In an era of heightened regulatory scrutiny and risk, ZIGRAM‘s PreScreening.io stands out as one of the best solutions for risk and name screening. This comprehensive SaaS platform is designed to streamline and enhance risk management processes, offering robust capabilities in identifying and mitigating customer and third-party risks, with a particular focus on Anti-Money Laundering (AML) and Financial Crime Compliance (FCC).

PreScreening.io facilitates the identification of various business risks through name screening, providing real-time or near-real-time results to enterprises of all sizes. It ensures compliance with global standards and best practices in risk management. The platform caters to multiple use cases, including AML compliance, vendor and supplier risk assessment, portfolio risk monitoring, employee screening, and third-party onboarding.

Related Reads:

What Is AML Name Screening? What Are The Techniques And Best Practices?

Want to know more? Get in touch with us!

Fore more information on AML events and updates sign up here

Why PreScreening.io is the Best Name Screening Software for Modern Compliance

Comprehensive Risk Coverage for AML and Financial Crime Compliance

PreScreening.io addresses a wide array of risk areas, including sanctions, Politically Exposed Persons (PEP), adverse press, AML penalties, and numerous international watchlists. This extensive coverage ensures businesses can efficiently identify potential risks associated with entities and individuals. Features include real-time screening for prompt threat responses, fuzzy matching for accurate detection, and effective false positive management for operational efficiency.

Risk Scoring Models that Power Informed Decisions

The platform employs a sophisticated risk scoring model that integrates various risk checks to provide an overall risk score for entities. This model categorizes risks into high, medium, and low probability, aiding businesses in making informed decisions. Additionally, PreScreening.io offers decision tools, analytics, dashboards, and customizable reports to enhance the risk assessment process.

Advanced AML Screening Technology and Automation

Utilizing advanced algorithms and machine learning technologies, PreScreening.io ensures accurate and efficient screening. The platform supports batch processing, monitoring, and API integration for seamless workflow incorporation. Its disambiguation support further reduces errors and enhances screening accuracy.

Access to Global and Local Risk Data Sources

PreScreening.io leverages an extensive database of risk-relevant global and local lists, covering over 2,650 watchlists and 410 regulators and agencies across 240 countries and jurisdictions. This includes specialized lists such as the India Watchlists, providing detailed coverage of risk-relevant entities in India.

Customizable Name Screening for Different Business Needs

The platform allows for the customization of scoring checks and thresholds based on specific client or user requirements. This flexibility ensures that PreScreening.io can adapt to various business needs and regulatory environments, offering configurable rules for tailored customization.

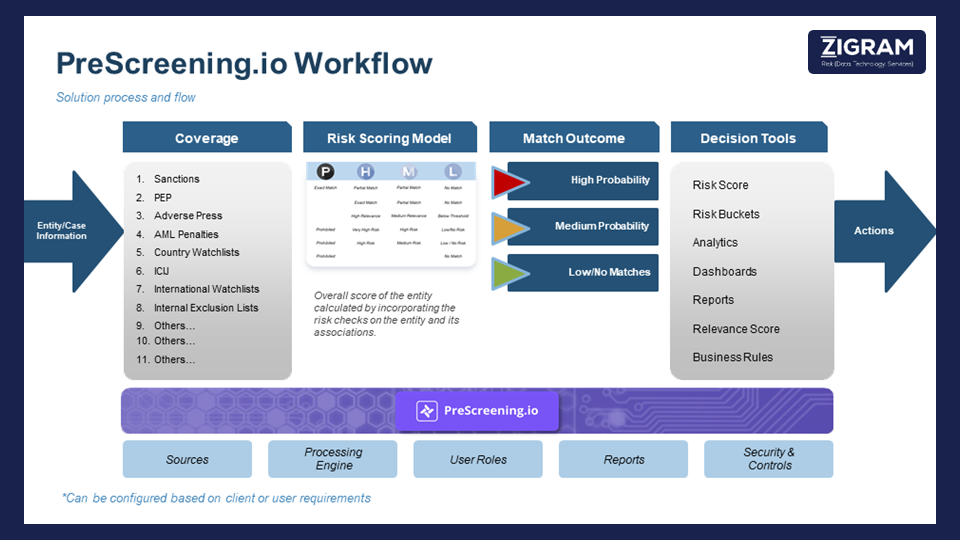

How ZIGRAM’s PreScreening.io Name Screening Software Works

PreScreening.io provides a comprehensive solution for entity screening and risk assessment. The workflow is designed to efficiently process and analyze entity information through multiple stages, ensuring accurate risk scoring and actionable outcomes.

