Name Screening in money laundeirng plays a critical role in the operations of financial institutions, particularly in combating money laundering, strengthening the Know Your Customer (KYC) processes, and reducing fraud and financial crimes. By integrating name screening into their workflows, financial institutions can enhance their due diligence measures, identify potential risks linked to customers or transactions, and implement effective actions to mitigate these risks.

Check out ZIGRAM on LinkedIn for AML-related content.

What Is AML Name Screening and How Does It Help Prevent Financial Crime?

AML name screening is the process of checking the names of individuals and entities against various watchlists, databases, and records to identify potential risks related to money laundering, terrorist financing, and other financial crimes. This screening involves cross-referencing customer names with lists provided by regulatory bodies, law enforcement agencies, and international organizations to ensure that financial institutions do not engage in transactions with sanctioned or high-risk individuals or entities.

The primary objective of AML name screening is to identify and prevent financial transactions involving parties that pose a risk to the financial system. This process is an essential aspect of customer due diligence (CDD) and Know Your Customer (KYC) procedures, ensuring that financial institutions adhere to regulatory requirements and maintain the integrity of the financial system.

Name screening is a crucial AML practice that entails matching names against databases and watchlists to identify individuals or entities associated with risks or legal restrictions. This practice is essential for preventing money laundering, terrorist financing, fraud, and other financial crimes. Through comprehensive name screenings, financial institutions can ensure regulatory compliance and mitigate potential risks to their operations and reputation.

Why Is AML Name Screening Important for Financial Institutions?

AML (Anti-Money Laundering) name screening is a crucial process in the financial industry aimed at preventing illegal activities such as money laundering, terrorism financing, and other financial crimes. It involves the verification of individuals and entities against lists of known or suspected criminals, sanctioned parties, and politically exposed persons (PEPs). By conducting AML name screening, financial institutions can identify and assess potential risks associated with their clients and transactions, ensuring compliance with regulatory requirements. This process helps in maintaining the integrity of the financial system and preventing the flow of illicit funds that can be used for nefarious purposes.

Moreover, AML name screening protects the reputation of financial institutions by demonstrating their commitment to combating financial crime. It aids in building trust with customers, stakeholders, and regulatory bodies, which is essential for the institution’s long-term success. Non-compliance with AML regulations can result in severe penalties, including hefty fines, legal repercussions, and loss of business licenses. Therefore, implementing robust AML name screening procedures not only helps in safeguarding the financial system but also ensures the institution’s operational and reputational stability.

ZIGRAM’s Prescreening.io: Quick scan to identify and manage third party money laundering, financial crime and emerging risks.

To find more data on ML/TF related penalties and regulations, sign up on our AML Penalties platform.

Why Risk Identification and Fraud Detection Are Critical in AML and CTF

Identifying risks is very crucial in Anti-Money Laundering (AML) and

Counter-Terrorist Financing (CTF) because it serves as the first line of

defense against financial crimes that can have devastating consequences.

By recognizing potential threats early, financial institutions can implement appropriate measures to mitigate them, ensuring the integrity and

stability of the financial system. Effective risk identification allows institutions

to allocate resources more efficiently, focusing on high-risk areas that require immediate attention while maintaining routine vigilance over lower-risk areas. This proactive approach not only helps in preventing illegal activities but also in avoiding the financial, legal, and reputational damages associated with non-compliance and involvement in money laundering or terrorist financing. measures to mitigate them, ensuring the integrity and stability of the financial system. Effective risk identification allows institutions to allocate resources more efficiently, focusing on high-risk areas that require immediate attention while maintaining routine vigilance over lower-risk areas. This proactive approach not only helps in preventing illegal activities but also in avoiding the financial, legal, and reputational damages associated with non-compliance and involvement in money laundering or terrorist financing.

Moreover, identifying risks is crucial for maintaining regulatory compliance, which is essential for the continued operation of financial institutions. Regulatory bodies impose strict requirements on risk assessment and management, necessitating a thorough understanding of potential threats to ensure adherence to legal standards. Failure to identify and address risks can result in severe penalties, including fines, sanctions, and loss of business licenses. Additionally, it can lead to operational disruptions and increased scrutiny from regulators, impacting the institution’s ability to function effectively. By systematically identifying risks, financial institutions not only protect themselves from regulatory and legal repercussions but also enhance their reputation, build trust with customers and stakeholders, and contribute to the broader goal of maintaining a secure and transparent financial system.

