Shifting Patterns in Threshold Transaction Reporting: Insights from FIU-Nepal’s Recent Data

In recent years, Nepal has witnessed a significant transformation in its financial reporting landscape, particularly in the submission of Threshold Transaction Reports (TTRs) by Reporting Entities (REs) to the Financial Information Unit (FIU-Nepal). A closer analysis of the trends over the past five fiscal years reveals critical shifts in reporting behaviors, digital integration, and sectoral contributions to financial transparency.

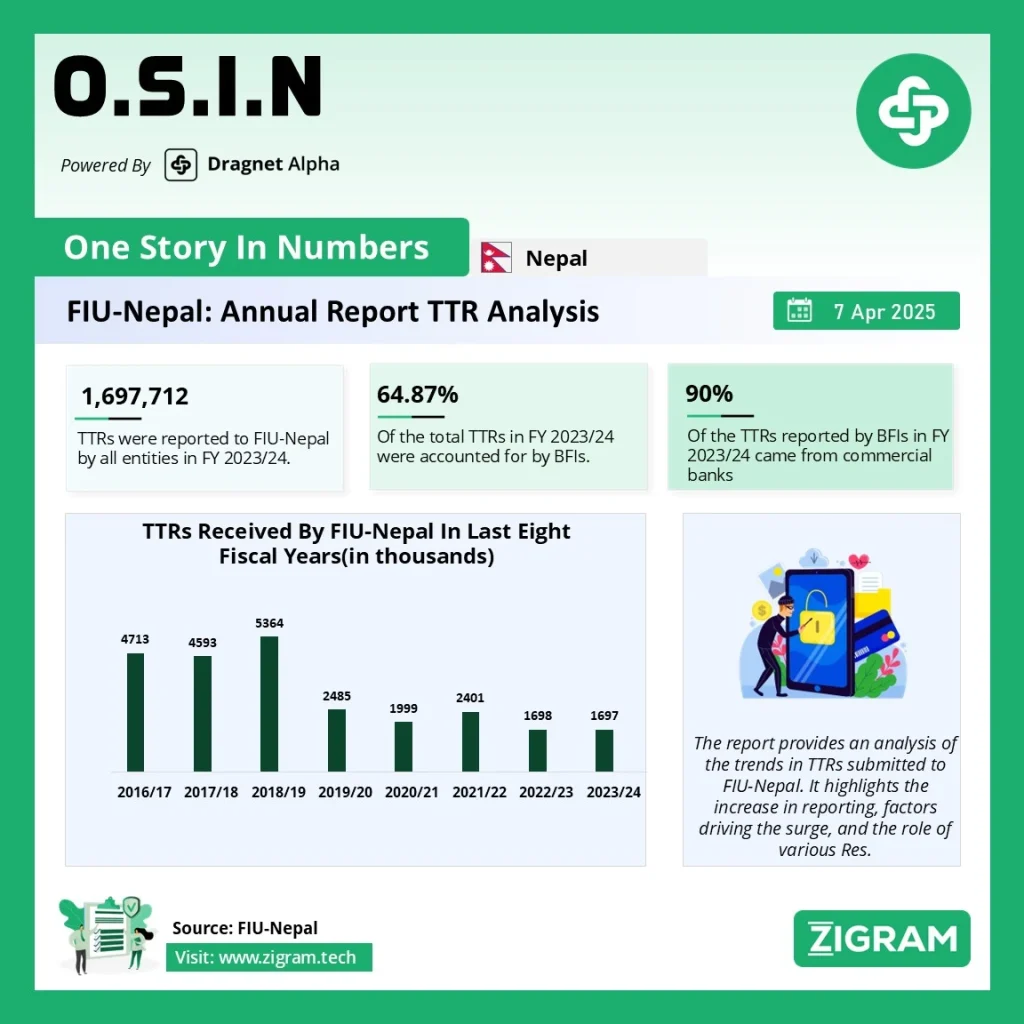

Overall Decline in TTRs

The total number of TTRs submitted to FIU-Nepal has shown a declining trend, falling from a high of over 2.4 million in FY 2021/22 to approximately 1.69 million in FY 2023/24. A significant reason behind this decline is the implementation of the goAML system—a secure platform for online submission of reports related to money laundering and terrorism financing. Prior to its implementation, multiple transactions from the same individual or entity were often double-counted. The automation and improved categorization within goAML streamlined reporting, reducing redundancies and inflating figures.

Digital Transformation and Reduced Cash Transactions

The shift toward digital payments through mobile banking, internet banking, connectIPS, and Real-Time Gross Settlement (RTGS) has also played a pivotal role in the downward trend of TTRs, particularly within the “TTR-Cash” category. As the use of electronic channels gains momentum, the frequency of cash transactions surpassing threshold limits declines, thereby affecting the volume of TTRs.

BFIs: Still Leading but Losing Share

Bank and Financial Institutions (BFIs) continue to dominate TTR submissions. In FY 2019/20, they accounted for over 90% of all TTRs, a number that dropped to about 64.87% by FY 2023/24. While BFIs still report the largest share, their decreasing contribution indicates that other sectors are gradually catching up due to broader goAML integration and awareness efforts.

Cooperatives and Non-Bank Institutions: Fluctuating Contributions

Cooperatives showed a notable rise in TTRs in FY 2020/21 and FY 2021/22, peaking at 274,113 reports. However, their share decreased to just over 122,000 in FY 2023/24. This fluctuation can be attributed to the staggered onboarding of these institutions into the goAML ecosystem.

Insurance and Securities Companies: Emerging Contributors

Insurance companies have gradually increased their share, contributing over 196,000 TTRs in FY 2023/24—around 11.57% of the total. Securities companies, meanwhile, saw a dramatic surge, rising from a mere 32,846 TTRs in FY 2019/20 to over 261,000 in FY 2023/24, reflecting the boom in stock market activities and improved compliance.

DNFBPs Enter the Reporting Framework

A notable development in FY 2023/24 was the inclusion of Designated Non-Financial Businesses and Professions (DNFBPs) such as casinos, dealers in precious metals and stones, and hire purchase companies. Though their share remains minimal (only 0.01%), their participation marks a critical step toward holistic anti-money laundering (AML) oversight across varied sectors.

Others: Digital Wallets and Remittance Companies Join In

Emerging sectors like PSP/PSOs, remittance companies, and entities like the Citizens Investment Trust (CIT) began reporting in recent years. Their cumulative contribution remained below 1% but signifies the growing diversity of REs in Nepal’s AML/CFT framework.

Regulatory Support and the Way Forward

The issuance of the TTR Guidelines, 2020 under the Asset (Money) Laundering Prevention Act (ALPA), 2008 has clarified reporting obligations and empowered FIU-Nepal to enforce robust financial monitoring. As more institutions adopt goAML and as digital transactions become the norm, the nature of financial reporting is expected to become more accurate and inclusive.

Read the full report here.

Please read about our product: Dragnet Alpha

Click here to book a free demo

- #AML

- #CFT

- #FinancialTransparency

- #goAML

- #TTR

- #FIUNepal

- #DigitalPayments

- #AntiMoneyLaundering

- #Compliance

- #FinancialInstitutions

- #Cooperatives

- #SecuritiesMarket

- #Insurance

- #DNFBPs

- #RegTech

- #FinTech

- #NepalFinance

- #AMLReporting

- #ThresholdTransactions

- #MoneyLaunderingPrevention