Anti-Money Laundering Performance in 2024: How Guyana FIU Strengthened Financial Crime Defenses

Anti-money laundering (AML) performance has become a critical benchmark for financial system resilience, especially in emerging economies. In 2024, the Financial Intelligence Unit of Guyana delivered measurable improvements in AML effectiveness, intelligence output, cross-border cooperation, and reporting infrastructure, as documented in its official Annual Report.

This article explores how FIU Guyana’s AML performance evolved in 2024, highlighting operational results, compliance expansion, intelligence outcomes, and global cooperation benchmarks.

AML Reporting Performance in 2024

Suspicious Transaction Reports (STRs)

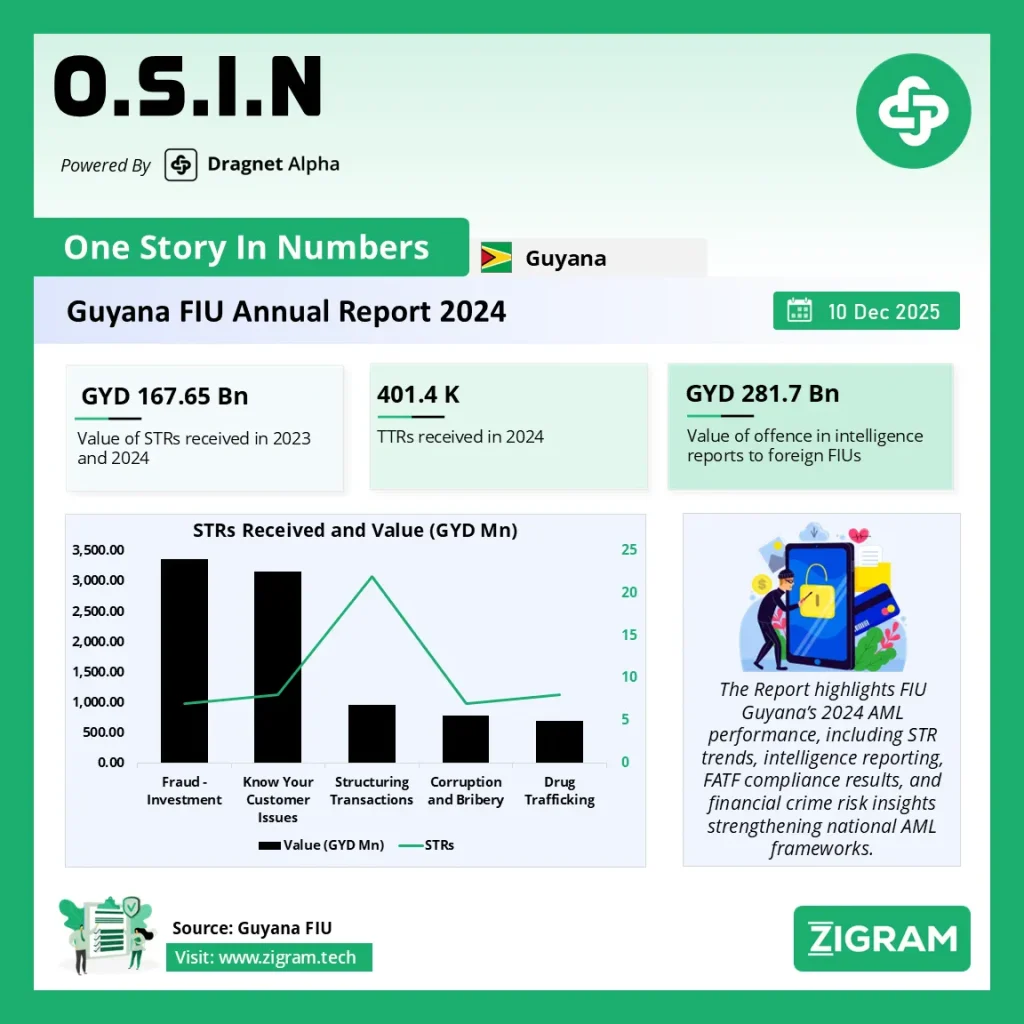

FIU Guyana recorded a 15.6% increase in STRs, receiving 208 reports in 2024, compared to 180 in 2023.