Related Reads: How Does Transaction Monitoring Detect Fraud?

To know more about Anti Money Laundering, book a free demo with us!

Key Types of Lists Used in AML Name Screening for Risk and Compliance

Sanction Lists: Identifying Individuals and Entities Under Global Restrictions

Individuals, organizations, and countries that are under economic and financial sanctions imposed by governments or international bodies. They are used to restrict certain financial transactions and activities to accomplish various objectives, such as combating terrorism, promoting human rights, or addressing security concerns.

PEP Lists: Screening Politically Exposed Persons With High Risk of Financial Crime

Individuals who hold or have held a prominent public position, such as heads of state, senior government officials, or high-ranking political party officials. PEPs are considered to be at a higher risk for involvement in money laundering and other financial crimes due to their access to power and influence.

Watchlists: Monitoring Suspicious Entities for Money Laundering and Terrorist Financing

Individuals and organizations that may pose a risk of money laundering, terrorist financing, or other illicit activities. Financial institutions are required to report any transactions or activities that may be related to individuals or organizations on these lists to the appropriate Financial Intelligence Unit (FIU).

For more information on these lists check out ZIGRAM’s Data Assets

What Is the Impact of Not Using Name Screening Tools in AML Programs?

- Exposure to significant operational and reputational risks.

- Erosion of customer trust and stakeholder confidence.

- Inability to identify clients or transactions linked to financial crimes.

- Risk of hefty fines, legal penalties, and loss of operating licenses.

- Attraction of criminal activity and increased fraud risk.

- Potential for sanctions and trade restrictions.

- Limited access to global markets, affecting economic stability.

- Long-term operational and financial challenges.

Essential Techniques for AML Name Screening: Matching, Algorithms, and Automation

To ensure effective AML Name Screening, financial institutions employ various techniques and methodologies. Some of the commonly used techniques include:

Exact Matching: Character-by-Character Comparison Against Watchlists

This technique involves comparing names character by character for an exact match. It helps identify direct matches on the watchlists, allowing prompt action to be taken.

Fuzzy Matching: Handling Name Variations, Abbreviations, and Phonetics

Fuzzy matching allows for a degree of flexibility in matching names by considering variations in spelling, abbreviations, phonetics, and other factors. This technique helps minimize false negatives and improves the overall accuracy of name screening.

Advanced Algorithms: Context-Aware Screening Using AI and Metadata

Sophisticated algorithms are employed to enhance the screening process. These algorithms consider contextual factors, such as geographic information, known aliases, and name variations, to improve the accuracy of the screening results.

Batch Screening: High-Volume Name Screening for Large Customer Bases

To handle large volumes of customer data, automated batch screening is employed. This technique allows institutions to screen thousands of names simultaneously, saving time and ensuring efficient compliance.

Real-Time Screening: Onboarding and Transaction Monitoring With Instant Checks

Real-time screening enables immediate checks against updated watchlists during customer onboarding or transaction processing. This technique ensures that any changes in the status of individuals or entities are promptly detected.

