India’s Financial Crime Watchdog Intensifies Crackdown: Highlights from ED Annual Report 2024–25

India’s Directorate of Enforcement (ED) released its Annual Report for FY 2024–25, shedding light on the country’s intensifying efforts to tackle money laundering, economic crimes, and foreign exchange violations. The report outlines ED’s evolving mandate, operational achievements, risk-based strategies, and major case studies, signaling a more data-driven, collaborative, and globally aligned approach to financial crime enforcement.

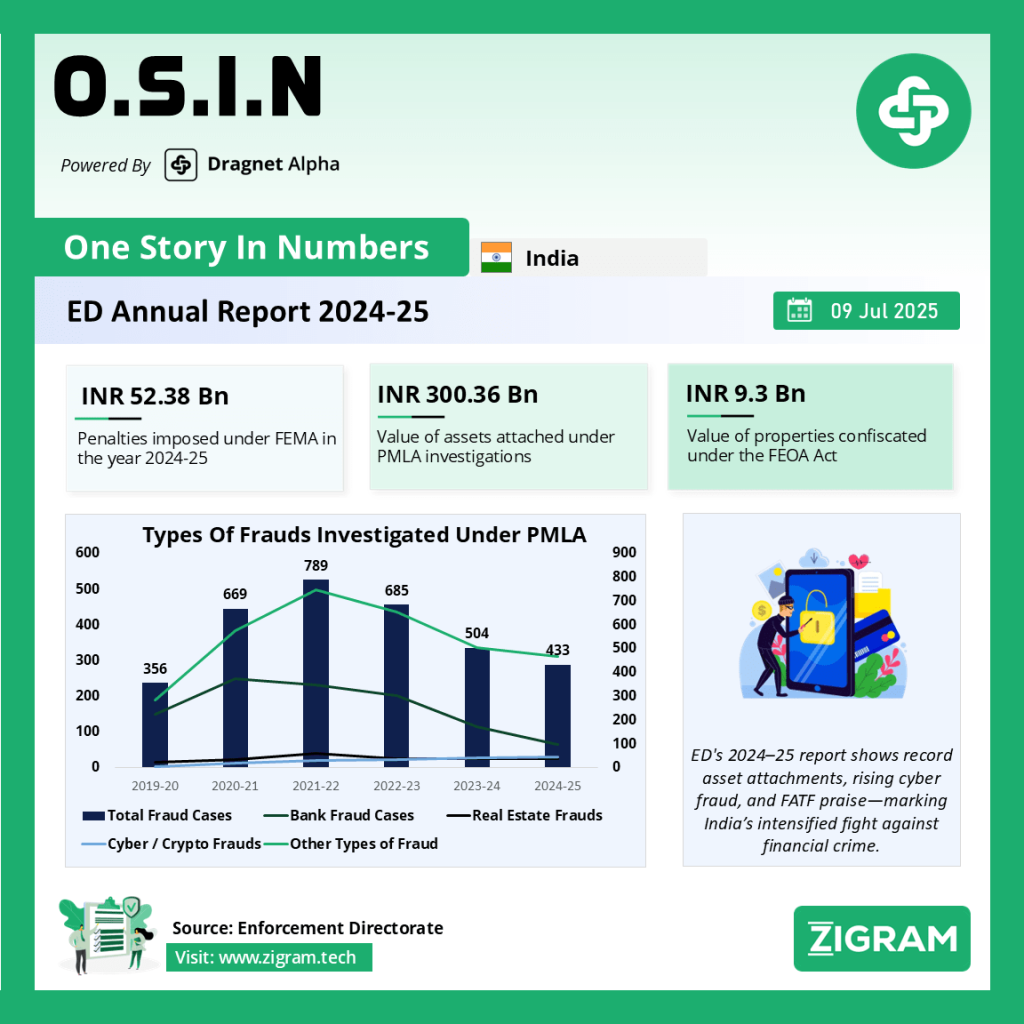

A Record Year for Enforcement

FY 2024–25 was marked by a 141% rise in provisionally attached assets, totaling ₹30,036 crore. The cumulative value of assets under ED’s provisional attachment reached ₹1,54,594 crore as of March 2025. These figures underscore ED’s enhanced operational reach and efficiency. Additionally, restitution of ₹15,261 crore was made in 30 cases through non-conviction-based confiscation mechanisms.

Surge in Investigations and Convictions

A record 775 new PMLA (Prevention of Money Laundering Act) investigations were initiated, 333 prosecution complaints filed, and 34 individuals convicted. Since the inception of PMLA enforcement, 1,739 prosecution complaints have been filed, of which 47 cases have concluded with a 93.6% conviction rate.

The Rise and Shift of Predicate Offences

While bank and real estate fraud cases showed a declining trend, cyber and crypto-related frauds saw a steep rise. Fraud continues to be the most dominant predicate offence, with a notable transition toward more technologically-enabled crimes. ED recorded 122 cybercrime cases in FY 2024–25, with PoC (Proceeds of Crime) exceeding ₹20,000 crore.

Key Typologies and Evolving Threats

ED identified new laundering methods: pig butchering scams (investment frauds mixed with romance scams), phantom hacking (targeting elderly with fake tech support), and digital arrest scams (posing as government agents to extort funds). Other typologies included illegal online betting, spoofed payment apps, and instant loan scams linked to Chinese-controlled fintech fronts. Shell companies and mule accounts remain central tools in laundering schemes.

Case Study: A Consortium Bank Fraud

A leading case involved directors of a corporate group defrauding public sector banks using forged documents and manipulating balance sheets. Loans worth thousands of crores were diverted into real estate via benami companies. Assets worth ₹5115 crore were attached, and key promoters arrested.

Institutional Strength and International Recognition

The ED’s risk-based framework, aligned with India’s National Risk Assessment (NRA), enabled effective resource allocation and targeted interventions. Notably, FATF’s Mutual Evaluation Report placed India in the “regular follow-up” category—an elite grouping within G20 peers—and rated India as “substantially effective” in several key areas.

Fugitive Economic Offenders and Cross-Border Collaboration

Under the Fugitive Economic Offenders Act (FEOA), 14 individuals have been declared fugitives with over ₹900 crore in confiscated assets. ED signed its first international MoU with Mauritius and played a leading role in global asset recovery networks like ARIN-AP.

Human Resources, Infrastructure & Coverage

The ED now operates through 5 regional offices, 27 zones, and 18 sub-zones, with an expanded presence in Northeast India. Its workforce has been strategically realigned to tackle growing case complexity, cross-border crime, and tech-driven laundering.

Conclusion

The 2024–25 Annual Report highlights the ED’s transformation into a data-savvy, globally engaged, and technologically equipped enforcement agency. As cyber-enabled frauds and global laundering networks evolve, ED’s strategic, risk-focused response underscores India’s determination to secure its financial ecosystem against criminal exploitation.

Read the full report here.

Please read about our product: Dragnet Alpha

Click here to book a free demo

- #EDAnnualReport2024-25

- #PMLA

- #FEMA

- #FOEA

- #RiskAssessment