Luxembourg’s 2024 AML and Financial Crime Supervision: A Year of Intensified Scrutiny

The Commission de Surveillance du Secteur Financier (CSSF) has released its 2024 Annual Report, providing a detailed overview of Luxembourg’s supervisory activities in the fight against money laundering and financial crime. The findings highlight a year of intensified oversight, targeted inspections, international cooperation, and a greater emphasis on high-risk sectors such as private banking and virtual assets.

Supervisory Engagement and Dialogue

Throughout 2024, the CSSF sustained a strong supervisory presence within the financial sector. The authority engaged in 170 meetings with banks focused specifically on anti-money laundering and counter-terrorist financing (AML/CFT) issues. Beyond the banking sector, a further 67 off-site meetings were held with other segments of the financial industry to assess compliance frameworks and address potential risks. In December 2024, the CSSF also organised its annual AML/CFT conference, attracting over 1,300 participants, underlining the importance of continuous dialogue, knowledge sharing, and industry-wide alignment with supervisory expectations.

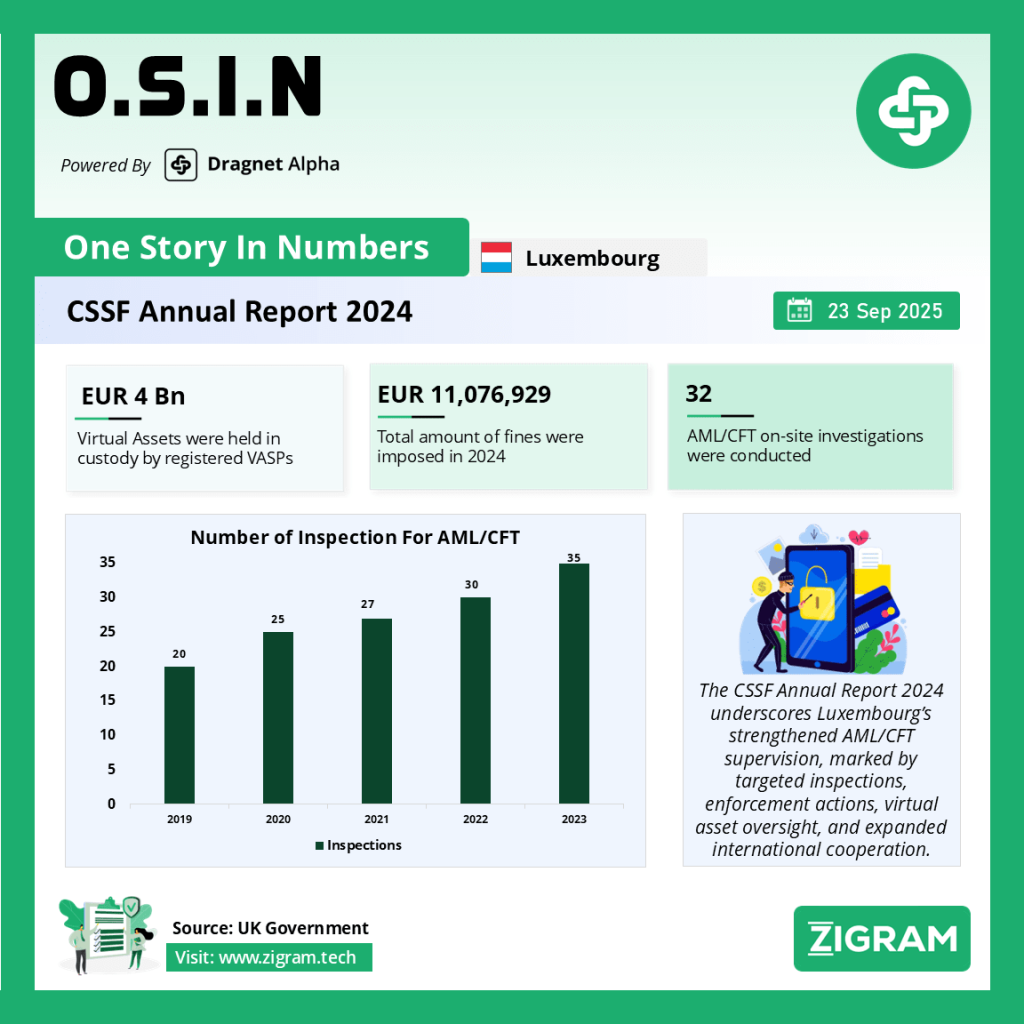

On-Site Inspections and Targeted Reviews

On-site inspections formed a central part of the CSSF’s supervisory strategy. In total, 32 inspections dedicated to AML/CFT matters were conducted during the year, with a particular focus on high-risk areas such as private banking, trade finance, and virtual asset service providers. Of these, 21 inspections concentrated on critical processes including customer due diligence, transaction monitoring, and name screening. Within the collective investment sector, 15 inspections were carried out on investment fund managers, reflecting the regulator’s determination to strengthen oversight of Luxembourg’s globally significant fund industry. This transition towards a risk-based supervisory model underscores the CSSF’s strategy of concentrating resources where vulnerabilities are most acute.

