Published Date:

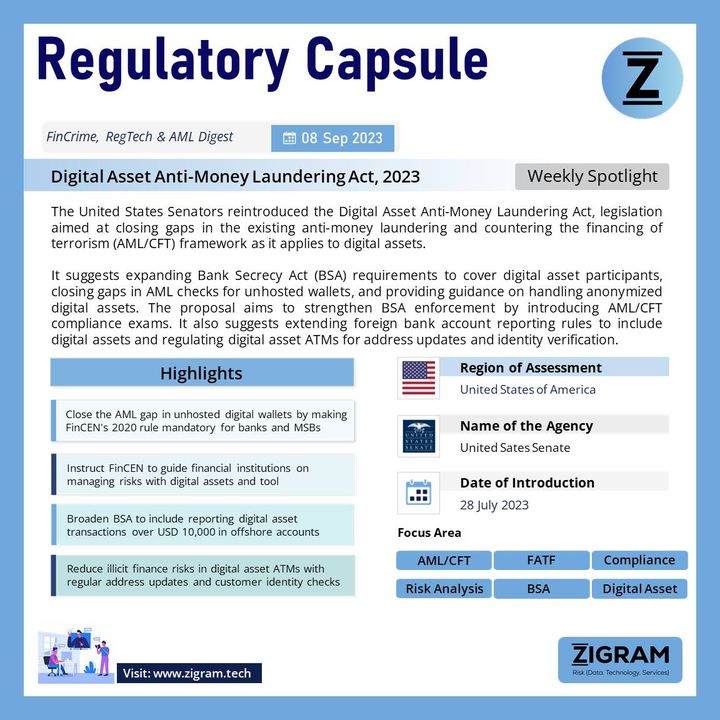

The Digital Asset Anti-Money Laundering Act, legislation that would reduce the risks that digital assets pose to US national security by closing loopholes and bringing the digital asset ecosystem into greater compliance with the anti-money laundering and countering the financing of terrorism (AML/CFT) framework, was reintroduced by United States Senators Elizabeth Warren (D-Mass.), Roger Marshall (R-Kan.), Joe Manchin (D-W.Va.), and Lindsey Graham (R-S.C.). It suggests extending the Bank Secrecy Act’s (BSA) application to cover all members of the digital asset ecosystem, including wallet providers, miners, validators, and others. The proposal urges mandating AML checks for unhosted digital wallets and those hosted in non-BSA-compliant jurisdictions, ensuring identity verification, record-keeping, and reporting for specific transactions in order to close significant loopholes. Furthermore, it emphasizes guidance from the Financial Crimes Enforcement Network (FinCEN) on managing the risks associated with anonymized digital assets. Additionally, it recommends extending foreign bank account reporting rules to cover digital assets and regulating digital asset ATMs for regular address updates and identity verification, aiming to mitigate illicit finance risks within the cryptocurrency space.

- #DigitalAssetAML

- #NationalSecurity

- #AMLFramework

- #CryptoRegulation

- #BSACompliance

- #DigitalAssetEcosystem

- #AntiMoneyLaundering

- #Cryptocurrency

- #FinCENGuidance

- #IllicitFinance

- #CryptoATM

- #RegulatoryReform

- #USLawmakers

- #FinancialSecurity

- #DigitalWallets