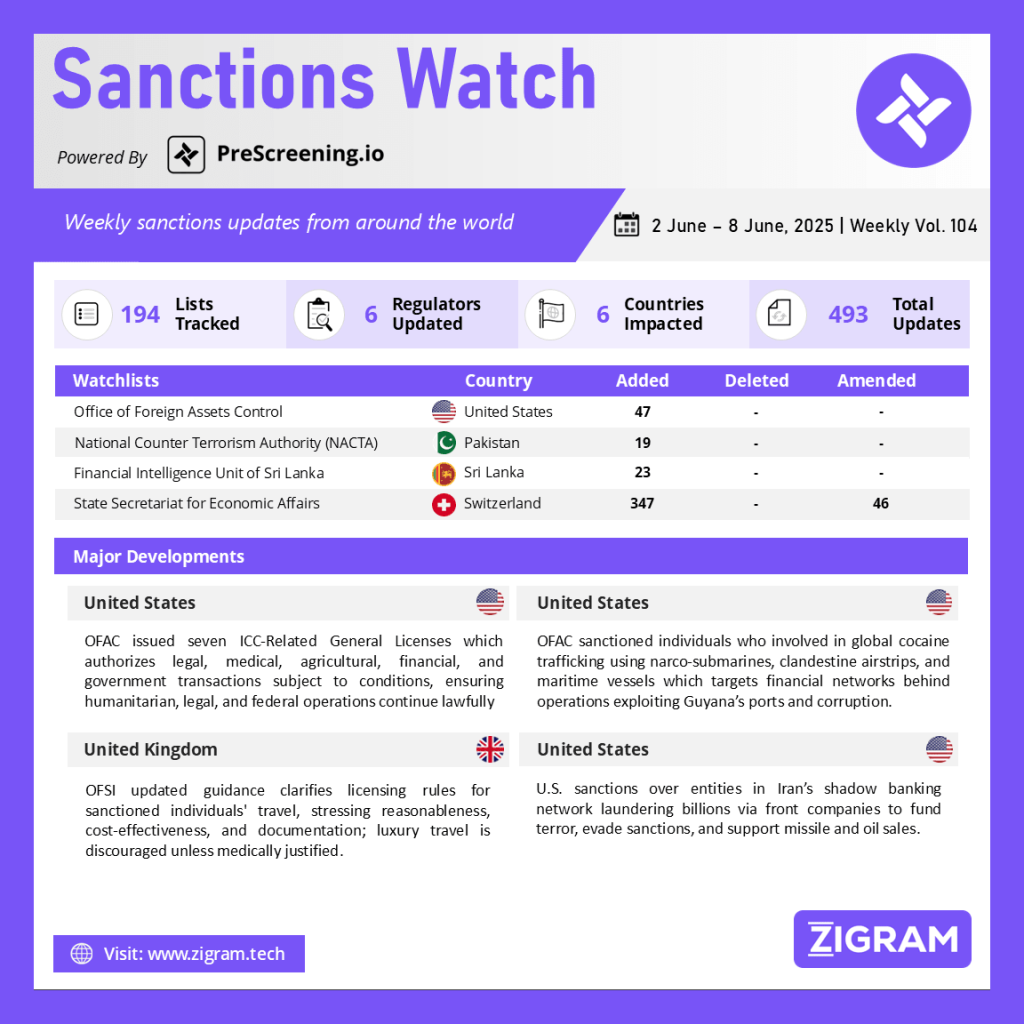

Sanctions Watch Vol 104

In the latest edition of our Sanctions Watch weekly digest, we present significant updates on sanction watchlists and regulatory developments.

1. OFAC Issues Seven ICC-Related General Licenses Amid Sanctions, Ensuring Continuity of Legal, Medical, and Government Operations

The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) issued seven General Licenses in response to sanctions imposed under Executive Order 14203 targeting the International Criminal Court (ICC) and specific individuals associated with it. These licenses aim to mitigate the broader humanitarian and operational impacts of the sanctions while reinforcing the U.S. government’s stance against what it considers illegitimate ICC actions targeting the United States and Israel.

General License 1 authorizes the wind-down of transactions involving five newly sanctioned ICC officials until July 8, 2025. General License 2 permits the provision of certain legal services to those individuals, including representation and legal advice within U.S. jurisdiction, while General License 3 allows payments for those legal services from non-U.S. sources under strict conditions. General License 4 authorizes the delivery of emergency medical services to sanctioned individuals, and General License 5 enables U.S. financial institutions to process normal service charges and maintain internal transfers between blocked accounts. General License 6 permits the supply of agricultural commodities, medicine, and medical devices for personal, non-commercial use to sanctioned individuals. Finally, General License 7 ensures that transactions necessary for official U.S. government business may continue without disruption. These licenses reflect a calibrated approach, maintaining pressure on targeted entities while safeguarding legal, humanitarian, and governmental functions.

