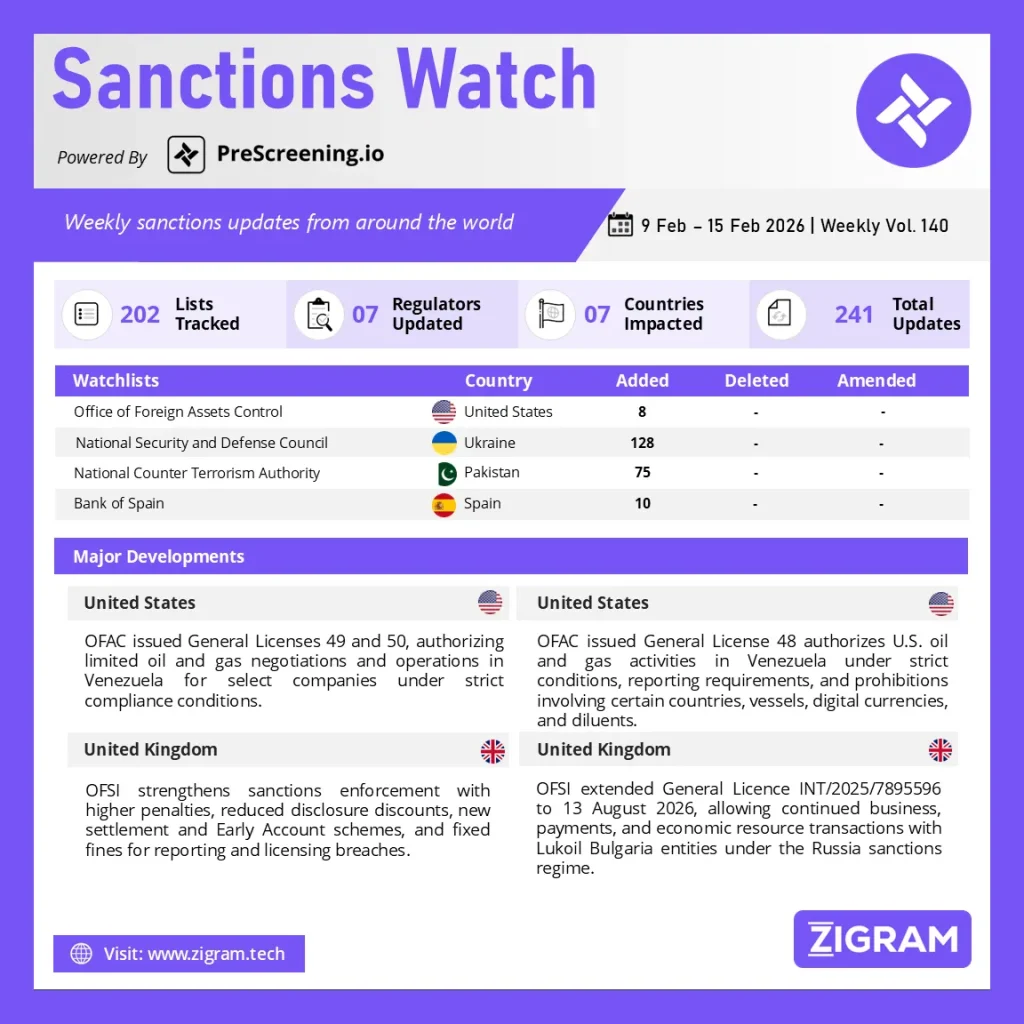

Sanctions Watch Vol 140

In the latest edition of our Sanctions Watch weekly digest, we present significant updates on sanction watchlists and regulatory developments.

1. U.S. Treasury Issues General Licenses 49 and 50, Easing Restrictions on Select Oil and Gas Activities in Venezuela

The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) issued General Licenses (GL) 49 and 50 under the Venezuela Sanctions Regulations (31 CFR part 591), introducing targeted authorizations for certain oil and gas sector activities in Venezuela.

General License 49 permits U.S. persons and entities to negotiate and enter into contingent contracts for new or expanded oil and gas investments in Venezuela, including joint ventures and related due diligence activities. However, performance under such contracts remains subject to separate OFAC authorization. The license does not permit transactions involving parties linked to Russia, Iran, North Korea, Cuba, or China, nor does it allow dealings with blocked vessels or the unblocking of blocked property.