Entity Case Information: The Foundation of Accurate Screening

ZIGRAM’s proprietary data solution works perfectly with our in-house software. Because both the data and software are developed by ZIGRAM, they are closely linked and work seamlessly together. Our software is designed to work with our data in real time. It uses the data to provide accurate and efficient results, and it gives feedback that helps improve the data algorithms. This means the software can perform advanced tasks like refining searches and enhancing risk assessments.

To ensure the system works well, we focus on high-quality data. Old or incorrect records can cause many false positives, which make real-time risk screening less effective. That’s why ZIGRAM’s team of global data experts continuously reviews and updates profiles, ensuring that the AML/CFT data used by our software is always accurate and up-to-date.

Extensive Coverage Across Risk Categories

The system is designed to handle a wide range of risk categories. This structured approach ensures that the software provides comprehensive and reliable risk screening, tailored to meet specific client needs.

- Sanctions

- Politically Exposed Persons (PEP)

- Adverse Press

- Anti-Money Laundering (AML) Penalties

- Country Watchlists

- International Criminal Court (ICU) lists

- International Watchlists

- Internal Exclusion Lists

- Other customizable lists as per client requirements, and many more

Risk Scoring Model for Accurate Match Outcomes

Our system features an advanced risk scoring model designed to thoroughly evaluate entities. This model employs a variety of name-matching techniques to screen entity names with high precision. It can combine multiple factors, such as name and date of birth, or name and location/address, to enhance the accuracy of the screening process. By integrating these different matching models, the system minimizes false positives and ensures that entities are accurately identified and assessed. This comprehensive approach helps in achieving the highest possible accuracy in risk evaluation. The possible match outcomes generated by the risk scoring model include:

- Exact Match: The entity's details perfectly match with the data in the system.

- Partial Match: Some details of the entity align with the data, but not all.

- Fuzzy Match: The entity's details are close to, but not exactly, matching the data, often due to variations in spelling or format.

- No Match: The entity's details do not match any records in the system.

This meticulous process ensures that the system provides reliable and precise risk assessments, significantly reducing the likelihood of missing critical information or generating incorrect alerts. Each match outcome is then further classified into probability categories to assess the level of risk associated with the entity:

High Risk

Medium Risk

Low Risk

For example, an entity that is on a sanctions list would be categorized as high risk. Similarly, an entity located in a FATF blacklisted country would also be considered high risk. On the other hand, entities with lower risk profiles might include those with no significant adverse associations or those located in low-risk jurisdictions. This classification helps prioritize the review and action based on the risk level associated with each entity.

Interpreting Match Outcomes for Risk-Based Actions

Based on the risk scoring model, the system assesses the probability of risk and categorizes the match outcomes into:

- High Probability: Indicates a strong likelihood that the entity poses a significant risk. This could be due to exact matches with high-risk lists or other strong indicators of risk. Entities in this category require immediate attention and thorough investigation.

- Medium Probability: Suggests a moderate risk level. This might result from partial matches or fuzzy matches that suggest some degree of risk but are less definitive. Entities in this category should be reviewed more carefully, and additional verification may be necessary.

- Low/No Matches: Indicates a low risk or no significant risk found. Entities falling into this category either have minimal risk factors or are not found in the database. While these entities may not require immediate action, periodic monitoring is advisable to ensure that no new risk factors emerge.

Decision Tools for Compliance Teams

To support effective decision-making, the system offers a range of tools:

- Risk Score: Provides a numerical value representing the level of risk associated with an entity, aiding in prioritizing further actions.

- Risk Buckets: Categorizes entities into predefined risk levels (e.g., high, medium, low), making it easier to manage and respond to different risk profiles.

- Analytics: Offers insights into risk patterns and trends, helping to identify potential issues and make informed decisions based on data-driven analysis.

- Dashboards: Provides a visual overview of risk assessments, allowing users to monitor risk levels and track key metrics in real time.

- Reports: Generates detailed reports on risk assessments and match outcomes, supporting compliance and audit requirements with comprehensive documentation.

- Relevance Score: Evaluates how closely an entity’s details match risk criteria, providing an additional layer of assessment for more accurate decision-making.

