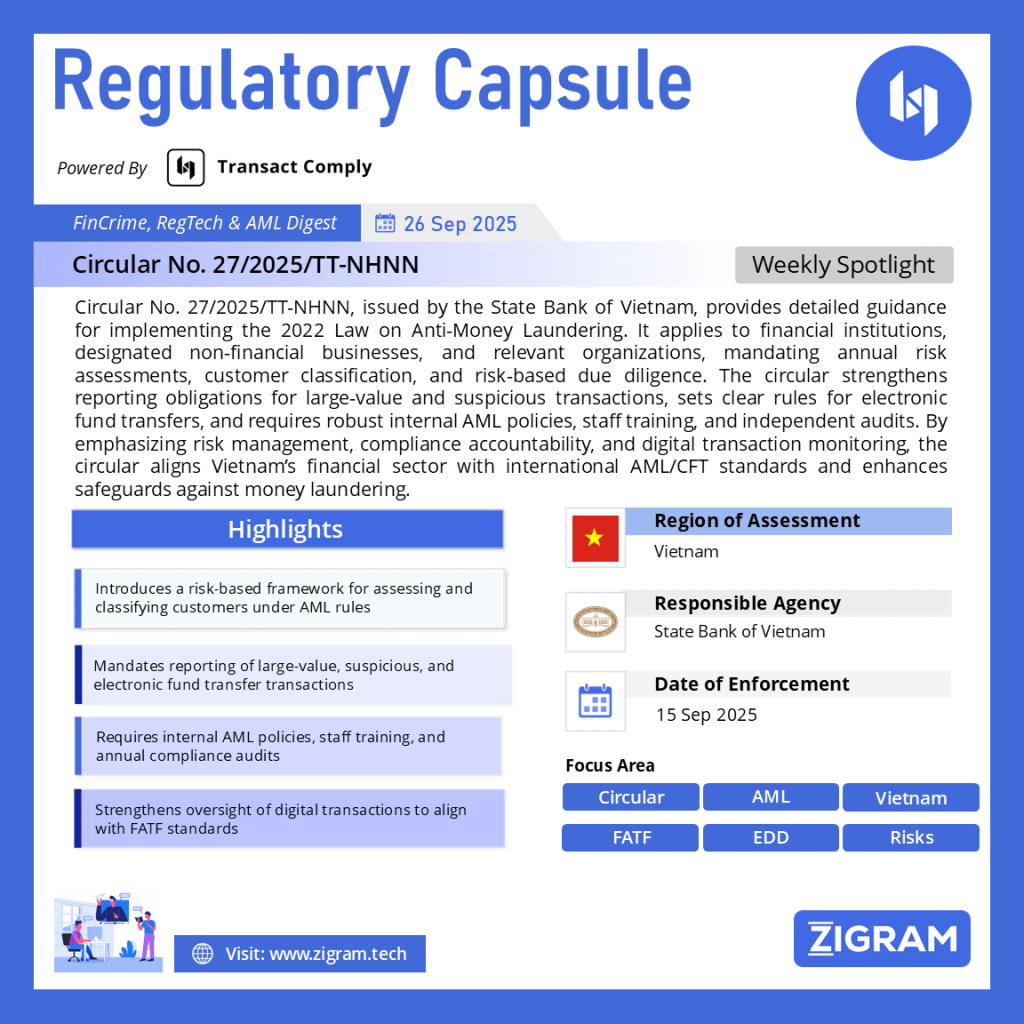

Regulation Name: Circular No. 27/2025/TT-NHNN

Date Of Effect: 15 Sep 2025

Region: Vietnam

Agency: State Bank of Vietnam

Vietnam Issues Circular 27/2025/TT-NHNN: Strengthening AML Compliance

In September 2025, the State Bank of Vietnam (SBV) issued Circular No. 27/2025/TT-NHNN to provide detailed guidance on the implementation of several provisions of the Law on Anti-Money Laundering (AML) 2022. This circular is a landmark development in Vietnam’s regulatory landscape, aimed at reinforcing preventive measures, ensuring compliance across industries, and aligning national practices with international anti-money laundering and counter-terrorism financing (AML/CFT) standards.

Scope and Applicability

The circular has a wide scope of application. It governs the activities of financial institutions such as banks, securities companies, insurance firms, and other entities operating in the financial sector. It also extends to designated non-financial businesses and professions including real estate companies, casinos, law firms, auditors, and accountants, all of which are considered vulnerable to money laundering threats. Furthermore, the rules apply to Vietnamese and foreign organizations and individuals that engage in transactions with financial institutions or non-financial businesses in Vietnam, as well as other parties with relevant AML obligations. In this way, the circular ensures comprehensive coverage of all entities and individuals that could play a role in the prevention or facilitation of money laundering.

Risk Assessment Framework

A central feature of the circular is the establishment of a risk assessment framework. Reporting entities are required to identify and assess money laundering risks using both environmental and operational indicators. Risks must be assessed from the perspective of the external environment, including industry type, business sector, and geographical regions or countries where the clients or transactions are linked. At the same time, business activity risks must be considered, such as the risks associated with particular customers, the products and services offered, and the channels through which these services are delivered.

Entities are also expected to evaluate the adequacy and effectiveness of their internal AML policies. A scoring system ranging from one to five must be applied, with higher scores indicating higher levels of risk or compliance gaps. This process enables reporting entities to classify their customers into different categories of money laundering risk: low, medium, or high. Importantly, risk assessments are not one-time exercises. Institutions must update their assessments annually and submit results to the State Bank of Vietnam as well as to other relevant supervisory authorities.