Observations and Enforcement Measures

The supervisory intensity of 2024 was matched by firm enforcement actions. The CSSF issued 168 observation letters to banks outlining deficiencies and required improvements, while 255 additional observation letters were directed at the collective investment management sector. Enforcement escalated further with five injunction letters issued to banks for serious AML/CFT shortcomings, alongside two reprimands for failures in name-screening procedures. One bank faced a financial sanction for grave breaches of AML/CFT obligations. Across the wider financial sector, the CSSF issued 12 injunctions linked to financial crime in 2024, a significant reduction from the 47 imposed in 2023. This decline suggests improvements in compliance maturity but also points to a shift towards more focused and proportionate enforcement.

Virtual Assets: Expanding but Monitored Closely

Luxembourg’s growing virtual asset sector was under particular scrutiny during the year. By December 2024, the number of registered virtual asset service providers (VASPs) had increased to 15, up from 11 in the previous year. These firms processed more than EUR 50 billion in exchange transactions and held over EUR 4 billion in assets under custody. Such figures highlight the sector’s rapid expansion and systemic relevance, while also justifying the CSSF’s intensified oversight. The regulator has consistently emphasised that VASPs must maintain robust AML/CFT frameworks proportionate to the risks inherent in digital asset markets.

International Cooperation and Cross-Border Oversight

Given Luxembourg’s role as a global financial hub, international cooperation remained a vital aspect of supervisory work in 2024. The CSSF initiated 35 requests for cooperation with foreign regulators and organised 16 AML/CFT supervisory colleges for the collective management sector. In the banking domain, it participated in 30 supervisory colleges covering 38 Luxembourg banks with international operations. These forums facilitated coordination between home and host regulators, ensuring consistency in supervision and reinforcing Luxembourg’s credibility in the global fight against financial crime.

Penalties and Sanctions

The CSSF also applied monetary sanctions where deficiencies were identified. In 2024, administrative fines amounting to EUR 186,600 were imposed on three specialised professionals of the financial sector. The largest of these, at EUR 152,100, related to breaches of central data retrieval obligations concerning IBANs and safe deposit boxes. A further EUR 27,000 fine was levied for failures in AML/CFT systems, while a EUR 7,500 penalty addressed governance and reporting shortcomings. While not as severe in monetary terms as those seen in larger jurisdictions, these penalties signal the CSSF’s readiness to enforce compliance obligations and address systemic weaknesses.

FATF Recognition and Screening Deficiencies

Luxembourg achieved notable international recognition in 2024 when the Financial Action Task Force (FATF) confirmed that the country had reached full compliance in its assessment of Designated Non-Financial Businesses and Professions, including lawyers, accountants, and real estate agents. Despite this strong performance, the CSSF’s inspections uncovered weaknesses in screening technologies across several institutions. In particular, the use of excessively strict fuzzy matching thresholds of 99 percent was deemed problematic, as such settings risk overlooking relevant alerts. The CSSF instead emphasised the effectiveness of thresholds set in the 85 to 90 percent range, which balance sensitivity with operational efficiency.

Outlook for 2025

The CSSF’s 2024 supervisory record reflects a regulatory authority balancing dialogue, preventive supervision, and enforcement action. The decline in injunctions compared to 2023 indicates progress in compliance across the financial sector, yet challenges remain in areas such as screening, governance, and emerging risks linked to virtual assets. As Luxembourg continues to expand its role as a leading financial centre, the CSSF is expected to maintain its vigilant stance, ensuring that AML/CFT frameworks evolve in line with both international standards and the realities of an increasingly complex financial landscape.

Read the full report here.

Please read about our product: Dragnet Alpha

Click here to book a free demo

- #AML

- #CFT

- #FraudPrevention

- #Regulation

- #Compliance

- #Luxembourg

- #VirtualAssets

- #VASPs

- #Enforcement

- #Supervision