Nepal’s AML/CFT System in Numbers: Inside the Annual Report 2024-25, STRs Hit 9,565 as Digital Reporting Took Over

Why Nepal’s AML Numbers Matter in 2024/25

In February 2025, Nepal entered the FATF “Jurisdictions under Increased Monitoring” list, putting unprecedented pressure on its anti-money laundering and counter-terrorist financing (AML/CFT) system. Against this backdrop, the Financial Intelligence Unit of Nepal (FIU-Nepal) published an unusually data-heavy annual report for FY 2024/25, explicitly focusing on statistics, volumes, and operational outputs rather than institutional narrative.

The numbers tell a clear story: reporting surged, digital coverage expanded nationwide, and financial intelligence dissemination reached record levels — even as analytical capacity remains stretched.

This OSIN breaks down the year entirely through numbers.

- STRs Cross a Psychological Threshold

The headline figure of the year is unmistakable:

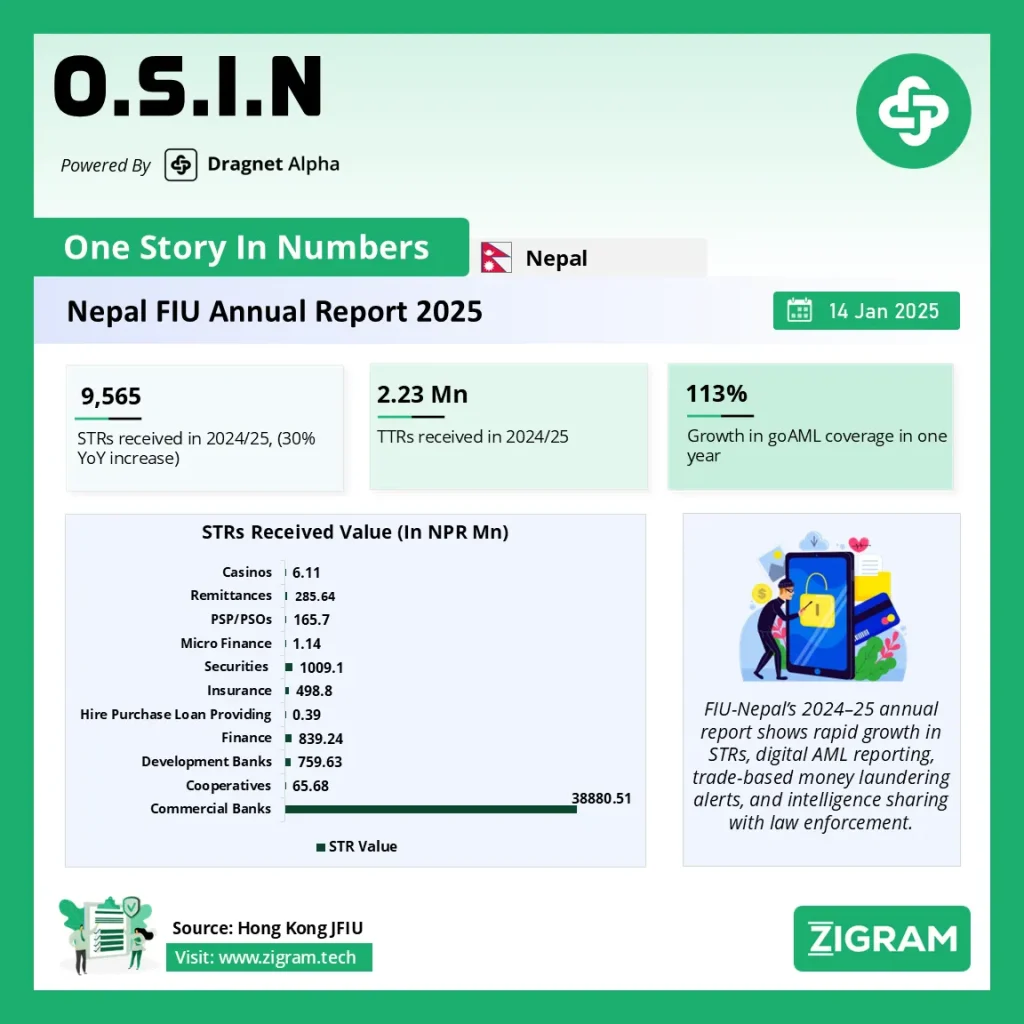

9,565 Suspicious Transaction / Activity Reports (STRs/SARs) were filed in FY 2024/25 — a 30% year-on-year increase from 7,338 in FY 2023/24 .

This continues a five-year growth curve:

Fiscal Year | STRs/SARs |

2020/21 | 1,533 |

2021/22 | 2,780 |

2022/23 | 5,935 |

2023/24 | 7,338 |

2024/25 | 9,565 |

In just four years, STR volumes increased more than six-fold, reflecting both rising compliance and rising risk exposure.

