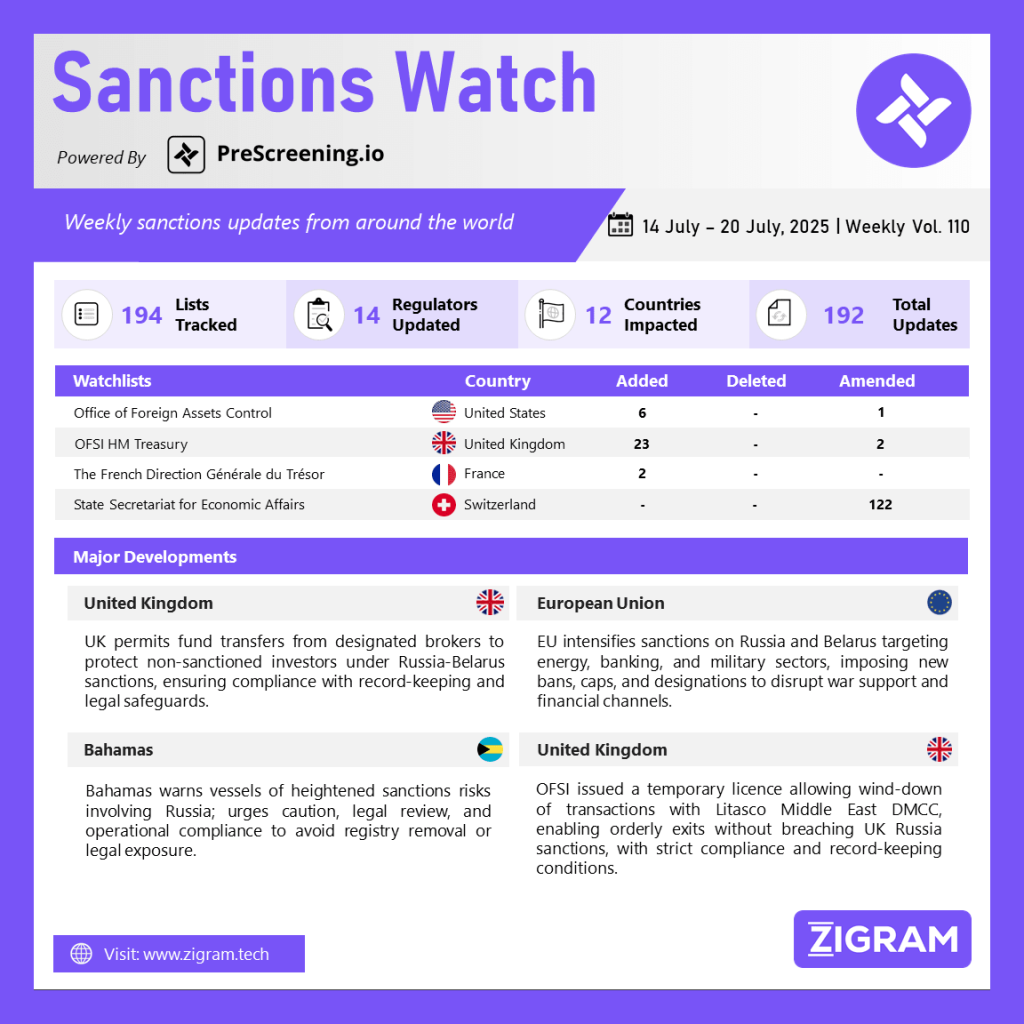

Sanctions Watch Vol 110

In the latest edition of our Sanctions Watch weekly digest, we present significant updates on sanction watchlists and regulatory developments.

1. UK Issues General Licence Allowing Fund Transfers from Designated Brokers under Russia and Belarus Sanctions

The UK’s Office of Financial Sanctions Implementation (OFSI), part of HM Treasury, issued General Licence INT/2025/6641960 under the Russia and Belarus Sanctions Regulations. This licence permits non-designated individuals or entities—those who are not themselves sanctioned—to transfer their investment funds away from sanctioned (designated) brokers to non-designated brokers. The key condition is that the only designated party involved must be the broker itself.

The licence defines the scope of permissible actions, allowing asset holding institutions and intermediaries to transfer frozen funds or client money, provided it can be reasonably confirmed that these assets were invested prior to the broker’s designation. The transfer can include accrued interest, dividends, and fees, and updates to ownership registers are also permitted under the licence. Institutions involved may deduct contractual fees before the transfer.

However, the licence does not permit any action that knowingly or recklessly results in making funds or economic resources available in violation of other sanctions laws, unless explicitly authorised. Record-keeping and reporting obligations for all involved parties are also mandated.

This general licence is a significant regulatory step to protect non-sanctioned investors while maintaining the integrity of the sanction’s regime imposed on Russia and Belarus.

