Jersey FIU Q3 2025: Reporting rebounds as VASPs enter the SAR system and fraud dominates suspicion

Introduction and context

Jersey’s Financial Intelligence Unit (FIU) published its Q3 2025 Suspicious Activity Reports (SARs) – Industry Feedback, offering a granular statistical snapshot of how suspicious activity is being detected, reported, and assessed across the island’s financial system. The quarterly dataset allows comparison across Q1–Q3 2025, alongside year-on-year context against Q3 2024, and provides insight into sectoral behaviour, predicate criminality, consent decisions, and geographic risk exposure.

At first glance, the headline figure is a sharp increase in SAR volumes. However, the underlying data shows that this rise is not merely cyclical. Instead, it reflects a structural broadening of reporting, driven by new sectors—most notably Virtual Asset Service Providers (VASPs)—combined with sustained fraud risk and increasingly assertive gatekeeping by reporting entities.

The numerical turning point: SAR volumes rebound

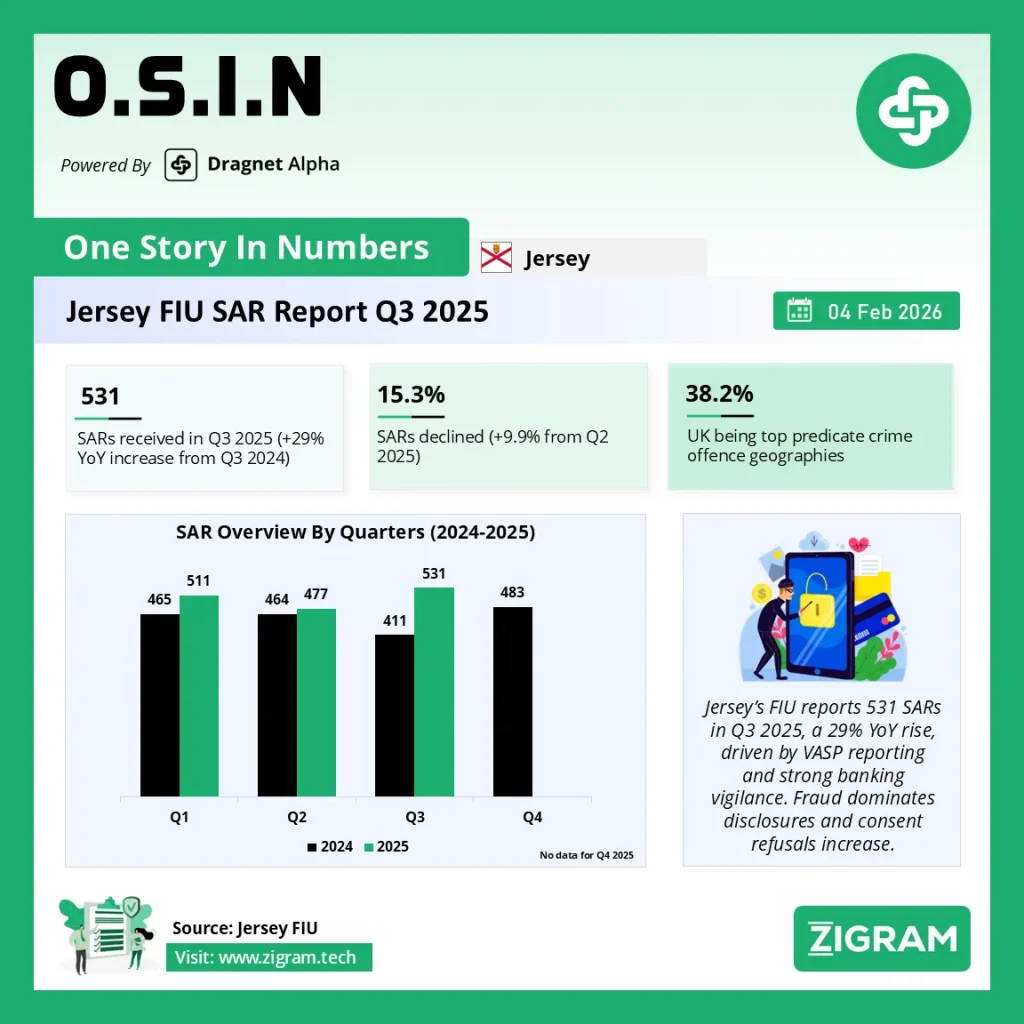

In Q3 2025, the Jersey FIU received 531 SARs, representing a 29% increase compared to Q3 2024. The FIU notes that Q3 2024 reporting levels were unusually low, meaning the year-on-year growth partly reflects a statistical correction. Even so, Q3 2025 volumes exceeded both Q1 and Q2 2025, confirming that the increase cannot be attributed solely to base effects.

Monthly data shows uneven reporting across the quarter, with a noticeable dip in August 2025. The FIU attributes this plausibly to reduced business activity or resourcing constraints rather than a decline in suspicious behaviour. The key signal is that overall reporting momentum strengthened across the quarter, not weakened.

Almost all SARs in Q3 2025—529 out of 531—were filed under the Proceeds of Crime (Jersey) Law 1999, with only two reports linked to the Terrorism (Jersey) Law 2002. This confirms that money laundering and associated predicate offences remain the dominant risk driver, rather than terrorism-related activity.

Earlier intervention: business declined SARs rise

One of the most revealing shifts in Q3 2025 is the rise in business declined SARs. Of the 531 SARs submitted, 81 reports (15.3%) indicated that the underlying business relationship had been declined. This represents a significant increase from 9.9% in Q2 2025.

This trend is important. Declined business SARs typically reflect risk detection at onboarding or early engagement, rather than post-transaction monitoring. The data suggests that Jersey firms are increasingly willing to deny access to the financial system rather than manage high-risk relationships.

