Hong Kong AML/CFT in 2024, JFIU Annual Report: Inside the Year STRs Hit a Historic High

The 2024 Annual Report of the Joint Financial Intelligence Unit (JFIU) captures a watershed year for Hong Kong’s anti-money laundering and counter-terrorist financing (AML/CFT) regime. For the first time, Suspicious Transaction Reports (STRs) crossed the 140,000 mark, reflecting not just higher criminal activity, but a structural shift in how financial institutions, non-bank payment providers, and virtual-asset platforms detect and report financial crime.

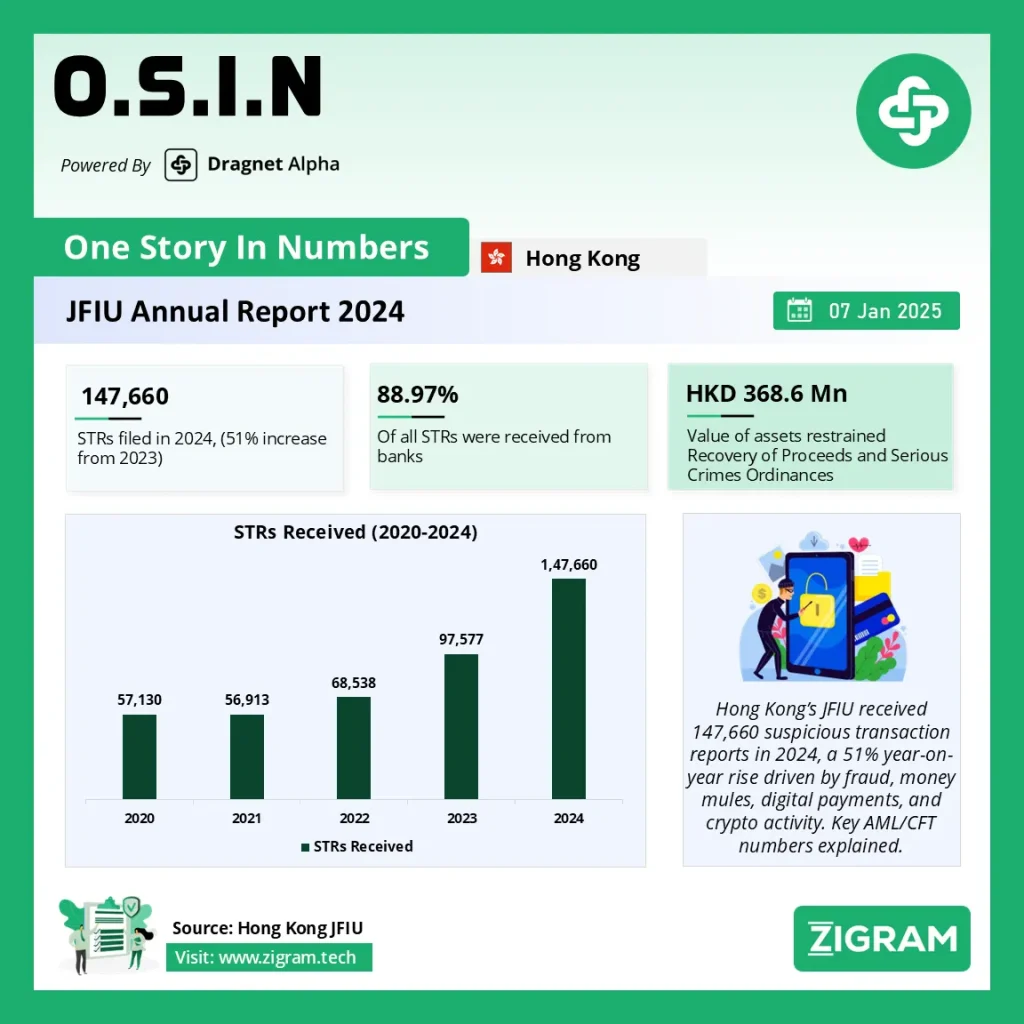

At 147,660 STRs, 2024 represents a 51.3% year-on-year increase compared to 97,577 STRs in 2023—an unprecedented surge by any historical measure . The report makes clear that this jump is inseparable from two parallel developments: a sharp rise in deception and fraud offences, and the widespread deployment of advanced analytics, automation, and artificial intelligence across Hong Kong’s financial system.

This OSIN long-read unpacks what those numbers really mean—how STRs are generated, processed, disseminated, and ultimately converted into arrests, prosecutions, and asset restraint.

STR Volumes: From Gradual Growth to Structural Surge

Between 2020 and 2022, Hong Kong’s STR volumes grew steadily but predictably, hovering between 56,000 and 68,000 reports per year. That trajectory changed dramatically in 2023 and accelerated again in 2024.

STRs received by JFIU

- 2020: 57,130

- 2021: 56,913

- 2022: 68,538

- 2023: 97,577

- 2024: 147,660

The JFIU explicitly links this spike to an “alarming surge in deception cases,” with fraud becoming the dominant predicate offence associated with money laundering investigations . In 2024 alone, 44,480 deception cases were reported in Hong Kong, accounting for over 46% of all recorded crime and around 90% of ML-related predicate offences.

