Regulation Name: The Financial Services and Markets Act 2000 (Regulated Activities and Miscellaneous Provisions) (Cryptoassets) Order 2025

Date Of Release: 29 April 2025

Region: United Kingdom

Agency: HM Treasury

UK’s Draft Crypto Regulation: A Closer Look at What’s Changing, Who It Affects, and Legal Connections

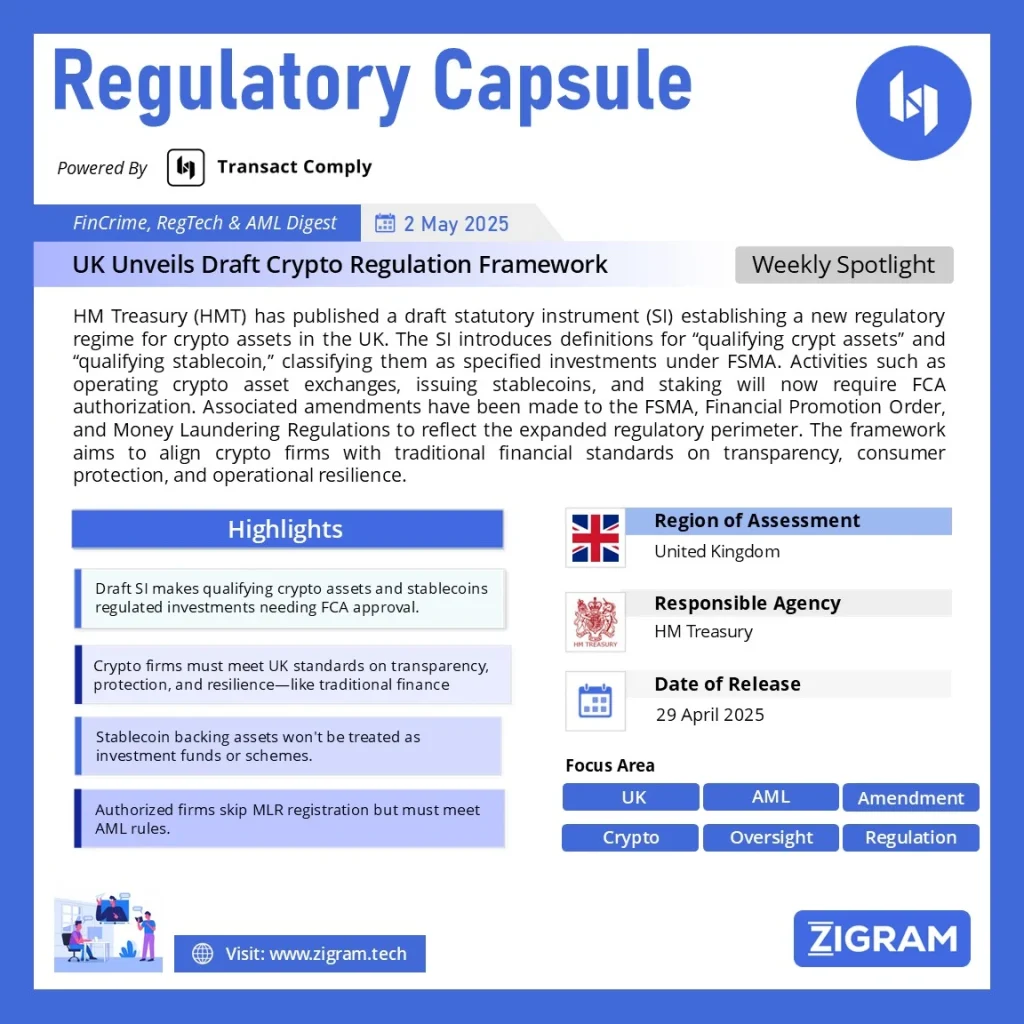

The UK is preparing to regulate cryptoassets with the same seriousness as traditional finance. On 29 April 2025, HM Treasury (HMT) released a draft statutory instrument (SI) — The Financial Services and Markets Act 2000 (Regulated Activities and Miscellaneous Provisions) (Cryptoassets) Order 2025. This long-awaited legal framework lays the foundation for the UK’s full-scale regulation of the cryptoasset market.

While the full regime is still under development, the draft SI provides significant clarity on the scope, activities, and legal changes involved. Here’s a breakdown of the key changes, who stands to be affected, and how this SI interacts with other financial laws.

What’s Changing?