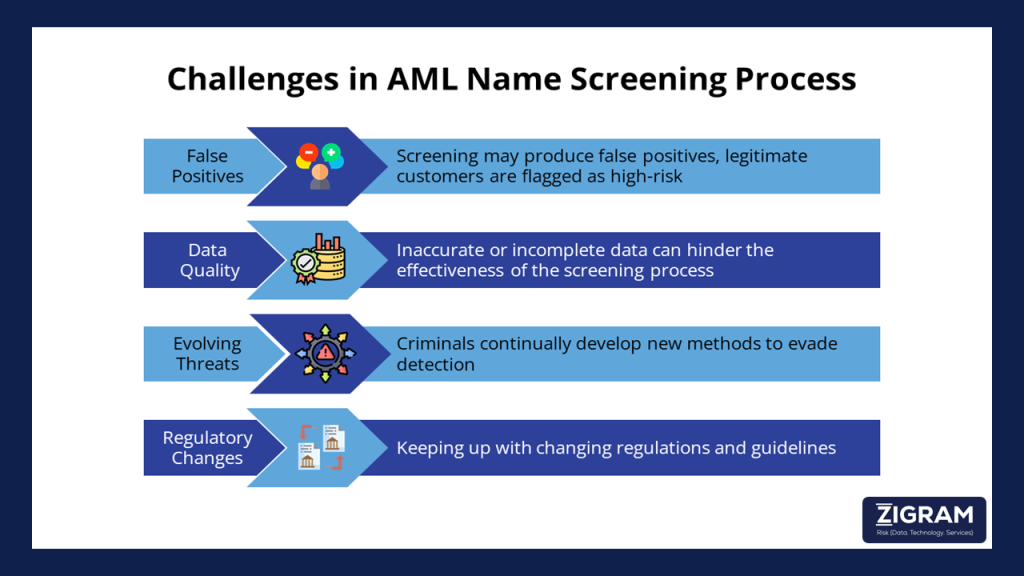

Challenges In AML Name Screening Process

Best Practices for AML Name Screening to Improve Accuracy and Reduce Compliance Risk

To ensure an effective AML name screening process and mitigate associated challenges, institutions should consider the following best practices

- Keep Watchlists and Screening Criteria Regularly Updated: Regularly update watchlists and screening criteria to reflect current threats and regulations. By maintaining up-to-date information, institutions can minimize false positives and ensure that legitimate customers are not incorrectly flagged as high-risk. This practice directly addresses the challenge of evolving threats by keeping the screening process responsive to new methods criminals may use to evade detection.

- Leverage Advanced Technology for Smarter Screening: Regularly update watchlists and screening criteria to reflect current threats and regulations. By maintaining up-to-date information, institutions can minimize false positives and ensure that legitimate customers are not incorrectly flagged as high-risk. This practice directly addresses the challenge of evolving threats by keeping the screening process responsive to new methods criminals may use to evade detection.

- Train Compliance Teams to Manage Screening Processes Effectively: Provide ongoing training for employees to ensure they understand AML policies and procedures. Well-trained staff can better handle false positives and improve overall data quality by correctly inputting and managing information. This training ensures that employees are equipped to recognize and respond to evolving threats and stay compliant with regulatory changes.

- Adopt a Risk-Based Approach to Prioritize High-Risk Entities: Implement a risk-based approach to screening, focusing resources on high-risk areas. By prioritizing efforts on the most significant threats, institutions can effectively allocate resources, reducing the impact of data quality issues and evolving threats. This method ensures that screening processes are both efficient and thorough, addressing the most critical risks first.

- Collaborate Across Institutions to Share AML Intelligence: Collaborate with other institutions and regulatory bodies to share information and best practices. Through collaboration, institutions can stay informed about the latest regulatory changes and evolving threats. Sharing insights and strategies helps improve data quality and reduces the occurrence of false positives, fostering a more effective and unified approach to AML compliance.

AML name screening is a vital component of financial compliance, helping institutions identify and mitigate risks associated with money laundering and terrorist financing. By adhering to regulatory requirements, utilizing advanced technology, and implementing best practices, financial institutions can protect their operations, reputation, and the integrity of the financial system.

ZIGRAM can significantly enhance screening solutions by providing advanced data intelligence and analytics capabilities. Our AML screening solution, Prescreening Io, is a SaaS platform designed to identify and mitigate customer and third-party risks, including anti-money laundering (AML), financial crime, and other emerging business risks.

How ZIGRAM’s Prescreening.io Enhances Screening Outcomes

- Pre-integrated checks for PEPs, Global Sanctions, and Country Specific Watchlist.

- Compliance with regulatory requirements, such as those from financial intelligence units and regulators such as, CBUAE, RBI, OFAC, FinCEN, FATF, FCA, EBA, AUSTRAC and others.

ZIGRAM’s screening solutions focus on AML risk identification, delivering real-time or near real-time results. We integrate best practices and standards for screening, accommodating enterprises of all sizes and use cases.

Reach out to us to explore our comprehensive screening solutions and request a FREE DEMO.

- #AMLNameScreening

- #PreScreening

- #RiskIdentification

- #Compliance