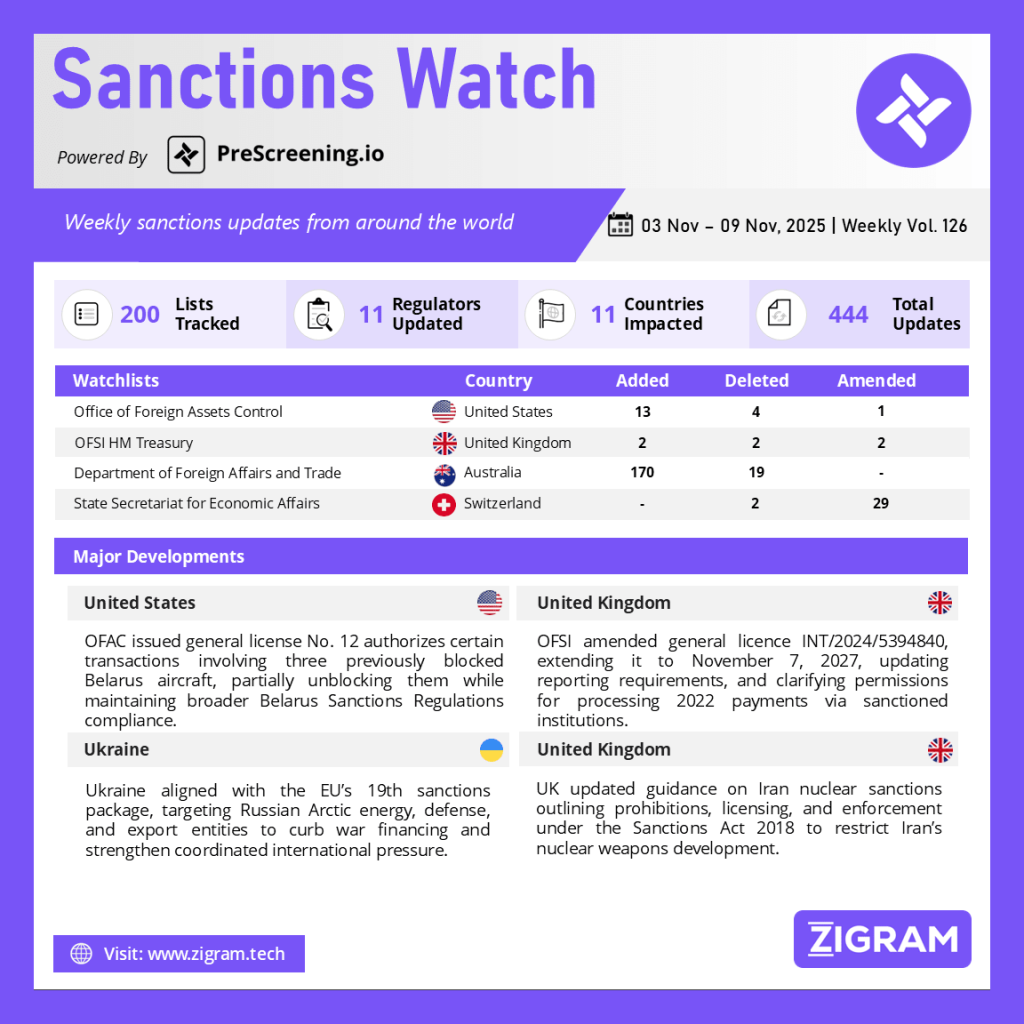

Sanctions Watch Vol 126

In the latest edition of our Sanctions Watch weekly digest, we present significant updates on sanction watchlists and regulatory developments.

1. U.S. Treasury issued General license which Eases Sanctions to Permit Limited Transactions Involving Belarus Aircraft

The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) issued General License No. 12 under the Belarus Sanctions Regulations (31 CFR Part 548). The license authorizes certain transactions related to three specific Belarusian aircraft — tail numbers EW-001PA, EW-001PB, and EW-001PH — which were previously blocked. This authorization extends to activities connected with Alyaksandr Lukashenka and Foreign Limited Liability Company Slavkali, entities sanctioned under the same regulations.

The license effectively unblocks these aircraft for specified uses, allowing related financial and operational transactions to proceed, except those involving other blocked individuals or funds frozen before the effective date. Importantly, this measure does not remove other existing restrictions or override federal regulations under the International Traffic in Arms Regulations (ITAR) or Export Administration Regulations (EAR).

