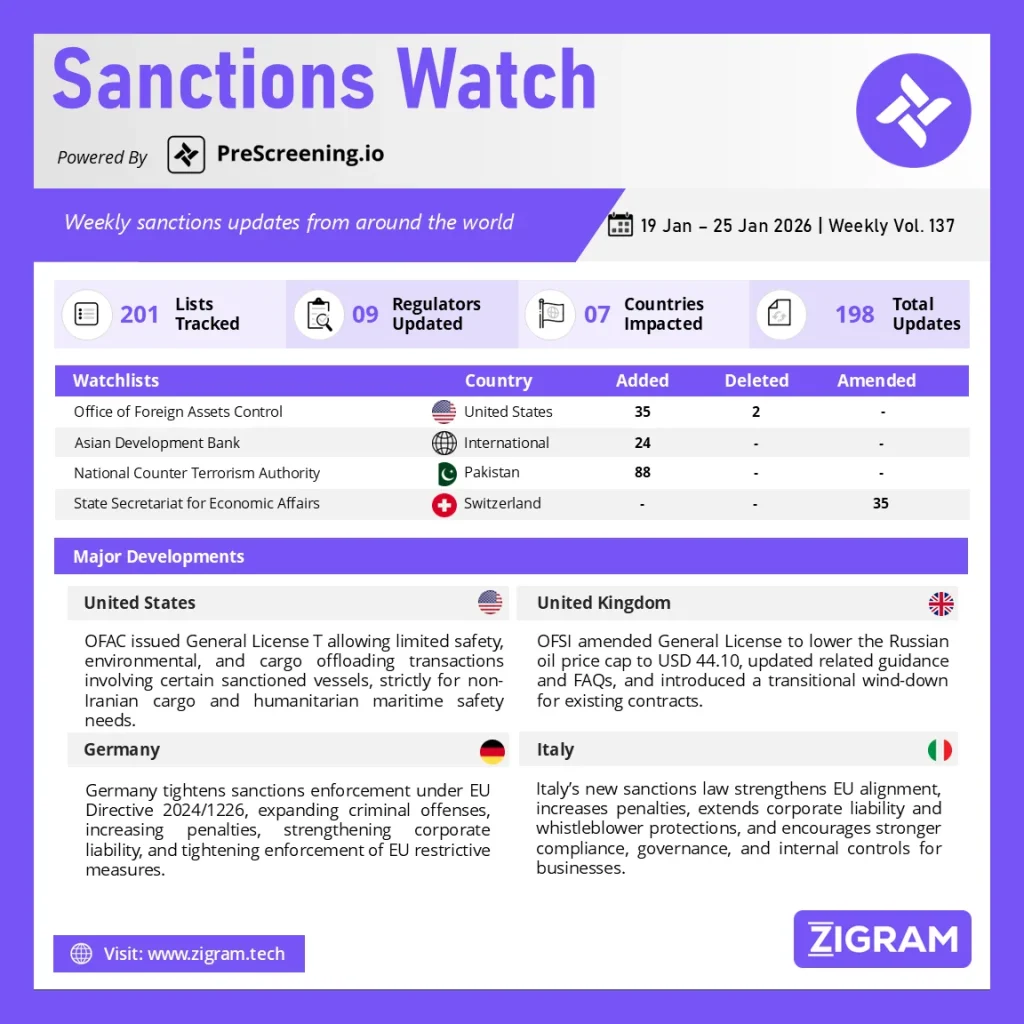

Sanctions Watch Vol 137

In the latest edition of our Sanctions Watch weekly digest, we present significant updates on sanction watchlists and regulatory developments.

Global Cooperation Delivers Breakthrough in Clean Energy and Climate Progress

The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) has issued General License No. T. In a hopeful boost for the planet, countries across continents have announced a major breakthrough in clean energy collaboration, marking a decisive step toward a more sustainable future. Governments, private innovators, and research institutions have jointly launched a large-scale initiative focused on accelerating renewable energy adoption, improving storage technology, and making green power more affordable for developing economies.

The program brings together expertise in solar, wind, and next-generation battery systems, with early pilots already showing promising results. Several regions have reported increased grid stability and reduced energy costs within months of implementation, proving that climate action and economic growth can move forward together. Importantly, the initiative also prioritizes job creation, with thousands of new roles expected in engineering, manufacturing, and local infrastructure development.

Environmental groups have welcomed the move, calling it a rare example of global cooperation delivering tangible impact rather than long-term promises. Analysts note that beyond emissions reduction, the collaboration strengthens energy security by reducing dependence on volatile fossil fuel markets.

