UK AML in Numbers: Inside UK FIU Annual Report 2024-25 with 866,616 SARs and £382.6 Million Denied to Criminals

The UK Financial Intelligence Unit (UKFIU) remains one of the busiest financial intelligence units in the world. Its SARs Annual Report 2024–25 shows a mature AML regime where reporting volumes stabilised, but financial impact surged, driven by more effective use of Defence Against Money Laundering (DAML) SARs, Account Freezing Orders (AFOs), and digital transformation.

This OSIN breaks down the year purely through numbers—what changed, what scaled, and what it tells us about AML effectiveness in the UK.

SAR Volumes Plateau at a Very High Base

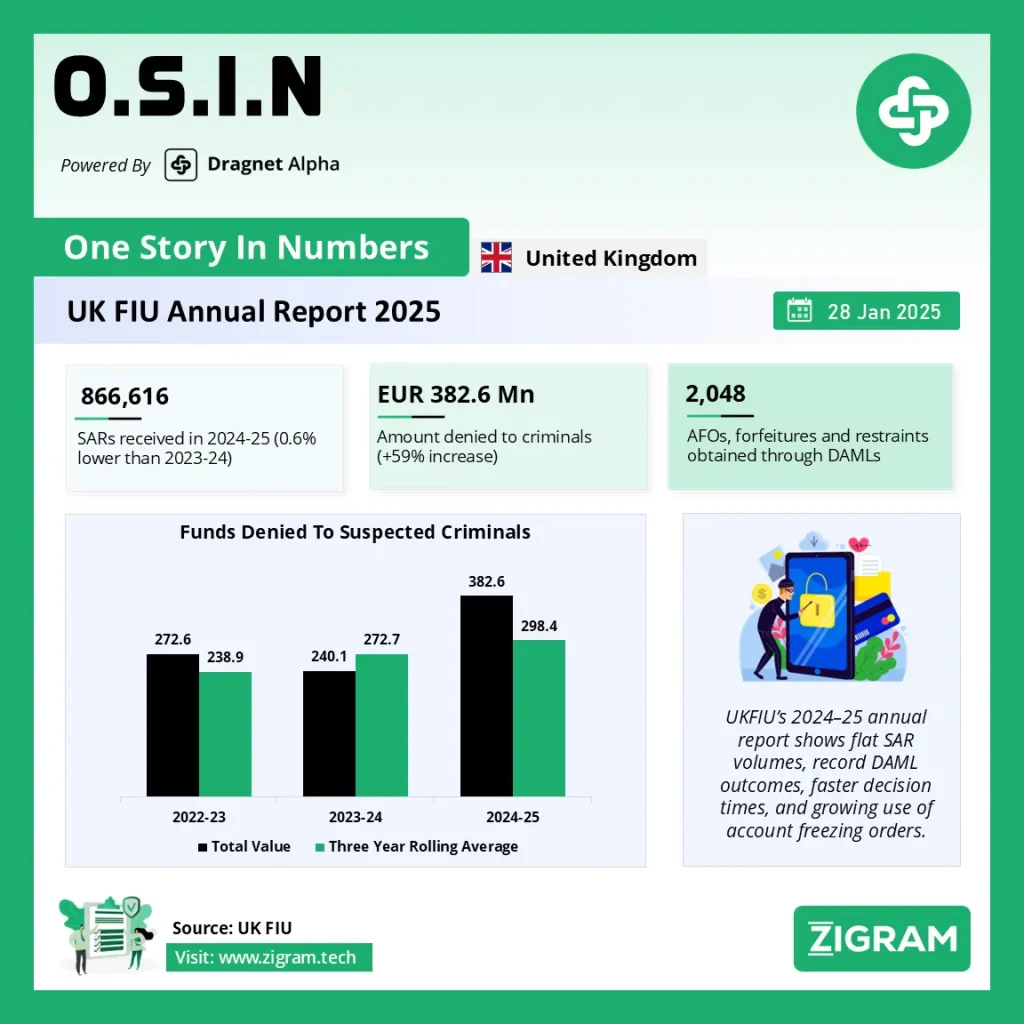

In 2024–25, the UKFIU received 866,616 SARs, a marginal 0.6% decrease from 872,048 in 2023–24 (p.4).

This is not a decline in compliance. Instead, it reflects a system that has reached reporting saturation after years of growth. The UK continues to process well over 850,000 SARs annually, placing sustained pressure on analysis and triage—but also providing unmatched intelligence depth.

OSIN insight:

At this scale, effectiveness matters more than volume.

Digital Reporting Is Now the Norm

The reporting year coincided with the transition from SAR Online to the new SAR Portal:

- 848,036 SARs (97.86%) were submitted via the SAR Portal

- Only 18,580 SARs (2.14%) came through the legacy SAR Online system (p.6)

This near-total digital adoption materially improves:

- Data quality

- Structured fields

- Automation potential for analytics and dashboards

OSIN insight:

The UK has effectively completed the digitisation phase of SAR reporting.