The issuance reflects a targeted easing of sanctions to facilitate limited and controlled aviation-related activities without undermining broader U.S. sanctions policy toward Belarus. The order, signed by Bradley T. Smith, Director of OFAC, demonstrates a nuanced approach balancing diplomatic pressure with practical regulatory flexibility.

2. OFSI Amendment Clarifies Rules for Processing 2022 Payments via Sanctioned Financial Entities

The UK Office of Financial Sanctions Implementation (OFSI) amended General Licence INT/2024/5394840, which governs certain payments made in 2022 that were processed by sanctioned credit or financial institutions at some stage in the payment chain. Originally issued under Regulation 64 of the Russia (Sanctions) (EU Exit) Regulations 2019, the licence allows relevant UK financial institutions to process payments between non-designated third parties, provided the payments were temporarily blocked due to their passage through sanctioned intermediaries.

The amendment extends the licence’s validity from November 7, 2025, to November 7, 2027, ensuring continued legal clearance for these transactions. It also refines reporting requirements, mandating that institutions submit detailed monthly reports to HM Treasury within 14 days of month-end, specifying transaction amounts, sender and recipient identities, payment routes, and processing dates. The licence further reiterates record-keeping obligations—requiring six years of documentation—and prohibits processing funds that may directly or indirectly benefit sanctioned entities.

This update reflects the UK government’s ongoing effort to maintain compliance clarity and financial stability while preventing inadvertent breaches of sanctions regulations related to Russian financial institutions.

3. Ukraine Aligns with EU’s 19th Sanctions Package, Crippling Russian Arctic Energy and Defense Sectors

Ukraine enacted two decrees synchronizing its sanctions with the European Union’s 19th package and introducing additional restrictions on Russian entities involved in Arctic resource extraction. The updated sanctions list includes 14 individuals and 57 organizations supporting Russia’s war operations, sanction evasion, and resource exports. The coordinated measures primarily target sectors linked to Russia’s energy, defense, and technological supply chains and are expected to cut billions of euros from Russia’s annual revenue.

A separate decree imposes penalties on 18 individuals and 36 entities engaged in Arctic energy extraction, export operations, and the development of military engineering and industrial research projects. These sanctions extend to companies participating in geological exploration, mineral resource development, and the export of Russian coal through maritime intermediaries to bypass restrictions. Ukrainian authorities emphasized that partner nations are expected to adopt similar sanctions, amplifying the collective impact. Additional measures are being prepared against Russian propaganda entities, defense producers, and domestic collaborators. In response to Russia’s symbolic counter-sanctions on Ukrainian officials, Kyiv reaffirmed that its coordinated global strategy aims to weaken Moscow’s economic capacity, restrict access to critical resources, and sustain international pressure to end the ongoing war.

4. UK Updates Iran Nuclear Sanctions Guidance to Strengthen Compliance and Enforcement Framework

The UK government released updated guidance on the Iran (Sanctions) (Nuclear) (EU Exit) Regulations 2019, strengthening its framework for compliance with United Nations Security Council Resolutions aimed at curbing Iran’s nuclear weapons programme. The revised document outlines comprehensive prohibitions covering financial, trade, and immigration sanctions, including asset freezes, restrictions on military and nuclear-related goods, and limitations on providing funds or technical assistance to designated Iranian entities.

The guidance clarifies enforcement roles for key agencies such as the Office of Financial Sanctions Implementation (OFSI), the Office of Trade Sanctions Implementation (OTSI), HM Revenue and Customs (HMRC), and the Insolvency Service, with penalties reaching up to ten years’ imprisonment for serious breaches. It also details licensing exceptions for humanitarian aid, technical cooperation, and non-proliferation activities under strict international oversight.

By reinforcing reporting obligations, end-user verification requirements, and coordination with the UN and IAEA, the updated framework ensures that UK individuals and companies operate within legal boundaries while supporting international peace and security. The move underscores the UK’s ongoing commitment to non-proliferation and responsible global trade practices.

Know more about the product: PreScreening.io

Click here to book a free demo.

Sanctions Watch is a weekly recap of events and news related to sanctions around the world.

- #SanctionsUpdate

- #USTreasury

- #OFSI

- #Belarus

- #UkraineSanctions

- #EUSanctions

- #IranNuclear

- #Compliance

- #FinancialRegulations

- #GlobalSecurity

- #SECO