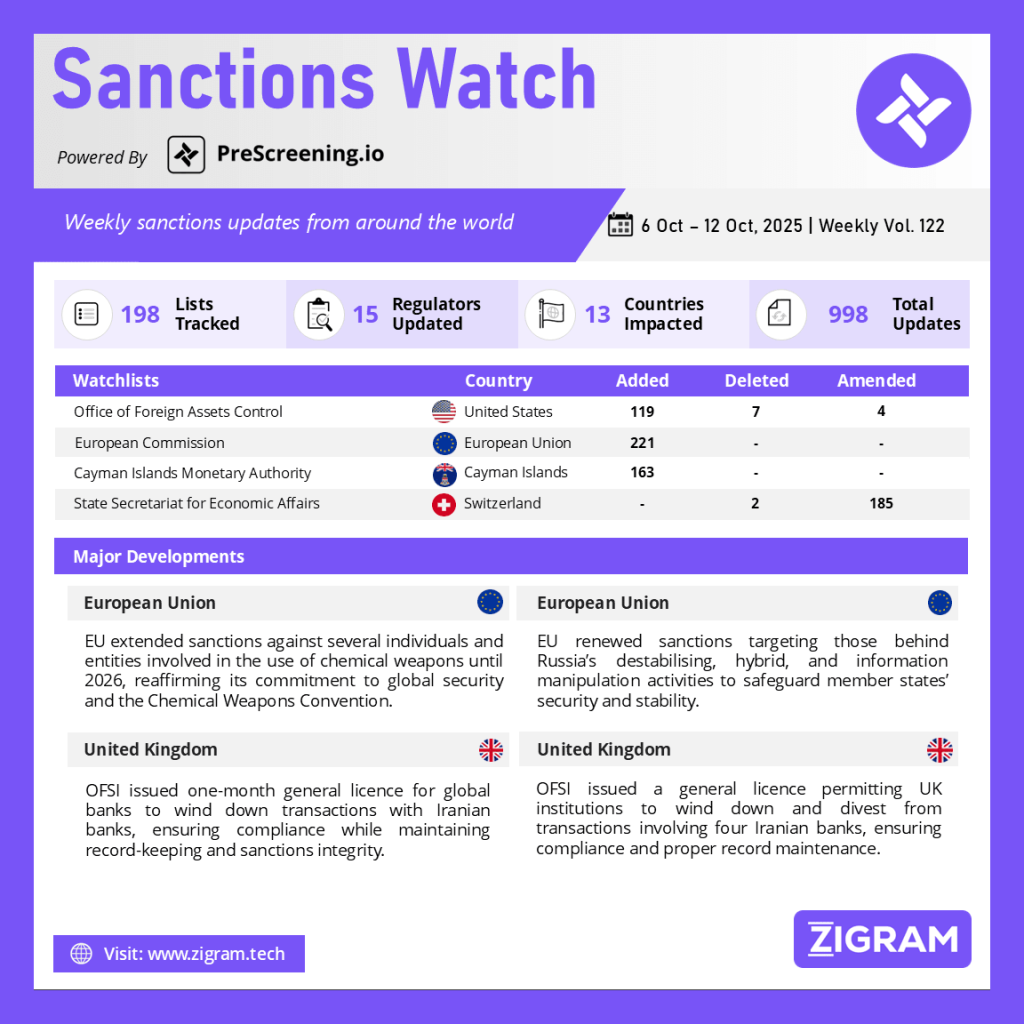

Sanctions Watch Vol 122

In the latest edition of our Sanctions Watch weekly digest, we present significant updates on sanction watchlists and regulatory developments.

EU Extends Sanctions Against Chemical Weapons Use Until 2026, Targeting Russian Entities

The Council of the European Union has extended restrictive measures targeting individuals and entities involved in the proliferation and use of chemical weapons for another year, now effective until 16 October 2026. These sanctions, first established in October 2018, apply to a total of 25 individuals and 6 entities. The listed subjects face asset freezes, travel bans, and prohibitions on providing financial or economic resources directly or indirectly to them.

This decision aligns with the EU’s ongoing commitment to uphold the principles of the Chemical Weapons Convention (CWC) and to deter any form of chemical weapon development, production, or use. The renewal reinforces the EU’s zero-tolerance stance toward chemical warfare, which the European Council had strongly condemned in March 2018 as a severe threat to global security.

