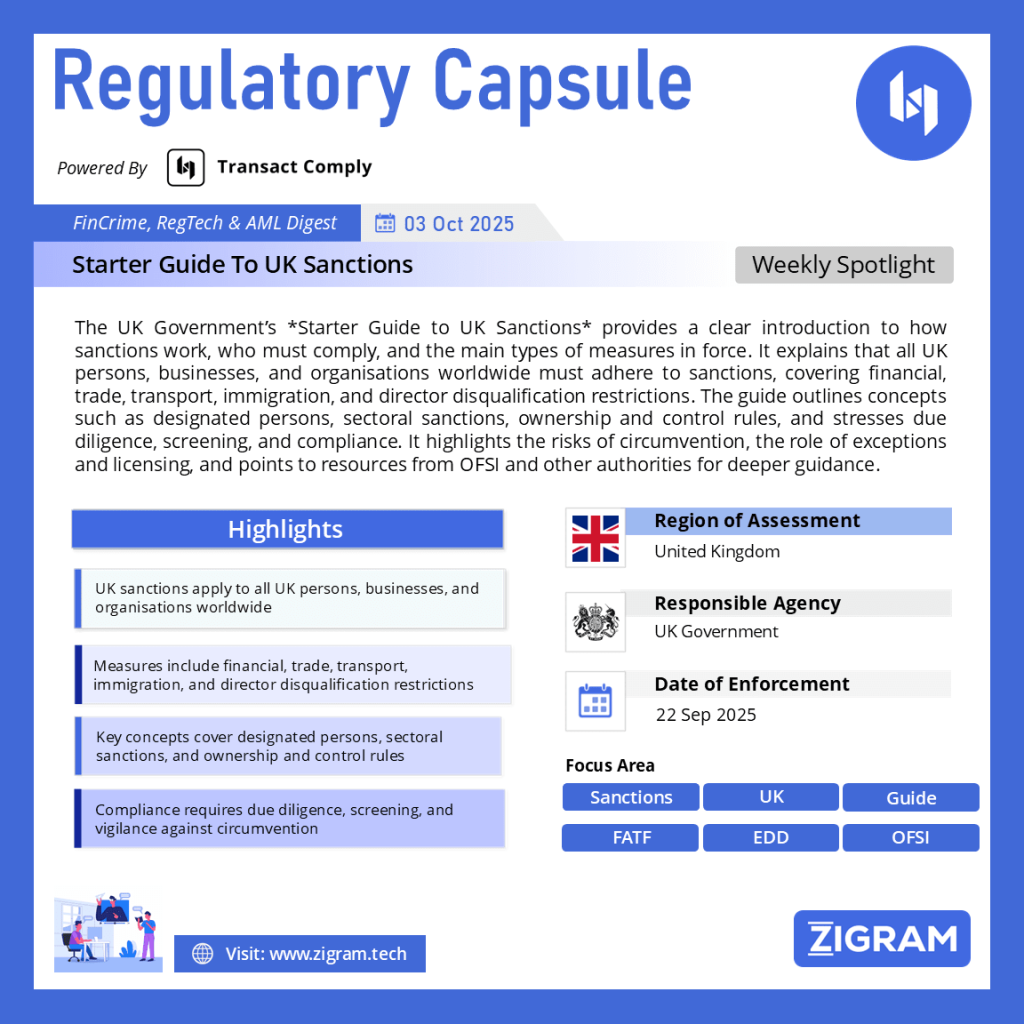

Regulation Name: Starter Guide To UK Sanctions

Date Of Release: 22 Sep 2025

Region: United Kingdom

Agency: UK Government

A Beginner’s Guide to UK Sanctions: Understanding Compliance and Obligations

Sanctions are an important tool in the diplomatic, security, and foreign-policy toolbox of states. They act as a way for governments to exert pressure, block resources, or restrict activity without resorting to direct military conflict. The UK’s “Starter Guide to UK Sanctions” is intended as an introductory roadmap aimed at businesses, organisations, and individuals who need to understand how UK sanctions work, what rules apply, and how to comply.

This guide does not replace the detailed statutory guidance and regulations, but serves as an entry point for non-legal specialists to grasp the core concepts, structures, and compliance obligations.

