Gibraltar’s Q1 2024 Suspicious Activity Report (SARs) Highlights Key Trends in Financial Crime

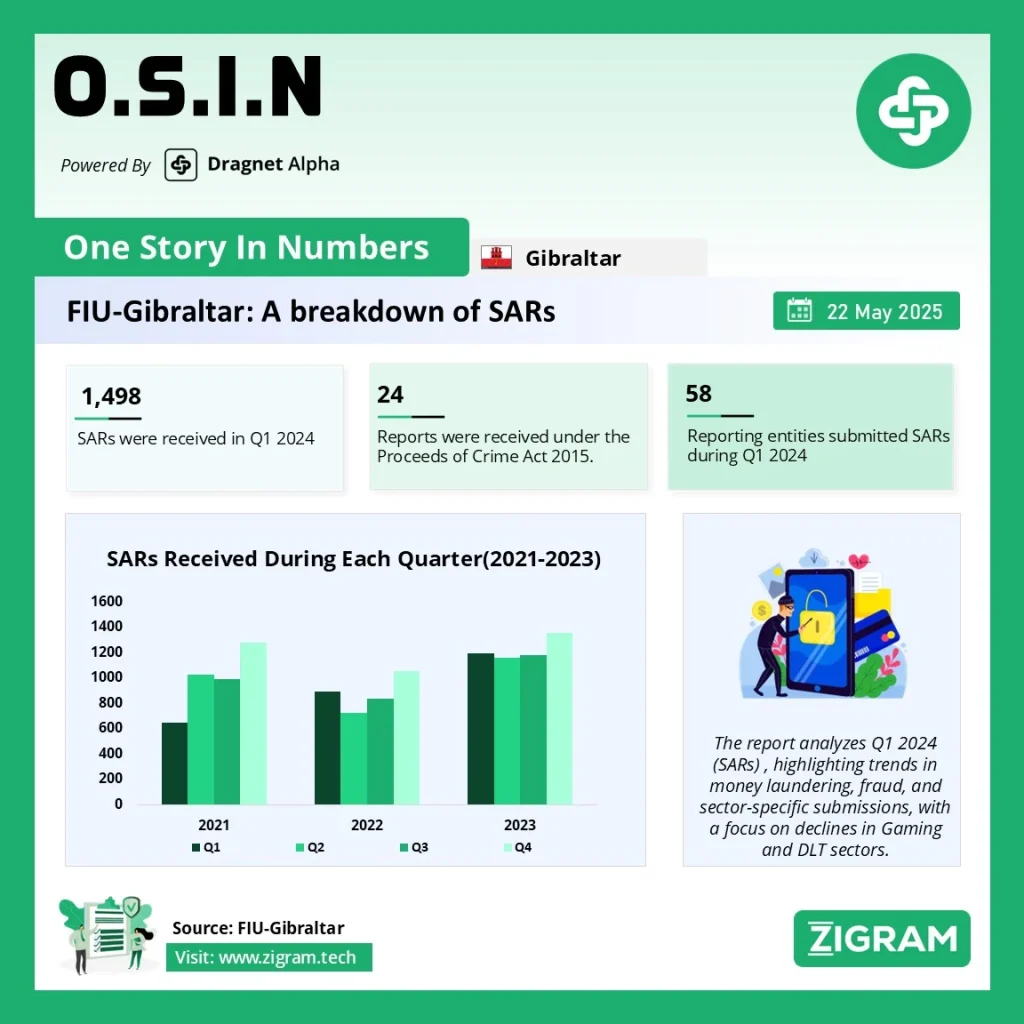

The Gibraltar Financial Intelligence Unit (GFIU) has released its Q1 2024 Statistics Report, shedding light on the latest trends in financial crime, including money laundering, fraud, and terrorist financing. Here are the key takeaways:

- Decline in SARs, But Banking Sector Sees Increase

- 1,059 SARs were filed in Q1 2024, marking an 11% decrease from Q1 2023 (1,193) and a 22% drop from Q4 2023 (1,355).

- The decline was driven by fewer reports from the Gaming and DLT sectors, while the Banking sector saw an increase in SARs (126 in Q1 2024 vs. 51 in Q1 2023).

- Top Reporting Sectors

- Gaming remained the dominant sector, contributing 67% of SARs, followed by DLT (16%) and Banking (12%).

- Excluding Gaming, SARs increased by 18% YoY, highlighting shifting trends in financial crime reporting.

- Most Reported Criminal Activities

- Money Laundering (73.75%) and Fraud (15.49%) were the top suspected crimes.

- Other notable offenses included Tax Crimes (3.12%), Sanctions Violations (1.13%), and Drug Trafficking (1.79%).

- DAML Requests: High Approval Rate

- 91 Defence Against Money Laundering (DAML) requests were submitted, with 86% granted—most originating from Banking, DLT, and Gaming sectors.

- Legislation & Compliance

- 98.77% of SARs were filed under the Proceeds of Crime Act 2015, reinforcing its role in Gibraltar’s AML framework.

- 98% of SARs met reporting standards, indicating strong compliance among financial institutions.

Conclusion

While overall SAR submissions declined, the rise in Banking sector reports and persistent money laundering risks underscore the need for vigilance. Gibraltar’s GFIU continues to enhance financial crime monitoring, ensuring alignment with global AML/CFT standards.

Read the full report here.

Please read about our product: Dragnet Alpha

Click here to book a free demo

- #FinancialCrime

- #MoneyLaundering

- #AML

- #Fraud

- #Gibraltar

- #Compliance

- #SARs

- #Banking

- #Gaming

- #DLT

- #FinTech

- #Regulation

- #GFIU

- #RiskManagement