Sanctions Watch Vol 77

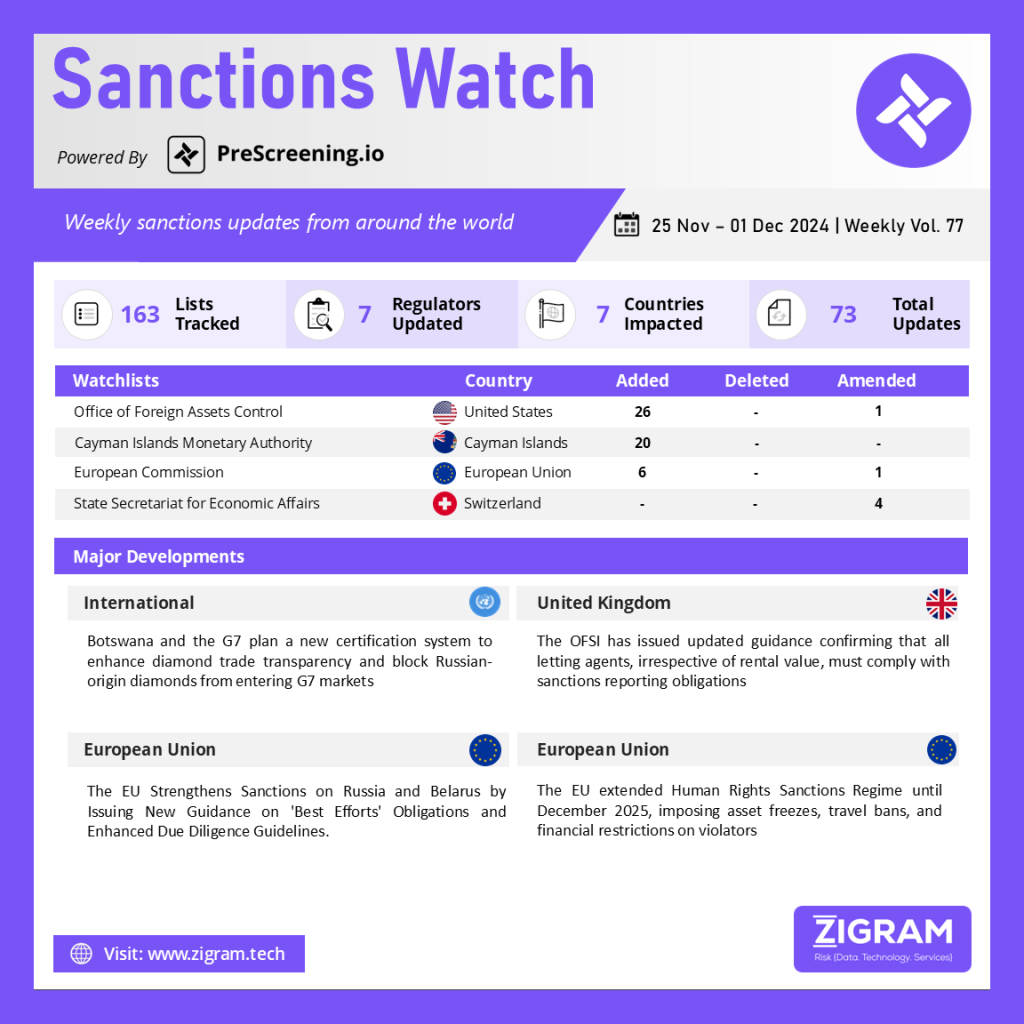

In the latest edition of our Sanctions Watch weekly digest, we present significant updates on sanction watchlists and regulatory developments.

1. Botswana and G7 Unite to Enhance Diamond Trade Transparency, Combat Russian-Origin Imports

Botswana and the G7 diamond technical team have announced significant progress in enhancing traceability and transparency in the diamond trade. A G7 import ban on Russian-origin diamonds took effect on January 1, 2024, extending to Russian diamonds processed in third countries from March 1, 2024. To support this, the EU launched the first certification node on March 1, 2024, enabling certification of rough diamond origins and issuance of G7-compliant certificates.

In collaboration with Belgium, Botswana conducted a detailed gap analysis to assess its certification framework, ensuring alignment with G7 requirements. The goal is to prevent Russian-mined diamonds from entering G7 markets and establish traceability across the supply chain. Based on the analysis, Botswana and the G7 technical team are developing a roadmap to address gaps and make Botswana’s export certification node operational next year.

President Duma Boko highlighted Botswana’s commitment to ethical and sustainable diamond mining at the FACET event in Antwerp on November 26, 2024. Establishing this node will enhance Botswana’s global leadership in responsible diamond production, bolster investor confidence, and drive economic growth. The G7 team is engaging other African producers, such as Namibia and Angola, to explore similar initiatives.