Who Must Comply

The guidance makes it clear that sanctions obligations apply to a wide set of actors. Any individual, business, or organisation that undertakes activities in the UK, including its territorial sea, must comply with UK sanctions. In addition, any business or entity that is incorporated or constituted in the UK has to follow sanctions rules regardless of where in the world it operates. The obligations also extend to UK nationals, wherever they are located. In short, the responsibility to comply travels with UK persons and entities beyond the country’s borders. The guide also advises those who are unsure of their obligations to seek legal advice and reminds them of the need to report any suspected breaches.

What Are UK Sanctions — An Overview

The guide describes sanctions as “restrictive measures” imposed by the UK government on individuals, organisations, or ships. These measures turn policy decisions into enforceable law. Their primary purposes include ensuring compliance with UN or other international obligations, supporting UK foreign policy and national security, maintaining international peace and security, and countering terrorism. Sanctions regimes are divided into two categories: geographic regimes, which focus on specific countries or territories, and thematic regimes, which address policy areas such as counterterrorism. Within these regimes, different types of measures may apply, ranging from financial and trade restrictions to transport, immigration, and director disqualification sanctions.

How Sanctions Work — Key Concepts

A central feature of UK sanctions is the use of designated persons and specified ships. Many measures, including asset freezes and travel bans, target specific individuals, organisations, or ships named by the government. An asset freeze, for instance, may cover funds, economic resources, or other assets that are owned, held, or controlled by a designated person, even if those assets are technically in the possession of another party. Similarly, ships that have been specified under sanctions regimes may face trade or transport restrictions.

Another key concept is the use of sectoral sanctions. Instead of targeting named individuals, these measures restrict broader classes of activity in particular industries or types of trade. They can apply to anyone who engages in certain kinds of economic activity linked to a sanctioned country or regime. Because they are not based on a list of names, compliance requires reviewing the relevant statutory rules to determine whether a given activity is restricted.

Ownership and control rules also play a vital role. Even if an entity is not specifically designated, it may still be caught by sanctions if it is owned or controlled by a designated person. Determining control often involves examining shareholding structures, voting rights, and influence over decision-making. The guide directs readers to the Office of Financial Sanctions Implementation (OFSI) for detailed advice on how ownership and control are assessed.

Main Types of Sanctions

Financial sanctions are among the most widely used measures. The most common form is the asset freeze, which prohibits any dealings with funds or economic resources belonging to designated persons or entities. In addition to asset freezes, financial sanctions may also include restrictions on financial services, investment, insurance, or correspondent banking relationships. Breaches of these rules can lead to severe consequences, ranging from warnings and public disclosures to criminal or civil penalties. To support compliance, OFSI offers extensive guidance, including FAQs, threat assessments, and video resources.

Director disqualification sanctions are another type of measure. Under these, a designated person can be prohibited from serving as a director of a UK company, or of a foreign company that has a sufficient connection to the UK. They may also be barred from promoting, forming, or managing a company. The Insolvency Service provides guidance on how such disqualifications work and the conditions under which licences may be issued.

Trade sanctions are designed to restrict the movement of goods, technology, or services. These measures may apply to exports, imports, or the provision of goods and services, including what are known as “ancillary services” such as brokering, technical assistance, and financing linked to the trade of sanctioned goods. Some regimes extend to dual-use goods, which are items with both civilian and potential military applications. In certain cases, such as the sanctions against Russia, standalone restrictions apply to services in areas such as accounting, law, IT, energy, and infrastructure consulting. One notable feature within the trade sanctions framework is the Oil Price Cap mechanism. While Russian oil exports are generally restricted, the rules allow supply to continue under tightly defined conditions if the oil is sold at or below a set price.

Immigration sanctions take the form of travel bans. Individuals who are designated may be refused UK visas, or if already in the UK, may have their existing leave revoked and face removal. The legal basis for these measures is provided by the Immigration Act 1971.

Transport sanctions address restrictions on ships and aircraft. These measures can include prohibitions on entering UK ports, detention or seizure of vessels, or bans on operating within certain regimes. At present, regimes covering countries such as Russia, Belarus, North Korea, and Libya have transport sanctions in place.

