Regulation Name: AML/KYC Obligations For Investment Advisers

Publishing Date: 28 August 2024

Region: United States of America

Agency: Financial Crimes Enforcement Network (FinCEN)

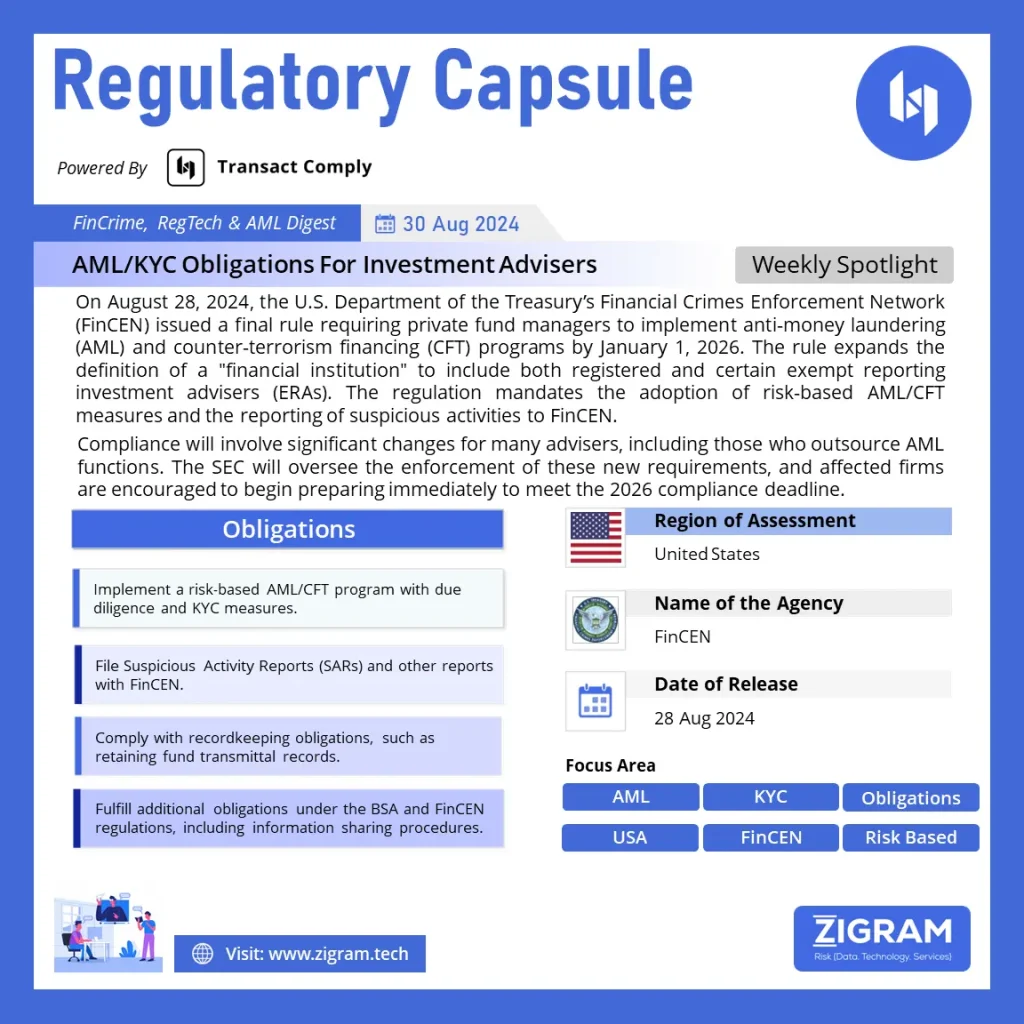

The Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. Department of the Treasury released a final rule for AML/KYC obligations for investment advisers. The rule brings certain investment advisers under the purview of the Bank Secrecy Act (BSA), thereby requiring them to adhere to anti-money laundering (AML) and countering the financing of terrorism (CFT) standards.

Overview Of The Final Rule

The final rule effectively expands the definition of “financial institution” under the BSA to include certain investment advisers. This expansion mandates that these advisers establish AML/CFT programs and report suspicious activities to FinCEN. The rule aims to mitigate the risks associated with money laundering, terrorist financing, and other illicit activities that could be funneled through the investment adviser industry.

Key Provisions And Requirements

1. Definition of Financial Institution:

The rule broadens the definition of a “financial institution” to include investment advisers registered with the Securities and Exchange Commission (SEC) and exempt reporting advisers (ERAs). However, the definition excludes certain categories of advisers, such as those with no assets under management (AUM) or those registered solely due to being mid-sized or multi-state advisers.

2. AML/CFT Program Requirements:

Investment advisers are now required to establish and maintain AML/CFT programs. These programs should be designed to prevent the misuse of advisory services for illicit financial activities. The programs must include procedures for customer due diligence (CDD), monitoring transactions, and filing Suspicious Activity Reports (SARs).

3. Suspicious Activity Reporting:

Investment advisers covered under this rule are obligated to report suspicious transactions to FinCEN. This includes any transactions that raise suspicions of money laundering, terrorist financing, or other forms of illicit finance.

4. Exemptions and Clarifications:

The rule does not apply to state-registered advisers, foreign private advisers, or family offices. It also allows certain exclusions for mutual funds and other specified entities from the AML/CFT program requirements.

5. Compliance and Supervision:

The rule assigns the SEC the authority to examine investment advisers for compliance with these new AML/CFT requirements, leveraging the SEC’s expertise in regulating the investment advisory industry.

6. Illicit Finance Risks in the Investment Adviser Industry:

The rule was prompted by the recognition that investment advisers, particularly those managing private funds, pose significant illicit finance risks. These advisers can serve as entry points for illicit proceeds from corruption, fraud, and tax evasion. The rule aims to address these risks by bringing the industry under more stringent regulatory oversight.

7. Implementation Timeline:

The rule will come into effect on January 1, 2026, giving investment advisers time to establish and implement the required AML/CFT programs and reporting mechanisms.

Implications For The Industry

This rule marks a significant regulatory shift for the investment adviser industry, which has historically been less stringently regulated compared to other financial sectors. By bringing investment advisers under the BSA’s framework, FinCEN aims to close gaps in the U.S. financial system that could be exploited by illicit actors. The rule is expected to enhance the transparency and integrity of the investment advisory industry, thereby safeguarding national security and preventing financial crimes.

As the investment adviser industry evolves, so too must the regulatory frameworks that govern it. This final rule by FinCEN represents a crucial step in aligning the industry with broader financial crime prevention measures. By January 2026, investment advisers will need to have robust AML/CFT programs in place, ensuring that they are not inadvertently aiding illicit financial activities. The implementation of this rule is poised to strengthen the U.S. financial system against threats posed by money laundering, terrorist financing, and other illicit finance activities.

Read the details here.

Know more about the product: Transact Comply

Click here to book a free demo.

- #FinCEN

- #AML

- #CFT

- #InvestmentAdvisers

- #FinancialRegulations

- #BSA

- #MoneyLaundering

- #TerroristFinancing

- #SEC

- #FinancialCompliance