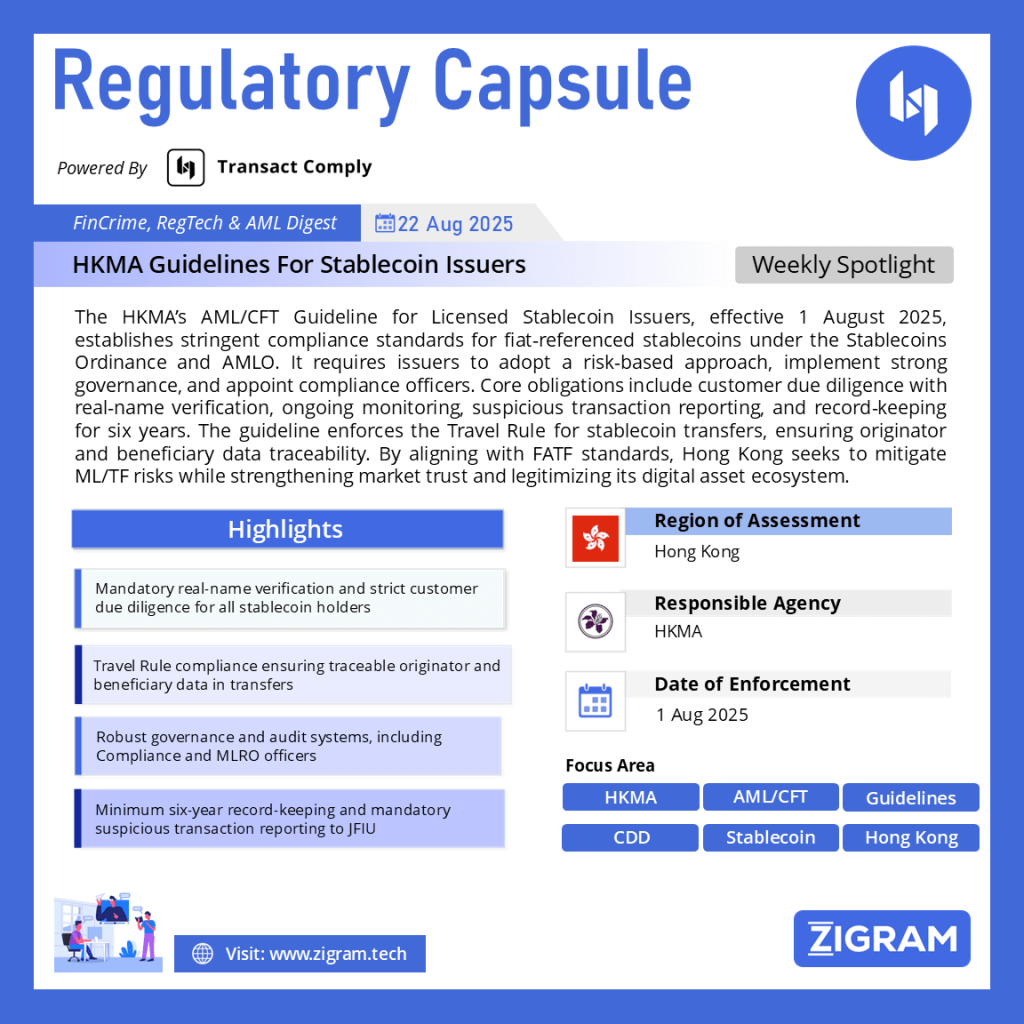

Regulation Name: Guideline on Anti-Money Laundering and Counter-Financing of Terrorism (For Licensed Stablecoin Issuers)

Date Of Effect: 1 Aug 2025

Region: Hong Kong

Agency: Hong Kong Monetary Authority

Hong Kong’s AML/CFT Guideline for Licensed Stablecoin Issuers: A New Era of Digital Asset Regulation

On 1 August 2025, Hong Kong took a historic step in its digital finance journey by enforcing a statutory guideline on anti-money laundering and counter-financing of terrorism (AML/CFT) for licensed stablecoin issuers. Published under the Stablecoins Ordinance and the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (AMLO), this guideline represents one of the most comprehensive regulatory frameworks globally. It is aimed at ensuring that stablecoin activities, particularly those involving fiat-referenced stablecoins (FRS), are conducted with robust safeguards against financial crime while supporting innovation in the digital asset sector.

The Hong Kong Monetary Authority (HKMA) has emphasized that the new guideline not only brings stablecoin issuers into the fold of financial regulation but also sets global benchmarks in applying AML/CFT standards to emerging financial technologies.

