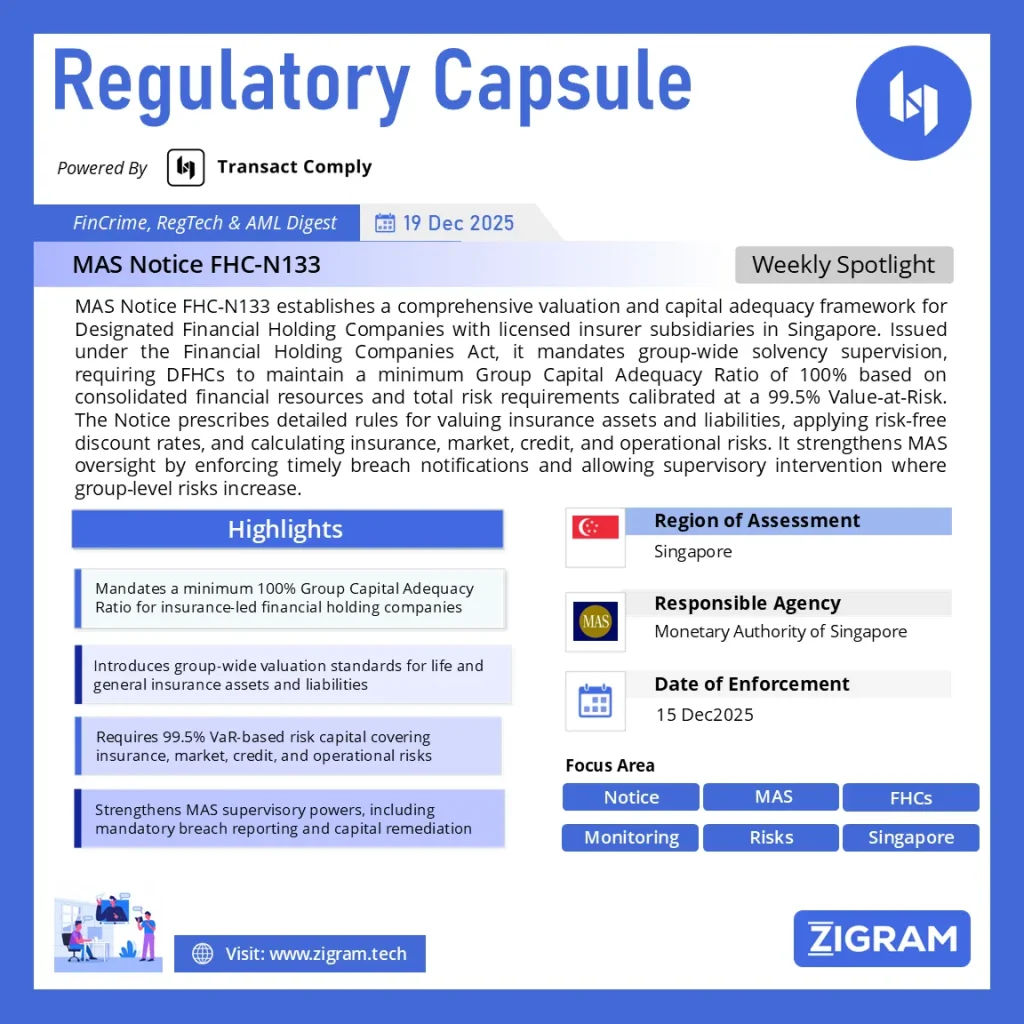

Regulation Name: MAS Notice FHC-N133

Date Of Issue: 15 Dec 2025

Region: Singapore

Agency: Monetary Authority of Singapore

MAS Notice FHC-N133 Explained: Valuation and Capital Framework for Designated Financial Holding Companies (Licensed Insurers)

The Monetary Authority of Singapore (MAS) continues to strengthen group-wide supervision of insurance-led financial conglomerates through MAS Notice FHC-N133, which sets out a comprehensive valuation and capital adequacy framework for Designated Financial Holding Companies (DFHCs) with licensed insurer subsidiaries. Originally effective from 1 January 2024 and last revised on 8 December 2025, this Notice establishes how insurance-led FHC groups must value assets and liabilities, calculate group capital, and assess consolidated risk exposure.

MAS Notice FHC-N133 is issued under Section 36(1) of the Financial Holding Companies Act 2013, reinforcing MAS’s shift towards risk-based, group-wide solvency supervision. The framework mirrors global regulatory expectations such as IAIS Insurance Core Principles while maintaining Singapore-specific prudential controls.

This article explains what MAS Notice FHC-N133 covers, who it applies to, and what DFHCs must do to remain compliant.

What Is MAS Notice FHC-N133?

MAS Notice FHC-N133 prescribes mandatory requirements and supervisory guidelines governing:

- Capital adequacy at the FHC group level

- Valuation of insurance assets and liabilities

- Calculation of Group Total Risk Requirement (TRR)

- Determination of Group Financial Resources (FR)

- Treatment of life and general insurance businesses, including foreign insurance entities (FIEs)

The Notice applies to all DFHCs that have at least one licensed insurer incorporated or operating in Singapore. Deviations from the guidelines may not constitute an offence by themselves, but MAS may impose additional supervisory or capital requirements where increased risk is identified.