Who Is Reporting? Sectoral Breakdown of STRs

Despite the expansion of Hong Kong’s AML perimeter, financial institutions continue to dominate STR reporting.

In 2024:

- Over 98.5% of STRs came from financial institutions

- Banks (including digital banks) accounted for 88.97% of all STRs

- Stored Value Facility (SVF) operators were the second-largest source, contributing around 5%

- Money Service Operators (MSOs) and securities firms formed smaller but consistent shares

One of the most striking changes, however, came from the virtual asset sector. STRs from Virtual Asset Trading Platforms (VATPs) jumped more than 19-fold, from 5 reports in 2023 to 95 in 2024. JFIU attributes this surge directly to the new licensing regime implemented by the Securities and Futures Commission (SFC), which brought VATPs fully within Hong Kong’s regulatory and reporting framework .

Keywords such as “virtual asset,” “crypto,” and “cryptocurrencies” appeared with increasing frequency in JFIU intelligence, signalling a shift in laundering typologies toward digital assets.

- From Filing to Intelligence: How STRs Are Processed

Volume alone does not determine effectiveness. The JFIU places heavy emphasis on risk-based triage and intelligence value.

In 2024:

- 90.17% of STRs were processed electronically, enabling large-scale analytics

- Only 9.83% required manual processing, continuing a multi-year downward trend

STRs are assessed based on:

- Degree of suspicion

- Severity and ML/TF risk

- Intelligence value and actionability

Following triage, prioritised STRs undergo holistic analysis to produce intelligence packages for downstream enforcement .

- Dissemination: Turning Reports into Enforcement Leads

Out of the 147,660 STRs received in 2024, JFIU disseminated 45,376 STRs to law-enforcement agencies—a 30.7% dissemination rate .

The majority went to:

- Hong Kong Police Force (HKPF): 42,728 STRs (94.2%)

- Customs and Excise Department (C&ED): 1,068 STRs (2.4%)

This intelligence directly supported investigations that neutralised multiple cross-boundary money-laundering syndicates operating across Hong Kong and neighbouring jurisdictions .

STREAMS: Demand for Financial Intelligence Explodes

JFIU’s STR ecosystem is powered by STREAMS (Suspicious Transaction Report and Management System), first launched in 2006.

Between 2020 and 2024:

- Direct searches on STREAMS rose from 214,730 to 334,661

- Annual record-check requests remained consistently high, between 2,500 and 5,000 per year

The surge in usage underscores how STR data has become operationally central to investigations, not merely a compliance artefact.

Enforcement Outcomes: Arrests, Prosecutions, Deterrence

The enforcement impact of this intelligence pipeline is visible.

In 2024:

- 8,607 persons were arrested for money laundering, up 44% from 5,977 in 2023

- 89.23% of those arrested were money mules (stooge account holders)

JFIU notes a concerted effort to pursue heavier sentences in mule-account cases. In the most serious instances, sentences increased by over 33%, strengthening deterrence against facilitating fraud and laundering networks .

Technology as an AML Force Multiplier

A recurring theme throughout the report is technology-enabled AML.

Key initiatives include:

- Development of the Financial Data Analytics Platform (FDAP)

- Planned rollout of STREAMS 2 between 2025 and 2027

- Use of AI, machine learning, and data mining to automate intelligence processing

These systems are designed to cope with sustained high STR volumes without compromising analytical quality.

- Public-Private Partnerships and FINEST

In 2024, 10 major banks participated in FINEST, Hong Kong’s bank-to-bank intelligence-sharing platform developed with the Hong Kong Monetary Authority .

FINEST enables:

- Early identification of mule accounts

- More targeted enhanced due diligence

- Faster disruption of fraud networks

Legislative amendments to the Banking Ordinance now provide legal backing for broader information sharing, reinforcing Hong Kong’s whole-of-society AML approach.

International Cooperation at Scale

Financial crime is inherently transnational, and JFIU’s international footprint remains extensive.

In 2024:

- 1,960 financial-intelligence exchanges were conducted globally

- Intelligence was exchanged with 95 Egmont Group FIUs and 5 non-Egmont counterparts

- Asia-Pacific FIUs accounted for the largest share of exchanges

JFIU also co-led a major FATF project on updating Money Laundering National Risk Assessment guidance, reinforcing Hong Kong’s influence in shaping global AML standards .

- What the Numbers Ultimately Say

The 2024 data tells a clear story:

- STR growth is no longer linear—it is systemic

- Fraud and mule-account abuse dominate the ML threat landscape

- Digital payments and virtual assets are reshaping reporting behaviour

- Enforcement agencies are converting intelligence into arrests at scale

Hong Kong’s AML/CFT regime in 2024 was not just busier—it was structurally transformed.

Click here to read the full report.

Please read about our product: Dragnet Alpha

Click here to book a free demo

- #AML

- #CFT

- #HongKong

- #STR

- #FinancialCrime

- #MoneyLaundering

- #Compliance

- #Enforcement

- #Payments

- #FinCrime