Published Date:

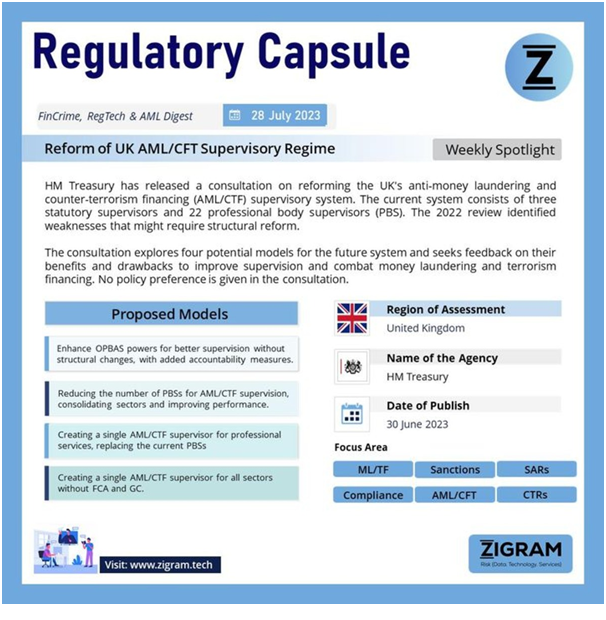

The UK’s Anti-Money Laundering/Counter-Terrorism Financing (AML/CTF) regime, governing businesses regulated by the MLRs 2017, experienced shortcomings in professional body supervision. In response, the Office for Professional Body Anti-Money Laundering Supervision (OPBAS) was established in 2017 to ensure consistent, robust supervision across private bodies overseeing legal and accountancy firms. Though OPBAS led to significant improvements, weaknesses persisted in the broader supervision regime. A 2022 review by HM Treasury identified the rationale for further reforms. The proposed amendments to the MLRs aim to facilitate a more risk-based approach for regulated firms. Consultation on these regulatory changes is slated to commence by Q4 2023, with the goal of strengthening the UK’s AML/CTF framework and enhancing information sharing between supervisors and law enforcement.

- #AML

- #CTF

- #MoneyLaundering

- #CounterTerrorismFinancing

- #MLRs2017

- #Supervision

- #OPBAS

- #ProfessionalBodySupervision

- #RegulatoryReform

- #RiskBasedApproach

- #FinancialRegulation

- #UKGovernment

- #HM

- #Treasury

- #Consultation2023

- #LawEnforcement

- #InformationSharing

- #FinancialIntegrity

- #AMLFramework

- #AMLCompliance

- #FinancialCrimePrevention