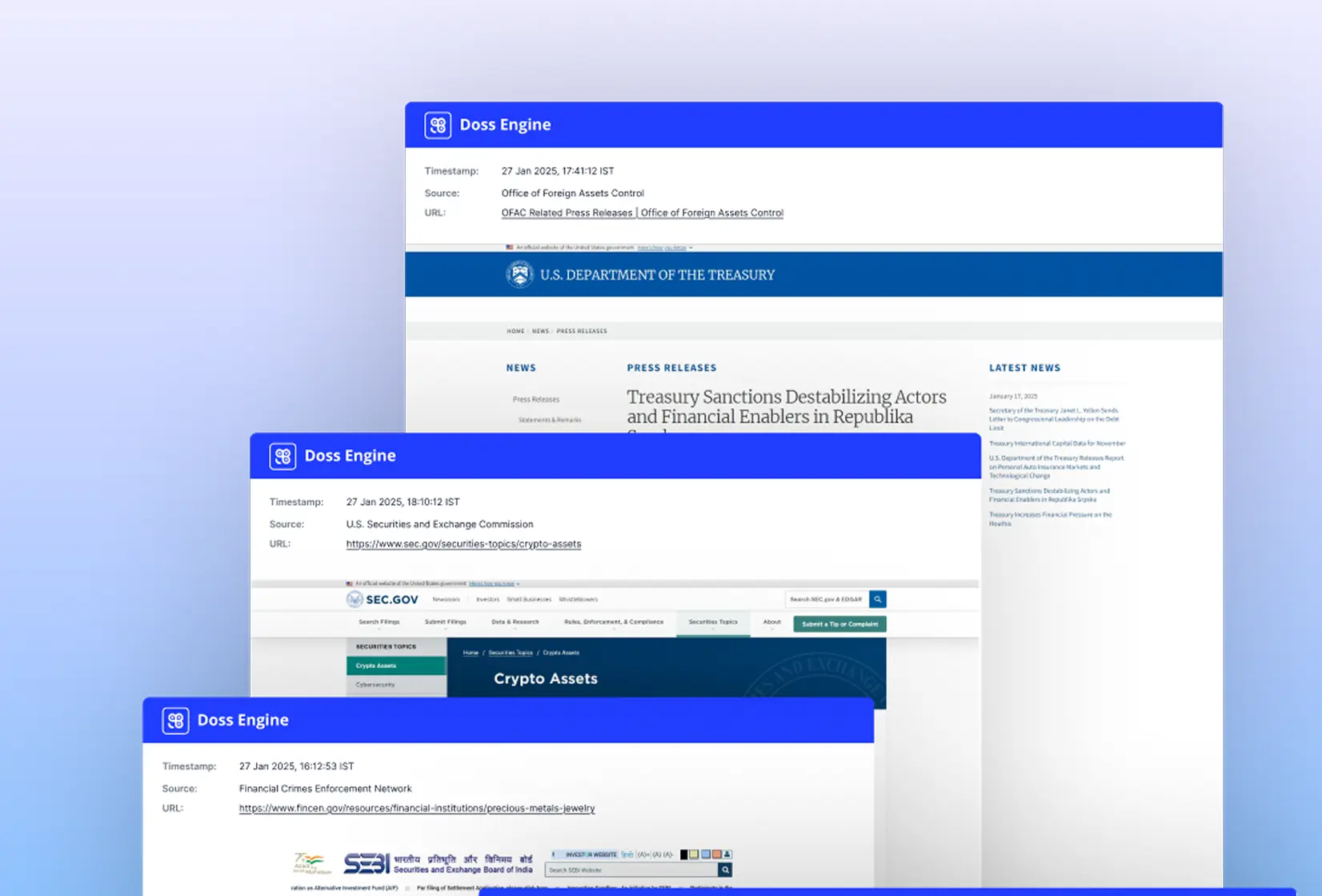

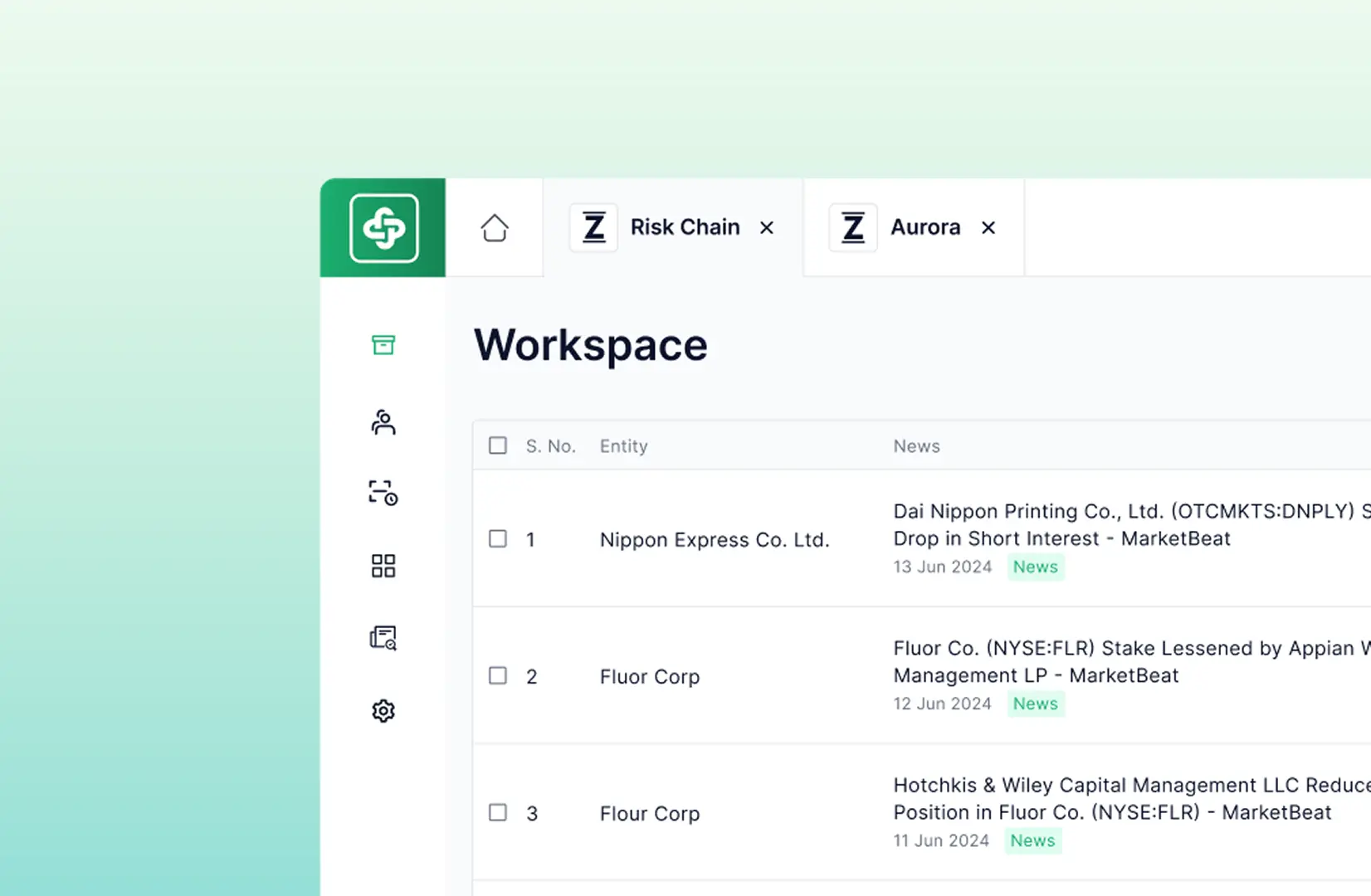

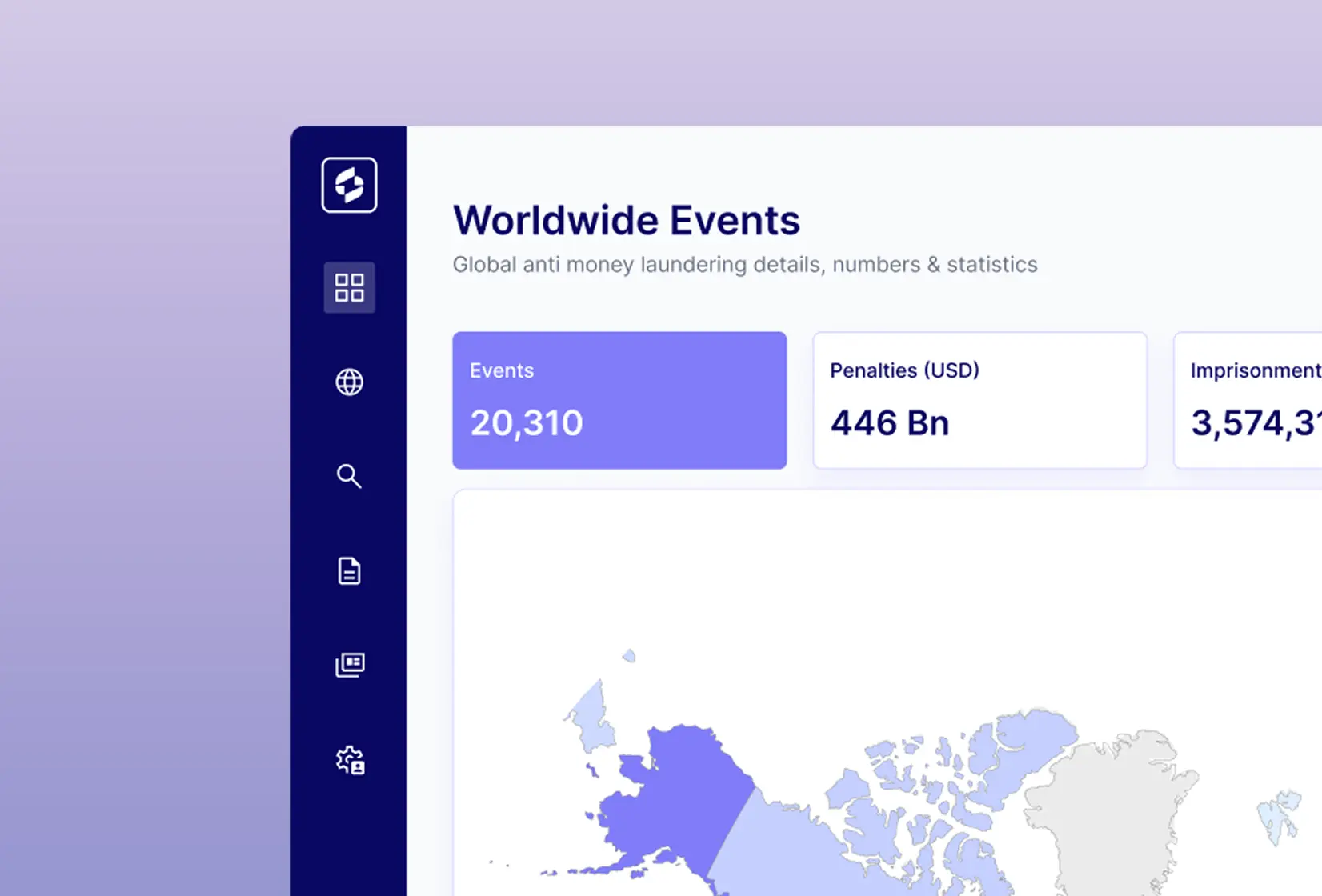

Capital markets involve complex, high-value transactions where financial crime risks and regulatory compliance are major challenges. Investment firms need tools to monitor transactions, assess counterparties, and meet global AML standards. ZIGRAM’s solutions provide real-time risk insights and automated compliance management.