General License 50 authorizes specified energy companies—BP PLC, Chevron Corporation, Eni S.p.A., Repsol S.A., and Shell PLC—and their subsidiaries to conduct transactions related to oil and gas operations in Venezuela. Contracts must be governed by U.S. law, and certain payments must be directed to designated U.S. government accounts. The license also requires detailed reporting to U.S. authorities and maintains restrictions on non-commercial payment structures and sanctioned jurisdictions.

These measures signal a calibrated adjustment to U.S. sanctions policy while maintaining core compliance safeguards.

2. U.S. Issues General License 48 Allowing Limited Oil and Gas Operations in Venezuela Under Strict Conditions

The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) has issued General License No. 48 under the Venezuela Sanctions Regulations (31 CFR part 591), authorizing certain transactions related to oil and gas operations in Venezuela. The license permits U.S. persons and entities to provide goods, technology, software, and services necessary for the exploration, development, and production of oil and gas in Venezuela, including transactions involving the Government of Venezuela and Petróleos de Venezuela, S.A. (PdVSA), subject to strict conditions.

Authorized activities include payment processing, shipping and logistics arrangements, marine insurance, port services, and maintenance or repair of oil and gas infrastructure. However, contracts must be governed by U.S. law with dispute resolution in the United States, and payments to blocked persons must be directed to designated U.S. government accounts.

The license prohibits debt swaps, digital currency payments (including the petro), transactions involving certain high-risk jurisdictions, dealings with blocked vessels, formation of new joint ventures, and exports of diluents to Venezuela. Companies operating under this license must submit detailed transaction reports to U.S. authorities. This move signals a carefully structured easing of restrictions to support energy-related activities while maintaining strong compliance safeguards.

3. OFSI Strengthens Sanctions Enforcement with Tougher Penalties, Early Account Scheme, and New Settlement Framework

UK Office of Financial Sanctions Implementation (OFSI) published updated guidance significantly strengthening its civil enforcement framework for financial sanctions breaches. The reforms introduce tougher penalty calculations, reduced discounts for voluntary disclosure, and expanded enforcement tools aimed at improving transparency, efficiency, and accountability.

Under the revised framework, the maximum discount for voluntary disclosure has been reduced from 50% to 30%, with full eligibility now requiring prompt reporting and proactive cooperation. OFSI has also introduced a new four-level seriousness matrix, with high-severity cases potentially attracting penalties of up to 100% of the breach value or referral for criminal prosecution. Additionally, the UK government intends to double the statutory maximum penalty to £2 million or 100% of the breach value.

New mechanisms include an Early Account Scheme (EAS), allowing companies to submit a comprehensive early report in exchange for potential penalty reductions, and a Settlement Scheme offering up to 20% discount for agreeing not to contest findings. OFSI has also introduced fixed penalties of £5,000 or £10,000 for certain reporting and licensing breaches.

Overall, the reforms signal a more robust and outcome-driven sanctions enforcement regime in the UK.

4. OFSI Extends Lukoil Bulgaria General License Until August 2026, Supporting Continued Business Operations

The UK’s Office of Financial Sanctions Implementation (OFSI) has extended General License INT/2025/7895596 under the Russia (Sanctions) (EU Exit) Regulations 2019, enabling the continued operation of business activities involving Lukoil Bulgaria entities. Originally issued on 14 November 2025, the license was amended on 10 February 2026 to extend its expiry date from 14 February 2026 to 13 August 2026.

The license permits persons to continue business operations with Lukoil Bulgaria EOOD and Lukoil Neftochim Burgas AD—subsidiaries of PJSC Lukoil—as well as additional covered subsidiaries, including Lukoil Aviation Bulgaria EOOD and Lukoil Bunker Bulgaria EOOD. Authorized activities include payments to and from the Lukoil Bulgaria entities under existing or new contractual obligations, payments involving other persons connected to such contracts, and the provision or receipt of economic resources.

The extension provides regulatory clarity and operational continuity for businesses and financial institutions engaging with the covered entities, ensuring that permitted transactions may proceed in compliance with UK sanctions law. OFSI has also updated its related guidance (FAQ 173) to reflect the revised expiry date.

Know more about the product: PreScreening.io

Click here to book a free demo.

Sanctions Watch is a weekly recap of events and news related to sanctions around the world.

- #OFAC

- #SanctionsUpdate

- #OFSI

- #VenezuelaSanctions

- #RussiaSanctions

- #OilAndGas

- #EnergyCompliance

- #FinancialSanctions

- #RegulatoryUpdate

- #GlobalCompliance