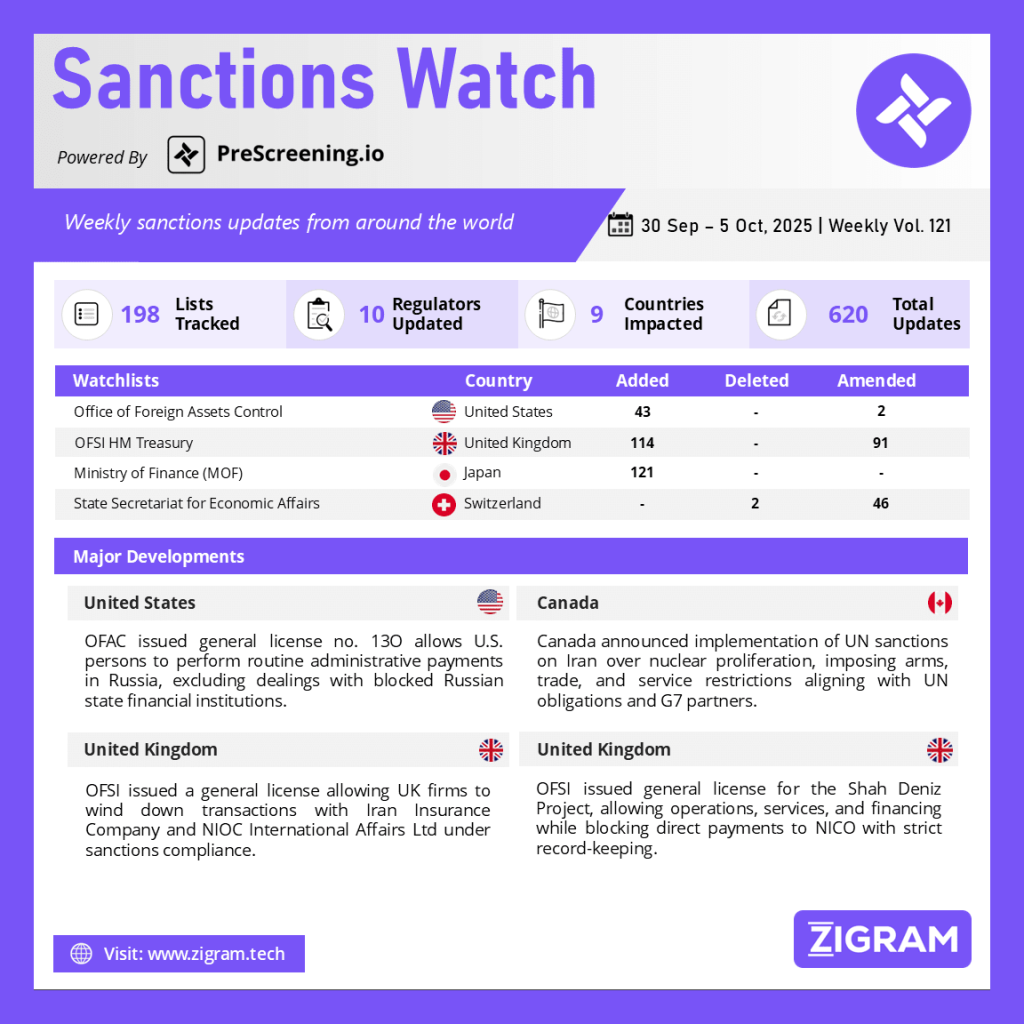

Sanctions Watch Vol 121

In the latest edition of our Sanctions Watch weekly digest, we present significant updates on sanction watchlists and regulatory developments.

1. OFAC Issued General License No. 130, Extending Authorization for Essential U.S. Business Operations in Russia

The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) issued General License No. 13O, replacing the earlier License 13N. This license permits U.S. persons, as well as entities owned or controlled by them, to continue certain administrative transactions in Russia that would otherwise be restricted under sanctions. Specifically, the authorization allows for the payment of taxes, fees, and import duties, as well as the purchase or receipt of permits, licenses, registrations, certifications, and tax refunds. These transactions are permitted only to the extent that they are ordinarily incident and necessary for day-to-day operations of U.S. businesses operating in Russia.

Importantly, the license makes clear that it does not permit any debits to accounts of the Central Bank of Russia, the National Wealth Fund, or the Russian Ministry of Finance within U.S. financial institutions. It also does not authorize transactions with individuals or entities blocked under the Russian Harmful Foreign Activities Sanctions Regulations. The license is effective immediately and remains valid through 12:01 a.m. EST, January 9, 2026, ensuring operational continuity for U.S. companies in Russia while maintaining compliance with broader sanctions.

