Sanctions Watch Vol 106

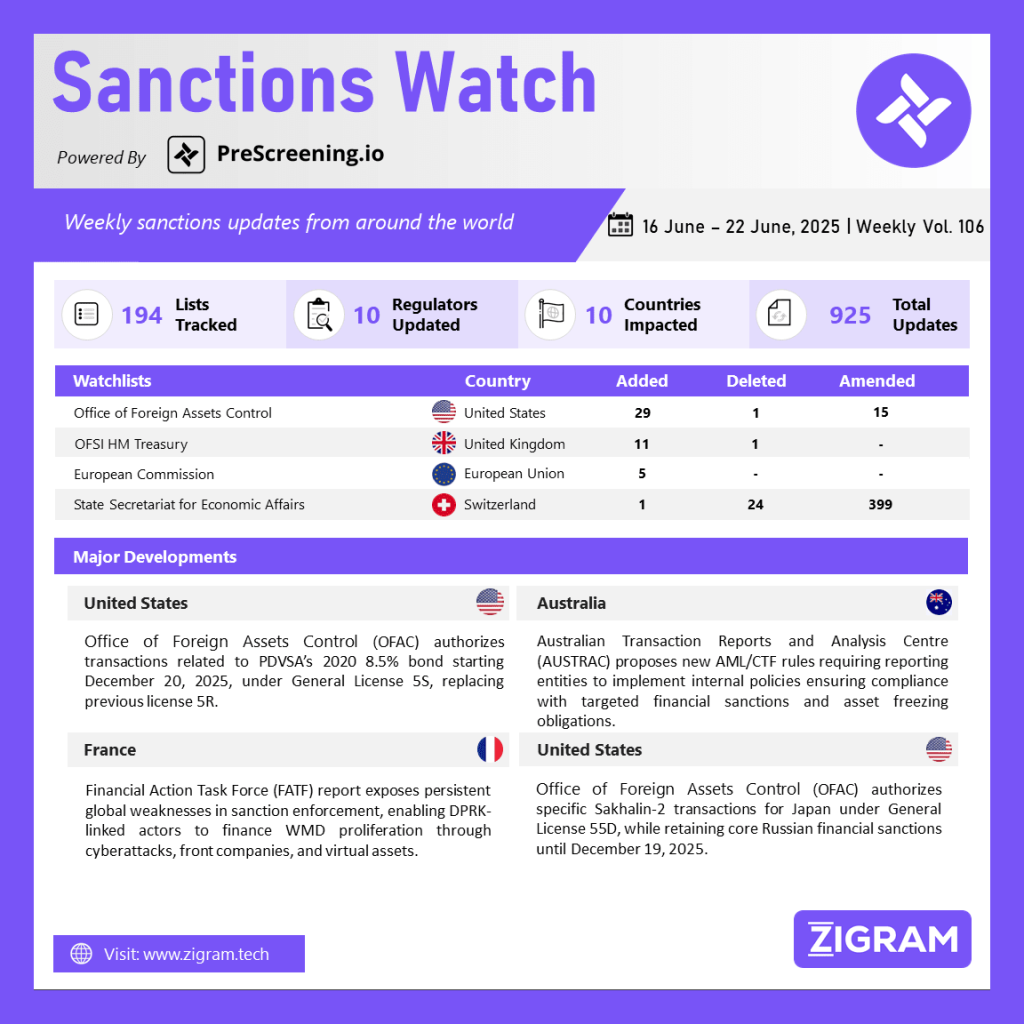

In the latest edition of our Sanctions Watch weekly digest, we present significant updates on sanction watchlists and regulatory developments.

1. U.S. Treasury Issues General License No. 5S Authorizing Bond-Related Transactions Involving Petróleos de Venezuela S.A. (PDVSA)

The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) issued General License No. 5S under the Venezuela Sanctions Regulations (31 CFR Part 591). This license authorizes all transactions and dealings associated with the Petróleos de Venezuela, S.A. (PDVSA) 2020 8.5 Percent Bond, provided they occur on or after December 20, 2025. The authorization includes activities related to financing and other commercial dealings that would otherwise be prohibited under subsection 1(a)(iii) of Executive Order 13835, as amended by Executive Order 13857.