Fraud and false accounting were the most frequently cited grounds for disclosure in declined business cases, followed by deficiencies uncovered during due diligence and adverse media findings. From a system-effectiveness perspective, this points to stronger front-end controls, which reduce the likelihood that illicit funds are ever fully integrated into the financial system.

Who is reporting: sectoral concentration and new entrants

The banking sector remained the backbone of Jersey’s SAR regime in Q3 2025, accounting for 61.2% of all SARs. This is broadly consistent with previous quarters and reflects banks’ central role in transaction monitoring and payment flows.

However, two structural shifts stand out.

First, Trust and Corporate Service Providers (TCSPs) accounted for 20.1% of SARs, reinforcing their importance as a risk-sensitive sector given their role in structuring ownership, control, and cross-border arrangements.

Second—and most notably—the VASP sector emerged meaningfully for the first time, contributing 4.6% of all SARs in Q3 2025. In earlier quarters of 2025, VASP reporting was negligible. The FIU explicitly links the Q3 increase in overall SAR volumes to the expansion of the VASP sector in Jersey.

This is a pivotal data point. It indicates that virtual asset activity is no longer peripheral to Jersey’s AML framework and that crypto-related entities are now actively integrated into the SAR ecosystem, with corresponding supervisory and enforcement implications.

Consent Requests: rising refusal rates

Alongside SAR volumes, the report provides detailed data on consent requests, requests by reporting entities seeking FIU permission to proceed with a transaction, act, or exit a relationship.

In Q3 2025, the FIU received 639 consent requests. Of these:

- 75.6% were granted

- 19.8% were refused

- The remainder were withdrawn or deemed not to be consent matters

The refusal rate increased compared to earlier quarters in 2025. The FIU notes that refusals are often linked to insufficient information provided by submitters, rather than an absence of suspicion. This highlights a key operational message: quality and completeness of submissions directly affect transaction outcomes.

From an OSIN perspective, rising refusal rates point to more assertive use of FIU intervention powers, particularly in fraud-linked and high-risk cases.

What crimes are suspected: fraud dominates, ambiguity persists

When reporting entities were required to select a predicate offence, fraud emerged as the dominant category, cited in 40.9% of SARs in Q3 2025. Tax crimes followed at 11.5%, while corruption, narcotics trafficking, and other offences appeared at much lower levels.

