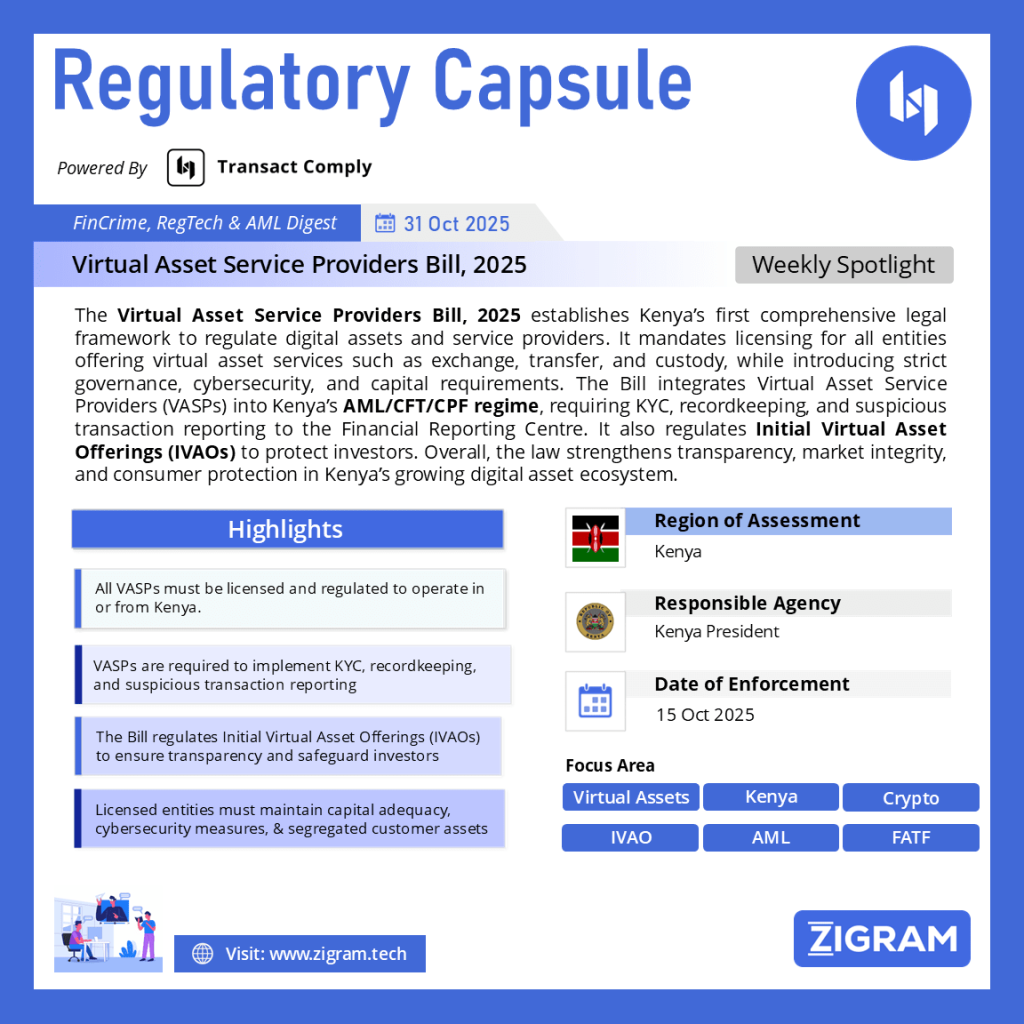

Regulation Name: Virtual Asset Service Providers Bill, 2025

Date Of Release: 15 Oct 2025

Region: Kenya

Agency: Kenyan Government

Kenya Virtual Asset Service Providers Bill 2025: Regulation, Licensing, and AML Compliance

Kenya has entered a defining phase in its digital finance journey with the introduction of the Virtual Asset Service Providers Bill, 2025. This legislation provides a comprehensive regulatory framework for the fast-growing world of virtual assets and cryptocurrency services in Kenya. By aligning with global standards and the Financial Action Task Force (FATF) recommendations, the Bill sets out to balance innovation with accountability—ensuring transparency, investor protection, and effective oversight of Virtual Asset Service Providers (VASPs).

Objectives and Scope of the Bill

The primary objective of the Bill is to regulate virtual asset activities and promote integrity and stability within Kenya’s digital asset ecosystem. It aims to:

– Establish clear licensing, registration, and supervision standards for Virtual Asset Service Providers.

– Prevent misuse of virtual assets for illicit activities, including money laundering and terrorist financing.

– Foster trust, consumer protection, and market transparency in Kenya’s fintech sector.

The Bill applies to all persons or entities providing virtual asset services in or from Kenya, covering activities such as exchange, transfer, safekeeping, and participation in the issuance or sale of virtual assets.

