ICAEW AML Supervision Report 2024/25: Raising the Bar for Compliance in the UK Accounting Sector

The Institute of Chartered Accountants in England and Wales (ICAEW) has released its Anti-Money Laundering (AML) Supervision Report 2024/25, which presents a detailed picture of how the accounting profession continues to confront financial crime risks. Supervising approximately 9,500 firms under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017 (MLR17), ICAEW remains the largest professional body supervisor in the UK. The latest report captures the organisation’s balance between enforcement and education, combining monitoring with guidance to promote improvement across the regulated sector.

ICAEW’s Role as an Improvement Regulator

ICAEW defines its mission as that of an “improvement regulator”—one that not only enforces compliance but helps firms elevate their standards. Its Professional Standards Department (PSD) and Regulatory Board (IRB) maintain independence and transparency, ensuring that regulatory work is not influenced by the Institute’s representative functions. Duncan Wiggetts, Chief Officer of Professional Standards, noted that ICAEW’s commitment to continuous improvement has never been clearer. He highlighted how the Institute has invested in proactive monitoring, thematic reviews, and targeted interventions, all aimed at strengthening public trust and resilience within the profession. Wiggetts also reiterated that the focus is not solely on enforcement but on enabling firms to improve through education, stakeholder engagement, and guidance.

Monitoring Results: Compliance Steady, Gaps Persistent

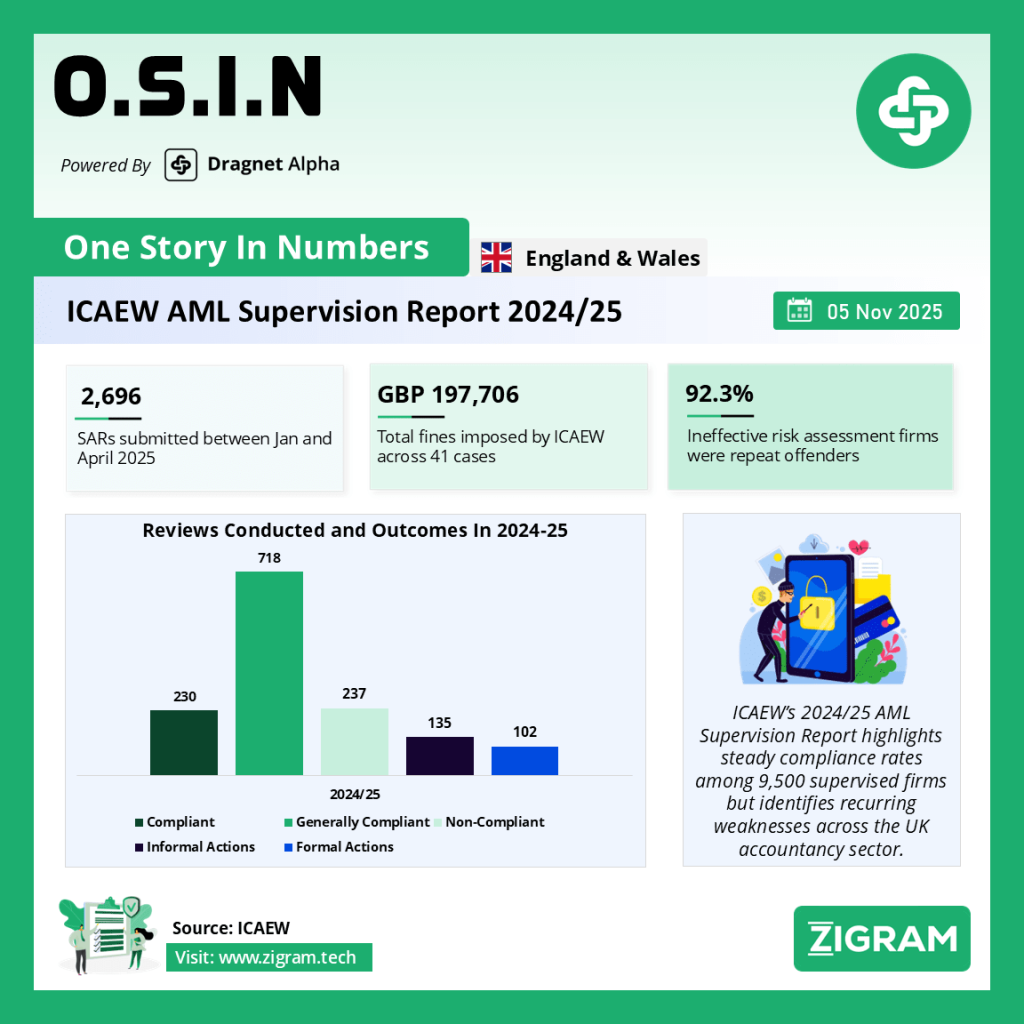

During FY24/25, ICAEW completed 1,185 monitoring reviews—an increase from 1,112 in the previous year. The report found that 80% of firms were compliant or generally compliant, demonstrating consistency in standards year-on-year. However, 20% of firms remained non-compliant, showing that challenges persist across the sector. Of the total reviews, 19.4% of firms were deemed fully compliant, 60.6% were generally compliant, and 20% were non-compliant. The most common failings related to customer due diligence (CDD), which continues to represent a critical vulnerability. ICAEW reviewers found weaknesses in client identification, risk documentation, verification procedures, and the ongoing monitoring of client relationships. Inadequate understanding of beneficial ownership, incomplete risk documentation, and failure to update due diligence over time were among the most frequent issues.