The draft SI proposes a number of fundamental changes to bring cryptoassets and stablecoins under the UK’s financial regulatory perimeter. Here’s a detailed look:

1. New Definitions Introduced

The SI introduces definitions for:

• “Qualifying cryptoassets” – broad category including tokens used for investment or trading.

• “Qualifying stablecoin” – cryptoassets pegged to fiat currencies, intended for payment purposes.

These definitions help establish which tokens fall within scope, ensuring clarity on what is and isn’t regulated.

2. Crypto as “Specified Investments”

Cryptoassets that fall under the above definitions will be treated as “specified investments” under the Financial Services and Markets Act 2000 (FSMA). This means they are formally recognised as financial instruments and subject to regulatory oversight.

3. Introduction of Regulated Activities

The draft law identifies several activities that will require FCA authorisation if they involve qualifying cryptoassets or stablecoins.

These include:

• Operating a trading platform

• Issuing or redeeming stablecoins

• Safeguarding (custody) of cryptoassets

• Dealing as principal or agent

• Arranging transactions

• Staking services

Each of these activities will fall under FSMA’s regulatory framework, and firms will need explicit permission to conduct them.

4. Territorial Scope

The law clarifies geographic application. Activities carried out in or to the UK will be in scope. However, non-UK firms dealing only with institutional clients may benefit from a more flexible approach — a key relief for global players.

5. Regulatory Clarity for Hybrid Assets

The draft distinguishes between:

• Qualifying stablecoins

• Tokenised deposits

• Electronic money (e-money)

This aims to prevent regulatory overlap and confusion between different forms of digital value transfer, offering clarity for banks and fintechs alike.

Who Will It Affect?

The draft SI has wide-ranging implications for multiple categories of firms and stakeholders:

1. Crypto Exchanges and Trading Platforms

Exchanges offering trading in qualifying cryptoassets or stablecoins will now be required to:

• Become authorised by the FCA

• Meet standards for transparency, system resilience, and market integrity

• Comply with financial promotions and AML rules

2. Stablecoin Issuers

Entities issuing fiat-backed stablecoins — particularly for UK consumers — will be treated similarly to payment firms and must:

• Demonstrate sound reserve practices

• Meet operational risk standards

• Provide clear disclosures to users

3. Custodians and Wallet Providers

Crypto custodians will fall under new safeguarding obligations to ensure secure management of customer assets, including capital and risk management requirements.

4. Global Firms Serving UK Clients

Non-UK firms with retail or institutional clients in the UK will need to assess whether their services fall under the new regime — even if they operate entirely offshore. Those working solely with institutions may see more lenient treatment under the geographic perimeter carve-out.

5. Traditional Financial Firms Expanding into Crypto

Banks, investment firms, and fintechs looking to integrate crypto products will need to align their operations with the SI and apply for new or varied permissions from the FCA.

Connections to Other Laws

HMT proposes several amendments to existing financial legislation to effectively implement this regime, ensuring consistency across the UK’s regulatory landscape.

1. Financial Services and Markets Act 2000 (FSMA)

• The new crypto activities will be embedded within the FSMA framework, subjecting them to the same standards as traditional financial services.

• The FCA will gain expanded powers to authorise and supervise crypto firms.

2. Financial Promotion Order 2005

• Cryptoasset promotions will be brought under financial promotions regulations, meaning any marketing must be clear, fair, and not misleading.

• Firms must either be authorised or have their communications approved by an authorised firm.

3. Money Laundering Regulations 2017

• The SI aligns the scope of the AML regime with the new regulatory perimeter.

• Authorised crypto firms will no longer need separate AML registration, but they must still comply with AML rules and notify the FCA of their activities.

4. Electronic Money Regulations 2011

• To avoid confusion, the SI draws clear lines between e-money, qualifying stablecoins, and tokenised bank deposits.

• This ensures that stablecoins used for payments aren’t inadvertently regulated as e-money unless they meet those definitions.

5. Investment Fund Regulations

• The draft ensures that backing assets for stablecoins are not mistakenly classified as collective investment schemes or alternative investment funds.

Read the full draft here.

Read about the product: Transact Comply

Empower your organization with ZIGRAM’s integrated RegTech solutions – Book a Demo

- #CryptoRegulation

- #UKCryptoLaw

- #DigitalAssets

- #FinancialRegulation

- #Stablecoins

- #CryptoCompliance

- #FCA

- #FinTech

- #FSMA

- #AMLCompliance

- #RegTech

- #CryptoPolicy

- #BlockchainRegulation

- #FinancialServices

- #CryptoMarkets

- #UKFinance

- #FinReg

- #RegulatoryCompliance

- #CryptoIndustry