FinCEN Year in Review FY 2024: Leveraging Financial Intelligence to Combat Crime

The Financial Crimes Enforcement Network (FinCEN) has published its Year in Review for Fiscal Year 2024, presenting a comprehensive overview of how Bank Secrecy Act (BSA) data continues to power efforts to detect and disrupt financial crimes. Through collaboration with law enforcement, regulatory action, international engagement, and enforcement measures, FinCEN has reinforced its role as a central hub for financial intelligence and anti-money laundering efforts.

BSA Data as a Critical Tool for Law Enforcement

BSA reporting remains a cornerstone for U.S. law enforcement agencies in their efforts to investigate financial crimes. Agencies such as the Internal Revenue Service–Criminal Investigation (IRS-CI), the Federal Bureau of Investigation (FBI), and Homeland Security Investigations (HSI) utilize Suspicious Activity Reports (SARs) and Currency Transaction Reports (CTRs) to develop leads and support ongoing cases. The FBI, for instance, reported that in FY 2024, 32% of its active investigations in complex financial crimes were linked to SARs and CTRs.

In other programs like the Organized Crime Drug Enforcement initiative, 40% of investigations were supported by this data. Homeland Security Investigations conducted approximately 290,000 BSA-related queries, leading to over 27,000 new criminal investigations, more than 29,000 arrests, 9,000 convictions, and asset seizures totaling \$1.2 billion.

Overview of BSA Reporting Volumes

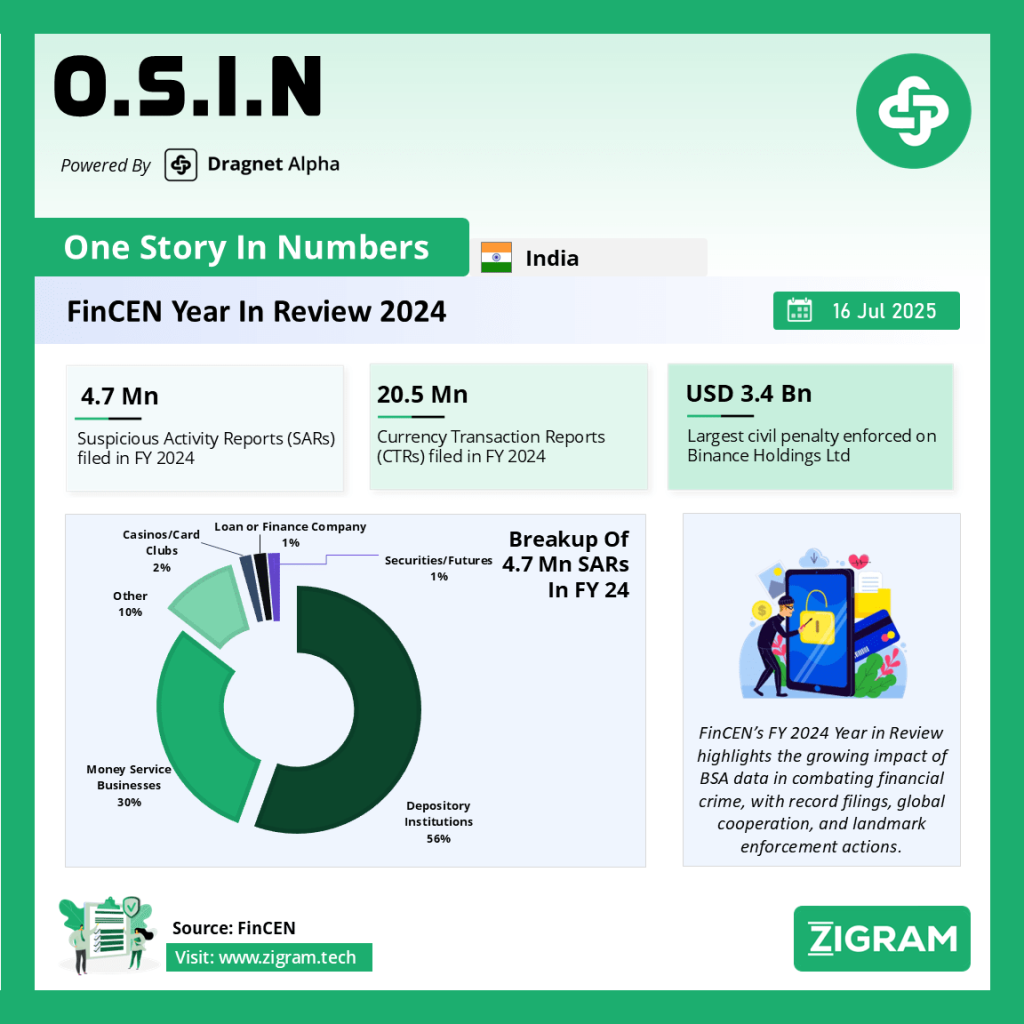

FinCEN received filings from approximately 324,000 registered financial institutions and e-filers. In FY 2024, SARs rose to 4.7 million filings, averaging 12,870 per day. CTRs were slightly lower than the previous year, but still accounted for 20.5 million reports, with an average of 56,160 daily filings. Reports on cash payments over \$10,000 in trade or business transactions (Form 8300) increased to 470,400, while filings for Foreign Bank and Financial Accounts (FBARs) reached 1.7 million. Notably, the top 10 institutions accounted for 45% of all SAR filings, emphasizing the concentration of reporting responsibility among major players in the financial sector.