However, the license strictly excludes any transactions still prohibited under other provisions of the Venezuela Sanctions Regulations or other sections of Title 31. This new license (5S) effectively replaces and supersedes General License No. 5R, dated March 6, 2025, providing further clarity and forward-looking permissions regarding Venezuelan sovereign debt instruments.

2. Australia Proposes Mandatory Sanctions Compliance Policies for AUSTRAC-Regulated Entities in Second AML/CTF Rule Consultation

Australia is taking a decisive step toward strengthening its financial crime prevention framework. On 19 May 2025, the Australian Transaction Reports and Analysis Centre (AUSTRAC) launched its Second Public Consultation on proposed changes to the Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) Rules.

Among the key proposals is a new requirement for reporting entities regulated by AUSTRAC to develop, maintain, and comply with internal policies that ensure they do not contravene Australia’s targeted financial sanctions obligations. These obligations include asset freezing measures in the delivery of designated financial services.

To aid the consultation process, the Australian Sanctions Office (ASO) has clarified the distinct but complementary roles of the two agencies. The ASO remains responsible for implementing and enforcing Australia’s sanctions regimes, which impose legal restrictions on financial and trade dealings with certain countries, individuals, and organisations. AUSTRAC, as Australia’s financial intelligence unit and AML/CTF regulator, will supervise how reporting entities incorporate sanctions compliance into their broader risk management and compliance programs.

This proposed change will enhance the ability of AUSTRAC-regulated institutions to effectively detect and prevent financial crimes such as money laundering, terrorism financing, and proliferation financing. It also ensures that these institutions are properly equipped to implement and uphold sanctions obligations, thereby strengthening the integrity of Australia’s financial system.

Stakeholders are invited to participate in the consultation and contribute to shaping a robust, transparent, and globally aligned sanctions compliance framework.

3. FATF Warns of Major Global Gaps in Enforcing Sanctions Against WMD Proliferation

The FATF’s June 2025 report, “Complex Proliferation Financing and Sanctions Evasion Schemes,” highlights critical weaknesses in global efforts to counter proliferation financing (PF), particularly in enforcing targeted financial sanctions against the proliferation of weapons of mass destruction (WMD). Only 16% of countries assessed showed high or substantial effectiveness in implementing UNSCRs on proliferation. The Democratic People’s Republic of Korea (DPRK) remains the most significant actor, leveraging cyberattacks, front companies, and virtual assets to finance its WMD program—most notably the USD 1.5 billion theft from ByBit in February 2025.

The report identifies four key typologies in sanctions evasion: use of intermediaries, concealment of beneficial ownership, exploitation of virtual assets, and misuse of maritime networks. It urges public and private sectors to strengthen compliance, improve information sharing, and issue targeted alerts. FATF emphasizes that failure to act on these evolving PF threats could lead to catastrophic global security consequences.

4. U.S. Treasury Extends Authorization for Sakhalin-2-Related Transactions Under Russia Sanctions Until December 2025

The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) issued General License No. 55D under the Russian Harmful Foreign Activities Sanctions Regulations. This license authorizes specific transactions related to the Russian Sakhalin-2 oil and gas project through December 19, 2025. It permits the maritime transport of crude oil from Sakhalin-2 solely for importation into Japan. The license also allows transactions involving Gazprombank and its affiliates when connected to Sakhalin-2, and authorizes petroleum services under Executive Order 14071.

However, the license explicitly excludes any transactions restricted under Directives 2 and 4 of Executive Order 14024, such as those involving the Central Bank or National Wealth Fund of Russia. It also prohibits dealings with blocked persons under the broader Russian sanctions framework unless specifically authorized. This action reflects a strategic exemption supporting Japan’s energy needs while upholding comprehensive sanctions aimed at curbing Russia’s harmful foreign activities.

Know more about the product: PreScreening.io

Click here to book a free demo.

Sanctions Watch is a weekly recap of events and news related to sanctions around the world.

- #OFAC

- #SanctionsCompliance

- #GeneralLicense

- #VenezuelaSanctions

- #AMLCTF

- #SanctionsAdvisory

- #FATF

- #ProliferationFinancing

- #CyberSanctions

- #ShadowFleet

- #RussiaSanctions

- #EnergySanctions

- #FinancialSanctions

- #G7Sanctions