Sanctions Watch Vol 120

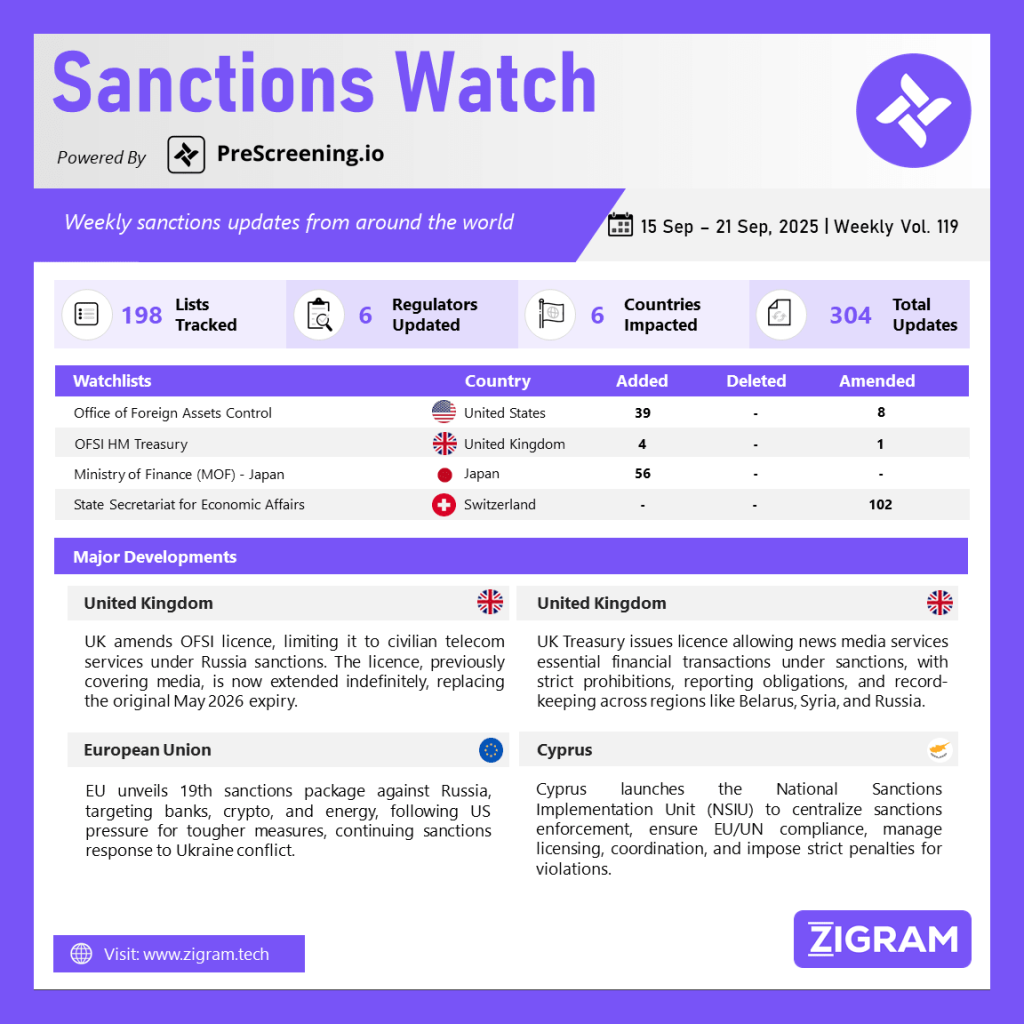

In the latest edition of our Sanctions Watch weekly digest, we present significant updates on sanction watchlists and regulatory developments.

1. U.S. Treasury Revises Syria Sanctions, Expands Accountability Under New Executive Orders

The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) has amended the Syria-Related Sanctions Regulations, renaming them the “Promoting Accountability for Assad and Regional Stabilization Sanctions Regulations.” This update, effective September 25, 2025, incorporates two new Executive Orders issued earlier in the year, on January 15 and June 30, 2025. The June order formally revoked the previous national emergency that served as the foundation of Syrian sanctions but preserved core restrictions targeting human rights violators, actors linked to chemical weapons, and individuals or entities threatening regional stability. To ensure continuity, OFAC also announced that certain persons previously sanctioned under earlier authorities would be redesignated under the new framework.

The amendments expand the statutory base of the program by integrating the Syria Human Rights Accountability Act, the Caesar Syria Civilian Protection Act, and the Illicit Captagon Trafficking Suppression Act. They also revise program tags on the Specially Designated Nationals (SDN) list to reflect the updated authorities. Despite these structural changes, the substantive prohibitions remain intact: U.S. persons are still barred from engaging in transactions with designated individuals and entities, and all property or interests in property subject to U.S. jurisdiction remain blocked. The regulations also maintain visa restrictions and financial sanctions on sanctioned parties. Through this realignment, OFAC underscores its intent to sustain pressure on the Assad regime and associated networks, while aligning enforcement tools with evolving statutory mandates and regional security concerns.

