FIC Annual Report 2025: A Transformative Year for Namibia’s AML/CFT Regime and Progress on FATF Grey Listing

The Financial Intelligence Centre (FIC) Annual Report 2025 marks one of the most significant years in Namibia’s AML/CFT/CPF landscape. Covering the period 1 April 2024 to 31 March 2025, the report documents sweeping policy reforms, improved FATF technical compliance, increased supervisory actions, broad-based sector training, strengthened intelligence capabilities, and the FIC’s transition into a fully independent institution.

This period also represents Namibia’s first year on the FATF Grey List following increased monitoring measures imposed on 23 February 2024, which accelerated nationwide AML/CFT reforms and brought national focus to systemic strengthening.

The 2025 report stands as a detailed record of these changes and lays out an ambitious roadmap for Namibia’s exit from the Grey List before the May 2026 deadline.

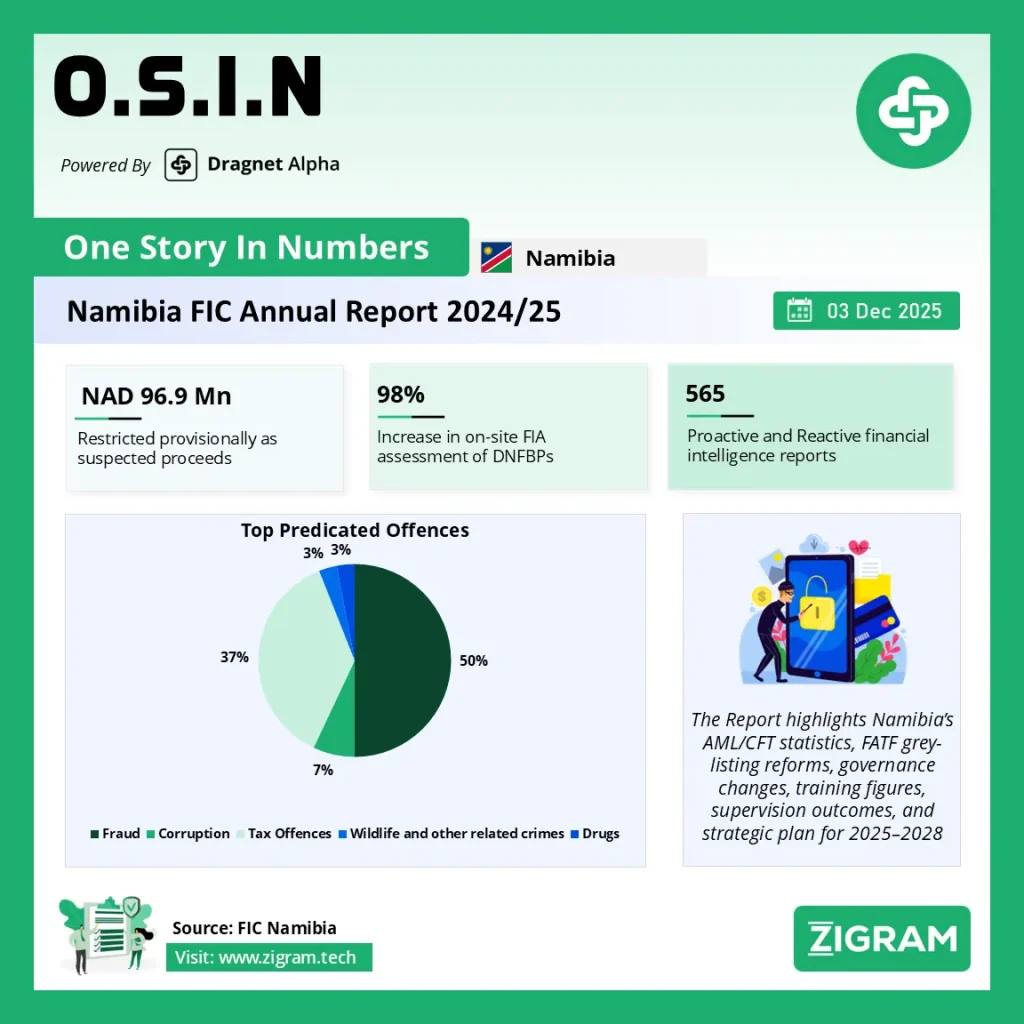

The Year at a Glance:

- 565 Proactive and Reactive Financial Intelligence Reports produced

- NAD 96.9 Mn Provisionally restricted as suspected proceeds of unlawful activities

- 148 criminal investigations conducted

- 98% increase in the number of on-site FIA compliance assessments of DNFBPs

- 729% increase in the number of off-site FIA compliance assessments of DNFBPs

- 297% increase in the number of trainings, awareness and outreach activities

- 852 Administrative actions taken

- 24 Administrative sanctions issued

- 3 Progress reports submitted to FATF Africa Joint Group

Grey-Listing: A Catalyst for National AML/CFT Transformation

Namibia’s grey-listing triggered a nationwide response across regulators, law enforcement, financial institutions, DNFBPs, and supervisory bodies. The FATF action plan required the country to address 13 strategic deficiencies, including beneficial ownership transparency, risk-based supervision, sanctions implementation, and financial intelligence utilisation.

By March 2025, the country had already addressed 25% of these action items, showing strong early momentum toward full compliance.

Upgrades on FATF Technical Recommendations

Namibia achieved successful re-rating from ESAAMLG across two successive review cycles (October 2024 and March 2025). In total:

- 16 FATF Recommendations were upgraded

- Including major improvements in:

- R.1 (Risk Assessment)

- R.10 (CDD)

- R.24 & R.25 (Beneficial Ownership)

- R.26 & R.28 (Supervision)

- R.35 (Sanctions), among others

These improvements reflect modernised laws, enhanced supervisory programs, and better alignment with FATF requirements.

