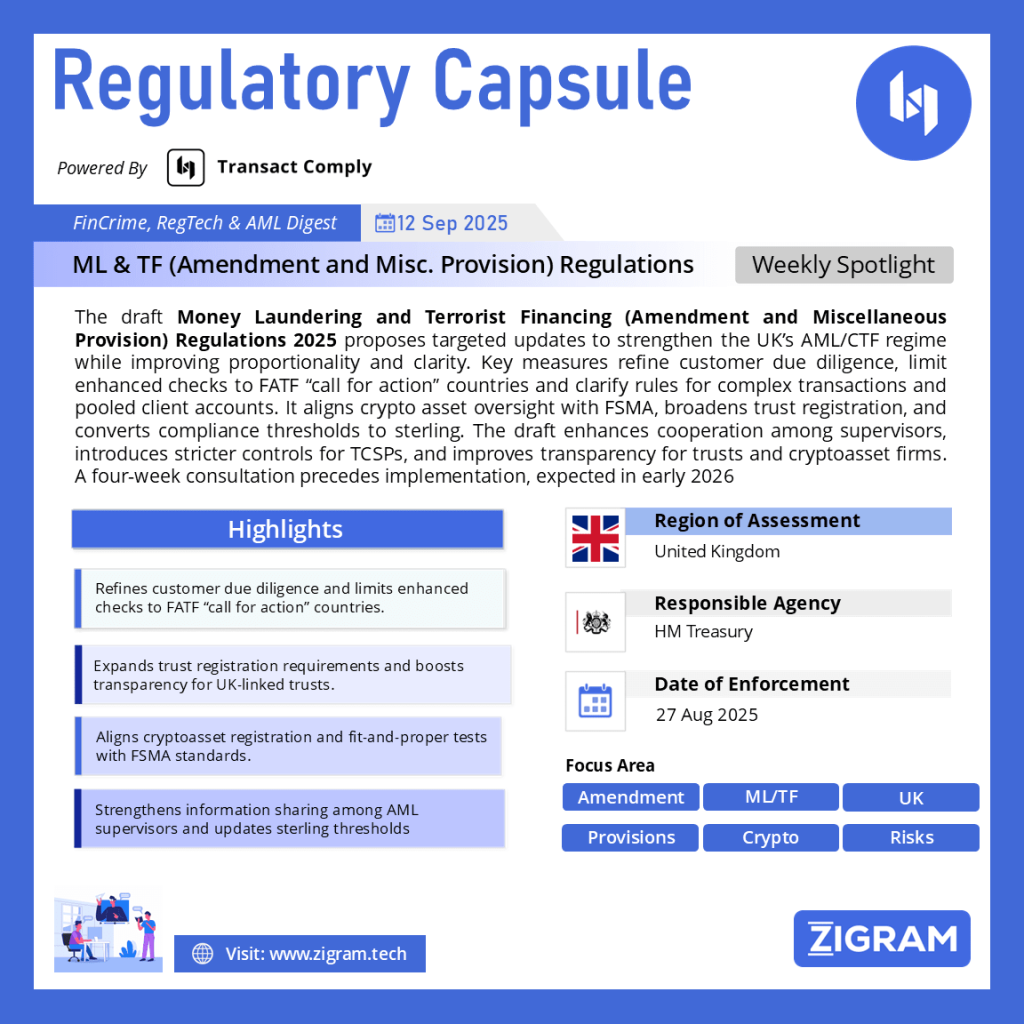

Regulation Name: Money Laundering and Terrorist Financing (Amendment and Miscellaneous Provision) Regulations 2025

Date Of Effect: 02 Sep 2025

Region: United Kingdom

Agency: HM Treasury

Strengthening the UK’s ML/TF Regime: A Deep Dive into the Draft 2025 Regulations

The UK government has unveiled a draft of the Money Laundering and Terrorist Financing (Amendment and Miscellaneous Provision) Regulations 2025, signalling a significant step in modernising its approach to anti-money laundering (AML) and counter-terrorist financing (CTF). Published by HM Treasury on 2 September 2025, this policy note outlines targeted amendments designed to close loopholes, enhance proportionality, and address emerging risks in financial crime.

Background and Purpose

The proposals stem from the government’s consultation on “Improving the Effectiveness of the Money Laundering Regulations.” Stakeholders identified weaknesses in the UK’s AML framework, including the regulation of pooled client accounts, trust registration, cryptoasset oversight, and the practicality of customer due diligence (CDD). The draft Statutory Instrument (SI) responds to these challenges, aiming to balance rigorous financial crime prevention with business workability.