Defining Virtual Assets and Service Providers

The Bill defines a virtual asset as a “digital representation of value that can be digitally traded or transferred and used for payment or investment purposes.” It explicitly excludes fiat currency or digital versions of fiat issued by the Central Bank of Kenya.

A Virtual Asset Service Provider (VASP) includes any person or company engaged in:

– Exchange between virtual assets and fiat currencies;

– Exchange between different virtual assets;

– Transfer or safekeeping of virtual assets;

– Participation in or facilitation of virtual asset issuance.

This broad definition ensures that the Bill captures all key players in the virtual asset economy, from exchanges to custodians.

Licensing and Registration Requirements

Under Part III, no one may operate as a Virtual Asset Service Provider without a valid licence.

Key licensing requirements include:

– Incorporation and registered office in Kenya.

– Compliance with “fit and proper” tests for key persons.

– Sufficient financial and operational capacity to meet obligations.

– Maintenance of a Register of Licensed VASPs, accessible to the public for transparency.

Operating without a licence constitutes an offence and attracts penalties, signalling Kenya’s firm stance against unregulated crypto operations.

Governance, Capital, and Consumer Protection

Licensed Virtual Asset Service Providers must meet high standards of corporate governance, transparency, and financial soundness.

The Bill mandates:

– Adequate capital and solvency levels;

– Segregation of customer and company assets;

– Implementation of strong cybersecurity controls;

– Annual external audits and financial disclosures;

– Notification of regulatory authorities before mergers or ownership changes.

These measures protect consumers, promote accountability, and reinforce Kenya’s commitment to responsible virtual asset regulation.

AML/CFT/CPF Compliance Framework

Part V of the Bill is particularly significant for AML professionals and regulators. It brings Virtual Asset Service Providers under Kenya’s Anti-Money Laundering and Counter-Terrorism Financing (AML/CFT) regime.

VASPs are required to:

– Conduct Know Your Customer (KYC) and due diligence on clients.

– Maintain detailed transaction and customer records.

– Report suspicious transactions to the Financial Reporting Centre (FRC).

– Establish internal compliance programs and risk management systems.

– Cooperate fully with regulatory and investigative authorities.

This integration ensures that Kenya’s virtual asset sector cannot be exploited for money laundering or terrorism financing, in line with global FATF Recommendation 15.

Regulation of Initial Virtual Asset Offerings (IVAOs)

The Bill also introduces oversight for Initial Virtual Asset Offerings (IVAOs)—digital fundraising mechanisms similar to ICOs.

Key provisions include:

– Mandatory approval for any virtual asset issuance.

– Requirement to publish a white paper with detailed disclosures on token purpose, governance, and risks.

– Oversight by the Capital Markets Authority (CMA) to protect investors and maintain market integrity.

This regulatory clarity curbs the risks of fraudulent token sales and encourages legitimate innovation within Kenya’s blockchain and fintech sectors.

Supervision, Enforcement, and Penalties

The regulator is granted extensive powers to supervise and enforce compliance. It can:

– Conduct inspections and audits of VASPs;

– Issue binding directives and compliance orders;

– Impose administrative penalties for violations;

– Suspend or revoke licences for non-compliance.

Operating an unlicensed virtual asset business or violating AML obligations may result in fines up to KES 5 million or imprisonment, establishing strong deterrence against misconduct.

Significance for Kenya’s Digital Economy

The Virtual Asset Service Providers Bill, 2025 positions Kenya as one of Africa’s leaders in responsible fintech innovation. It:

– Provides legal certainty for crypto and blockchain projects;

– Attracts foreign investment into regulated digital finance;

– Strengthens compliance with global financial standards;

– Enhances Kenya’s reputation as a secure hub for digital assets.

However, implementation success will depend on the issuance of detailed subsidiary regulations, inter-agency collaboration, and continuous stakeholder engagement.

Conclusion

The Virtual Asset Service Providers Bill, 2025 is a milestone for Kenya’s digital transformation. It bridges innovation with accountability—ensuring that the benefits of blockchain and crypto adoption are realised without compromising financial integrity.

For compliance professionals, fintech companies, and regulators, this Bill opens new pathways for collaboration and technology deployment. By bringing Virtual Asset Service Providers under a unified legal framework, Kenya demonstrates that digital finance can evolve responsibly — with innovation and regulation moving hand in hand.

Read about the law here.

Read about the product: Transact Comply

Empower your organization with ZIGRAM’s integrated RegTech solutions – Book a Demo

- #VirtualAsset

- #VASPBil2025

- #KenyaCryptoLaw

- #DigitalAssets

- #CryptoRegulation

- #FintechKenya

- #AMLCompliance

- #CFT

- #BlockchainRegulation

- #FinancialInnovation