2. Canada Reimposes UN Sanctions on Iran Over Nuclear Proliferation Threats

Global Affairs Canada announced the reimplementation of United Nations sanctions against Iran in response to its continued nuclear proliferation activities. The decision, led by Foreign Affairs Minister Anita Anand, amends the Regulations Implementing the United Nations Resolutions on Iran (UN Iran Regulations), reinstating restrictions previously lifted under the 2015 Joint Comprehensive Plan of Action (JCPOA). The sanctions cover a wide scope, including prohibitions on nuclear, dual-use, and missile-related exports and imports, a complete arms embargo, bans on technical and financial assistance for restricted goods, and restrictions on services for Iranian vessels. This action aligns with Canada’s obligations under Article 25 of the UN Charter and reflects growing concerns about Iran’s failure to comply with international agreements.

The move follows the activation of the JCPOA “snapback” mechanism by France, Germany, and the United Kingdom in August 2025, which triggered the reinstatement of UN sanctions on September 28. Canada emphasized that Iran has not honored commitments under the Treaty on the Non-Proliferation of Nuclear Weapons or cooperated fully with the International Atomic Energy Agency (IAEA). Alongside G7 partners, Canada continues to urge Iran to re-engage in negotiations with the United States and work toward a comprehensive agreement that guarantees Iran never acquires nuclear weapons.

3. UK Treasury Grants Temporary Licence to Wind Down Transactions with Iran-linked Firms, Ensuring Orderly Compliance for UK Businesses

The HM Treasury’s Office of Financial Sanctions Implementation (OFSI) issued a General Licence (INT/2025/7345264) under the Iran (Sanctions) (Nuclear) (EU Exit) Regulations 2019. This licence permits UK persons and institutions to wind down or divest from transactions involving designated Iranian entities. The decision aims to provide businesses with an orderly transition period, ensuring compliance with sanctions while preventing financial disruption.

The licence specifically covers transactions involving entities such as Iran Insurance Company and National Iranian Oil Company (NIOC) International Affairs Ltd, as listed in Annex 1. Under its terms, relevant UK financial institutions, corporate entities, and individuals are allowed to close out positions and conduct activities reasonably necessary to disengage from these relationships. Strict record-keeping requirements mandate that all parties maintain accurate documentation of related activities for at least six years. Importantly, the licence does not override other sanctions regulations and only applies within its defined scope.

The General Licence remains valid from 29 September 2025 to 28 October 2025, after which it will expire unless revoked or extended by HM Treasury. This move reflects the UK government’s approach to balancing sanctions enforcement with operational certainty for businesses.

4. UK Grants General Licence for Shah Deniz Gas Project, Ensuring Continued Energy Flow to Europe

The UK Treasury, through its Office of Financial Sanctions Implementation (OFSI), has issued a General Licence (INT/2025/7363752) under the Iran (Sanctions) (Nuclear) (EU Exit) Regulations 2019. This licence specifically allows activities necessary for the continued operation of the Shah Deniz Project, one of the largest natural gas developments in the world, which supplies gas from Azerbaijan to Turkey and Europe. The licence ensures that relevant UK institutions and associated persons may provide goods, services, financing, or other support required for the project, as long as strict conditions are followed. Crucially, the framework prevents any direct payments to Naftiran Intertrade Company (NICO), the designated party, ensuring compliance with sanctions while safeguarding energy flows.

This development is seen as a positive step for regional energy security. By enabling the Shah Deniz Project’s uninterrupted operations, the licence helps sustain Europe’s access to diversified gas supplies at a time when energy stability is a pressing concern. It mandates strict record-keeping for six years and prohibits any action that could directly breach nuclear-related sanctions. Taking effect from 29 September 2025, the licence provides a balanced mechanism that supports vital energy infrastructure while upholding UK sanctions obligations.

Know more about the product: PreScreening.io

Click here to book a free demo.

Sanctions Watch is a weekly recap of events and news related to sanctions around the world.

- #OFAC

- #Sanctions

- #Russia

- #UKTreasury

- #Iran

- #OFSI

- #GeneralLicense

- #EnergySecurity

- #Compliance

- #FinancialSanctions

- #Geopolitics

- #TradeRestrictions

- #ShahDenizProject