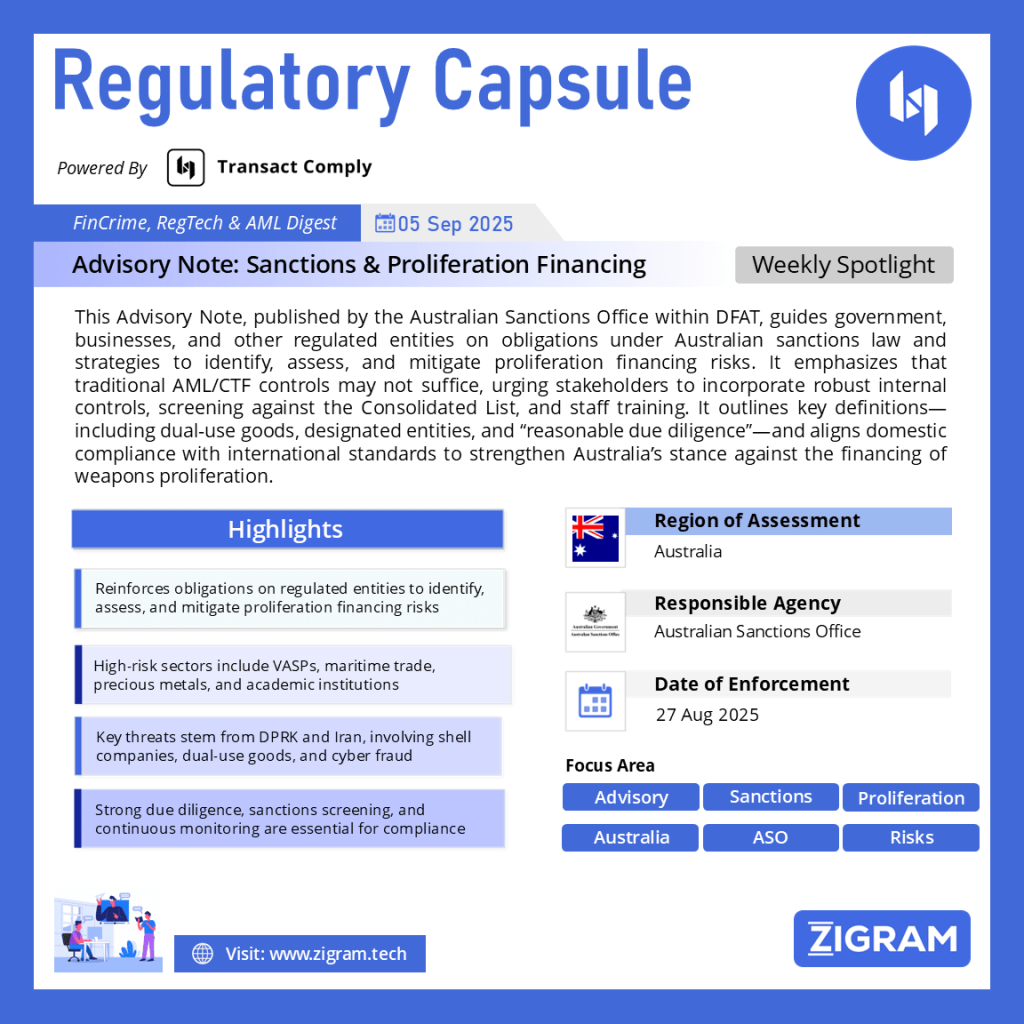

Regulation Name: Advisory Note – Sanctions & Proliferation Financing

Date Of Effect: 27 Aug 2025

Region: Australia

Agency: Australia Sanctions Office

Strengthening Defenses Against Proliferation Financing: Insights from Australia’s Sanctions Advisory

Proliferation financing—the act of providing financial support for the development, acquisition, or movement of weapons of mass destruction (WMDs) and related materials—remains one of the most pressing global security challenges. Recognizing the complexity of these threats, the Australian Sanctions Office (ASO) under the Department of Foreign Affairs and Trade (DFAT) has issued an Advisory Note on Sanctions and Proliferation Financing. This comprehensive guidance outlines the obligations of regulated entities, identifies high-risk sectors, and provides practical strategies for compliance with both domestic and international frameworks.

Understanding Proliferation Financing and Sanctions Obligations

The advisory defines proliferation financing as any financial activity that facilitates the development or transport of nuclear, chemical, biological, or radiological weapons in violation of international law. Such activities are directly linked to national security concerns and global peace.

Under Australian law, regulated entities—including government agencies, businesses, and financial institutions—must comply with sanctions laws. These laws restrict dealings with designated persons, entities, vessels, or countries linked to WMD proliferation. The Consolidated List maintained by DFAT serves as a central resource for screening and compliance.