A four-week technical consultation, closing on 30 September 2025, invites feedback from regulated firms, supervisors, and other stakeholders on the draft’s clarity and feasibility. The final instrument is expected to be laid before Parliament in early 2026, coming into force 21 days after adoption.

Key Measures and Policy Intent

- Proportionate and Effective Customer Due Diligence

The regulations introduce nuanced changes to ensure CDD is risk-based and consistent:

Sectoral Alignment: Transaction-based CDD triggers for letting agents and art market participants will now match those for high-value dealers.

Bank Insolvency Scenarios: Credit institutions may verify customer identity after account opening in cases of bank insolvency, provided enhanced safeguards and FCA supervision are maintained.

Enhanced Due Diligence (EDD): Requirements for high-risk jurisdictions will focus solely on FATF “call for action” countries, streamlining compliance and directing resources where risks are greatest. Clarifications also specify that EDD for complex or large transactions applies only when they are unusually so for the sector.

- Pooled Client Accounts (PCAs)

To improve access while maintaining controls, banks will no longer need to categorise PCAs as inherently low-risk. Instead, they must assess account purposes, understand customer business models, and apply additional controls as needed. Holders of PCAs must disclose the identity of underlying clients when requested, bolstering transparency without imposing full CDD obligations on all beneficiaries.

- Improved Coordination and Information Sharing

The draft SI strengthens cooperation between AML/CTF supervisors and public bodies:

Companies House is now explicitly part of AML supervisory cooperation.

The Financial Regulators Complaints Commissioner gains access to relevant information.

FCA powers to share confidential data extend to supervision of cryptoasset firms, enhancing oversight of this fast-evolving sector.

- Clarity on Scope and Registration

The proposals aim to simplify compliance and reflect post-Brexit realities:

Monetary Thresholds: All euro-denominated CDD and transaction thresholds will be converted into sterling (e.g., €10,000 becomes £10,000).

Trust and Company Service Providers (TCSPs): Selling off-the-shelf companies now falls squarely within the scope of regulated TCSP activities, requiring full compliance with AML rules.

Cryptoassets: Registration and change-in-control requirements for cryptoasset businesses will align with the Financial Services and Markets Act (FSMA), ensuring consistent fit-and-proper tests for owners and controllers.

- Reforming the Trust Registration Service

Transparency remains a central theme. The draft expands the range of trusts that must register with the Trust Registration Service (TRS), targeting vehicles with significant UK connections. Low-value or estate-related trusts may benefit from exclusions, while the automatic trigger linked to Stamp Duty Reserve Tax (SDRT) will be removed to reduce administrative burden.

- Further Technical Adjustments

Additional refinements promote clarity and alignment with global standards:

Exemptions for overseas sovereign wealth funds and reinsurance contracts are updated to reflect risk assessments.

A new rule obliges cryptoasset exchanges and wallet providers to apply EDD in correspondent banking relationships and bans ties with shell banks.

The list of recognised professional bodies is revised, and FCA-supervised entities must promptly report inaccuracies in information previously submitted.

Data Protection Considerations

Responses to the consultation may include personal data, such as names, contact details, and professional opinions. HM Treasury will process this information under Article 6(1)(e) of the UK GDPR, ensuring it is used solely for consultation purposes and handled securely. Participants retain rights to access, rectify, or erase their data, and complaints can be lodged with the Information Commissioner’s Office if necessary.

The draft Money Laundering and Terrorist Financing Regulations 2025 showcase the UK’s commitment to strengthening its financial crime framework while maintaining a pragmatic approach for businesses. By refining due diligence, enhancing trust transparency, and aligning cryptoasset oversight with broader financial regulations, the proposals seek to ensure that the UK remains resilient against evolving money laundering and terrorist financing threats.

If adopted as planned, these measures will mark a critical evolution in the country’s AML/CTF landscape, reinforcing its position as a global leader in tackling financial crime.

Read the full advisory here.

Read about the product: Transact Comply

Empower your organization with ZIGRAM’s integrated RegTech solutions – Book a Demo

- #UKAML

- #CTFRegulations

- #FinancialCrimePrevention

- #CryptoCompliance

- #TrustTransparency

- #AMLUpdates

- #RiskBasedApproach

- #HMTRules

- #AntiMoneyLaundering

- #FinancialRegulation