Capital Adequacy Under MAS FHC-N133

Group Capital Adequacy Ratio (Group CAR)

A DFHC must maintain a Group Capital Adequacy Ratio (CAR) of at least 100% at all times. The Group CAR is calculated as:

Group CAR = Group Financial Resources ÷ Group Total Risk Requirement

Key regulatory expectations include:

- Group Financial Resources must not fall below SGD 5 million

- Group TRR is calibrated at a 99.5% Value-at-Risk (VaR) over a one-year horizon

- Consolidated financial statements must be used, with insurance assets and liabilities re-valued according to this Notice

MAS also permits the Aggregation Method for Group CAR calculations, subject to prior written approval.

Supervisory Intervention and Notification Obligations

If a DFHC breaches or is likely to breach its capital adequacy requirement, it must immediately notify MAS in writing. MAS may then:

- Require a capital restoration plan

- Impose higher capital requirements

- Mandate more frequent financial reporting

- Direct how the DFHC conducts its business during remediation

Notably, DFHCs are not exempt from notification on self-incrimination grounds, reinforcing MAS’s strict supervisory posture.

Valuation of Assets and Liabilities

Life and General Insurance Businesses

MAS Notice FHC-N133 establishes detailed valuation standards that align with MAS Notice 133 and the Insurance (Valuation and Capital) Regulations 2004, while extending them to foreign insurance entities within the FHC group.

Key principles include:

- Assets and liabilities must be recognised under Accounting Standards

- Valuation must follow sound actuarial principles

- Policy liabilities for:

- Life business are governed by Appendices 3A-1 to 3A-3

- General business are governed by Appendices 3B-1 to 3B-3

MAS retains discretion to specify valuation methodologies where necessary.

Discount Rates, Matching Adjustment, and Illiquidity Premium

Risk-Free Discount Rate

DFHCs must use the MAS-prescribed risk-free discount rate, determined under Appendix 3C, when valuing:

- Non-participating life policies

- Guaranteed benefits under universal life policies

- Minimum condition liabilities

Matching Adjustment (MA) and Illiquidity Premium (IP)

- Singapore-licensed insurers may apply MA or IP in accordance with MAS Notice 133

- For Foreign Insurance Entities, prior MAS approval is required

- MA and IP cannot be applied simultaneously

- Applicability depends on product type, currency, and business characteristics

These requirements ensure consistent valuation discipline across jurisdictions within the FHC group.

Group Total Risk Requirement (TRR)

The Group TRR aggregates all material risks across the FHC group and comprises:

Component 1 (C1): Insurance Risk

- Mortality

- Longevity

- Morbidity

- Lapse risk

- Catastrophe risk

- Expense risk

Component 2 (C2): Asset Risk

- Market risk

- Credit risk

- Interest rate mismatch

- Currency mismatch

Operational Risk Requirement (ORR)

Risks from Non-Insurance Entities

MAS requires DFHCs to calculate risks at both:

- Non-diversifiable portfolio level

- Group-wide consolidated level

Diversification benefits are permitted only within defined boundaries, particularly for participating funds and matching adjustment portfolios.

Homogeneous Risk Groups (HRGs) and Actuarial Governance

For life insurance risks, DFHCs may group policies into Homogeneous Risk Groups (HRGs) to calculate capital requirements more efficiently, provided:

- Policies have similar risk characteristics

- Grouping is stable and reviewed at least annually

- No cross-entity or cross-portfolio grouping is permitted

This reflects MAS’s emphasis on robust actuarial governance and model discipline.

Who Does MAS Notice FHC-N133 Apply To?

MAS Notice FHC-N133 is particularly relevant for:

- Designated Financial Holding Companies with insurance subsidiaries

- Life and general insurers within Singapore-regulated groups

- Foreign insurance entities consolidated into Singapore FHCs

- Group CROs, CFOs, actuaries, and compliance leaders

- Boards responsible for group-wide solvency oversight

Why MAS FHC-N133 Matters for Insurer-Led Groups

MAS Notice FHC-N133 represents a material elevation of group-wide insurance supervision in Singapore. It closes regulatory gaps between solo-entity insurance rules and conglomerate supervision, ensuring that capital strength is assessed holistically across jurisdictions and business lines.

For DFHCs, compliance is no longer just a technical actuarial exercise—it requires integrated data, real-time risk visibility, and consistent valuation controls across the group.

Final Thoughts

MAS Notice FHC-N133 sets a high bar for capital adequacy, valuation integrity, and risk governance across insurance-led financial holding companies. As MAS continues to align Singapore with international best practices, DFHCs that invest early in robust compliance systems, actuarial automation, and group-wide risk analytics will be best positioned to meet both regulatory expectations and strategic growth objectives.

Read about the full notice here.

Read about the product: Transact Comply

Empower your organization with ZIGRAM’s integrated RegTech solutions – Book a Demo

- #MAS

- #FHCN133

- #InsuranceRegulation

- #CapitalAdequacy

- #GroupSolvency

- #RiskBasedSupervision

- #InsuranceCompliance

- #FinancialHoldingCompanies

- #ActuarialGovernance

- #SingaporeRegulation