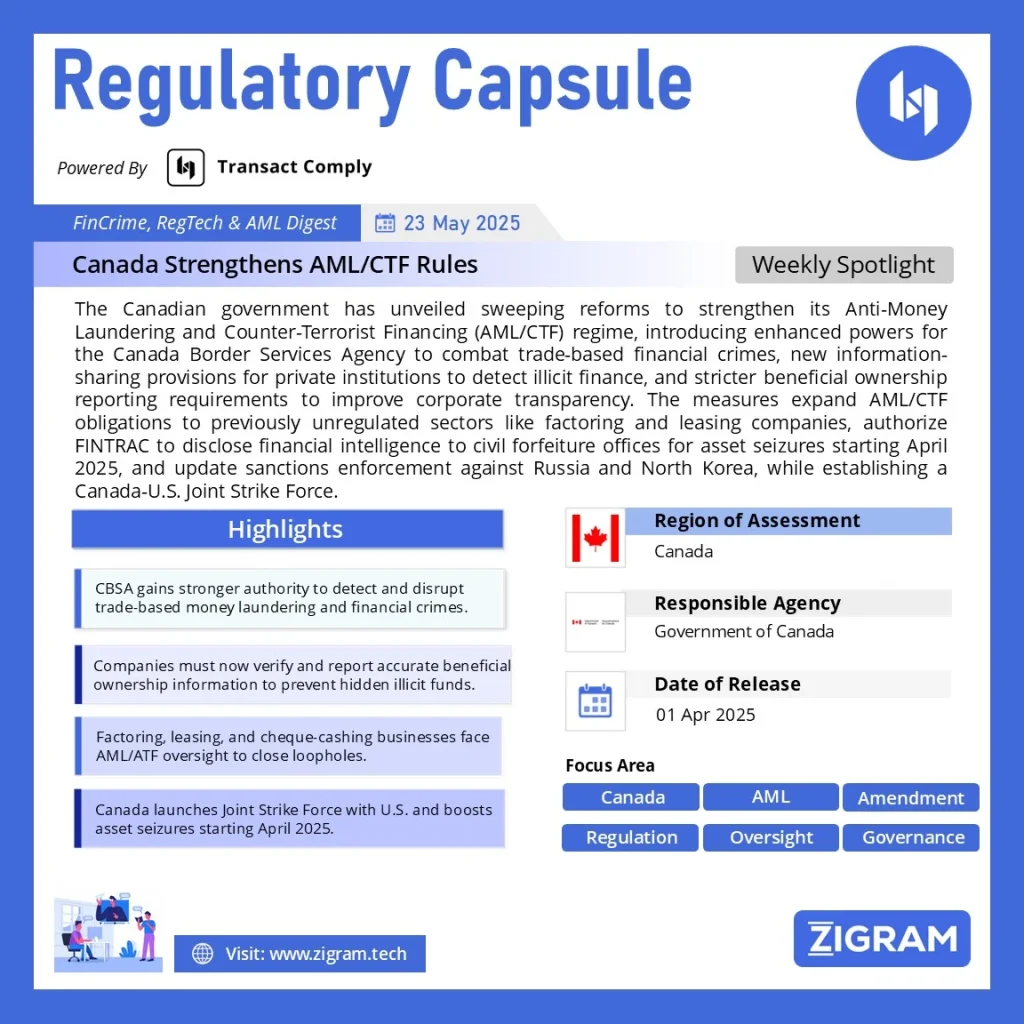

Regulation Name: AML/CFT Rules

Date Of Release: 01 Apr 2025

Region: Canada

Agency: Government of Canada

Canada Strengthens Anti-Money Laundering and Anti-Terrorist Financing Framework with New Regulatory Measures

The Government of Canada has announced sweeping regulatory amendments to bolster the country’s Anti-Money Laundering and Anti-Terrorist Financing (AML/ATF) framework, ensuring a more robust response to financial crimes, transnational organized crime, and drug trafficking—particularly the illegal fentanyl trade.

These changes align with Canada’s Border Plan and the newly established Canada-U.S. Joint Strike Force, a collaborative effort to combat organized crime and enhance border security. The updated measures aim to close regulatory gaps, improve financial intelligence sharing, and strengthen enforcement capabilities.

Key Measures in the New AML/ATF Framework

1. Enhanced Border Security Against Trade-Based Financial Crime

The Canada Border Services Agency (CBSA) will receive expanded authorities to better detect, deter, and disrupt trade-related money laundering schemes, including illicit financial flows linked to drug trafficking and transnational crime.

2. New Information-Sharing Framework for Private Institutions

A new framework will allow banks and other financial institutions to share information related to money laundering, terrorist financing, and sanctions evasion. This will make it harder for criminals to exploit the financial system and evade detection.

3. Mandatory Reporting of Beneficial Ownership Discrepancies

Private institutions will now be required to report discrepancies between their records and the federal beneficial ownership registry maintained by Corporations Canada. This ensures greater accuracy and transparency in tracking corporate ownership to prevent misuse by criminals.

4. Expanded AML/ATF Obligations for High-Risk Sectors

To close regulatory loopholes, factoring companies, cheque cashing businesses, and financing/leasing companies will now be subject to AML/ATF regulations, reducing opportunities for criminals to launder money through less-regulated financial services.

5. FINTRAC Disclosures to Civil Forfeiture Offices

Starting April 1, 2025, provincial and territorial civil forfeiture offices will receive financial intelligence disclosures from the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC). This will support efforts to seize criminal assets, disrupting illicit financial networks.

Strengthening Sanctions Enforcement

The Minister of Finance and Intergovernmental Affairs will update directives related to the Democratic People’s Republic of Korea (North Korea) and the Russian Federation to combat sanctions evasion and protect Canada’s financial system.

Investments and Collaborative Efforts

These measures build on $379 million in funding over the past five years to enhance Canada’s AML/ATF regime. Recent legislative changes have also provided new tools for law enforcement, introduced stricter penalties, and expanded oversight to high-risk sectors.

Additionally, on February 19, 2025, the government launched the Integrated Money Laundering Intelligence Partnership, enabling permissible intelligence sharing between law enforcement and major banks to combat organized financial crime.

A Stronger, More Secure Financial System

“These regulatory changes demonstrate Canada’s commitment to fighting financial crime, protecting our borders, and ensuring the integrity of our financial system,” said a government spokesperson. “By closing gaps and enhancing collaboration, we are making it harder for criminals to profit from illegal activities.”

The new measures underscore Canada’s proactive stance in global AML/ATF efforts, ensuring a safer and more transparent financial environment for all Canadians.

Read the full plan here.

Read about the product: Transact Comply

Empower your organization with ZIGRAM’s integrated RegTech solutions – Book a Demo

- #AMLCFT

- #Canada

- #LawEnforcement