AUSTRAC Annual Report 2024–25: Analysis of Australia’s AML/CTF Landscape

The AUSTRAC Annual Report 2024–25 presents the most statistically rich and transformative year Australia has seen in financial crime regulation. Record reporting volumes, expanded partnerships, new national AML/CTF laws, strong enforcement outcomes, and unprecedented intelligence insights all marked a watershed year. With more than 2 million financial intelligence reports, thousands of regulatory actions, and a dramatic rise in suspicious activity detection, the report signals a new era of data-driven AML/CTF oversight.

What Is AUSTRAC and Why 2024–25 Was a Defining Year

AUSTRAC—Australia’s AML/CTF regulator and financial intelligence unit—experienced an exceptional operational year shaped by legislative reform, skyrocketing suspicious reporting, and enhanced intelligence capability. The agency began implementing the AML/CTF Amendment Act 2024, the most significant AML/CTF expansion in nearly 20 years, bringing lawyers, accountants, real estate agents, trust and company service providers, and precious metal dealers under regulatory supervision.

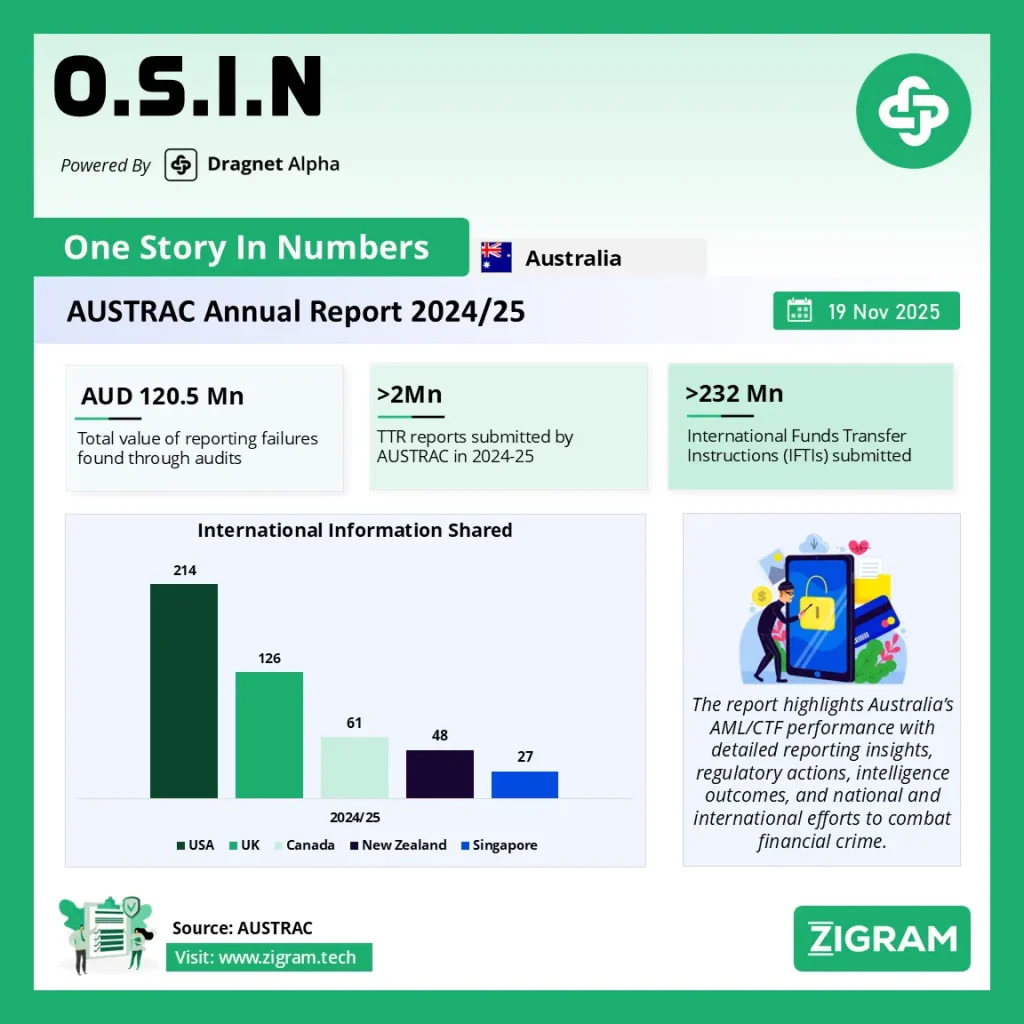

Throughout the year, AUSTRAC processed 452,951 Suspicious Matter Reports (up 19%), 2,038,848 Threshold Transaction Reports (up 6%), and more than 232 million IFTIs, reflecting both an increasingly vigilant industry and escalating criminal activity. The regulator also reported 12,699 intelligence requests, demonstrating the heightened reliance on AUSTRAC’s financial intelligence by domestic and international partners.

