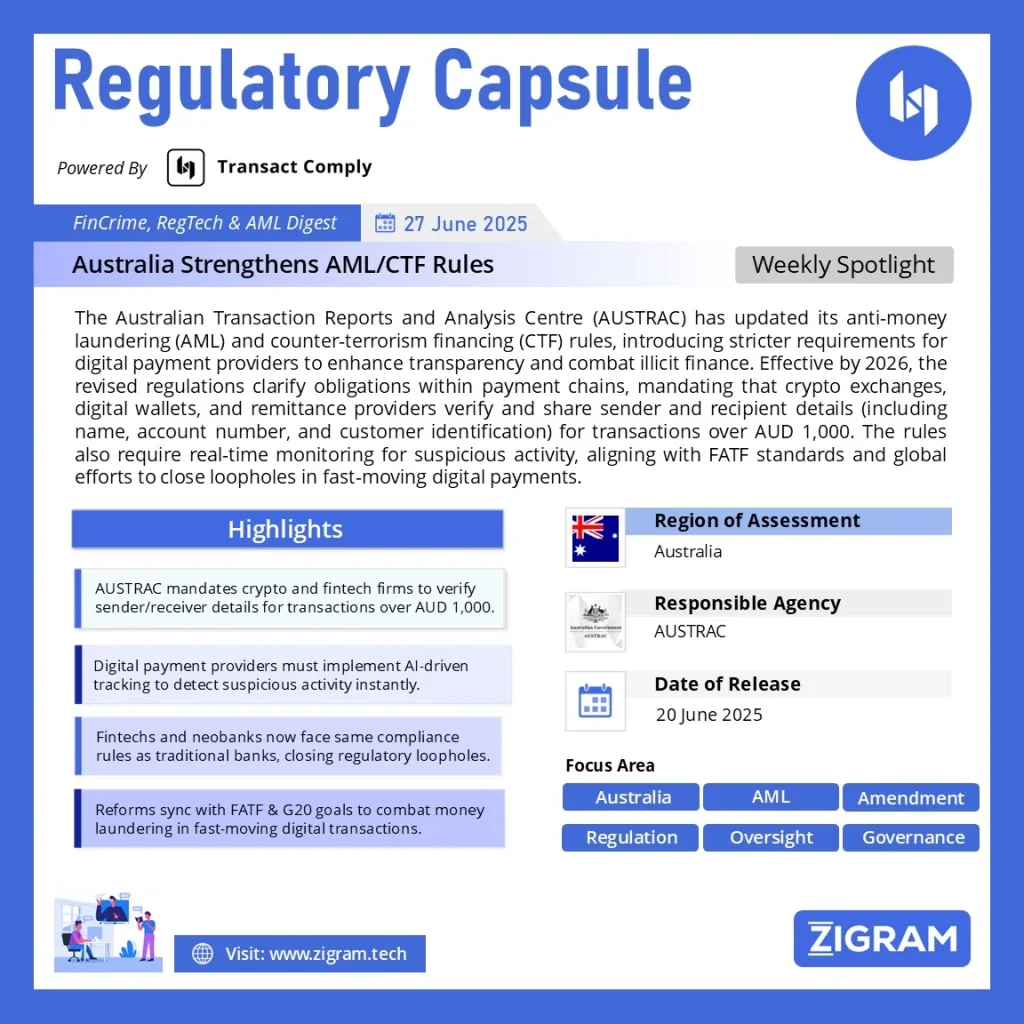

Regulation Name: AML/CFT

Date Of Release: 20 June 2025

Region: Australia

Agency: AUSTRAC

Australia Strengthens Financial Sanctions Compliance: AUSTRAC and Australian Sanctions Office Clarify Roles

In a move to bolster Australia’s financial integrity, new proposed changes will require entities regulated by AUSTRAC to develop and enforce policies ensuring compliance with targeted financial sanctions, including asset freezing. This initiative aims to prevent businesses from inadvertently violating sanctions obligations while providing designated services.

To support this effort, the Australian Sanctions Office (ASO) is working to clarify the respective roles between itself and AUSTRAC in overseeing sanctions implementation. The ASO is responsible for enforcing Australia’s sanctions regimes, which restrict trade and financial dealings with sanctioned countries, individuals, or entities. Meanwhile, AUSTRAC, as Australia’s anti-money laundering (AML) and counter-terrorism financing (CTF) regulator, supervises businesses to detect and report suspicious transactions that could indicate financial crime.

The proposed changes emphasize that AUSTRAC-regulated entities must have robust measures in place to enforce targeted financial sanctions, with AUSTRAC ensuring these measures are effective through supervision. This collaboration enhances Australia’s ability to combat money laundering, terrorist financing, and proliferation financing, thereby safeguarding the integrity of the financial system.

Read the full reforms here.

Read about the product: Transact Comply

Empower your organization with ZIGRAM’s integrated RegTech solutions – Book a Demo

- #FinancialCompliance

- #AUSTRAC

- #Sanctions

- #AML

- #CTF

- #FinancialCrime

- #AssetFreezing

- #AustralianSanctions

- #RegulatoryCompliance

- #FinancialIntegrity