Regulation Name: Proceeds of Crime (Money Laundering) and Terrorist Financing Act (AML/CFT)

Date Of Release: 03 June 2025

Region: Canada

Agency: House of Commons Canada

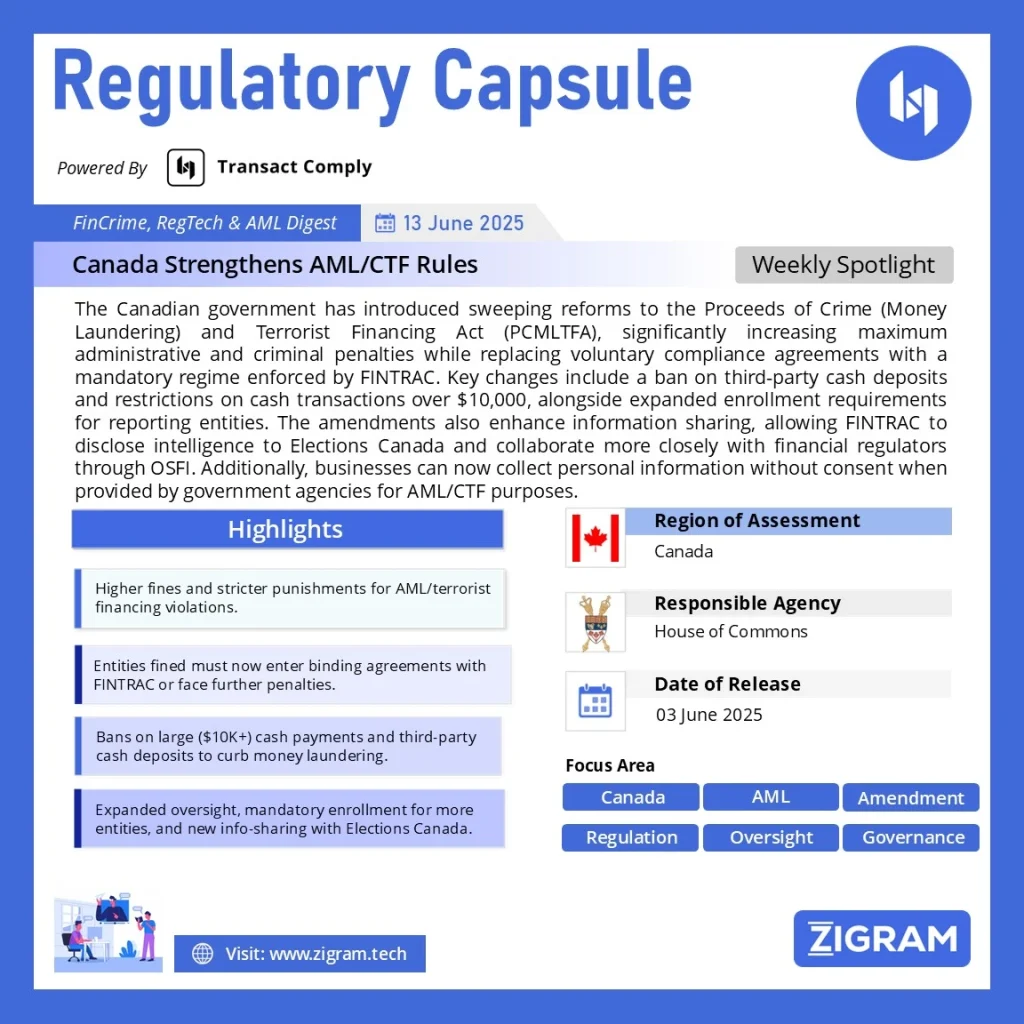

Canada Strengthens Anti-Money Laundering and Terrorist Financing Laws with Major Amendments

The Canadian government has introduced sweeping reforms to the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA), significantly enhancing the country’s ability to combat financial crimes, terrorist financing, and sanctions evasion. The amendments introduce stricter penalties, mandatory compliance agreements, new cash transaction restrictions, and expanded information-sharing powers for the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC).

Key Changes in the Amendments

Tougher Penalties for Non-Compliance

The new legislation increases maximum administrative monetary penalties (AMPs) for violations of the PCMLTFA, ensuring stronger deterrence against money laundering and terrorist financing. Additionally, criminal penalties for serious offences under the Act have been heightened, reinforcing Canada’s commitment to prosecuting financial crimes aggressively.

Mandatory Compliance Agreements (No More Voluntary System)

Previously, businesses found in violation of AML/CTF rules could enter into voluntary compliance agreements with FINTRAC. Under the new law:

- 1. Entities receiving an AMP must enter into a compliance agreement with FINTRAC.

- 2. If a business refuses or fails to comply, the Director of FINTRAC can issue a compliance order.

- 3. Violating a compliance order is now a punishable offence, adding another layer of enforcement.

Expanded Registration Requirements

Entities covered under Section 5 of the PCMLTFA—including money service businesses (MSBs), casinos, and certain financial service providers—must now enroll with FINTRAC, even if they were previously exempt. This broadens regulatory oversight and reduces gaps in Canada’s AML/CTF framework.

New Restrictions on Cash Transactions

To curb money laundering through cash movements, the amendments:

- – Prohibit certain entities (e.g., banks, MSBs) from accepting third-party cash deposits (targeting “money mules”).

- – Ban cash payments, donations, or deposits of $10,000 or more, with exceptions for entities already reporting large cash transactions under existing rules.

Enhanced Information Sharing

- – FINTRAC can now disclose financial intelligence to the Commissioner of Canada Elections, helping detect illicit election financing.

- – The Director of FINTRAC joins the OSFI (Office of the Superintendent of Financial Institutions) Committee, improving coordination between financial regulators.

New Rules for Personal Information Collection

Under the amended law, regulated entities can collect and use personal information without an individual’s consent if:

- 1. The data is provided by a government or law enforcement agency.

- 2. The purpose is detecting money laundering, terrorist financing, or sanctions evasion.

Related amendments to the Personal Information Protection and Electronic Documents Act (PIPEDA) ensure privacy laws align with these national security measures.

Why These Changes Matter

Canada has faced criticism in recent years for weaknesses in its AML regime, particularly in real estate, banking, and cryptocurrency sectors. These reforms:

- – Close loopholes that criminals exploit for money laundering.

- – Strengthen FINTRAC’s enforcement powers to ensure compliance.

- – Align Canada with international standards (e.g., Financial Action Task Force recommendations).

- – Balance privacy concerns while improving financial crime detection.

Conclusion

These reforms mark a major step forward in Canada’s fight against financial crime, ensuring stronger enforcement, better inter-agency cooperation, and reduced anonymity for illicit transactions. Businesses must act quickly to align with the new requirements or face severe penalties.

Read the full reforms here.

Read about the product: Transact Comply

Empower your organization with ZIGRAM’s integrated RegTech solutions – Book a Demo

- #AML

- #FINTRAC

- #Compliance

- #CanadaLaw

- #FinancialCrime