Regulation Name: Anti-Money Laundering and Countering Financing of Terrorism (AML/CFT) Act 2009

Date Of Release: 01 June 2025

Region: New Zealand

Agency: Government of New Zealand

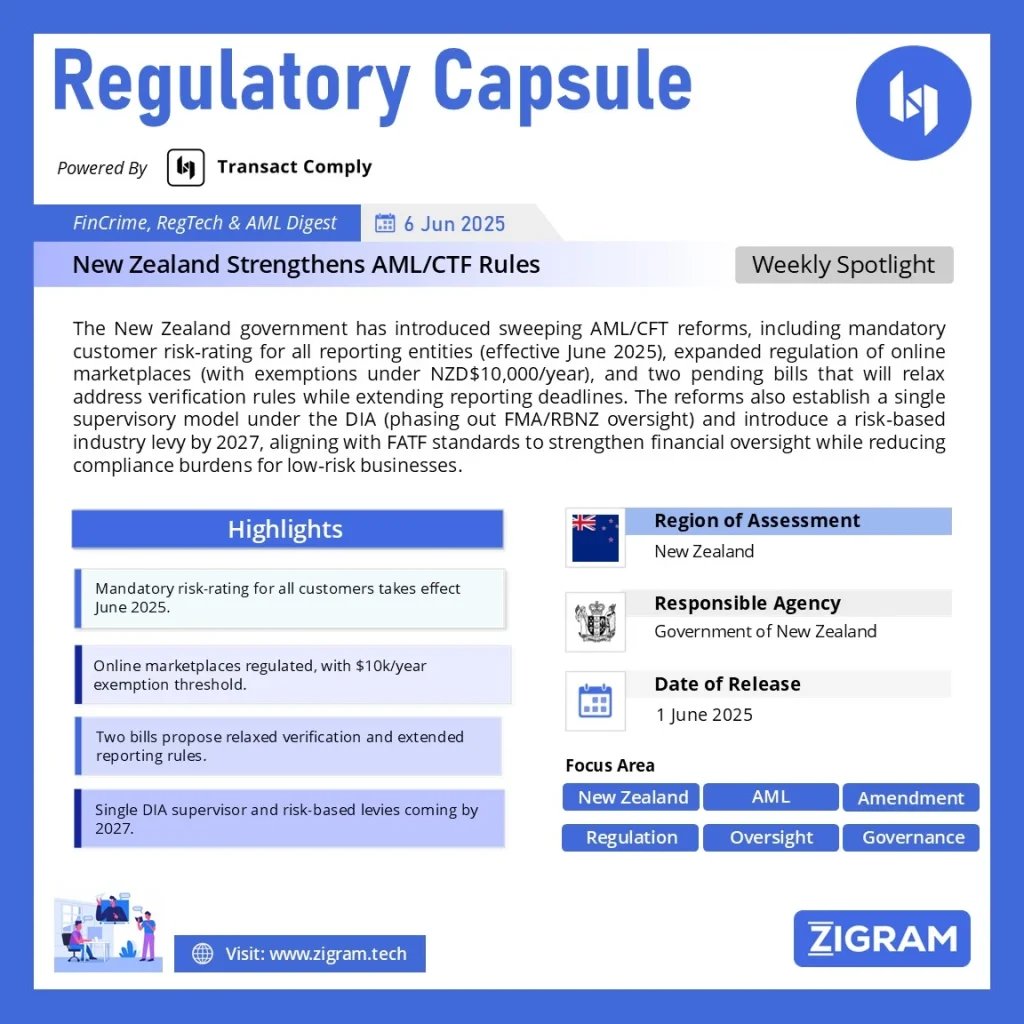

New Zealand’s AML/CFT Reforms: What Businesses Need to Know

June 2025 – The New Zealand government has introduced significant reforms to the Anti-Money Laundering and Countering Financing of Terrorism (AML/CFT) Act 2009, with some changes already in effect and more on the horizon. These updates aim to strengthen financial crime protections, align with international standards, and streamline compliance for businesses.

Financial institutions, law firms, accountants, real estate agents, and now online marketplaces must adapt to these changes. Here’s a breakdown of the key updates and what they mean for reporting entities.

- Key Changes Effective from 1 June 2025

Customer Risk Rating Requirement

All reporting entities are now required to implement a formal process for risk-rating new customers. This means assigning each customer a risk level—such as low, medium, or high—based on factors like their transaction patterns, country of origin, and business relationship. These ratings must be documented and reviewed periodically, particularly during ongoing customer due diligence (CDD).

The Department of Internal Affairs (DIA) has clarified that smaller businesses with straightforward operations can adopt a simplified approach. However, larger institutions, such as banks and investment firms, may need more sophisticated risk-assessment tools, such as weighted scoring models or risk matrices.

Regulation of Online Marketplaces

Online marketplaces that facilitate payments—such as Trade Me or other e-commerce platforms—are now subject to AML/CFT obligations. This change addresses the growing risk of money laundering through digital transactions.

Marketplaces must now conduct customer due diligence on users who transact more than NZD $10,000 within a 12-month period. However, they are exempt from CDD requirements for users below this threshold. Regardless of transaction size, all platforms must monitor for and report suspicious activity.

- Upcoming Legislative Changes

Statutes Amendment Bill

This bill, expected to pass in mid-2025, introduces two key adjustments. First, it relaxes address verification rules, requiring businesses to verify customer addresses only when the transaction risk justifies it. Second, it extends the deadline for submitting prescribed transaction reports from 10 to 20 working days, giving businesses more time to comply.

AML/CFT Amendment Bill

A more comprehensive reform, this bill includes 26 proposed amendments. Key changes include clearer rules on when customer due diligence must be performed, updated definitions for terms like “beneficial owner” and “trust service provider,” and a requirement for businesses to consider official guidance in their risk assessments. The bill is currently under review by a parliamentary select committee, with a report due by August 2025.

- Future Reforms: Single Supervisor and Industry Levies

Consolidated Supervision Under DIA

Currently, AML/CFT supervision is divided among three agencies: the DIA, Financial Markets Authority (FMA), and Reserve Bank of New Zealand (RBNZ). Under the new model, the DIA will become the sole supervisor, simplifying oversight and reducing compliance costs for businesses. The transition is expected to take place by 2026 or 2027.

New Levy-Based Funding Model

To fund the AML/CFT regime, the government will introduce an industry-wide levy system. High-risk sectors, such as major banks, will contribute more, while smaller businesses will face lower costs. The exact structure of the levy is still being finalized, but it is expected to take effect by 2027.

Risk-Based Flexibility

Future amendments will give businesses more flexibility in applying AML/CFT measures, allowing them to focus resources on higher-risk areas while reducing unnecessary checks for low-risk customers.

Read the full reforms here.

Read about the product: Transact Comply

Empower your organization with ZIGRAM’s integrated RegTech solutions – Book a Demo

- #AML

- #CFT

- #Compliance

- #FinancialCrime

- #RiskManagement

- #RegulatoryReform

- #NewZealand

- #Banking

- #FinTech

- #AntiMoneyLaundering

- #Finance

- #LawReform

- #BusinessCompliance

- #DIA