Operational Intelligence & AML Enforcement: Strong Outputs and Expanding Capabilities

The period saw significant growth across the FIC’s intelligence, analysis, and enforcement functions.

Even though STR/SAR figures were not published in this edition, the FIC reported measurable outcomes across supervision, compliance reviews, cross-agency intelligence, and enforcement.

Surge in Supervisory and Compliance Actions

One of the strongest statistical indicators of AML/CFT strengthening came from compliance supervision:

- 981 cautions issued

- Highest number ever recorded by the FIC

- Demonstrates intensifying oversight and improved detection of compliance deficiencies

Where Compliance Risks Were Concentrated

Across all supervisory actions:

- 69.20% came from the banking sector

- 16.92% from DNFBPs

- 5.40% from law enforcement-linked entities

- Remaining share distributed across insurance brokers, forex bureaus, accountants, real estate, and others

Implementation Outcomes

Out of 1,633 required implementation points, the FIC reported:

- 42% completion rate across all sectors

This demonstrates a moderate but improving level of implementation by reporting entities and supervisory bodies.

Capacity Building: A Record Year for AML/CFT Training

Training and capability development across Namibia’s AML community reached unprecedented scale during the year.

Training Statistics for 2024–2025

- 2,459 individuals trained

- 210 institutions participated

- 18 training sessions conducted

- Training covered banks, insurers, real estate, DNFBPs, regulators, law enforcement, legal practitioners, and state-owned enterprises.

The training drive was aligned with FATF Action Plan requirements and contributed to improved understanding of ML/TF/PF risks, regulatory duties, STR/SAR reporting obligations, and targeted financial sanctions.

Institutional Reform: FIC Becomes Fully Independent

A defining highlight of the period was the formal legal separation of the FIC from the Bank of Namibia, transforming it into an independent entity with its own governance board.

Strategic Plan 2025–2028 Launched

On 25 March 2025, the FIC unveiled its first independent strategic plan built on four pillars:

- Organisational Development & Management

- Combating ML/TF/PF

- Automation & Digitisation

- Stakeholder Relations

Supported by seven strategic goals—strengthening leadership, enforcing ML/TF/PF laws, elevating digital capabilities, enhancing stakeholder engagement, and improving institutional efficiency.

Human Capital & AML Workforce Development

The FIC continued strengthening its internal AML workforce with targeted recruitment and training.

Workforce Statistics

- 43 of 66 positions filled (34.85% vacancy rate)

- 169 staff training activities conducted

- Workforce demographics:

- 51% male, 49% female

- Average age: 40 years

- Average tenure: 7 years, indicating strong institutional retention

The skill-building breakdown reveals:

- 36% soft skills

- 30% technical AML/CFT skills

- 17% digital transformation skills

- 17% leadership and management skills

This mix demonstrates a balanced strategy across operational and strategic AML capabilities.

Stakeholder Engagement: Deepening National & International Cooperation

The FIC expanded AML/CFT awareness, reporting compliance, and inter-agency coordination nationwide.

Domestic Engagements

Key highlights include:

- FATF Africa Joint Group visit

- Special Wildlife Court opening in Otjiwarongo

- Continuous engagements with banks, DNFBPs, LEAs, and regulators

- Awareness programs across multiple regions

Regional & International Cooperation

The report documents engagements with:

- ESAAMLG (including technical submissions & re-rating cycles)

- EU Global Facility

- UNODC

- IMF

- Egmont Group, where Namibia’s FIU Director was elected Regional Representative

These collaborations provided essential technical expertise to Namibia’s grey-listing remediation efforts.

Financial Performance 2024–2025

The FIC strengthened its financial footing, enabling greater operational and strategic capacity.

Key Financial Highlights

- N$65.5 million in operating expenses

- Increase of N$16.4 million from the previous year

- Reflects higher workload due to grey-listing reforms

- N$19.1 million surplus, nearly double the prior year

- N$59.2 million total assets, up N$11 million

- N$4.0 million investments, up from N$3.7M

This growth ensures sustained investment in digital systems, analytics, training, compliance supervision, and enforcement.

Grey-Listing Journey: Namibia’s Timeline Toward Compliance

The report lays out a clear timeline showing continuous progress:

- Sept 2022: MER finalised

- Oct 2022–Nov 2023: Post-observation period

- Feb 2024: Grey-listed

- July 2024: Voluntary progress report submitted

- Nov 2024: Mandatory FATF Joint Group report

- Oct 2024 & Mar 2025: ESAAMLG re-rating rounds

- May 2026: Target exit date & action plan deadline

The combination of strengthened supervision, enhanced intelligence, massive training efforts, and legislative reforms positions Namibia favourably for delisting.

Conclusion: A Strong and Statistically Evident AML/CFT Transformation

The FIC Annual Report 2025 is not just a narrative of institutional reform—it is a data-backed story of measurable AML/CFT progress. From 981 supervisory cautions, to 2,459 trained professionals, to 16 upgraded FATF Recommendations, the numbers demonstrate tangible improvement across the ecosystem.

Namibia’s intensified reforms, boosted compliance actions, structured national coordination, and strengthened intelligence capabilities place it firmly on a credible path toward exiting the FATF Grey List ahead of the May 2026 deadline.

The statistics make one thing clear: Namibia is entering a new era of financial integrity, transparency, and AML/CFT resilience.

Click here to read the full report.

Please read about our product: Dragnet Alpha

Click here to book a free demo

- #FICAnnualReport2025

- #NamibiaAML

- #AMLCFT

- #FinancialCrime

- #FATFGreyList

- #FATFCompliance

- #AMLReforms

- #FinancialIntegrity

- #RiskCompliance

- #AntiMoneyLaundering

- #TerroristFinancing