- Business Rules: Implements customized rules based on client-specific requirements, ensuring that the system's responses align with organizational policies and procedures.

Recommended Actions Based on Screening Results

Based on the decision tools and match outcomes, the system recommends actions tailored to the client’s specific needs. These actions might include:

- Enhanced Due Diligence: For high-probability matches, conducting a deeper investigation to verify the entity's status and mitigate potential risks.

- Further Verification: For medium-probability matches, additional checks and validation steps to confirm the entity's risk profile.

- Monitoring and Alerts: For low/no matches, setting up ongoing monitoring and alerts to ensure that any new risk indicators are promptly addressed.

These actions are designed to be flexible and can be adjusted according to the client’s specific requirements and risk management strategies.

Key Reasons to Choose PreScreening.io as Your Name Screening Solution

ZIGRAM’s PreScreening.io ensures a comprehensive, future-proof solution for effective risk management and compliance.

Comprehensive, Future-Proof Screening Capabilities

ZIGRAM's PreScreening.io’s key capabilities include real-time screening for prompt threat response, fuzzy matching for accurate detection, and effective false positive management for operational efficiency. Configurable rules allow for tailored screening processes to meet specific organizational needs. The screening software is designed to support all stakeholders in your fraud and AML programs, offering role-based access for analysts, team leaders, and chief risk officers. The platform also emphasizes automation, streamlining repeatable tasks to enhance cost-effective compliance and operational efficiency. With a risk-driven approach, PreScreening.io effectively implements risk policies, dynamically scores customer and case risks, and integrates seamlessly into existing workflows. This ensures a proactive and comprehensive risk management strategy.

Integrated Data and High-Quality AML Information

ZIGRAM's PreScreening.io offers comprehensive data integration, covering all jurisdictions and territories where your firm operates. By providing both software and proprietary data, ZIGRAM simplifies vendor management and reduces procurement costs. This integration ensures the software and data are closely linked, enhancing performance and functionality. Quality of data is prioritized, with global data experts ensuring AML/CFT data is accurate and up-to-date. This reduces false positives and enhances effective risk screening.

Full Compliance with Global AML Regulations

PreScreening.io aligns with AML regulations, accessing and incorporating updated sanctions lists from reliable sources. Automatic updates and alerts for changes in sanctions lists enhance compliance efforts and proactive risk management, minimizing the risk of engaging with sanctioned entities.

Smooth Integration and Technical Scalability

ZIGRAM ensures smooth implementation of AML programs with PreScreening.io. Key considerations include:

- Compatibility and Integration: Seamless integration with existing systems, supported by the vendor.

- Scalability and Performance: Handles increasing data volumes and transactions without compromising performance.

- API Response Times: Fast and consistent, minimizing transaction processing delays.

- UI and UX: Intuitive user interface with customizable dashboards and multi-language support.

- Configurability: High degree of configurability in screening rules, alert thresholds, and risk parameters, adapting easily to evolving compliance requirements.

Additional Benefits of ZIGRAM’s Name Screening Software

- Quick scan - Real time and batch processing

- Real time Monitoring capabilities for onboarded or watchlist customers

- Composite score to assess multiple associated entities & individuals – for B2B use case

- Case and entity specific reports – single and batch

- Customizable scoring, checks and thresholds

- Library feature for selection of risk checks – Sanctions, PEPs, etc.

- Focus on country, region and local lists

- ML driven global news checks

- API for platform and workflow integration

- Disambiguation support – technology, data science and resourcing

- Reduce time, efforts, and errors - consistently

- Rule engine

- Best practices & standards

- Team workflows

- Alerts: Provides 24/7 alert disambiguation-as-a-service.

Seamless Implementation and Ongoing Support for Name Screening Software

ZIGRAM ensures the seamless implementation of PreScreening.io with APIs that integrate smoothly into your workflows. We provide tuning, business rule development, and ongoing support. Our integration capabilities and expertise make PreScreening.io a reliable tool for risk management and compliance. PreScreening.io, a top product of ZIGRAM, offers extensive coverage, sophisticated risk scoring, and real-time processing, making it invaluable for enhancing risk management and compliance. Book your FREE DEMO with us now!

- #PreScreening.io

- #NameScreening

- #Compliance

- #RiskScreening

- #DueDiligence