Importantly, regulated entities are expected to exercise reasonable precautions and due diligence, tailoring their compliance frameworks according to business size, sector, geography, and transaction complexity.

Legal and Regulatory Framework

Australia’s sanctions obligations are grounded in both international commitments and domestic legislation. Key frameworks include:

United Nations Security Council Resolutions (UNSCRs) such as 1540 (2004), mandating states to prohibit non-state actors from engaging in WMD-related activities, and 2325 (2016), which strengthens controls over materials and financing linked to proliferation.

Australian Sanctions Regulations and the Charter of the United Nations Act 1945, which give domestic effect to UNSC measures and establish autonomous sanctions.

FATF Recommendation 7, requiring targeted financial sanctions to disrupt proliferation financing.

The AML/CTF Act, which by March 2026 will obligate regulated entities to identify, assess, and mitigate proliferation financing risks as part of broader financial crime compliance programs.

Countries of particular concern include Iran and the Democratic People’s Republic of Korea (DPRK), both subject to extensive UNSC and autonomous sanctions due to ongoing attempts to advance WMD capabilities.

High-Risk Sectors and Exploitation Methods

The advisory identifies several sectors vulnerable to exploitation by proliferators:

Trust and company service providers, including law firms and accountants, which may be used to obscure beneficial ownership.

Dealers in precious metals and stones, often targeted for cross-border value transfer.

Virtual Asset Service Providers (VASPs) and fintech platforms, providing fast and opaque channels for fund movement.

The maritime sector, exploited for transporting WMD-related materials and for sanctions evasion.

Universities and research institutions, where knowledge transfer and intellectual property theft are risks.

Known proliferation financing methodologies targeting Australia include the misuse of front and shell companies, dual-use goods, trade-based money laundering (TBML), and exploitation of cryptocurrencies. Additionally, the DPRK has been linked to fraudulent activities such as cyberattacks, IT worker schemes, and romance scams, all aimed at raising revenue for its WMD programs.

Indicators and Red Flags

The advisory provides several red flags for detecting potential proliferation financing:

Links to sanctioned countries such as Iran or DPRK.

Transactions inconsistent with the stated business profile.

Lack of clear end-user identification for dual-use goods.

Use of unusual shipping routes or transshipment hubs.

Obscured ownership through shell companies.

Misclassification of goods under export codes.

These indicators often overlap with broader money laundering and sanctions evasion patterns, underscoring the need for integrated risk management.

Strengthening Due Diligence and Compliance

The ASO emphasizes the need for a risk-based and proportionate compliance framework. Recommended measures include:

Screening customers and transactions against the Consolidated List.

Conducting enhanced due diligence (EDD) on high-risk clients, including establishing ultimate beneficial ownership (UBO) and verifying end-use of goods.

Training staff to recognize proliferation financing typologies and escalation procedures.

Submitting suspicious matter reports (SMRs) to AUSTRAC when sanctions breaches are suspected.

Integrating sanctions and proliferation controls into broader AML/CTF programs to avoid regulatory and reputational risks.

The Role of Defence Export Controls

Australia’s Defence Export Controls (DEC) plays a pivotal role in regulating the movement of military and dual-use goods. By reviewing export applications, issuing permits, and prohibiting transfers linked to WMD programs, DEC ensures compliance with international non-proliferation regimes. This regulatory oversight is crucial in preventing proliferators from exploiting Australia’s industries and research institutions.

Continuous Monitoring and Evolving Threats

The advisory stresses that sanctions compliance is not a one-time task but an ongoing, dynamic process. Threats evolve rapidly as proliferators adapt to enforcement measures, exploiting new sectors such as decentralized finance (DeFi) and emerging trade corridors. Entities are encouraged to consult external resources, such as AUSTRAC’s Proliferation Financing in Australia – National Risk Assessment and FATF’s Guidance on Risk Assessment and Mitigation.

Australia’s latest advisory underscores the growing sophistication of proliferation financing networks and the importance of robust sanctions compliance frameworks. For regulated entities, the challenge lies in balancing operational efficiency with heightened vigilance across high-risk sectors. With the implementation of upcoming AML/CTF obligations in 2026, the financial sector and broader business community must integrate proliferation financing risks into their compliance culture.

By strengthening due diligence, enhancing staff awareness, and leveraging global best practices, Australian entities can contribute to safeguarding both national security and the integrity of the global financial system.

Read the full advisory here.

Read about the product: Transact Comply

Empower your organization with ZIGRAM’s integrated RegTech solutions – Book a Demo

- #Sanctions

- #ProliferationFinancing

- #Compliance

- #AML

- #CTF

- #FinancialCrime

- #DueDiligence

- #RiskManagement

- #DFAT

- #Australia