Risk-Based Approach to AML/CFT

At the core of the guideline is the principle of a risk-based approach. Licensed stablecoin issuers are required to conduct ongoing assessments of money laundering (ML) and terrorist financing (TF) risks associated with their business models. This includes examining customer types, geographical exposure, transaction flows, and product features. The HKMA expects issuers to allocate resources proportionately, focusing compliance efforts where risks are greatest.

Issuers must maintain internal documentation of their risk assessment processes and ensure senior management oversight. Furthermore, these assessments must be reviewed regularly to reflect evolving threats, especially given the global and borderless nature of stablecoin transactions.

Governance and Internal Controls

The guideline underscores the importance of strong governance. Stablecoin issuers must establish an independent compliance function, appoint a compliance officer, and designate a Money Laundering Reporting Officer (MLRO). These roles are central to ensuring accountability in implementing AML/CFT obligations.

Internal policies, controls, and procedures must be developed to cover all aspects of AML/CFT compliance, including employee training, audit functions, and escalation protocols. The HKMA expects firms to embed a compliance culture across operations, ensuring that AML/CFT obligations are not treated as box-ticking exercises but as core business priorities.

Customer Due Diligence (CDD)

Customer due diligence requirements lie at the heart of the new framework. Licensed issuers are prohibited from offering anonymous accounts or pseudonymous wallets. Instead, they must implement real-name verification for all customers engaging with stablecoin products.

The guideline specifies that issuers must obtain and verify identification documents, understand the purpose and intended nature of the customer’s relationship, and apply enhanced due diligence for high-risk scenarios such as politically exposed persons (PEPs) or customers from high-risk jurisdictions. Where risks cannot be mitigated, issuers are required to reject the business relationship or terminate existing ones.

CDD obligations also extend to ongoing monitoring, meaning issuers must track transactions for unusual patterns and maintain up-to-date customer records. This creates a compliance environment closely aligned with that imposed on traditional financial institutions.

Record-Keeping and Auditability

To ensure accountability, issuers must maintain comprehensive records of transactions and customer due diligence data for at least six years. These records must be readily accessible to regulators and law enforcement upon request.

Independent audit functions are mandated to periodically review the adequacy and effectiveness of AML/CFT systems. This ensures that compliance is not only embedded in theory but also tested in practice, providing assurance to regulators and market participants.

Suspicious Transaction Reporting

The guideline makes it clear that licensed issuers are obligated to identify, investigate, and report suspicious transactions to Hong Kong’s Joint Financial Intelligence Unit (JFIU). Issuers must establish clear internal channels for staff to escalate concerns and protect whistleblowers acting in good faith.

Failure to report suspicious activity carries significant penalties, reinforcing the seriousness of AML/CFT compliance within Hong Kong’s stablecoin ecosystem.

Stablecoin Transfers and the Travel Rule

One of the most notable aspects of the guideline is its treatment of stablecoin transfers, where issuers must comply with the international Travel Rule. Under this rule, issuers are required to collect, transmit, and retain information about the originator and beneficiary of transfers above a defined threshold.

This aligns Hong Kong with global standards established by the Financial Action Task Force (FATF) and ensures traceability of digital asset flows across borders. By enforcing these requirements, the HKMA aims to close potential loopholes that could otherwise be exploited for illicit transfers.

International Alignment and Industry Implications

The guideline firmly situates Hong Kong within the global movement toward tighter regulation of digital assets. By aligning its AML/CFT standards with FATF recommendations, Hong Kong positions itself as a jurisdiction of choice for responsible digital finance.

For industry players, however, the implications are significant. Compliance costs are set to rise, with issuers required to build sophisticated KYC systems, transaction monitoring tools, and governance structures. Yet, in the long run, this is expected to enhance market integrity, build investor trust, and attract institutional participation in Hong Kong’s stablecoin sector.

The enforcement of Hong Kong’s AML/CFT guideline for licensed stablecoin issuers on 1 August 2025 represents a landmark development in financial regulation. By combining rigorous compliance requirements with international best practices, Hong Kong has created a framework that strengthens safeguards against financial crime while supporting the legitimacy and growth of digital assets.

This new era of regulation highlights the city’s ambition to remain a leading global financial center while embracing the challenges and opportunities of the digital economy. As issuers adapt to these rules, the ultimate beneficiaries will be investors, regulators, and the integrity of Hong Kong’s financial system.

Read the full guideline here.

Read about the product: Transact Comply

Empower your organization with ZIGRAM’s integrated RegTech solutions – Book a Demo

- \#HongKong

- #Stablecoins

- #AML

- #CFT

- #FinancialRegulation

- #HKMA

- #Compliance

- #DigitalAssets

- #TravelRule

- #KYC

- #CryptoRegulation

- #FinTech

- #RiskManagement

- #AntiMoneyLaundering

- #TerroristFinancing