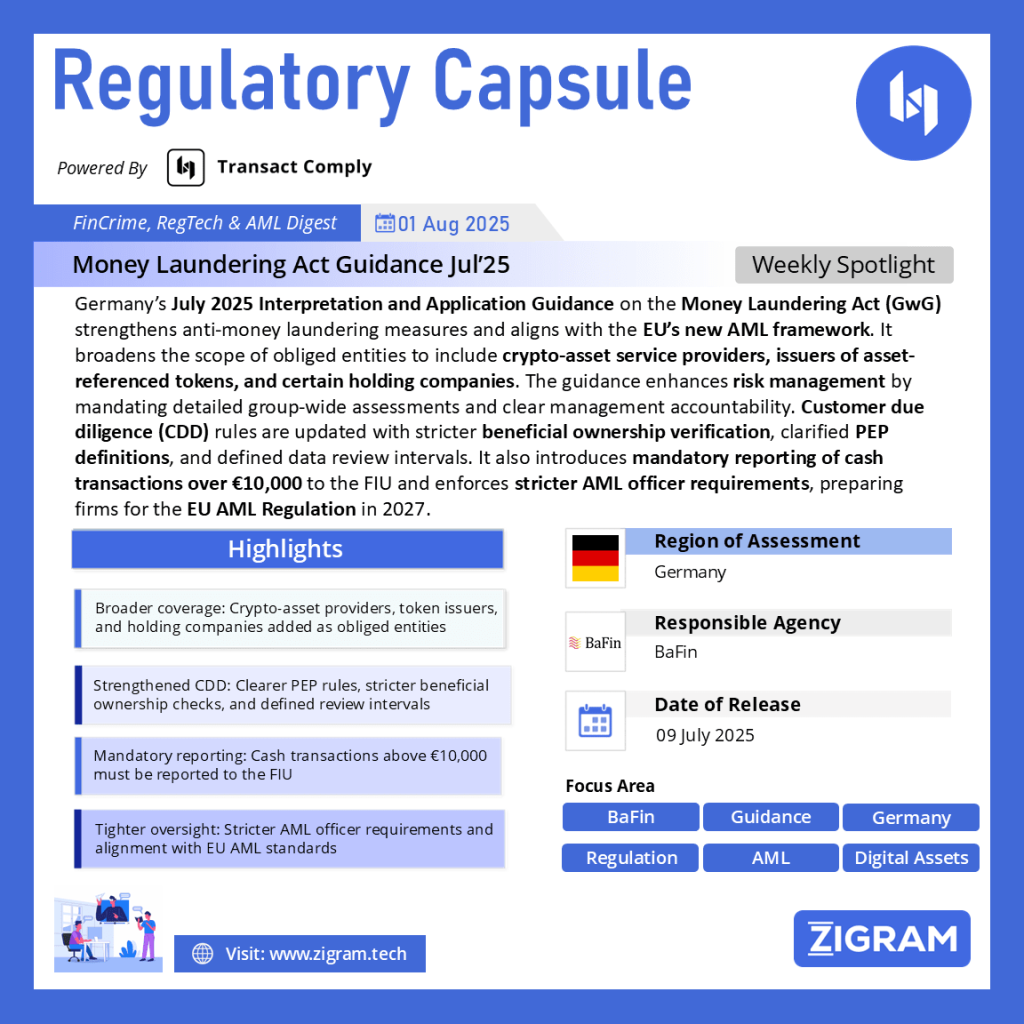

Regulation Name: July 2025 Interpretation and Application Guidance

Date Of Release: 09 July 2025

Region: Germany

Agency: BaFin

Germany’s July 2025 Guidance on the Money Laundering Act: Key Changes and Implications

In July 2025, Germany’s Federal Financial Supervisory Authority (BaFin) released an updated Interpretation and Application Guidance on the German Money Laundering Act (Geldwäschegesetz – GwG). This comprehensive guidance is a crucial step toward aligning Germany’s anti-money laundering (AML) framework with the European Union’s new AML legislative package while enhancing the country’s risk-based approach to financial crime prevention.

Context: Strengthening EU-Wide AML Framework

The latest guidance reflects Germany’s adaptation to the EU AML package – a set of four major legislative acts aimed at harmonizing AML/CFT standards across member states. These include:

- Regulation (EU) 2024/1620 – establishing the EU Anti-Money Laundering Authority (AMLA), effective 1 July 2025.

- Regulation (EU) 2024/1624 – the EU Anti-Money Laundering Regulation, directly applicable to German obliged entities from 10 July 2027.

- Regulation (EU) 2023/1113 – revised Transfer of Funds Regulation (TFR), focusing on crypto-asset traceability (applicable from 30 December 2024).

- Directive (EU) 2024/1640 – AMLD VI, to be transposed into German law by 10 July 2027.

Key Updates in the July 2025 Guidance

- Expanded Scope of Obliged Entities

The guidance clarifies that crypto-asset service providers (as per MiCAR), issuers of asset-referenced tokens, financial holding companies, and certain investment holding companies are now explicitly covered under the GwG.

- Enhanced Risk Management Requirements

BaFin underscores the risk-based approach, requiring entities to:

- Conduct comprehensive risk analyses covering all business activities.

- Document management-level accountability for AML systems.

- Implement group-wide procedures for multinational entities (Section 9 GwG).

- Politically Exposed Persons (PEPs) and Beneficial Ownership

- PEP definitions are now more detailed, aligning with EU standards.

- Beneficial ownership verification has been strengthened, especially for indirect holdings and cases where beneficial owners cannot be identified.

- Customer Due Diligence (CDD) Updates

- Data updating obligations:

- Standard-risk customers: at least once every five years.

- High-risk (enhanced due diligence): at least annually.

- Simplified due diligence: flexible, risk-based intervals.

- Crypto-asset providers must use blockchain analytics tools for transaction monitoring.

- Obliged entities must report cash transactions or deposits above €10,000 to the Financial Intelligence Unit (FIU).

- AML Officer Requirements

The updated guidance sets stricter expectations for Anti-Money Laundering Officers (AML officers):

- They must have sufficient German language proficiency to communicate with authorities.

- Their qualifications and reliability are subject to BaFin review, with the authority to revoke appointments if standards are not met.

- Adequate resources must be provided for their role, and outsourcing AML officer functions requires clear oversight structures.

- Alignment with EBA Guidelines

BaFin reaffirms its commitment to adopting European Banking Authority (EBA) guidelines under the “comply or explain” framework. Obliged entities must follow these guidelines unless explicitly stated otherwise.

Practical Implications for Financial Institutions

- Increased compliance complexity: Firms must prepare for EU-wide technical standards that AMLA will develop in the coming years.

- Heightened oversight for crypto providers: With new TFR obligations and blockchain analytics requirements, crypto firms face more stringent controls.

- Revised internal controls: Risk analysis, CDD updates, and AML officer requirements will require policy revisions and resource allocation.

- Cash transaction monitoring: The €10,000 reporting threshold reinforces the push toward greater transparency in high-value transactions.

Looking Ahead

The guidance applies from 1 February 2025 and is a precursor to the direct application of the EU AML Regulation in 2027. BaFin advises all obliged entities to anticipate changes and adapt internal processes early, ensuring a smooth transition to the future EU AML framework.

Read the full act here.

Read about the product: Transact Comply

Empower your organization with ZIGRAM’s integrated RegTech solutions – Book a Demo

- #FinancialTechnologyProtectionAct2025

- #DigitalAssets

- #AMLCFT

- #Crypto