Regulation Name: Anti-Money Laundering and Other Matters Bill 2024

Publishing Date: 2 July 2024

Region: Singapore

Agency: Parliament of Singapore

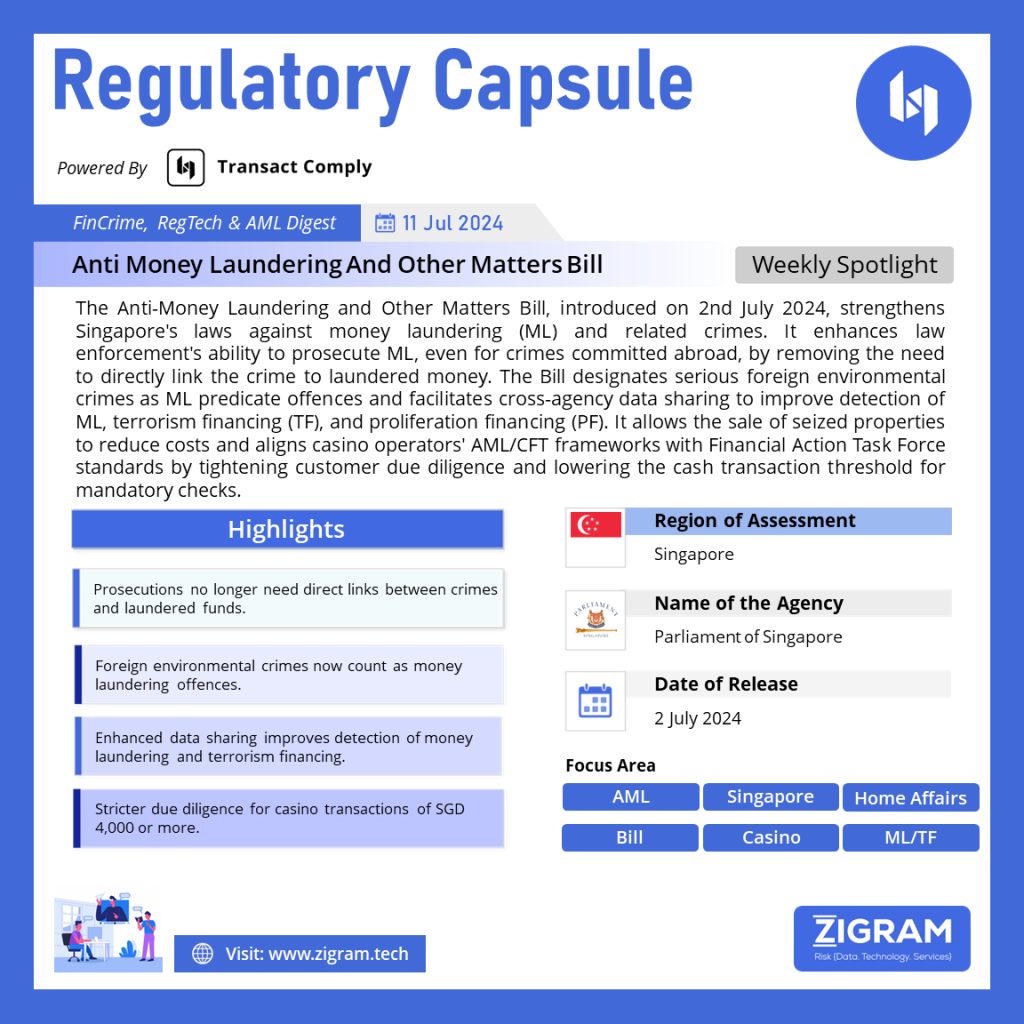

In a significant move to fortify Singapore’s defenses against financial crimes, the Anti-Money Laundering and Other Matters Bill was introduced in Parliament on 4th July 2024. This legislative initiative reflects the government’s commitment to staying ahead of evolving criminal activities and ensuring robust legal mechanisms to combat money laundering (ML), terrorism financing (TF), and proliferation financing (PF).

Enhancing Prosecution of Money Laundering Offences

One of the key amendments in the Bill is designed to simplify the prosecution of money laundering offences. Under the current law, prosecuting ML requires proving a direct link between the laundered money and specific criminal conduct, which is particularly challenging when the crime occurs abroad. The Bill removes this requirement, allowing prosecutions to proceed if it can be shown that the accused knew or had reasonable grounds to believe they were dealing with criminal proceeds. This change is expected to significantly improve the effectiveness of legal actions against money mules and other intermediaries involved in complex international money laundering schemes.

Addressing Foreign Environmental Crimes

Recognizing the global nature of financial crimes, the Bill also designates serious foreign environmental crimes, such as illegal mining and logging, as predicate offences for money laundering. This means that Singaporean law enforcement can now investigate and prosecute ML cases linked to these crimes, even if the offences themselves do not occur within Singapore’s borders. This alignment with international standards underscores Singapore’s commitment to combating environmental crime and its associated financial flows.

Improving Data Sharing Among Agencies

To enhance the detection of ML, TF, and PF, the Bill facilitates better data sharing between various government agencies. Amendments to laws like the Income Tax Act and the Goods and Services Tax Act will allow authorities, such as the Inland Revenue Authority of Singapore and Singapore Customs, to share relevant data with the Financial Intelligence Unit, the Suspicious Transaction Reporting Office (STRO). This inter-agency collaboration aims to provide richer intelligence, enabling more comprehensive analyses and timely regulatory actions.

Streamlining Management of Seized Properties

The Bill also addresses the management of properties seized in connection with suspected criminal activities. Currently, selling such properties requires the consent of all parties involved, leading to prolonged maintenance costs and potential depreciation. The new amendments will permit the court to order the sale of seized or restrained properties under certain conditions, such as when their value is likely to depreciate or when maintaining them incurs undue costs. This measure ensures that the value of seized assets is preserved, benefiting subsequent asset recovery and victim restitution efforts.

Aligning Casino Regulations with International Standards

Casino operators in Singapore will face tighter regulations under the new Bill. The threshold for mandatory customer due diligence (CDD) checks will be lowered from transactions involving S$10,000 to S$4,000. Additionally, casinos will be required to consider proliferation financing risks as part of their CDD processes. These changes align Singapore’s regulations with the Financial Action Task Force (FATF) standards, reinforcing the integrity of the country’s financial system.

The Anti-Money Laundering and Other Matters Bill represents a comprehensive update to Singapore’s legal framework, ensuring that the country remains resilient against sophisticated financial crimes. By enhancing prosecution capabilities, addressing global environmental crimes, improving data sharing, streamlining property management, and tightening casino regulations, the Bill reinforces Singapore’s position as a leader in financial integrity and security.

Read the bill here.

- #MoneyLaundering

- #FinancialSecurity

- #SingaporeLaw

- #AntiMoneyLaundering

- #AML

- #TerrorismFinancing

- #ProliferationFinancing

- #FinancialIntegrity

- #EnvironmentalCrimes

- #CasinoRegulations

- #LegalReform

- #FinancialIntelligence

- #CrimePrevention