Strengthening Financial Security in Macao: Insights from the 2024 Annual Report of the Financial Intelligence Office

A Year of Transformation and Integration

The year 2024 marked a turning point for the Financial Intelligence Office (GIF) of Macao SAR. On 1 February 2024, GIF was formally integrated into the Unitary Police Service (SPU) as an organic unit with technical and operational independence. This structural reform, supported by amendments to Law no. 1/2001 and Administrative Regulation no. 5/2009, strengthened GIF’s ties with law enforcement agencies while preserving its international standing within the Asia/Pacific Group on Money Laundering (APG) and the Egmont Group.

The move aligns with the Macao SAR Government’s policy of “streamlining administration,” consolidating intelligence resources, and bolstering mechanisms to counter money laundering (ML), terrorist financing (TF), and proliferation financing (PF).

Economic Recovery and Rising STRs

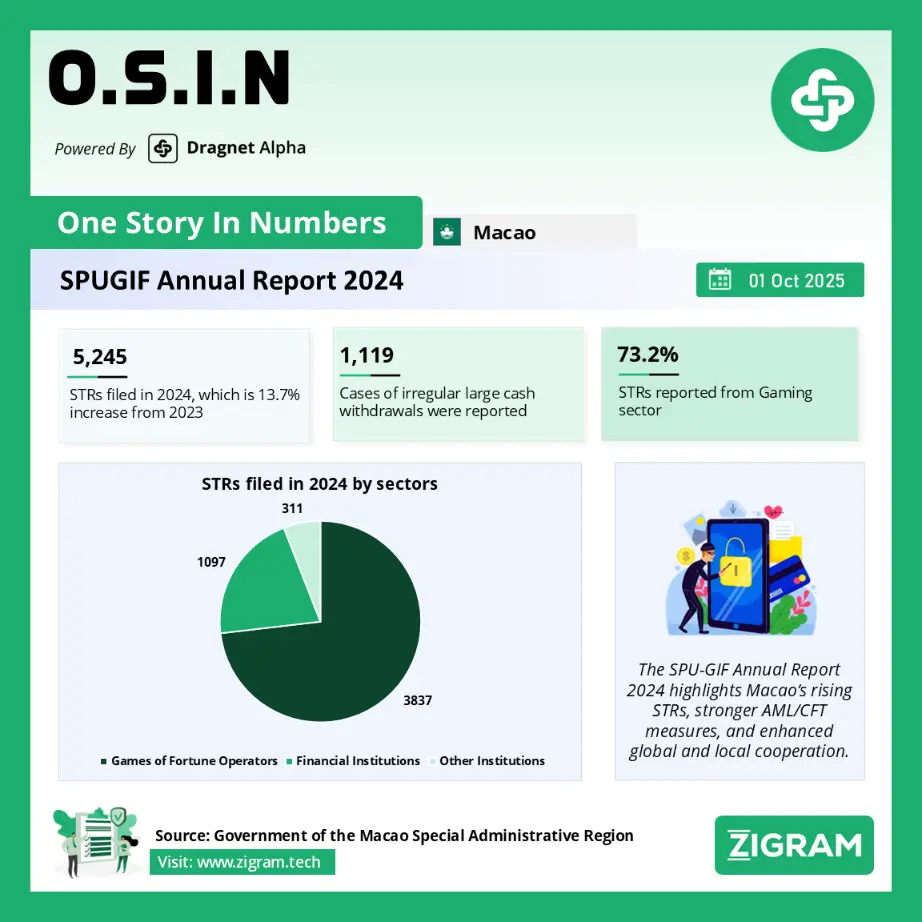

Macao’s economy showed resilience in 2024, with GDP rebounding to 86.4% of pre-pandemic (2019) levels. Service exports rose 9.2%, fueled by a revival in tourism. Alongside this recovery came increased scrutiny of financial activities: GIF received a record 5,245 suspicious transaction reports (STRs), a 13.7% rise from 2023, and a 78.3% jump compared to 2019.