Key Highlights from AUSTRAC’s 2024–25 Year in Review

AUSTRAC’s intelligence capability reached unprecedented scale in 2024–25. The Fintel Alliance generated 18,791 coded SMRs, exceeding its annual target by over 230%, while the total value of unreported transactions detected through regulatory audits surpassed $120.5 million. The Alliance also deepened its analytical capacity by integrating new data sources, expanding bank secondments, and formalising its structure as a dedicated intelligence division.

Enforcement activity was equally strong. Across the year, AUSTRAC processed 4,129 registrations, cancelled or refused renewal for around 1,600 businesses, and issued infringement notices including $75,120 in fines to Cointree for late suspicious reporting. These activities reflect the regulator’s prioritisation of high-risk sectors, including casinos, crypto exchanges, remittance providers and alternative payment channels.

Internationally, AUSTRAC exchanged intelligence 214 times with the United States, 126 with the UK, 61 with Canada, and 48 with New Zealand, solidifying Australia’s role as a major contributor to global AML/CTF disruption efforts.

The year also saw the emergence of the Crypto ATM Taskforce, responding to rising misuse of crypto ATMs for scams and laundering. This resulted in national rules introducing a $5,000 limit on deposits and withdrawals, mandatory scam warnings, and stronger CDD expectations for operators.

Major AML/CTF Reforms — The AML/CTF Amendment Act 2024

The AML/CTF Amendment Act 2024 modernises and expands the AML/CTF regime to align Australia with global standards and prepare the country for its 2026 FATF evaluation. The reforms bring an estimated 100,000+ Tranche 2 businesses under the AML/CTF Act. These sectors will now be subject to customer due diligence obligations, suspicious activity reporting, beneficial ownership checks, and ongoing monitoring expectations.

Additionally, simplified rules, clearer definitions, realignment of reporting obligations, and strengthened supervision models are expected to reduce ambiguity in the regime while increasing accountability. AUSTRAC’s data-driven approach—demonstrated by record reporting volumes and strengthened analytics—provides an operational foundation for these reforms.

AUSTRAC’s Performance Snapshot (2024–25)

The agency’s performance assessment highlights measurable improvements across intelligence, regulatory oversight, and industry engagement. A significant 87% of stakeholders rated AUSTRAC’s guidance as useful, while 71% of reporting entities stated they strengthened their AML/CTF controls based on the regulator’s interventions.

A particularly strong indicator of AUSTRAC’s effectiveness is that 77% of regulatory work was proactively identified, demonstrating increasingly sophisticated analytics and risk detection methods. Meanwhile, 65% of taskforce referrals produced meaningful outcomes, a high benchmark compared to previous years. Engagement levels also rose: primary engagements were up 14%, and escalated engagements rose 7%, reflecting both growing industry interaction and heightened regulatory scrutiny.

Growing Global Reach

AUSTRAC’s global footprint expanded significantly, with multi-jurisdictional intelligence exchanges supporting investigations into transnational money laundering, cyber-enabled fraud, scams, terrorism financing and sanctions evasion. AUSTRAC engaged in thousands of intelligence exchanges and collaborated with FIUs across the U.S., UK, Canada, New Zealand, Southeast Asia and Europe. Its 214 exchanges with the U.S. alone highlight the depth of collaborative work across global crime and finance networks.

These strengthened partnerships support AUSTRAC’s mission to track illicit funds across borders, particularly in high-risk areas such as digital currencies, professional money laundering organisations, online gambling, and international criminal syndicates.

Looking Ahead to 2025–26

AUSTRAC is preparing for the largest supervised population in its history, as Tranche 2 sectors transition into AML/CTF compliance for the first time. In the coming year, the regulator will continue to expand its data analytics capability, integrate external datasets, and strengthen real-time detection models. Additional investment will be made in sector-specific guidance as well as digital infrastructure to help manage the dramatic increase in reporting volumes.

The anticipated surge in SMRs and suspicious activity detections—already evident from the record 452,951 SMRs this year—positions AUSTRAC to adopt an even more intelligence-led, risk-based supervisory approach in 2025–26.

Conclusion

The AUSTRAC Annual Report 2024–25 marks a historic leap in Australia’s AML/CTF evolution. With more than 2 million intelligence reports, thousands of compliance actions, record enforcement outcomes, expanded international reach, and major law reform, AUSTRAC has entered the most data-rich and aggressive regulatory phase in its history. For reporting entities—both existing and newly regulated—this signals a new compliance landscape defined by sharper risk expectations, stronger supervision, and unprecedented regulatory visibility.

Click here to read the full report.

Please read about our product: Dragnet Alpha

Click here to book a free demo

- #AUSTRAC

- #FinancialCrime

- #AML

- #CTF

- #AntiMoneyLaundering

- #Compliance

- #RegTech

- #RiskManagement