- Digital Reporting Reaches Full Penetration

For the first time since the launch of Nepal’s goAML system, 100% of STRs/SARs were submitted digitally.

- 98.37% of TTRs (Threshold Transaction Reports) were also filed via goAML

- Only 36,445 TTRs were submitted via hard copy, down sharply from 151,916 the previous year

This transition matters because FIU-Nepal’s analytical capacity is directly tied to digital intake — paper-based reporting previously delayed triage and case linkage.

- Reporting Entities Nearly Double in One Year

The number of entities integrated into goAML jumped from 1,639 to 3,497 in a single fiscal year — an increase of 113.36%.

The growth was especially pronounced in non-financial and high-risk sectors:

- Cooperatives: 1,010 → 1,766

- Dealers in Precious Metals & Stones: 121 → 1,121

- Money Changers: 128 → 203

- Payment Service Providers / Operators: 3,260 → 13,922 TTRs reported

By October 2025, 4,098 entities (REs, LEAs, and supervisors combined) were connected to the system nationwide.

- STR Reporting Is No Longer Bank-Only

Commercial banks still dominate STR reporting — but less so than before.

In FY 2024/25:

- Commercial banks filed 7,303 STRs, accounting for 76.4% of all STRs

- This share declined from 84.2% the year before, as insurance companies, securities firms, PSPs, and cooperatives increased reporting

This diversification is critical for FATF effectiveness outcomes, which emphasize DNFBP and non-bank coverage.

- Total TTRs Surge Past 2.2 Million

FIU-Nepal received 2,236,067 TTRs in FY 2024/25 — a 31.7% increase from the previous year.

Key contributors:

- BFIs: 1.11 million

- Securities companies: 768,741

- Insurance companies: 260,631

- PSPs/PSOs: 13,922

Notably, TTRs from non-bank entities now account for ~50% of all TTRs, up from 35% the year before — a structural shift in Nepal’s AML data landscape .

- Analysis Capacity Lags Reporting Growth

While reporting volumes exploded, analysis capacity struggled to keep pace:

- 2,282 STRs/SARs were analyzed, representing ~24% of total submissions

- This was a 39.6% increase from the previous year, but still far below intake growth

- 1,337 STRs/SARs were postponed due to low risk, incomplete data, or insufficient suspicion

The report explicitly acknowledges capacity constraints and the need for automation and AI-assisted triage.

- Dissemination Reaches Record Highs

FIU-Nepal disseminated 945 intelligence reports to law enforcement and regulators — the highest annual figure to date.

After removing duplicates sent to multiple agencies:

- 908 unique STRs/SARs were disseminated

Five-year trend:

- 2020/21: 192

- 2021/22: 409

- 2022/23: 505

- 2023/24: 889

- 2024/25: 908

This near-five-fold increase since 2020 reflects growing operational maturity.

- Nepal Police Absorb the Bulk of Intelligence

Agency-wise dissemination shows a heavy investigative concentration:

- Nepal Police: 845 disseminations

- Inland Revenue Department: 30

- Department of Revenue Investigation: 17

- CIAA (anti-corruption): 6

- Nepal Insurance Authority: 2

This highlights Nepal Police as the primary downstream consumer of AML intelligence .

- Predicate Offences Shift Toward Fraud and Tax

STRs/SARs increasingly reflect economic crime rather than generic ML labels.

Top predicate offence categories in FY 2024/25 include:

- Money & banking offences

- Tax-related offences

- Fraud-related offences

- Firm/company misuse

- Corruption and bribery

Importantly, new categories appeared for the first time, including:

- Virtual currency-related STRs

- Hundi-related informal value transfer

- Undue transactions

- Trade-Based Money Laundering (TBML) Detection Improves

TBML-related STRs nearly doubled, rising from 22 to 43 year-on-year.

Although TBML is not a standalone predicate offence under Nepalese law, FIU-Nepal introduced dedicated reporting fields for A-class banks, resulting in:

- Better typology capture

- Granular sub-categories (over-/under-invoicing, fake documents, phantom shipments)

What the Numbers Ultimately Say

Nepal’s AML/CFT system in FY 2024/25 shows three simultaneous realities:

- Compliance and coverage expanded rapidly

- Digital infrastructure reached maturity

- Analytical depth remains the bottleneck

The numbers demonstrate progress — but also explain why FATF continues to demand effectiveness over volume.

For OSIN readers, the message is clear: Nepal is reporting more than ever — the next test is converting data into convictions.

Click here to read the full report.

Please read about our product: Dragnet Alpha

Click here to book a free demo

- #STR

- #CFT

- #HongKong

- #STR

- #FinancialCrime

- #MoneyLaundering

- #Nepal

- #FIU

- #Compliance

- #FinancialIntelligence