Published Date:

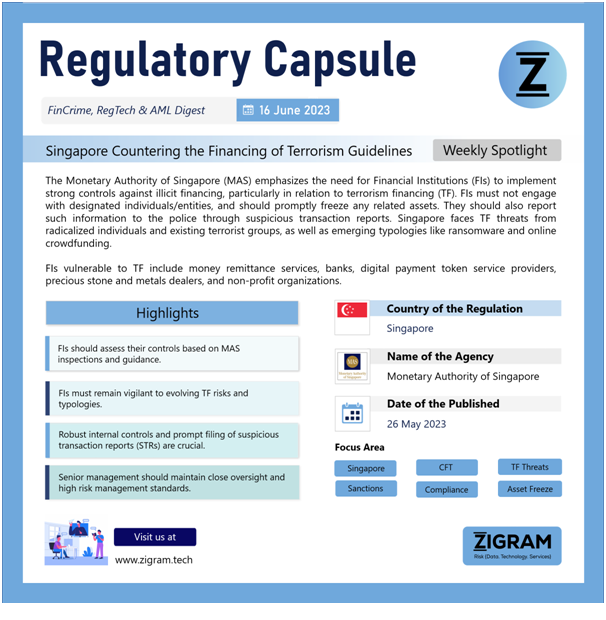

Singapore, as an international financial center and transport hub, is exposed to the risk of illicit financing, including terrorism financing (TF). The Monetary Authority of Singapore (MAS) emphasizes the need for robust controls at various stages of the account lifecycle to combat these risks. Financial institutions (FIs) are prohibited from dealing with designated individuals/entities unless exempted. FIs must detect such individuals/entities and freeze their assets, promptly reporting the information to the police. TF threats in Singapore include radicalized individuals, established terrorist groups like ISIS, Al-Qaeda, and JI, as well as potential financing of regional and global terrorist groups. Vulnerable sectors to TF include money remittance services, banks, digital payment token service providers, precious stone and metals dealers, and non-profit organizations. Additionally, emerging typologies of TF involve ransomware, arts and antiquities, and online crowdfunding mechanisms. FIs must also be wary of the misuse of digital payment tokens (DPTs) for TF, especially in jurisdictions without proper regulation and supervision.

- #SingaporeFinance

- #FinancialInstitutions

- #IllicitFinancing

- #TerrorismFinancing

- #TFControls

- #AccountLifecycle

- #MASGuidance

- #RiskAssessment

- #TFThreats

- #RadicalizedIndividuals

- #TerroristGroups

- #VulnerableSectors

- #DigitalPaymentTokens

- #AssetFreezing

- #SuspiciousTransactionReport

- #RiskManagement

- #SeniorManagementOversight

- #MoneyRemittances

- #BankingSector

- #TFDevelopments