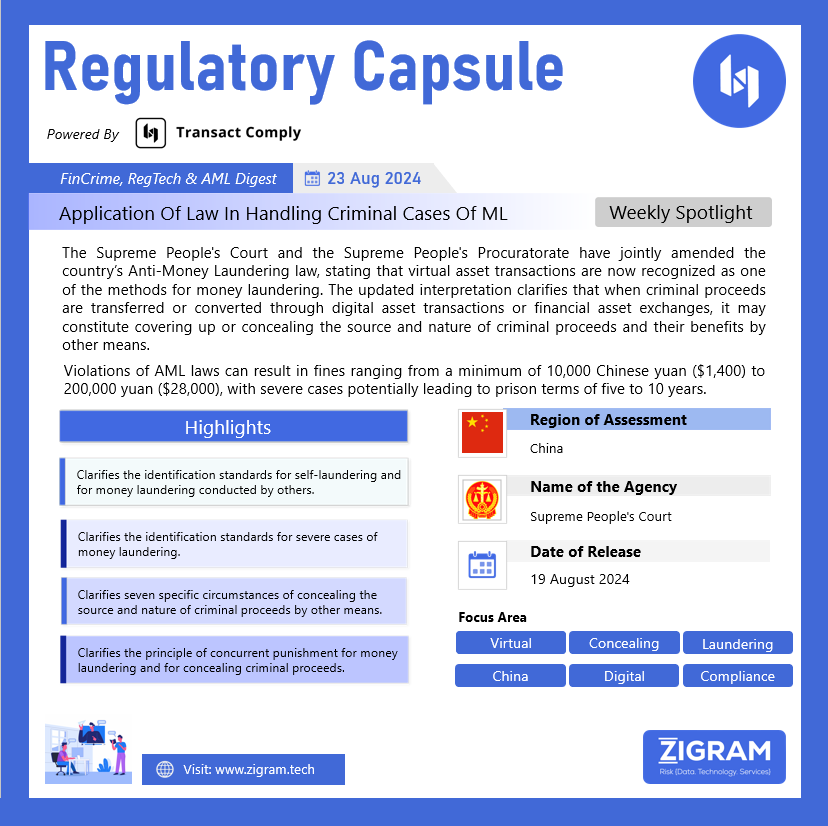

Regulation Name: Interpretation on Handling Criminal Cases of Money Laundering Concerning the Application of Law

Publishing Date: 19 August 2024

Region: China

Agency: Supreme People’s Court, Supreme People’s Procuratorate

On August 19, 2024, the Supreme People’s Court and the Supreme People’s Procuratorate jointly amended the country’s Anti-Money Laundering law, specifying that virtual asset transactions are to be recognized as a method of money laundering. The updated interpretation clarifies that when criminal proceeds are transferred or converted through digital asset transactions or financial asset exchanges, it may constitute covering up or concealing the source and nature of the criminal proceeds and their benefits by other means.

Clarifications

1. If money laundering exceeds 5 million yuan and involves multiple actions, refusal to cooperate in asset recovery, causing losses of over 2.5 million yuan, or results in other severe consequences, it is classified as a “serious circumstance.”

2. The Interpretation lists “virtual asset” transactions as a method of money laundering. It clarifies that transferring and converting criminal proceeds through “virtual asset” transactions and financial exchanges constitutes “concealing the source and nature of criminal proceeds,” as outlined in Article 191, Paragraph 1, Item 5 of the Criminal Law.

Explanation Of Several Issues Concerning Applicable Law For Handling Criminal Cases Of Money Laundering

1. Anyone who engages in money laundering to conceal or hide the proceeds from an offense outlined in Article 191 of the Criminal Law shall be convicted and punished under the same article.

2. Anyone who knowingly engages in money laundering to conceal or hide the source and nature of proceeds from crimes outlined in Article 191 of the Criminal Law shall be convicted and punished according to that article’s provisions.

3. To determine whether someone “knew or should have known” about the criminal nature of proceeds, several factors are considered. These include the information accessible to the individual, the context of handling the proceeds, the types and amounts involved, and the methods of transfer or conversion. Additionally, abnormal transaction behaviors, the person’s professional background, their relationship with the criminals, their statements, and witness testimonies are all evaluated. The burden shifts only if there is clear evidence proving the individual genuinely did not know. If the proceeds from a specific crime listed in Article 191 of the Criminal Law are also recognized as proceeds from other related crimes, it does not alter the determination of “knowing or should have known.”

4. Money laundering exceeding RMB 5 million is considered a “serious circumstance” under Article 191 of the Criminal Law if any of the following apply:

o Repeated money laundering activities.

o Refusal to cooperate in property recovery, resulting in the inability to recover stolen funds or property.

o Causing losses of RMB 2.5 million or more.

o Leading to other severe consequences.

o If someone commits multiple money laundering offenses without prior prosecution, the total amount laundered is calculated cumulatively.

5. To conceal or hide the source and nature of criminal proceeds under Article 191 of the Criminal Law, individuals may engage in various activities, such as transferring or converting funds through pawning, leasing, investing, or purchasing financial products. They might mix illicit funds with legitimate business income from cash-heavy operations like malls or restaurants or use fictitious transactions and false claims. Other methods include purchasing lottery tickets or precious metals, converting funds through gambling, or using virtual asset transactions. These actions are considered attempts to obscure the origins of criminal proceeds.

6. If an act of concealing or hiding criminal proceeds under Article 191 of the Criminal Law also constitutes a crime under Article 312, the individual will be convicted and punished according to Article 191. Similarly, if money laundering under Article 191 overlaps with crimes under Articles 349, 225, 177-1, or 120-1, the punishment will follow the provision with the harsher penalty.

7. The determination of a money laundering crime depends on the established facts of the upstream crime, regardless of whether the crime has been adjudicated. Money laundering can still be charged if there is evidence of the upstream crime, even if the perpetrator is at large, deceased, or not criminally liable for other reasons, or if they are convicted of a different crime.

8. Under Article 191 of the Criminal Law, “proceeds of organized crime of a mafia nature and the profits derived therefrom” refers to all assets, property rights, and profits gained by mafia organizations and their members through illegal activities, including those accumulated during the formation and growth of the organization.

9. A person convicted of money laundering will face a fine of at least RMB 10,000 if sentenced to up to five years of imprisonment or criminal detention. For sentences ranging from five to ten years, the fine increases to at least RMB 200,000.

10. If the perpetrator satisfies the conditions of Articles 1 and 2 of this Interpretation, truthfully confesses, pleads guilty, and cooperates in recovering criminal proceeds, they may receive a lighter sentence. In cases with minor circumstances, they may avoid prosecution or be exempt from criminal punishment.

11. When an entity commits a money laundering crime, it will be fined according to the sentencing standards for individuals. Additionally, the directly responsible supervisors and other key individuals will also face conviction and punishment.

12. “Upstream crimes” include drug offenses, organized crime, terrorism, smuggling, corruption, financial management disruptions, and financial fraud, as outlined in Article 191 of the Criminal Law.

This interpretation will take effect on August 20, 2024, and will replace the Supreme People’s Court’s Interpretation on the Specific Application of Laws in Money Laundering and Related Criminal Cases (Fa Shi [2009] No. 15), which is hereby repealed.

Read the details here.

Know more about the product: Transact Comply

Click here to book a free demo.

- #AML

- #CFT

- #VirtualAssets

- #Regulation

- #VASPs

- #Compliance

- #China