2. U.S. Treasury Targets Drug Trafficking Network Using Narco-Submarines and Aircraft, Sanctions Individuals Involved in Global Cocaine Smuggling

The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) sanctioned several individuals involved in trafficking large quantities of cocaine from South America to the United States, Europe, and the Caribbean. The individuals targeted were part of an extensive criminal network utilizing maritime vessels, narco-submarines, and clandestine airstrips to facilitate the movement of illicit drugs. These individuals have been linked to significant drug trafficking operations that exploit Guyana’s proximity to the Caribbean and its corrupt practices along its ports and borders. The sanctions also target those operating covert airstrips to traffic drugs via aircraft, further complicating enforcement efforts. Despite Guyana’s cooperation with U.S. authorities, corruption remains a significant challenge in combating this trade.

The sanctions are aimed at disrupting the drug trade, targeting the financial networks that support cartel operations, and enhancing the security of U.S. borders. This action follows a coordinated investigation involving multiple U.S. law enforcement agencies. OFAC’s enforcement of these sanctions highlights its commitment to curbing international narcotics trafficking by blocking the assets of those involved and preventing U.S. persons from engaging in transactions with these sanctioned individuals and entities.

3. OFSI Clarifies Permitted Travel Expenses Under Sanctions Licensing Regime

The UK’s Office of Financial Sanctions Implementation (OFSI) updated its guidance on licensing travel expenses related to sanctioned individuals. This guidance clarifies how and under what conditions travel-related costs may be permitted through licensing. When frozen funds are to be released for travel—often for legal proceedings—OFSI assesses the “reasonableness” of the request, as mandated by sector-specific sanctions regulations under the Sanctions and Anti-Money Laundering Act 2018.

Applicants must demonstrate that travel is necessary, cost-effective, and that alternatives, such as video conferencing, were considered. Applications should be submitted at least four weeks before travel, supported by detailed cost justifications, including the necessity of each traveler. OFSI generally permits economy-class travel for flights under six hours and standard rail tickets booked in advance. Taxis, hotel stays, and meal costs must be demonstrably essential and within reasonable rates. The guidance also outlines acceptable mileage reimbursement rates and strongly discourages luxury accommodations or first-class travel unless medically justified.

Importantly, obtaining a travel license does not override any existing travel bans. OFSI’s updated guidelines aim to streamline application reviews while ensuring compliance with the UK’s financial sanctions obligations. Failure to provide adequate documentation may result in delays or refusals.

4. U.S. Treasury Sanctions Iranian Shadow Banking Network Laundering Billions to Fund Regime’s Terror, Oil Sales

The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) sanctioned more than 30 individuals and entities involved in Iran’s covert shadow banking system. Central to the action are Iranian brothers, who operated a vast laundering network through Iran-based exchange houses and front companies in Hong Kong and the UAE. This network facilitated billions of dollars in illicit transactions, enabling the Iranian regime to bypass sanctions, fund nuclear and missile programs, and support terror proxies. The brothers’ firms—GCM Exchange, Berelian Exchange, and Zarrin Ghalam Exchange—channeled money through fictitious invoices and disguised trade payments for sanctioned goods, directly benefiting entities like the IRGC-QF, MODAFL, and NIOC.

Hong Kong-based companies like Hero Companion Limited and UAE-based companies such as Wide Vision General Trading L.L.C. were instrumental in this operation. Family members and associates also held leadership roles in sanctioned entities including Zarrin Tehran Investment Company and Kimia Sadr Pasargad Company. Designations were made under Executive Orders 13902 and 13846. The sanctioned parties’ U.S.-linked assets are blocked, and U.S. persons are prohibited from dealing with them. This action underscores the U.S. commitment to dismantling financial lifelines sustaining Iran’s destabilizing conduct.

Know more about the product: PreScreening.io

Click here to book a free demo.

Sanctions Watch is a weekly recap of events and news related to sanctions around the world.

- #OFAC

- #Sanctions

- #GeneralLicense

- #ICC

- #USPolicy

- #LegalServices

- #HumanitarianAid

- #DrugTrafficking

- #NarcoSubmarines

- #CocaineTrade

- #IllicitNetworks

- #Guyana

- #Iran

- #ShadowBanking

- #MoneyLaundering

- #TerrorFinance

- #IRGC

- #MissileProgram

- #ExecutiveOrder

- #OFSI

- #UKSanctions

- #FinancialSanctions

- #TravelLicensing

- #Compliance

- #FATF

- #CounterTerrorism

- #IllicitFinance

- #OFACEnforcement

- #TreasuryDepartment

- #GlobalSecurity