Risk-Based Customer Classification

The circular introduces a clear framework for classifying customers according to money laundering risk levels. Customers deemed to pose low levels of risk may be subject to simplified due diligence requirements, such as reduced frequency of updates or less stringent verification processes. Medium-risk customers, however, are subject to full due diligence in accordance with the AML Law and related decrees. For high-risk customers, institutions must conduct enhanced due diligence. This includes securing senior management approval before establishing or maintaining business relationships, updating customer information more frequently, verifying income and sources of funds, and subjecting transactions to heightened monitoring.

The rules also address specific situations, such as the verification of beneficiaries of life insurance contracts. Institutions must ensure that beneficiaries are identified and verified at the time of claim payment, with information on beneficiaries forming part of the risk assessment and classification process.

Internal Regulations and Controls

Another important element of Circular 27 is the requirement for reporting entities to establish detailed internal AML policies. These internal rules must cover all aspects of AML compliance, ranging from customer due diligence and identification procedures to risk management processes aligned with customer risk profiles. The circular also stresses the importance of proper data retention, requiring institutions to store and safeguard customer information and transaction records in accordance with legal requirements.

Additionally, institutions must have provisions for the application of temporary measures such as transaction suspensions or account freezes when necessary. They must also put in place procedures for timely reporting to the State Bank of Vietnam’s Anti-Money Laundering Department. Staff training is another mandatory component, as employees are required to be equipped with the knowledge and skills to identify, prevent, and report suspicious transactions. Furthermore, institutions must conduct internal audits or independent compliance reviews to evaluate the effectiveness of their AML programs. Even micro and small businesses are not exempt from these obligations; they are required to issue internal regulations appropriate to their operational scale.

Reporting Obligations

The circular reinforces the reporting obligations of entities subject to AML compliance. Large-value transactions are a particular focus, with cash transactions exceeding the threshold of 400 million Vietnamese dong or the equivalent in foreign currency being subject to mandatory reporting. Suspicious transactions must also be reported regardless of transaction value. These include any transaction suspected of being linked to money laundering, terrorism financing, or proliferation financing.

The rules for electronic fund transfers are especially detailed. Institutions must ensure that information about the sender and the beneficiary is complete and accurate. Domestic transfers valued at 500 million dong or more, and cross-border transfers valued at 1,000 US dollars or equivalent, must be reported to the authorities. Reports must be filed electronically through the State Bank of Vietnam’s system, although paper-based reporting is permitted in cases where digital submission is not possible. These reports are expected to be accurate, timely, and retained for regulatory oversight.

Compliance, Training, and Audit

The circular underscores the importance of compliance functions within organizations. Every reporting entity must appoint a compliance officer or designate a specialized unit to oversee AML measures. Management and staff directly involved in AML-related activities are required to undergo annual training programs. These sessions are intended to improve their understanding of money laundering risks, preventive measures, and reporting procedures.

Internal audits of AML programs are mandated on an annual basis, and entities must submit the results of these audits to the State Bank of Vietnam or to other supervisory authorities depending on their sector. Where full internal audits are not required by law, entities must at least conduct independent compliance reviews. These requirements create a strong accountability framework, ensuring that AML obligations are consistently met across the system.

Technology and Digital Transactions

Given the rapid growth of financial technology and digital services, the circular dedicates significant attention to electronic money transfers and digital transactions. Institutions are required to verify the completeness and accuracy of sender and receiver information in every electronic transfer. They must distinguish between domestic and cross-border transfers and ensure that monitoring systems are capable of detecting suspicious or unusual transaction patterns in real time.

This emphasis reflects Vietnam’s recognition of the risks associated with fintech innovations, virtual accounts, and digital payments, which can be exploited for money laundering if not carefully monitored. By setting stringent requirements, the circular aims to safeguard the integrity of Vietnam’s digital financial ecosystem.

Implications for Businesses

The issuance of Circular 27/2025/TT-NHNN significantly raises the compliance expectations for businesses operating in Vietnam. Reporting entities must move toward risk-based AML programs supported by quantitative scoring methodologies. They will need to strengthen due diligence processes for high-risk clients, invest in upgrading IT systems to handle reporting and monitoring, and ensure that senior management plays an active role in approving high-risk relationships. At the same time, businesses must commit resources to regular training and independent audits to ensure that AML obligations are not only formally adopted but also effectively implemented.

While compliance may increase operational costs, these requirements also bring Vietnam closer to the international standards of the Financial Action Task Force (FATF). Enhanced AML measures are expected to improve transparency, reduce financial crime risks, and strengthen the country’s position in the global financial system.

Conclusion

Circular No. 27/2025/TT-NHNN is a major regulatory milestone in Vietnam’s fight against money laundering and terrorist financing. By introducing a comprehensive framework for risk assessment, customer classification, internal controls, transaction reporting, and oversight of digital transfers, the circular provides the necessary tools for financial institutions and non-financial businesses to meet their AML obligations effectively. Beyond strengthening domestic compliance, the circular also signals Vietnam’s commitment to aligning with international best practices and enhancing its reputation as a responsible and secure jurisdiction within the global financial community.

Read about the circular here.

Read about the product: Transact Comply

Empower your organization with ZIGRAM’s integrated RegTech solutions – Book a Demo

- #Vietnam

- #AML

- #CFT

- #FinancialRegulation

- #AntiMoneyLaundering

- #Circular272025

- #SBV

- #Compliance

- #RiskManagement

- #FinancialCrime