2. UK Issues General Licence Allowing Revenue Authorities to Make Payments to Designated Persons’ Frozen Accounts

The UK Office of Financial Sanctions Implementation (OFSI), under HM Treasury, issued General Licence INT/2025/7328184, which permits limited payments to the frozen bank accounts of designated persons (DPs) under UK Autonomous Sanctions Regulations. The licence, effective from 00:01 on the same date, allows His Majesty’s Revenue & Customs (HMRC) to make “Permitted Payments” owed to sanctioned individuals or entities, provided the obligation to pay arose before their designation. This includes associated interest payments, regardless of when the interest obligation was established. In addition, HMRC is authorised to set off amounts owed to DPs against any tax or other liabilities that the same sanctioned person may owe the authority.

The framework clearly defines “frozen UK bank accounts” as accounts held with UK or relevant non-UK institutions operating within the UK, including clearing houses, payment service providers, and e-money institutions. While offering this flexibility, the licence includes important safeguards. It does not override broader prohibitions under the sanctions regime and does not authorise the release of funds or resources in ways that would breach UK Autonomous Sanctions Regulations. All use of the licence is subject to strict reporting and record-keeping obligations outlined in the text. In effect, this general licence strikes a balance between enforcing sanctions measures and ensuring that legitimate, pre-existing financial obligations owed by government revenue authorities can still be fulfilled without undermining the sanctions regime.

3. U.S. Treasury Renames and Expands Syria Sanctions Framework Amid Political Transition

The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) issued a final rule amending the Syria-Related Sanctions Regulations, renaming them the Promoting Accountability for Assad and Regional Stabilization Sanctions Regulations. This change reflects an expanded mandate to address both accountability for crimes under the former Assad regime and stabilization in the wider region. The update implements two significant executive orders issued in 2025. Executive Order 14142, signed on January 15, 2025, removed references to Türkiye to reflect evolving conditions in Syria. Later, Executive Order 14312, signed on June 30, 2025, revoked broad sanctions imposed under earlier frameworks tied to the Assad regime, while maintaining restrictions on ISIS, terrorist organizations, human rights violators, chemical weapons actors, and narcotics networks.

Importantly, OFAC has redesignated certain individuals and entities that were previously sanctioned, ensuring continuity under the amended authority of Executive Order 13894. The recalibration follows positive steps taken by Syria’s new government under President Ahmed al-Sharaa, which enabled the United States to narrow its sanctions while keeping accountability mechanisms intact. OFAC also updated its Specially Designated Nationals (SDN) List identifiers and integrated additional statutory authorities, including the Caesar Syria Civilian Protection Act of 2019 and the Illicit Captagon Trafficking Suppression Act of 2023.

Overall, the revised sanctions framework underscores a dual U.S. strategy encouraging Syria’s political transition while holding Assad-era perpetrators accountable and preserving robust restrictions on actors who continue to pose threats to U.S. and regional security.

4. UK publishes updated “Starter Guide to Sanctions” to bolster compliance among businesses

The UK government has published an updated Starter Guide to UK Sanctions to support businesses, organizations, and individuals in understanding their obligations under the sanctions regime. The guidance explains that compliance is required from all UK persons, including companies incorporated in the UK, UK nationals abroad, and entities operating internationally. Sanctions are imposed to advance foreign policy, protect national security, meet international obligations, and maintain peace and security. The guide outlines the main categories of sanctions, such as financial restrictions (including asset freezes), director disqualification, trade prohibitions, immigration controls, and transport measures targeting ships and aircraft.

It stresses the importance of consulting the UK Sanctions List and the OFSI Consolidated List to identify designated persons and restricted entities. Importantly, businesses must also consider the “ownership and control” principle, which extends restrictions to entities indirectly controlled by sanctioned individuals, even if not explicitly named. For trade sanctions, both goods and related services—such as legal, banking, or consultancy support connected to restricted goods—may be prohibited. In some cases, exceptions or specific licences may allow activity, especially for humanitarian purposes.

The guide also warns that violations, including dealing with frozen assets, providing prohibited services, or facilitating circumvention, can lead to severe civil or criminal penalties. To mitigate risks, businesses are advised to implement robust due diligence measures, such as regular Know-Your-Customer checks and enhanced monitoring of high-risk relationships.

Know more about the product: PreScreening.io

Click here to book a free demo.

Sanctions Watch is a weekly recap of events and news related to sanctions around the world.

- #OFAC

- #Sanctions

- #USTreasury

- #OFAC

- #SyriaSanctions

- #ExecutiveOrders

- #AssadRegime

- #HumanRights

- #ChemicalWeapons

- #RegionalStability

- #GeneralLicence