Regulation Name: Starter Guatemala’s AML Bill 6593

Date Of Release: 21 Jul 2025

Region: Guatemala

Agency: Congress of the Republic of Guatemala

Guatemala’s Bill 6593: Toward a Modern Anti-Money Laundering / Counter-Terrorism Financing Regime

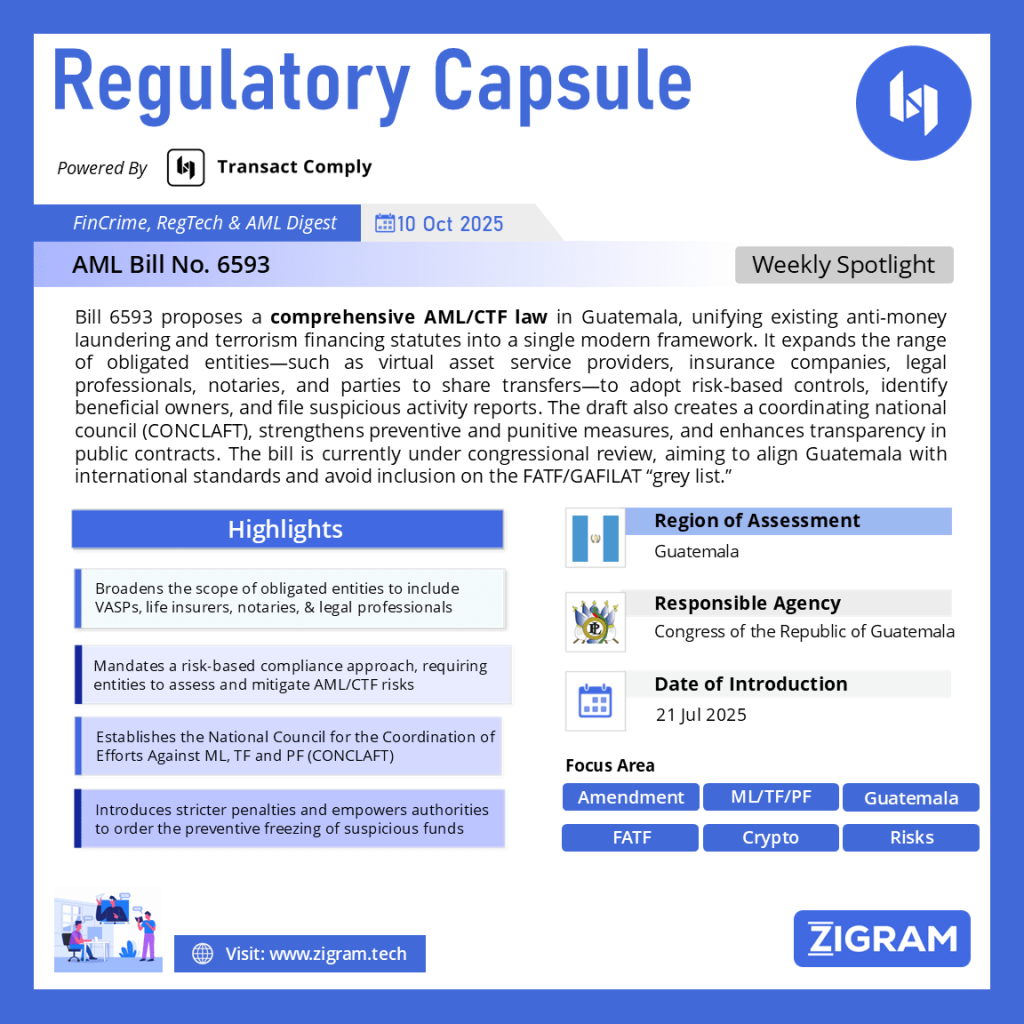

Guatemala’s current laws against money laundering and terrorist financing originate mainly from early 2000s legislation. Over time, many have argued that these laws have become inadequate due to changes in financial technologies, cross-border flows, virtual assets, and evolving international standards. To address such gaps and respond to pressures from international monitoring bodies, the Guatemalan government under President Bernardo Arévalo drafted a new comprehensive law, known as Iniciativa de Ley 6593. This proposed law seeks to replace and unify existing AML/CTF laws, strengthen prevention and enforcement, expand obligations, and modernize institutional frameworks.

What Bill 6593 Proposes

Bill 6593 is officially titled “Ley Integral contra el Lavado de Dinero u Otros Activos y el Financiamiento del Terrorismo.” The objective is to modernize Guatemala’s legal framework, making it more aligned with international norms (such as those of GAFILAT / FATF) while enhancing transparency, risk-based prevention, and enforcement against illicit financial flows.

The proposed law is structured in six titles and contains 126 articles. These titles cover general provisions; preventive administrative rules for “persons subject to obligation”; institutional framework; repression of money laundering, terrorist financing, and related crimes; legal reforms extending across multiple existing codes (like Penal, Commerce, Notary, etc.); and final & transitional provisions.