Significantly, in May 2025, the EU added three Russian entities to the sanctions list for their involvement in chemical weapon development and deployment during Russia’s military operations in Ukraine. The Council continues to monitor developments and has stated its readiness to revise or expand the sanctions as needed to ensure full compliance with international non-proliferation norms and to safeguard international peace and security.

EU Extends Sanctions Against Russian Hybrid Threats Amid Ongoing Disinformation and Cyber Attacks

The Council of the European Union has extended sanctions for another year, until 9 October 2026, targeting individuals and entities responsible for Russia’s continued hybrid threats and destabilising actions abroad. The decision comes in response to persistent Foreign Information Manipulation and Interference (FIMI) campaigns, cyberattacks, sabotage, and other malign activities directed against the EU, its member states, and partner nations.

The sanctions currently apply to dozens of individuals and entities associated with these hybrid operations. Those listed face asset freezes and travel bans, while EU citizens and companies are prohibited from providing them with financial or economic resources. The measures reflect the EU’s firm stance on safeguarding its democratic values, stability, and independence from foreign interference.

Initially adopted in October 2024, the sanctions framework was broadened in May 2025 to include financial backers of destabilising activities and to suspend broadcasting licenses of Russian media outlets engaged in disinformation campaigns. In July 2025, the EU’s High Representative condemned Russia’s systematic and malicious hybrid campaigns, noting that such actions have intensified since the war of aggression against Ukraine. The EU remains committed to employing all available tools to deter, prevent, and respond to ongoing hybrid and information manipulation threats.

UK Treasury Issues General Licence Allowing Global Banks to Wind Down Transactions with Iranian Financial Institutions

The HM Treasury’s Office of Financial Sanctions Implementation (OFSI) issued a General Licence (INT/2025/7345664) permitting global financial institutions and related entities to wind down or divest transactions involving specific Iranian banks. This move, under Regulation 40 of The Iran (Sanctions) (Nuclear) (EU Exit) Regulations 2019, provides a temporary window for banks and businesses to disengage from dealings with designated Iranian entities before sanctions are fully enforced.

The licence, valid from 29 September 2025 to 28 October 2025, authorizes closing out positions, divesting assets, and carrying out necessary transactions to ensure compliance. Covered entities include banks such as Bank Mellat, Bank Refah Kargaran, Sina Bank, Arian Bank, and several others listed in Annex 1. The directive mandates that all parties maintain detailed transaction records for six years and prohibits any activities that knowingly breach UK sanctions law.

This measured approach aims to balance regulatory enforcement with operational continuity, allowing financial institutions to manage exposure and mitigate risks while upholding the UK’s broader sanctions objectives regarding Iran’s nuclear activities.

UK Issues General License to Facilitate Wind-Down of Transactions with Iranian Banks

The UK Treasury’s Office of Financial Sanctions Implementation (OFSI) issued a General License (INT/2025/7345464) under the Iran (Sanctions) (Nuclear) (EU Exit) Regulations 2019. The licence allows UK persons and relevant financial institutions to wind down or divest from transactions involving specified Iranian banks, which are listed in the annex of the licence: Bank Melli, Bank Saderat Iran, Bank Tejarat, and Persia International Bank Plc.

The permissions granted cover activities such as closing out positions and carrying out any action reasonably necessary to complete the withdrawal process. Importantly, the licence requires strict record-keeping obligations, with all parties involved expected to maintain detailed records of activities undertaken for at least six years.

The licence is time-bound, taking effect from 29 September 2025 and expiring at 23:59 on 12 November 2025, providing just over six weeks for entities to complete their exit from dealings with the designated banks. While it authorizes specific wind-down transactions, it does not permit actions that could knowingly result in breaches of the broader sanctions framework. This move signals a controlled and transparent approach by the UK Government, balancing compliance with sanctions law while giving institutions a limited window to manage existing exposures responsibly.

Know more about the product: PreScreening.io

Click here to book a free demo.

Sanctions Watch is a weekly recap of events and news related to sanctions around the world.

- #Sanctions

- #EuropeanUnion

- #Russia

- #ChemicalWeapons

- #CyberSecurity

- #HybridThreats

- #IranSanctions

- #UKTreasury

- #OFSI

- #GlobalSecurity