Additionally, 8.3% of firms did not have proper procedures for reporting discrepancies in the Persons of Significant Control (PSC) Register, while 5.3% failed to conduct regular compliance reviews. Firm-wide risk assessments were also lacking in 4.4% of firms. ICAEW noted that repeat deficiencies were particularly concerning, with 92.3% of firms showing ineffective risk assessments having exhibited the same weaknesses in previous reviews. This pattern, the report suggests, indicates the need for firms to take corrective action more seriously and embed long-term compliance habits.

Enforcement and Sanctions

ICAEW’s enforcement work in FY24/25 resulted in £197,706 in fines across 41 cases, with penalties ranging from £240 to £31,700. Three firms faced exclusion or cancellation, and unregistered businesses accounted for £50,731 of the total fines imposed. The Practice Assurance Committee (PAC) continues to play a key role in managing formal enforcement, while the Conduct Committee deals with more serious breaches of integrity or competence. One notable case involved two connected firms found to have serious AML weaknesses, including missing risk assessments and outdated staff training. The case led to fines of £31,700 and £10,400 respectively, illustrating ICAEW’s willingness to escalate enforcement where remediation is insufficient.

Root Causes: Why Firms Fail

ICAEW’s analysis of non-compliant firms revealed that smaller firms with less than £300,000 in income were underrepresented among those referred for formal follow-up, even though they make up 70% of the supervised population. Larger firms, especially those earning over £2 million, were disproportionately represented, accounting for 26% of non-compliant cases referred for formal action. The report attributes non-compliance to three key root causes: gaps in knowledge of AML regulations, inadequate understanding of risk, and complacency in long-standing client relationships. Many firms focus narrowly on identity verification while neglecting broader risk assessment and mitigation. ICAEW warns that this misplaced focus leaves firms vulnerable to exploitation by criminal networks.

Thematic and Forward-Looking Reviews

Looking ahead, ICAEW plans to intensify its focus on specific risk areas. In FY25/26, it will conduct a thematic review on suspicious activity reports (SARs) to assess the quality and evolution of reporting since 2020. This initiative aligns with findings from the Office for Professional Body Anti-Money Laundering Supervision (OPBAS) and the UK Financial Intelligence Unit (UKFIU). The Institute will also launch an awareness campaign on the growing risk of fraudulent confirmation statements and falsified accounts, issues highlighted in the National Risk Assessment (NRA) 2025. Furthermore, the revised ICAEW Code of Ethics, effective July 2025, will introduce new sections reinforcing the importance of professional scepticism and the obligation for accountants to maintain an inquiring mindset.

National Risk Assessment 2025: Emerging Threats

The NRA 2025 identifies the accountancy profession as a high-risk sector for money laundering, given the wide range of services offered—from payroll and bookkeeping to tax and audit—that can be misused by criminals. The report highlights that payroll services are sometimes exploited to disguise illegal payments, while tax advisory and trust and company services are used to conceal beneficial ownership or facilitate tax evasion. Certificates of confirmation issued by accountants have also been misused to lend legitimacy to fraudulent activities. Although the terrorist financing risk for most accountancy firms remains low, ICAEW notes that for trust and company service providers (TCSPs), this risk has risen from low to medium due to increased misuse of UK-based structures for transferring funds linked to terrorism.

Reporting and SAR Trends

Under its obligation to report AML breaches, ICAEW received 16 reports from supervised firms during FY24/25. The Institute continues to provide a confidential channel for whistleblowing through its Raise a Money Laundering Concern platform. Data collected since January 2025 indicates that ICAEW-supervised firms filed at least 2,696 suspicious activity reports (SARs), with most firms submitting between one and five reports annually. The upcoming thematic review on SARs will use this data to identify reporting trends and strengthen the sector’s responsiveness to suspicious transactions.

Conclusion

The ICAEW AML Supervision Report 2024/25 demonstrates steady compliance across the accounting sector but also exposes recurring weaknesses in customer due diligence, risk assessment, and long-term remediation. As regulatory expectations evolve, ICAEW’s supervisory strategy continues to balance accountability with education, fostering a culture of continuous improvement. By combining enhanced monitoring, thematic research, and stronger ethical standards, ICAEW aims to build a profession that is trusted, transparent, and resilient against the ever-changing landscape of financial crime.

Click here to read the full report.

Please read about our product: Dragnet Alpha

Click here to book a free demo

- #ICAEW

- #AMLSupervision

- #FinancialCrime

- #AntiMoneyLaundering

- #MLR17

- #Compliance

- #RiskManagement