Key risk drivers:

- General fraud cases increased significantly (60 cases in 2024 vs 28 in 2023).

- Structuring of transactions remained a dominant trend.

Despite increased volume, the overall value of STRs declined by over 90%, due to a shift toward lower-value digital and payment service fraud typologies.

Threshold Transaction Reports (TTRs)

FIU Guyana received 401,414 TTRs in 2024, representing a 12.6% decrease from 2023.

This reduction resulted from a regulatory change — transactions are no longer aggregated monthly; only single transactions that meet thresholds are now reportable.

Cross-Border Currency Declarations

The Guyana Revenue Authority submitted:

- 845 international transportation of currency reports

- Representing a 4.3% decline year-on-year

More than 70% of declared currency was in USD, confirming high exposure to dollar-based cross-border risk.

AML Intelligence Performance

Domestic Intelligence Dissemination

FIU Guyana issued:

- 66 intelligence reports to domestic law enforcement

- Total estimated suspicious transaction value: G$298.9 billion

Key recipients:

- SOCU (54 cases)

- Guyana Revenue Authority (8 cases)

International Intelligence Cooperation

FIU Guyana sent:

- 20 intelligence reports to 11 foreign FIUs

- Covering approximately G$281.7 billion in suspicious transaction value

Countries included Argentina, India, USA, Canada, Germany, China, and Trinidad & Tobago.

Compliance Expansion and Institutional Performance

Reporting Entity Growth

FIU Guyana registered:

- 154 new reporting entities in 2024

- Total reporting entities reached 700

Auto Dealers represented the largest growth segment due to expanded regulatory enforcement.

International Standards Performance

FATF Mutual Evaluation Results

Guyana’s AML framework was assessed under the FATF and CFATF mutual evaluation process:

Assessment Area | Result |

FATF Technical Recommendations | 35/40 Positive Ratings |

Fully Compliant – FIU Independence (Recommendation 29) | Achieved |

Immediate Outcome 6 (Use of Financial Intelligence) | Substantial Effectiveness |

Strategic AML Risk Typologies Identified in 2024

The FIU documented structured AML risk patterns including:

- Online Sales / Non-Delivery Fraud Schemes

- Mobile Payment Account Takeover Attacks

These typologies directly influenced national risk training and real-time reporting guidance to financial institutions.

Technology and AML System Performance

FIU Guyana enhanced:

- Its secure reporting infrastructure

- Upgrades to CaseKonnect, the national online AML reporting system

- Secure international exchange via the Egmont Secure Web

These upgrades improved investigation turnaround time and reporting efficiency.

FAQs:

What was FIU Guyana’s AML performance in 2024?

FIU Guyana recorded higher STR volumes, expanded intelligence dissemination, improved international cooperation, increased reporting entity registrations, and received strong FATF effectiveness ratings in 2024.

How many STRs were filed in Guyana in 2024?

208 Suspicious Transaction Reports were submitted to FIU Guyana in 2024, a 15.6% increase from 2023.

What were the biggest AML risks in Guyana in 2024?

Fraud, transaction structuring, online sales scams, and mobile payment account takeovers were identified as major risks.

Geographic AML Context: Guyana

Guyana’s AML performance is increasingly relevant due to:

- Rapid economic expansion driven by offshore oil and gas.

- Growth in high-risk sectors like auto trading and precious minerals.

- Increased cross-border financial activity.

The FIU’s strengthened AML controls in 2024 were designed to protect Guyana’s financial system from transnational crime exposure.

Conclusion

The 2024 performance of FIU Guyana demonstrates a shift from reactive compliance toward intelligence-driven AML enforcement. With higher reporting volumes, improved international cooperation, and measurable effectiveness under FATF assessments, Guyana now positions itself as a rising benchmark for AML performance in emerging economies.

Click here to read the full report.

Please read about our product: Dragnet Alpha

Click here to book a free demo

- #AML

- #AntiMoneyLaundering

- #FinancialCrime

- #Compliance

- #AMLCompliance

- #FIUGuyana

- #FinancialIntelligence

- #SuspiciousTransactions

- #RiskCompliance

- #AntiMoneyLaundering

- #TerroristFinancing

- #RegTech