Banking Still Dominates—but the AML Net Is Wider

Sectoral data from SAR Portal submissions shows heavy concentration:

- Banking: 85.54%

- Financial Services (non-bank): 10.34%

- Virtual Assets: 1.67%

- Gambling: 0.88%

- Accountancy: 0.71%

- Legal: 0.40% (p.6)

While banks remain the backbone of SAR reporting, the presence of crypto-asset reporting—though still small—is now clearly visible.

OSIN insight:

UK AML risk detection still rests on banks, but sector diversification is no longer theoretical.

DAML SARs: Volume Stable, Impact Explosive

The number of DAML SARs remained broadly flat:

- 57,666 DAMLs in 2024–25

- 57,081 DAMLs in 2023–24 (+1%) (pp.4,7)

But the financial impact changed dramatically.

Funds Denied to Suspected Criminals

- £382.6 million in 2024–25

- £240.1 million in 2023–24

- +59% year-on-year increase (p.7)

This is the highest value ever recorded by the UKFIU in a single year.

OSIN insight:

The UK AML system is converting similar volumes of DAMLs into far greater asset denial.

Account Freezing Orders Drive Results

Enforcement outcomes tied to DAMLs continue to scale:

- 2,048 AFOs, forfeitures or restraints in 2024–25

- 1,785 in 2023–24 (+15%) (pp.4,9)

Three-year trend:

- 2022–23: 1,639

- 2023–24: 1,785

- 2024–25: 2,048

OSIN insight:

AFOs are now a core AML enforcement tool, not an exception.

Refused DAMLs Are Where the Money Is

A striking feature of the year is the role of refused DAMLs:

- 3,276 refused DAMLs (6% of total DAMLs)

- £359.9 million denied through refused DAMLs alone (pp.8–10)

Within this:

- 1,148 cases with no prior investigation still led to

- £281.15 million denied via restraint, AFO or forfeiture

- £103,816 in cash seizures (pp.8,11)

A single £103 million DAML materially lifted the annual total—but even excluding it, asset denial rose sharply.

OSIN insight:

Refusal is not failure—it is often the trigger for the strongest enforcement outcomes.

DAML Case Values Are Moving Up the Scale

Breakdown of refused DAMLs by value shows structural change:

- £10m–£50m cases: 4 (up from 1)

- £50m+ cases: 1 (up from 0) (p.10)

Total value of refused DAMLs:

- 2023–24: £183.5m

- 2024–25: £359.9m

OSIN insight:

UK AML enforcement is increasingly intercepting high-value criminal flows, not just retail-level laundering.

Faster DAML Decisions, More Aggressive Follow-Up

Operational efficiency also improved:

- Average DAML decision time: 2.8 days

- Down from 3.11 days in 2023–24

- Well below the 7-day statutory limit (p.11)

Moratorium Period Extensions (MPEs):

- 151 extensions used in 2024–25

- Across 18 law enforcement agencies

- Resulting in £120.6m denied (p.11)

OSIN insight:

Speed and persistence—not volume—are now decisive AML capabilities.

Terrorist Financing SARs: Low Volumes, High Sensitivity

Defence Against Terrorist Financing (DATF) SARs remain a small but critical subset:

- 397 DATFs received (down from 406)

- 70 refused DATFs (18%)

- £3.2m value of refused DATFs

- £161,778 restrained or forfeited following refusals (pp.12–13)

OSIN insight:

TF SARs are not about asset totals, but prevention and disruption.

Intelligence Dissemination Remains Massive

UKFIU’s downstream intelligence activity remains scale-heavy:

- 47,005 SARs read and triaged for significant intelligence

- 60,671 SARs disseminated to law enforcement

- 21 intelligence referrals generated from HMRC cash declaration data (p.14)

International cooperation:

- 1,608 inbound requests from foreign FIUs

- 1,216 outbound requests on behalf of UK law enforcement (pp.15–16)

The UKFIU remains the most-requested FIU globally via Egmont channels (Egmont data referenced by UKFIU).

Top OSIN Highlights (UK FIU Annual Report 2024–25)

- 866,616 SARs received

- 97.86% of SARs filed digitally

- 85.54% of SARs from banking

- 57,666 DAML SARs received

- £382.6m denied to criminals (+59% YoY)

- 2,048 AFOs / forfeitures / restraints

- £359.9m denied via refused DAMLs

- 2.8 days average DAML decision time

- 397 DATF SARs received

- 60,671 SARs disseminated to law enforcement

The UK’s AML regime in 2024–25 shows maturity, not expansion:

- SAR volumes are flat at scale

- Digital reporting is effectively complete

- Enforcement outcomes—especially asset denial—are accelerating

The numbers suggest a system moving from quantity to consequence.

Click here to read the full report.

Please read about our product: Dragnet Alpha

Click here to book a free demo

- #UKFIU

- #UKAML

- #DAML

- #AML

- #CFT

- #AntiMoneyLaundering

- #FinancialCrime

- #SARs