The gaming sector remained the largest reporting entity, filing 3,837 STRs (73.2%), followed by financial institutions with 1,097 STRs (20.9%), and other entities with 311 STRs (5.9%). Disseminations to the Public Prosecutions Office (MP) also grew, with 142 STRs referred, up 22.4% year-on-year, many linked to fraud and illicit fund transfers.

Emerging Typologies and Risks

The report highlights evolving money laundering patterns. The most common suspicious activity was “chips conversion without/with minimal gambling activities” (1,596 cases). Other prevalent typologies included:

• Irregular large cash withdrawals (1,119 cases)

• Non-verifiable cash deposits (796 cases)

• Use of online and electronic banking (555 cases)

• Suspicious wire transfers (411 cases)

The surge in digital banking-related STRs reflects growing risks of cyber-enabled laundering and misuse of fintech channels.

Strengthening Coordination and Risk Assessments

GIF continued to coordinate the Interdepartmental AML/CFT Working Group, comprising 13 agencies including the Monetary Authority of Macao (AMCM), Judiciary Police, Customs, and the Public Prosecutions Office. In 2024, GIF and its partners conducted thematic reviews of ML/TF/PF risks, ranging from the gaming sector to cross-border cash flows.

A key initiative was the dissemination of the Macao Risk Assessment Report on ML/TF/PF. From February to May 2024, GIF and supervisory bodies held 7 explanatory sessions with nearly 900 participants across financial institutions, gaming operators, real estate intermediaries, accountants, and lawyers.

Asset Freezing and International Engagement

GIF also served as Secretariat of the Asset Freezing Coordination Commission, which met for the 17th time in December 2024. The Commission worked on implementing UN Security Council Resolutions (UNSCRs), refining sectoral guidelines, and delivering 5 training sessions with 450 participants.

Internationally, GIF reinforced Macao’s status as a committed AML jurisdiction. Its representatives co-chaired the Asia/Pacific Joint Group (APJG), chaired the APG Mutual Evaluation Committee, and participated as assessors in evaluations of other member jurisdictions. By 2024, GIF had signed 33 Memoranda of Understanding (MoUs) with foreign FIUs, strengthening intelligence exchange, with 48 incoming requests and 60 outgoing requests recorded during the year.

Public Awareness and Capacity Building

Raising awareness remained a central theme. GIF conducted multiple training programs, reaching over 1,000 participants across financial institutions, government agencies, real estate, and education sectors. It also held the 2nd “Outstanding STR Case Award”, recognizing Hang Seng Bank (Macau) as the winner, alongside Bank of China (Macau) and ICBC (Macau). Public campaigns, including AML contests and school-based outreach, further promoted civic education.

Technology and Cybersecurity Enhancements

To match the sophistication of financial crime, GIF advanced its IT systems in 2024. Over 91.4% of STRs were submitted via a secured online portal, reducing reliance on paper. The agency also launched procurement for a new Anti-Money Laundering Analysis System, refined risk models, and deployed a cyber threat monitoring platform to enhance resilience against digital intrusions, in line with Macao’s Cybersecurity Law.

Looking Ahead

As Macao enters 2025 amid global economic headwinds and geopolitical complexity, GIF has pledged to adopt a proactive, risk-based approach. Guided by the principle of “Courage to Take Responsibility, Daring to Innovate, and Capable of Implementation,” the office aims to further strengthen AML/CFT/CPF mechanisms, deepen regional cooperation, and reinforce financial stability under the “One Country, Two Systems” framework.

Please read about our product: Dragnet Alpha

Click here to book a free demo

- #AML

- #CFT

- #FinancialCrime

- #STR

- #MoneyLaundering

- #TerroristFinancing

- #FinancialIntelligence

- #Compliance

- #RiskManagement

- #Cybersecurity

- #RegTech

- #APG

- #EgmontGroup

- #FinancialSecurity