2. EU Adopts 18th Sanctions Package Targeting Russia’s Energy, Banking, and Military Sectors

The European Union adopted its 18th package of sanctions against Russia, further escalating pressure in response to its ongoing war of aggression against Ukraine. The measures represent one of the EU’s most comprehensive packages to date, targeting Russia’s energy revenues, military capabilities, and financial networks. The package also includes reinforced restrictions on Belarus.

Key highlights include a reduced oil price cap (from $60 to $47.6/barrel), a ban on 105 additional tankers part of Russia’s shadow fleet, and sanctions against oil traders and an Indian refinery with links to Rosneft. For the first time, a shadow fleet vessel captain and a flag registry operator have also been listed. The EU introduced a full transaction ban on Nord Stream 1 and 2 pipelines and banned imports of petroleum products derived from Russian crude oil (excluding a few allies).

Banking sanctions now extend to 22 more Russian banks, increase restrictions on third-country crypto and financial institutions frustrating EU measures, and ban transactions with the Russian Direct Investment Fund. Export restrictions cover €2.5 billion worth of military-use items, CNC machines, UAV-related technology, and dual-use goods.

The EU also imposed sanctions on individuals involved in the indoctrination of Ukrainian children, Russian proxies in occupied regions, and propagandists. Sanctions against eight Belarusian military firms and a full embargo on arms imports from Belarus were also introduced.

The EU reaffirmed its commitment to Ukraine’s sovereignty and signaled readiness to impose further sanctions if necessary.

3. Bahamas Maritime Authority Issues Alert on Sanctions and Risks for Ships Linked to Russia

The Bahamas Maritime Authority (BMA) released Technical Alert 25-03, warning Bahamian-flagged ships and companies of increasing risks and legal exposure due to sanctions related to Russia’s war in Ukraine. The alert addresses the implications of U.S., UK, and EU sanctions on vessels owned, operated, financed, or insured by Russian entities or engaged in trade to or from Russia.

BMA urges all parties to prioritize the safety of vessels in the Black Sea region, citing risks such as direct attacks, collateral damage, and naval mines due to the ongoing Russia-Ukraine conflict. Owners, charterers, and operators are advised to conduct thorough due diligence before entering Russian ports and to seek independent legal advice to mitigate potential sanctions-related consequences.

The alert also highlights that any Bahamian ship sanctioned by the aforementioned authorities—or by The Bahamas—could face removal from the ship registry.

Additional guidance is provided regarding Russian and Ukrainian seafarers. Companies must contact the BMA if a seafarer’s Certificate of Competency expires while onboard. The alert emphasizes continuous monitoring of all Bahamas-flagged vessels operating in affected zones and mandates that AIS and LRIT systems remain operational per SOLAS Chapter V.

The alert remains valid until further notice and includes dedicated contact points for inquiries regarding ownership, sanctions, technical issues, or seafarer matters.

4. UK Grants General Licence for Wind-Down of Litasco Middle East DMCC Transactions

The UK’s Office of Financial Sanctions Implementation (OFSI), part of HM Treasury, issued General Licence INT/2025/6488808 under Regulation 64 of The Russia (Sanctions) (EU Exit) Regulations 2019. This licence provides temporary permission for individuals and entities to wind down transactions involving Litasco Middle East DMCC, which is designated under the Russia Regulations. The licence aims to facilitate an orderly exit from existing financial relationships or obligations with the designated entity without breaching sanctions, as long as the actions remain within the scope of the licence.

The licence permits any person, including corporate bodies, and Relevant UK Institutions to carry out activities necessary to close out transactions with Litasco. These include actions such as terminating contracts or financial positions, provided that no new economic resources or funds are made available to the designated person in violation of existing sanctions regulations. The definition of Relevant UK Institutions covers a broad range of financial entities, including those authorized under the Financial Services and Markets Act 2000, the Payment Services Regulations 2017, and operators of recognized payment systems.

Record-keeping requirements are clearly outlined for all parties using the licence, ensuring transparency and accountability. Importantly, the licence does not authorize any activity that would otherwise contravene the broader Russia sanctions regime, unless such actions are explicitly permitted under this or other relevant licences.

Know more about the product: PreScreening.io

Click here to book a free demo.

Sanctions Watch is a weekly recap of events and news related to sanctions around the world.

- #SanctionsCompliance

- #GlobalSanctions

- #RussiaSanctions

- #BelarusSanctions

- #SanctionsCompliance

- #FrozenAssets

- #EUSanctions

- #RussiaUkraineWar

- #EnergySanctions

- #MilitarySanctions

- #FinancialSanctions

- #EUForeignPolicy

- #BahamasMaritimeAuthority

- #ShippingSanctions

- #BlackSeaRisks

- #MaritimeCompliance

- #VesselSafety

- #SanctionsAlert

- #OFAC

- #SanctionsViolation

- #InteractiveBrokers

- #USSanctions

- #ComplianceFailure

- #FinancialRegulation

- #UKRegulations

- #AML

- #RegulatoryCompliance