South Africa’s Financial Intelligence Centre Strengthens the Fight Against Money Laundering and Financial Crime: FIC Annual Report 2024/25

The Financial Intelligence Centre (FIC) of South Africa’s 2024–25 Annual Report presents a pivotal year in strengthening the country’s anti-money laundering (AML) and counter-terrorist financing (CFT) regime. As the nation prepares to exit the Financial Action Task Force (FATF) grey list, the report highlights the FIC’s leadership in building a more resilient financial system—one capable of identifying, disrupting, and preventing financial crime at scale.

Exiting the Grey List: National Coordination and Compliance Momentum

South Africa’s FATF grey listing in February 2023 had placed the country under global scrutiny. However, by June 2025, the FATF acknowledged that South Africa had substantially completed all 22 action plan items, a milestone largely driven by the FIC’s reforms.

These reforms included the expansion of supervisory oversight, legal amendments under the General Laws (AML and CFT) Amendment Act, 2022, and enhanced cooperation across government and the private sector.

By the end of the reporting period, 20 of the 22 action items were fully addressed, demonstrating significant progress in rebuilding international confidence in South Africa’s financial crime compliance framework.

Record Financial Intelligence Output and Recoveries

The FIC reported a remarkable surge in operational productivity.

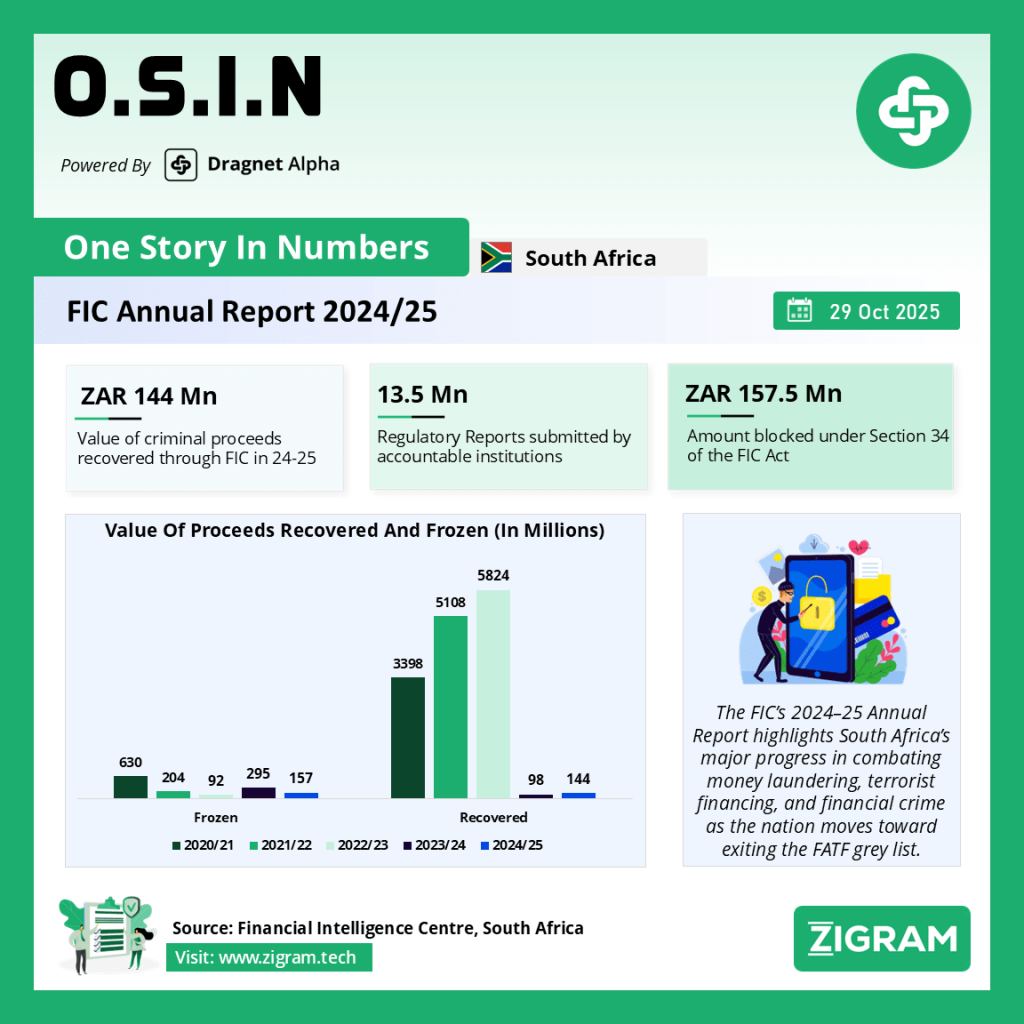

– 4,196 financial intelligence reports were generated—3,104 reactive and 1,092 proactive—directly contributing to the recovery of nearly R144 million in criminal proceeds.