Exceptions, Licensing and Relief

The UK government recognises that sanctions can sometimes have unintended consequences, so regulations provide for exceptions and licensing frameworks. Exceptions are narrowly defined allowances written into the regulations themselves, often covering humanitarian aid, medical supplies, or other essential needs. Licences, on the other hand, permit otherwise prohibited activity when reviewed and approved by the relevant authorities. These are often critical for allowing necessary operations such as relief activities or specific transactions involving designated persons under controlled conditions. The guide stresses that if there is any uncertainty about whether an exception or licence applies, organisations should seek legal advice.

Due Diligence, Screening and Compliance

The guide places strong emphasis on the need for due diligence and screening to avoid unintentional breaches. Businesses are expected to implement robust “Know Your Customer” processes, verifying counterparties, monitoring ownership structures, and reviewing any changes in directorship or shareholding. Effective compliance requires not only one-time checks but ongoing re-evaluation.

Sanctions screening is best supported by consulting the UK Sanctions List and the OFSI Consolidated List of Asset Freeze Targets, both of which are available to the public. Many firms also rely on third-party screening tools that use these official lists as a baseline. A sound compliance programme should combine screening with governance frameworks, training for staff, escalation protocols, and regular audits to ensure continued adherence.

Circumvention and Evasion

The guide highlights circumvention and evasion as major risks. Deliberately structuring transactions or arrangements in order to sidestep sanctions is itself a breach of the law and carries the same weight of penalties as a direct violation. Even indirect facilitation of prohibited activities can attract civil or criminal consequences. To help businesses spot these risks, the government provides guidance and case studies, particularly in relation to Russia, where sanctions evasion has been an ongoing concern.

Strengths, Challenges and Observations

The “Starter Guide” has several strengths. It is written in clear and accessible language, making it easier for non-specialists to grasp key concepts before exploring the detailed legal framework. It provides comprehensive coverage of the different types of sanctions and underscores the shared responsibility for compliance across all UK persons and entities. Importantly, it also points readers toward authoritative resources, such as OFSI and the Insolvency Service, ensuring they know where to find more detailed support.

There are, however, limitations. The guide itself makes clear that it is not a substitute for legal advice, and that those dealing with complex or high-risk situations must seek professional counsel. The complexity of individual sanctions regimes means that the starter guide cannot fully capture the legal definitions, exceptions, and nuances. Moreover, sanctions are constantly evolving as international conditions change, which requires businesses and individuals to stay vigilant and up to date. There is also significant room for interpretation in areas such as ownership and control, as well as in assessing circumvention, making expert review essential.

Implications for Businesses and Organisations

For UK businesses and their overseas subsidiaries, sanctions compliance must be embedded into risk management systems. Every supplier, customer, and transaction should be thoroughly screened, and any potential red flags should be escalated for review. Awareness of possible exceptions or licences is equally important, particularly in humanitarian or relief contexts.

Foreign entities that deal with UK counterparties must also pay close attention. Engaging with UK firms or individuals can bring them under the scope of UK sanctions, so understanding the extent of these obligations is vital. Contracts should include compliance warranties and protective clauses to reduce exposure.

For financial institutions and intermediaries, sanctions compliance is a core requirement. Banks, insurers, and payment service providers need robust systems for transaction monitoring, real-time screening, and escalation. They must stay updated on changes to the designated lists and remain alert to attempts at evasion. Proper governance, staff training, and record-keeping are essential safeguards.

Conclusion

The UK Government’s “Starter Guide to UK Sanctions” is a valuable resource that makes the complicated world of sanctions easier to understand for businesses, organisations, and individuals. It lays the groundwork by explaining who must comply, what types of sanctions exist, and how compliance should be managed. While it cannot replace the detailed statutory guidance or professional legal advice, it offers an accessible starting point that makes it clear that sanctions compliance is not optional but a legal responsibility. In a world where sanctions regimes are becoming more complex and far-reaching, this guide provides the first step for organisations and individuals to engage with the rules effectively and responsibly.

Read about the circular here.

Read about the product: Transact Comply

Empower your organization with ZIGRAM’s integrated RegTech solutions – Book a Demo

- #UKSanctions

- #Compliance

- #FinancialCrime

- #OFSI

- #RiskManagement

- #TradeRestrictions

- #AML

- #SanctionsCompliance

- #DueDiligence

- #RegTech