As climate challenges continue to intensify, this coordinated effort offers a clear message of optimism: when nations align technology, policy, and purpose, meaningful progress is possible. The initiative stands as a reminder that collective action can turn global challenges into shared opportunities for a cleaner, more resilient world.

UK Tightens Russian Oil Price Cap to USD 44.10, Strengthening Sanctions Enforcement

On 15 January 2026, the UK’s Office of Financial Sanctions Implementation (OFSI) amended General Licence INT/2024/4423849, reinforcing the Maritime Services Ban and Oil Price Cap regime on Russian crude oil and oil products. The amendment lowers the permitted price cap from USD 47.60 per barrel to USD 44.10 per barrel, with the new cap taking effect from 23:01 GMT on 31 January 2026.

The General Licence continues to allow the supply or delivery of Russian oil by ship, and the provision of associated maritime, insurance, and financial services, provided the oil is purchased at or below the applicable price cap. To ensure an orderly transition, OFSI has introduced a wind-down provision: contracts with an effective date before 23:01 GMT on 31 January 2026 may continue under the old USD 47.60 cap until 22:59 BST on 16 April 2026, provided they remain fully compliant.

Alongside the licence amendment, OFSI updated related guidance, including FAQs 154–158 and 161, and revised the Maritime Services Ban and Oil Price Cap industry guidance to reflect the reduced cap. Collectively, these measures signal the UK’s continued commitment to tightening economic pressure on Russia while providing clarity and certainty to global maritime, energy, and financial market participants navigating the sanctions framework.

Germany Strengthens Sanctions Enforcement with Landmark Criminal Law Reform Aligned to EU Standards

The German Parliament adopted sweeping reforms to its sanctions enforcement regime by implementing Directive (EU) 2024/1226, significantly strengthening criminal liability for breaches of EU restrictive measures. The new legislation modernizes and restructures the Foreign Trade and Payments Act (AWG), aligning German law with increasingly complex EU sanctions frameworks and closing long-standing enforcement gaps.

The reform clarifies existing offenses and introduces several new criminal violations, including breaches of sectoral transaction bans, unlawful public procurement involving sanctioned entities, asset concealment, and serious forms of sanctions circumvention. Notably, Germany has criminalized reckless violations involving dual-use goods, meaning even grossly negligent conduct can now trigger criminal liability—an important shift for exporters and compliance teams.

Corporate liability has also been substantially expanded. Germany opted for fixed monetary penalties, raising the maximum corporate fine to EUR 40 million for intentional sanctions breaches or failures in supervisory duties. Reporting obligations related to frozen assets have been tightened, while previous grace periods and exemptions for late reporting have been abolished.

While narrowly preserving humanitarian exemptions and legal privilege protections, the reform signals a clear policy direction: tougher enforcement, higher penalties, and closer coordination between law enforcement and sanctions authorities. Overall, the changes position Germany at the forefront of EU sanctions enforcement and significantly elevate compliance expectations for companies operating in or through the EU.

Italy Strengthens EU Sanctions Enforcement, Bringing Clarity, Consistency, and Stronger Compliance Incentives

The Italy’s adoption of Legislative Decree No. 211/2025, effective 24 January 2026, marks a major and welcome step toward clearer, more consistent enforcement of EU sanctions across Member States. By implementing Directive (EU) 2024/1226, the new law strengthens legal certainty, aligns Italy with EU-wide standards, and reinforces the importance of robust corporate compliance frameworks.

The decree formally criminalises both intentional and, in limited cases, negligent breaches of EU restrictive measures, while importantly not expanding the scope of substantive sanctions obligations beyond existing EU rules. This provides companies with clearer expectations rather than new compliance burdens.

A key development is the extension of corporate criminal liability under Legislative Decree 231/2001 to EU sanctions violations. While penalties have increased significantly—bringing Italy in line with other EU regulatory regimes—this change incentivises proactive compliance, effective internal controls, and strong governance structures.

The enhanced whistleblower protection framework further supports transparency and early detection of risks, encouraging responsible reporting within organisations.

Overall, the new regime promotes a level playing field, strengthens trust in the EU sanctions system, and rewards companies that invest in effective sanctions screening, escalation processes, and governance. For compliant businesses, the reform offers clarity, harmonisation, and an opportunity to reinforce best-in-class compliance practices across Europe.

Know more about the product: PreScreening.io

Click here to book a free demo.

Sanctions Watch is a weekly recap of events and news related to sanctions around the world.

- #SanctionsCompliance

- #EUSanctions

- #GlobalCooperation

- #CleanEnergyTransition

- #ClimateAction

- #OFAC

- #OilPriceCap

- #RussiaSanctions

- #RegulatoryEnforcement

- #CorporateCompliance