2. OFSI Clarifies Sanctions Compliance Rules for Letting Agents, Effective May 2025

The Office of Financial Sanctions Implementation (OFSI) has issued updated guidance confirming that both commercial and residential letting agents are subject to sanctions compliance requirements, regardless of rental value. From 14 May 2025, letting agents will be designated as “relevant firms,” required to report any knowledge or suspicion of sanctions breaches involving tenants or landlords.

This clarification addresses previous uncertainty about whether sanctions reporting was necessary when anti-money laundering (AML) checks were not required. The guidance emphasizes that no monetary threshold applies in enforcing compliance.

The expansion of the UK sanctions regime, particularly in response to the Ukraine conflict, has increased oversight to restrict sanctioned individuals or entities from conducting business within the UK. Industry leaders acknowledge the strengthened framework but note the additional due diligence burdens placed on letting agents, particularly in identifying beneficial owners.

Technological solutions, such as Credas’ KYB-2-KYC tool, are highlighted as essential in streamlining compliance and reducing operational challenges, allowing agents to adapt effectively to the new requirements. The guidance reinforces the UK’s commitment to financial sanctions enforcement, signaling a critical step towards greater accountability in the rental sector.

3. EU Strengthens Sanctions on Russia and Belarus: New Guidance on ‘Best Efforts’ Obligations and Enhanced Due Diligence Requirements

The EU has issued new guidance clarifying obligations for EU operators under the Russia and Belarus sanctions frameworks. These include “best efforts” obligations, as per Article 8a of Council Regulation (EU) 833/2014 (Russia) and Article 8i of Council Regulation (EU) 765/2006 (Belarus). EU entities must ensure that activities of non-EU subsidiaries do not undermine EU sanctions, requiring case-by-case assessments based on control, risk, and operational context. The EU Commission’s FAQs, published on 22 November 2024, outline compliance expectations, emphasizing internal compliance programs and the prevention of sanction-violating activities.

Additionally, enhanced due diligence obligations for EU operators supplying Common High Priority Items will take effect on 26 December 2024 under Article 12gb of the EU Russia Regulations, and on 2 January 2025 for Belarus. Operators must assess and mitigate risks associated with the export or use of these items in Russia, with compliance extending to controlled non-EU entities. A carve-out applies for supplies within the EU or to Partner Countries.

These measures aim to strengthen the enforcement of EU sanctions, and businesses should review and adjust practices to ensure compliance by the applicable deadlines. Divergences in national interpretations may necessitate further monitoring of guidance from Member States.

4. EU Global Human Rights Sanctions Regime: Renewed Until December 2025

The Council of the European Union has extended and updated its list of individuals, entities, and bodies subject to restrictive measures under the EU Global Human Rights Sanctions Regime for another year, until 8 December 2025. These measures are part of the EU’s ongoing commitment to addressing and denouncing serious human rights violations and abuses globally.

As of the latest update, restrictive measures apply to 116 individuals and 33 entities. Those listed face an asset freeze, and EU persons and entities are prohibited from making funds, financial assets, or economic resources available to them. Additionally, natural persons included on the list are subject to an EU travel ban.

This decision reflects the EU’s strong stance on the universality, indivisibility, interdependence, and interrelation of human rights. The sanctions framework was initially established on 7 December 2020 and allows the EU to target state and non-state actors responsible for severe human rights violations and abuses worldwide. The listings are reviewed annually to ensure their relevance and accuracy.

On 4 December 2023, the Council also extended the framework for restrictive measures under this regime for three more years, ensuring its validity until 8 December 2026. The EU continues to monitor developments closely and reviews listings regularly.

Know more about the product: PreScreening.io

Click here to book a free demo.

Sanctions Watch is a weekly recap of events and news related to sanctions around the world.

- #Sanctions

- #RegulatoryCompliance

- #FinancialSanctions

- #UNSanctions

- #ComplianceMatters

- #OFSI

- #GlobalGovernance

- #AML

- #KYC

- #RestrictiveMeasures

- #EconomicSanctions

- #SanctionsWatch

- #InternationalSanctions

- #EconomicSanctions

- #RegulatoryCompliance

- #TradeCompliance

- #SanctionsEnforcement

- #SanctionsViolations

- #WaterTreatment

- #SanctionsLaw

- #RegulatoryUpdate

- #GlobalCompliance

- #PeaceProcess

- #EconomicSanctions

- #SanctionsRegimes

- #SustainableGovernance

- #InternationalLaw

- #ConflictResolution

- #UKTreasury

- #GeneralLicense

- #OFAC

- #DueDiligence