A central feature is the expansion of the set of entities and persons required to comply with AML/CTF obligations. This includes the requirement that obligated entities implement internal compliance programs, do customer due diligence, identify ultimate beneficial owners, adopt a risk-based approach, designate compliance officers, etc. Not just financial institutions but also entities such as life insurance companies, virtual asset service providers, certain legal professionals, notaries, contractors in public procurement, and others are intended to be brought under obligation.

Another key element is strengthening institutional coordination. The law proposes creating a national coordinating council (referred to as CONCLAFT) for policy alignment, oversight, and institutional cooperation in preventing and prosecuting money laundering, terrorism financing, and proliferation financing.

On enforcement and penalties, the draft law seeks to increase the severity of sanctions, improve detection and reporting of suspicious transactions, tighten transparency (especially of beneficial ownership), and enhance oversight of public contracting to avoid misuse of state procurement channels for illicit financial flows.

Legislative Process and Current Status

The bill was formally presented by the Executive to Congress on 28 July 2025. This step marked its official transmission for consideration and set it into the legislative agenda.

Soon after, the bill was placed on the Congressional agenda for its first reading. The plan was for the full membership (pleno) of Congress to “know it” (lectura) and send it to relevant committees for study.

By early September 2025, the initiative was sent to the Comisión de Finanzas Públicas y Moneda and the Comisión de Economía y Comercio Exterior of Congress for review and drafting of committee opinions or “dictámenes.” This is one of the key stages; these commissions will analyze the law article by article, propose amendments or report in favor/disfavor, before it returns to the plenary for debate.

The government has emphasized urgency for the law’s passage. A crucial motivation is avoiding Guatemala’s placement on a “grey list” of countries under surveillance by international bodies such as GAFILAT or FATF. The evaluation by GAFILAT is scheduled for 2027, so the timeline implies the law should be approved in 2025, implemented in 2026, and fully operational by or before 2027.

Challenges and Debates

Despite the broad consensus about updating the AML framework, there are several challenges and debates around Bill 6593. One challenge is political: not all deputies in Congress seem aligned in supporting all aspects of the draft. Some fear that the law may impose heavy burdens on businesses or create regulatory delays. There are voices stating that the law is urgent, but there have also been delays or resistance.

Another concern is capacity. Even with a strong legal framework, enforcement depends on institutional resources: trained personnel, technical systems for monitoring finance, judicial efficacy, and interagency cooperation. Some critics observe that previous laws have failed in part due to gaps in enforcement, or because reporting entities lacked effective supervision. Ensuring effective oversight (e.g. by IVE, SIB) is going to be central.

Clarity is also being sought around exactly how new sectors will be regulated, what thresholds will apply, how “beneficial ownership” will be verified, what sanctions will apply, and what procedural protections will exist. Some stakeholders are watching for whether obligations will unfairly impact small or informal actors.

Finally, there is concern about whether passage will be timely enough to meet the 2027 evaluation deadline. If the law is delayed, or passed but not effectively implemented, Guatemala risks being placed in a disadvantaged international position.

Implications

If Bill 6593 is enacted with substantial strength and then properly implemented, several implications follow. First, the financial sector and related regulated sectors could see increased compliance costs, but also stronger credibility internationally. Access to cross-border finance, investment, and foreign trade may be more secure. International financial institutions may view Guatemala more favorably if gaps are closed. The government claims the law is part of an effort to achieve or improve a “grade of investment” status.

Second, transparency in public contracting is likely to improve: contractors, suppliers, and entities involved in state procurement may face higher scrutiny, thus closing some avenues for corruption via procurement channels. This could affect how the government awards contracts, the accountability attached, and public trust.

Third, sectors previously less covered — virtual assets, legal professionals, notaries, real estate, etc. — will have to build AML/CTF compliance infrastructure. Over time, this could help reduce misuse of non-financial sectors for money laundering.

Fourth, the judiciary, law enforcement, and regulatory agencies may need strengthened capacities: better investigative tools, faster legal processes, stronger cross-agency coordination, and possibly better whistleblower protections. Effectiveness will depend heavily on these executional factors.

Conclusion

Iniciativa de Ley 6593 holds the potential to significantly modernize Guatemala’s defenses against money laundering, terrorist financing, and corruption. It addresses many of the criticisms of the older legal framework: fragmentation, weak preventive measures, limited scope of obligated entities, insufficient transparency, and outdated institutional arrangements.

However, passage and implementation are far from guaranteed. The legislative process is underway but still in review by congressional committees. Political consensus, resource allocation, ability to enforce, and meeting tight timelines are all critical. The 2027 GAFILAT evaluation looms large; it is both a motivator and deadline. For Guatemala to avoid international sanctions or reputational harm, not only must the law pass in 2025, but it must function in practice in the years immediately following.

Read about the circular here.

Read about the product: Transact Comply

Empower your organization with ZIGRAM’s integrated RegTech solutions – Book a Demo

- #GuatemalaAML

- #Ley6593

- #AntiMoneyLaundering

- #FATFCompliance

- #CONCLAFT

- #AMLReform

- #FinancialTransparency

- #GuatemalaLegislation

- #RiskBasedCompliance

- #VirtualAssetsRegulation

- #TerrorismFinancingPrevention