– R157.5 million was blocked under section 34 of the FIC Act as suspected proceeds of crime.

– 51 reports focused specifically on illicit financial flows, underscoring FIC’s proactive stance in cross-border money laundering detection.

The Asset Recovery Hub, a collaboration with the National Prosecuting Authority (NPA) and Asset Forfeiture Unit, recovered over R33 million, while the Shared Forensic Capability (SFC)—now in its first full year of operation—added R14 million in recovered assets and enrolled 14 cases for prosecution.

Expanding Oversight and Compliance Across Non-Financial Sectors

A defining aspect of the year was the FIC’s assumption of supervisory responsibility for all Designated Non-Financial Businesses and Professions (DNFBPs)—including lawyers, real estate agents, dealers in precious metals and stones, and casinos—as well as credit providers and crypto asset service providers.

By March 2025, 55,262 institutions were registered with the FIC, a 4,000+ increase from the previous year. These entities submitted 13.5 million regulatory reports, nearly doubling the volume from 2023/24.

The Centre introduced risk-based supervision tools, including the Risk and Compliance Return (RCR) questionnaire and analytical assessment systems, enabling more targeted inspections and data-driven enforcement. During the period, 556 inspections were conducted, mostly targeting high-risk institutions.

Strengthening the AML/CFT Ecosystem through Collaboration

The FIC maintained and deepened its collaborative approach, working with both domestic and international partners. Key partnerships included:

– The Reformed Fusion Centre, which investigated 562 cases involving complex money laundering and corruption schemes.

– The South African Anti-Money Laundering Integrated Task Force (SAMLIT), a public–private alliance that enhances financial intelligence sharing among banks and regulators.

– Inter-Agency Working Group on Illicit Financial Flows (IAWG-IFFs), aimed at reducing illegal capital flight.

– International cooperation with 102 foreign financial intelligence units (FIUs) through memorandum of understanding, facilitating timely exchange of intelligence.

This networked approach enabled South Africa to strengthen its intelligence ecosystem, promote asset recovery, and reinforce compliance culture across both the public and private sectors.

Crypto Regulation and the Travel Rule Directive

Recognizing the rapid evolution of virtual asset risks, the FIC issued Directive 9, implementing the Travel Rule for crypto asset transfers. This measure aligns South Africa with FATF Recommendation 15 and requires crypto asset service providers (CASPs) to share sender and receiver details in digital asset transfers, ensuring traceability and accountability in virtual transactions.

The country’s regulatory response has elevated South Africa’s AML/CFT framework to global standards, reducing the systemic risk associated with digital asset misuse.

Integrating Technology and Artificial Intelligence

The report details major technological advancements within the FIC. The agency is leveraging artificial intelligence (AI) and machine learning (ML) to enhance the analysis of suspicious transaction reports (STRs) and improve data-driven decision-making.

A comprehensive cybersecurity strategy and cloud computing framework are also in place to safeguard sensitive financial intelligence data.

These innovations have improved the FIC’s productivity, enabling faster turnaround times and higher-quality intelligence outputs for law enforcement and supervisory partners.

Governance, Integrity, and Human Capital

The FIC received an unqualified audit opinion with no material findings for the 2024–25 fiscal year, reinforcing its reputation for sound governance.

It also continued its commitment to transformation, with 84.98% of its workforce from designated race groups and 61.9% female representation.

The workforce grew to 275 employees, supported by training and internal promotions aimed at developing specialized AML expertise.

Outlook: Beyond Grey Listing

Looking ahead, the FIC’s priorities include strengthening artificial intelligence-driven compliance monitoring, expanding forensic capabilities, and ensuring readiness for the FATF’s fifth-round mutual evaluation (2026–27).

The agency’s strategic vision—to make South Africa’s financial system intolerant to abuse—remains at the heart of its efforts. With the grey-list exit imminent, the FIC is positioned as a regional leader in financial intelligence, contributing not only to national stability but also to Africa’s broader financial integrity framework.

Conclusion

The FIC Annual Report 2024–25 underscores South Africa’s remarkable progress in fortifying its defenses against money laundering, terrorism financing, and other financial crimes. Through innovation, inter-agency coordination, and an unwavering focus on compliance, the FIC has not only rebuilt institutional trust but also positioned South Africa for sustained global credibility in financial governance.

Click here to read the full report.

Please read about our product: Dragnet Alpha

Click here to book a free demo

- #AntiMoneyLaundering

- #FinancialCrime

- #FATFGreyList

- #SouthAfrica

- #CryptoCompliance

- #FIC

- #CFT

- #FinancialIntegrity