However, “Other – undetermined” remained strikingly high at 38.1%. This category reflects cases where entities could not confidently identify a single predicate offence at the point of reporting. The FIU acknowledges this challenge and shows, through comparative analysis, that its own post-submission assessment often reallocates these cases into clearer categories such as fraud, tax crime, or corruption.

The persistence of high “undetermined” rates signals genuine complexity, rather than weak compliance. Modern financial crime often spans multiple offence types, particularly in cases involving layered transactions, professional intermediaries, or cross-border structures.

Geography of risk: Jersey’s external exposure

The report’s geographic analysis highlights the United Kingdom as the most frequently cited country of predicate criminality, accounting for 38.2% of SARs in Q3 2025. Jersey itself followed at 22.6%, reflecting domestic investigations and proximity effects.

Beyond this, Hong Kong (9.3%), the United States (7.7%), and the United Arab Emirates (6.3%) featured prominently, underscoring Jersey’s exposure to global financial flows and international risk vectors. Smaller but notable volumes linked to India, China, South Africa, and Egypt reinforce the jurisdiction’s role as an international financial centre rather than a purely domestic market.

What the numbers ultimately tell us

Taken together, the Q3 2025 data tells a coherent story:

- Reporting volumes are rising, not because risk has suddenly increased, but because the reporting perimeter is expanding.

- VASPs are now firmly inside the SAR regime, marking a structural shift in Jersey’s AML landscape.

- Fraud remains the single most important driver of suspicious activity across sectors.

- Earlier intervention is strengthening, as shown by rising declined-business SARs and consent refusals.

- Complexity, not complacency, explains the persistence of undetermined predicate offences.

Regulatory and compliance implications

For regulators and supervisors, the data supports continued focus on non-bank sectors, particularly TCSPs and VASPs, where structural risk and growth coincide.

For banks and financial institutions, the message is clear: front-loaded due diligence and decisive exits are increasingly expected, not exceptional.

For VASPs, Q3 2025 marks the end of the “observational phase.” Entry into meaningful SAR volumes means heightened scrutiny, higher expectations, and faster escalation when controls fail.

10 Statistics That Matter

- 531 SARs filed in Q3 2025, a 29% YoY increase versus Q3 2024 (noted by the FIU as a low base).

- Q3 volumes exceeded Q1 and Q2 2025, confirming a mid-year upswing in reporting activity.

- 99.6% of SARs were ML-related: 529 under the Proceeds of Crime (Jersey) Law and 2 under the Terrorism Law.

- 81 SARs (15.3%) involved business declined, up from 9.9% in Q2, highlighting stronger gatekeeping at onboarding.

- Banking accounted for 61.2% of SARs, remaining the largest reporting sector.

- Trust & Corporate Service Providers (TCSPs) rose to 20.1%, indicating elevated structure-related risk signals.

- VASPs contributed 4.6% of SARs in Q3, up from near-zero earlier in 2025—the fastest-growing sectoral shift.

- 639 consent requests were received; 19.8% were refused, an increase on prior quarters.

- Fraud was cited in 40.9% of SARs (entity-selected), with “Other—undetermined” still high at 38.1%, reflecting complexity at point of reporting.

- Top predicate-crime geographies: UK (38.2%), Jersey (22.6%), followed by Hong Kong (9.3%) and USA (7.7%).

Regulatory & Compliance Implications

For regulators / FIUs

- Expect continued supervisory focus on VASPs and TCSPs, where reporting growth and structural risks intersect.

- Higher consent refusals underscore the need for richer pre-submission information.

For banks and reporting entities

- Onboarding controls matter: The data rewards early declines where risk signals are present.

- Improve predicate clarity in SAR narratives to reduce “undetermined” selections.

For VASPs

- Entry into the SAR ecosystem brings heightened scrutiny; controls, documentation, and transaction context will be tested quickly.

Click here to read the full report.

Please read about our product: Dragnet Alpha

Click here to book a free demo

- #OSIN

- #Jersey

- #FIU

- #AML

- #CFT

- #SARs

- #VASP

- #FinancialCrime

- #Compliance