Enhancing Investigations through Data Access and Training

FinCEN continued to empower its partners by offering direct access to BSA data through its secure BSA Search tool. In FY 2024, authorized personnel from 432 law enforcement and regulatory agencies conducted more than 2.3 million searches. Over 12,000 users were granted access to these databases. To strengthen investigative capacity, FinCEN provided BSA-related training to 20,600 individuals across 494 sessions. Additionally, nearly 400 analytical intelligence reports were produced to assist in high-priority investigations. FinCEN also surveyed over 1,400 users of its Portal, helping improve its service delivery based on feedback.

Promoting Secure Information Sharing

Sections 314(a) and 314(b) of the USA PATRIOT Act continued to support information sharing between financial institutions and law enforcement. Section 314(a) allows FinCEN to relay law enforcement inquiries to financial institutions to identify transactions and accounts tied to suspected money laundering or terrorist financing. Section 314(b) facilitates collaboration among over 6,100 registered financial institutions, allowing them to exchange information on potential criminal activity. In FY 2024, more than 48,000 SARs referenced 314(b) information sharing, including 62 SARs linked to terrorism-related activity.

Strategic Alerts and Financial Trend Analysis

FinCEN used its advisory and alert system to flag high-risk threats to the financial system. Notable publications included alerts on counter-financing of Hamas (320 SARs), COVID-19 Employee Retention Credit fraud (1,250 SARs), and Iran-backed terrorist financing (30 SARs). Other advisories focused on counterfeit passport card fraud, illicit fentanyl trafficking, and timeshare scams by Mexico-based transnational groups. FinCEN also published several Financial Trend Analysis reports in compliance with the Anti-Money Laundering Act of 2020. Topics included identity-related suspicious activity, the use of cryptocurrency for child exploitation, elder financial abuse, and check fraud linked to mail theft.

Public-Private Partnerships and Global Cooperation

FinCEN hosted 14 FinCEN Exchange events during the year, continuing its efforts to bridge the gap between the private sector and law enforcement. These exchanges help financial institutions identify risk indicators and enhance SAR quality. Internationally, FinCEN remained active within the Egmont Group, comprising 177 financial intelligence units worldwide. In FY 2024, FinCEN received 972 requests from foreign FIUs, issued 452 requests, and processed over 1,200 spontaneous disclosures both inbound and outbound. Its Rapid Response Program (RRP), designed to help recover stolen funds from cyber-enabled financial crimes like business email compromise, continued to provide timely support to global partners.

Enforcement and Regulatory Action

FinCEN exercised its authority under Section 311 of the USA PATRIOT Act and Section 9714 of the Combating Russian Money Laundering Act to target entities posing money laundering threats. Actions included a notice of proposed rulemaking against Convertible Virtual Currency (CVC) mixers and a final rule against Al-Huda Bank. Additionally, the designation against ABLV Bank was rescinded, and action was taken against PM2BTC under Russian illicit finance concerns.

The most significant enforcement event of FY 2024 was the \$3.4 billion civil penalty imposed on Binance Holdings Ltd. and related entities—the largest in the history of the U.S. Department of the Treasury. This penalty was part of FinCEN’s broader enforcement efforts, which included processing 127 whistleblower tips and two major civil actions during the year.

Recognition of Effective Use of BSA Data

To highlight the impact of BSA data on successful investigations, FinCEN hosted its annual Law Enforcement Awards. In FY 2024, seven awards were presented for cases involving a total of 8,582 reviewed BSA filings submitted by 339 different institutions. These cases led to 178 convictions and were supported by 45 law enforcement agencies, showcasing the effectiveness of financial intelligence in the criminal justice system.

Conclusion

The FinCEN Year in Review for FY 2024 reflects the growing complexity of financial crime and the central role that financial intelligence plays in combating it. Through millions of reports, enhanced data access, international cooperation, trend analyses, and enforcement actions, FinCEN has positioned itself as a key player in safeguarding the U.S. and global financial systems. With evolving threats such as cyber fraud, synthetic drugs, and virtual currency misuse, FinCEN’s data-driven and collaborative approach will continue to be instrumental in protecting economic and national security.

Read the full report here.

Please read about our product: Dragnet Alpha

Click here to book a free demo

- #FinCEN

- #AML

- #BSAData

- #FinancialCrime

- #MoneyLaundering

- #SAR

- #CTRs

- #Enforcement

- #CyberCrime

- #BinancePenalty

- #RegTech

- #FinancialIntelligence

- #USApatriotAct

- #EgmontGroup

- #AMLCompliance